What is retirement? Is it age or amount of money? We can have different definitions about retirement but financially retirement marks the beginning of a new phase in an individuals life. It’s a transition in one’s finances with a regular stream of income no longer available, the savings made over one’s working years now have to provide for all needs. But Can you afford to retire? Are you prepared for it? The new edition of Retire Rich, Invest Rs 40 a day by PV Subramanyam, blogger at subramoney.com, is a must read book for all ages, younger the better.

You can be young without money but you can’t be old without it. Tennessee Williams

Table of Contents

About the Book: Retire Rich Invest Rs 40 a day

Retirement planning is quite a complex task, it encompasses portfolio planning, tax planning, behavioural science and individual psychology. Do you need a portfolio manager, a financial planner, a chartered account, a broker?

Retirement sounds very intimidating to many people. However, like all journeys, it begins with a small step. Like all events in life, the person who is better prepared will face it better.

The book, Retire Rich, Invest Rs 40 a day is a personal finance book written by an Indian, PV Subramanyam, who blogs at subramoney.com and simplifies finance. He has also conducted 1000 training, sessions, meet thousands of people and talked about their dreams, goals, fears about money. It is about preparing you for retirement. It was first launched in 2013 and has sold more than 1,50,000 copies. The new edition has come out in 2019. It has 100 more pages and more chapters, like “stop pretending you are rich” separate chapter on “women and retirement”, which were not in the earlier version.

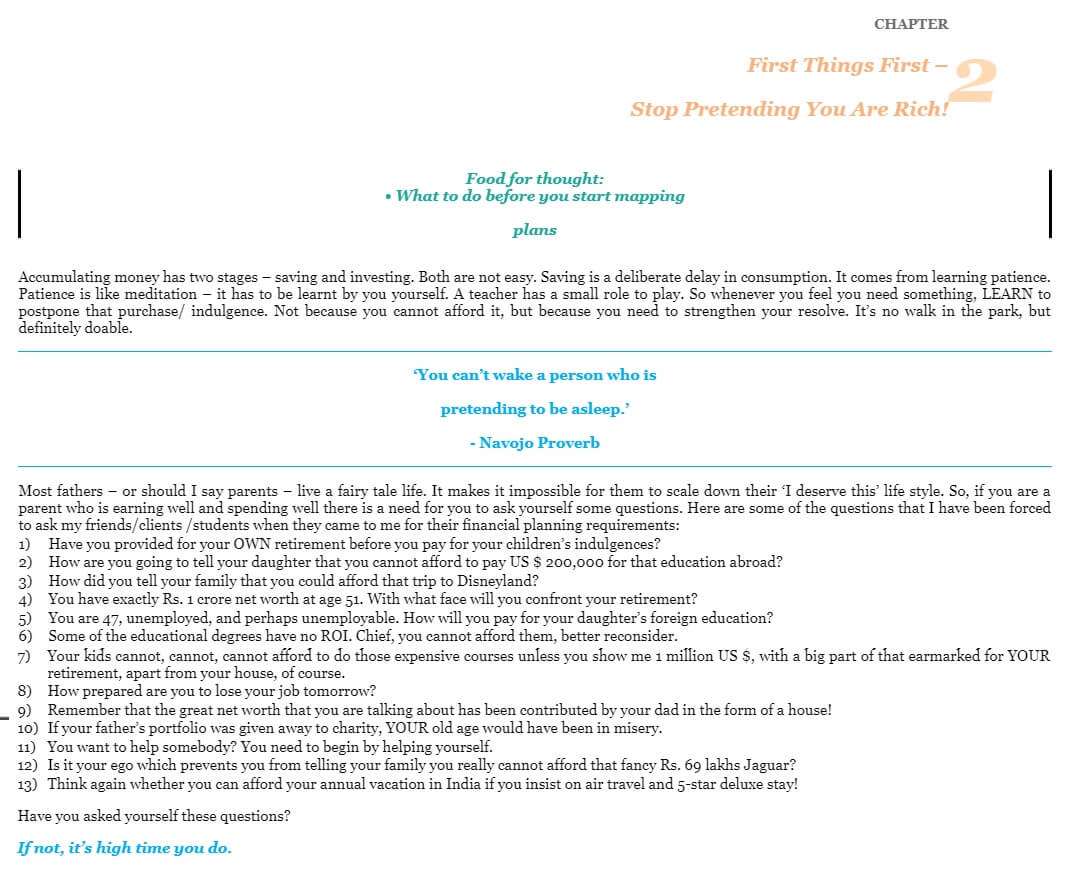

It is a do it yourself kind of book with MRP Rs 699(often at discount) and in Hardcover. It is in simple English with no jargons, 350 pages, with pointers, case studies and methods to maximize your investments based on his interaction with his clients. It gives an overall perspective, explains the terms like Annuities, Investment Instruments. Each chapter starts with a nice Food for thought, has many relevant quotes (I will be quoting them in my tweets for my twitter handle @bemoneyaware), is straight forward with bullet points and direct hard hitting questions. An excerpt of which you can see later in the article, here.

