RSU or Restricted Stock Units are shares of the company given to employees free of cost but with some restrictions. What are RSUs? Why are RSUs given? What is the vesting date? When are RSU taxed? Is there a capital gain on selling RSU? What is the capital gain from selling RSU? We shall answer these questions by talking about the RSU of an American MNC.

Table of Contents

Overview of RSU, Tax, and ITR

RSU or Restricted Stock Units are shares of the company given to employee free of cost but with some restrictions(as the name suggests)

- On Granting of RSU no tax implication. It is just a promise by the employer

- On the vesting day, the given percentage of RSUs are transferred to employee’s trading account.

- Employee has to pay tax based on his income slab.