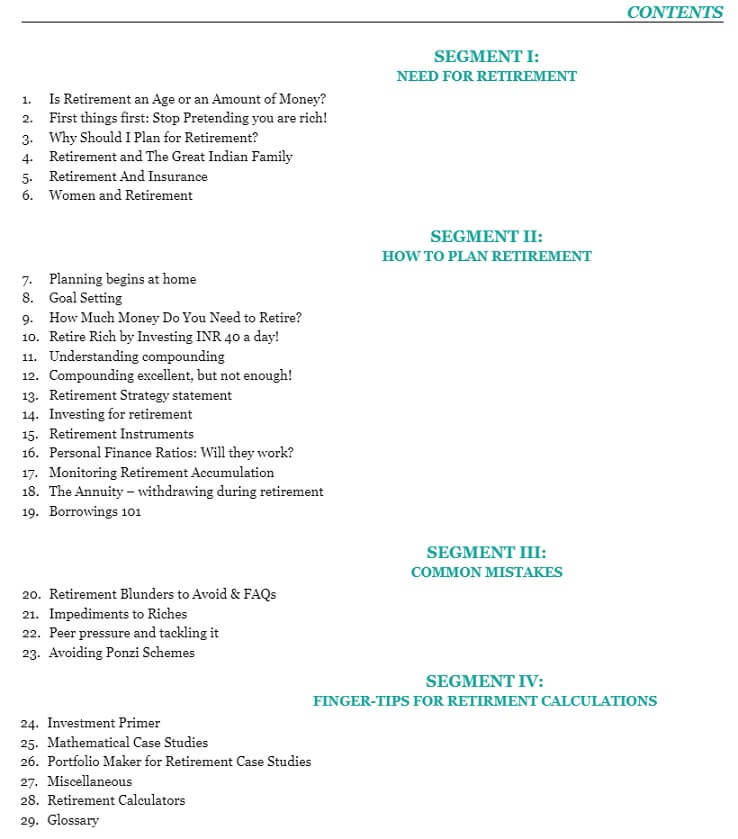

The Book is divided into 29 chapters spread across four segments given below. The image here shows the content.

- Need for retirement

- How to plan your retirement

- Common Mistakes

- Finger Tips for Retirement Calculations

Who should read the book: Anyone who wants to have a rich retirement. The earlier you start, the better.

My favourite part of the books Parents and Children Money discussion, Retirement blunders to avoid, Peer Pressure. Retiring rich by saving Rs 40 a day makes me realise every time, importance of small baby steps.

It is also not a book that you can read once and keep it away. You need to go back to it again and again.

Stages in a person’s Life

Shakespeare in his play As you like it talked about Seven stages of a man’s life. All the world’s a stage, And all the men and women merely players; They have their exits and their entrances, And one man in his time plays many parts, His acts being seven ages. But here Subramanyam breaks life into following stages.

- when you first see the world: From childhood to 12th class. Between 8 to 10 years of age, you start understanding money. You come across budgeting inflation.

- end of school to completion of a college education

- the beginning of earning life

- growing in your career, you are buying some asset

- middle age, with grown up with children in college

- Retirement

Post-retirement years is likely to be in various stages

- Stage 1: could be from age 55 years to age 65 years. During this time, there may be some income coming in from some commercial activity.

- Stage 2: could be from 65 years to 75 years. Here the income is mostly from investments, expenses have reduced and are mostly medical expenses and the travel is no longer enjoyable.

- Stage 3: From age 75 years to age 85 years.

What goes into a successful retirement

It is nice to get out of the rat race, but you have to earn to get along with less cheese. Gene Perret

Questions you need to ask for being retirement ready

The timing of retirement, Postretirement lifestyle, Postretirement money, Physical and Mental preparation. Questions that you need to answer for retirement are as follows.

- how much money I have now

- at what age I want to retire

- what lifestyle I wish to support in retirement

- whom will I support other than my spouse

- how involved will my spouse be in my investment portfolio

- do I want to leave anything your estate

- Will my money last longer than me and my spouse

- Will I have the liquidity when I need it?

- Will I be protected against inflation?

- What is the safe amount that I can withdraw on a regular basis?

- If I do a reverse mortgage am I putting my net worth at risk?

- Will I leave anything for my children?

- If I am leaving should I distribute it when they need or at the end of my life?

- If there tax implication for my children who are inheriting?

These boil down to finding answers to the following questions

- How much you would need

- How much you have, How much you owe: Assets and Liabilities

- What would be your cash flow: Will you get a pension? What will you be spending on?

- What is your insurance

- Your will

And this involves Planning, making Retirement Strategy Statement or RSS which spells out an investors investment philosophy, asset allocation targets and expected results.

Planning is bringing the future into the present so that you can do something about it now.

How prepared are you to lose your job tomorrow?

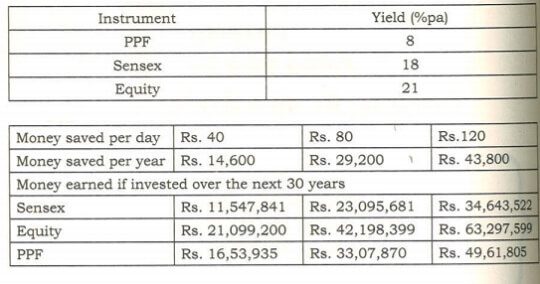

How can one Retire by just investing Rs 40 a day

When we think of accumulating a large amount of money, we trouble ourselves into believing that it takes a lot of money to create money. Most people don’t care about small numbers and wait for that big amount to come by for them to save. Well, it is not so. It is simple, simpler than you imagine. The thing that is going to help you retire rich.

By investing Rs 40 a day.

The image below shows that numbers don’t lie. If you save Rs 40 a day every day for the next 30 years at 8% in PPF it will become around 16.53 lakhs, but in Equity Mutual Fund at the rate of 21%, it will become 2.1 crores. If the amount spent per month is 3,500 then you can get 44.18 lakh in PPF(@8%) while 5.6 crores in Equity(@21%).

Will Equity markets give 21% return over the next 30 years? What about inflation? Well, you can ask these questions till the cows come home. But you need to make a start!

Your retirement corpus can come only from sacrifices. Most smokers know the damage that 54,750 cigarettes can do their health. But one cigarette does not matter. Ditto for that just one cold drink or one chocolate. Remember.

Your life is a function of your habits

If you want to reap financial benefits, you have to sow financially

Parents and Children Money discussion

I loved this section.

Talking to your parents about their money and money management skill makes one more nervous than talking to them about your first date. You could be perceived as greedy for asking about inheritance.

Discussion between parents and adult child should cover the following. If you shy away from this discussion then consequences would be enormous. In any case, Parents and children should know where all important documents are kept.

- do your parents need financial help?

- are they financially well off?

- do they need you to look after their finances

- have their finances been well managed

- are they in a position to comprehend the financial bombarding that must be happening

- are they vulnerable to being cheated

- do you need to forcibly look after their finances

- do they have a will

- are all their nominations in place

Parents while dividing the estate may not be fair

Scenario 1: A sister says My brother is not bothered about my father. I look after him so my father’s house belongs to me. But brother after father’s funeral can go to court and claim undue influence. What should a parent do in such case?

Scenario 2: You think: Qualified son can do with a smaller inheritance that the daughter whose husband is bum.

What will son say “Give more to me as I will be there for my sister when she needs me”

or

Are you punishing me for doing well in life by leaving money to that bum!

Retirement blunders to avoid

Be not ashamed of mistakes and thus make them crime – Confucius

- Consuming your retirement corpus much before retirement

- Postponing/Procrastination

- Having no clue about how much to save or invest

How much should you save for Retirement? Retirement Calculator

No single formula can answer this question but can only estimate how much will you need. The Retirement Calculator from the book tries to give a rough figure.

Excerpt of the Book

Table of Contents and Excerpt from the book are given below. You can also read more with Amazon’s Look Inside Feature here.

Excerpt from the book

Related Articles

- Personal Finance Books For Adults And Young Adults in India

- Book Review-JagoInvestor:16 personal finance principles every investor should know

- Review of Book:11 Principles To Achieve Financial Freedom

- Books on Money for Children

- Robert Kiyosaki’s Rich Dad Poor Dad : Is it good personal finance book?

- Secrets of Millionaire Mind : How Rich and Poor People think differently

- Book Review : Financial Planning Essentials For Software Professional

Retirement cannot be downsized, postponed or avoided. Retirement is like a time bomb and we are not prepared for it. This book is about getting prepared for retirement. Do you think reading personal finance books is useful? Do you read personal finance book? Which is your favourite personal finance book?

It is all about choices – if you choose pain now, pleasure will come later. if you choose pleasure now, pain will follow.

Hi,

For business news, Kindly look for –

https://kapso.in/blog/

Hi A very responsive and helpfull site.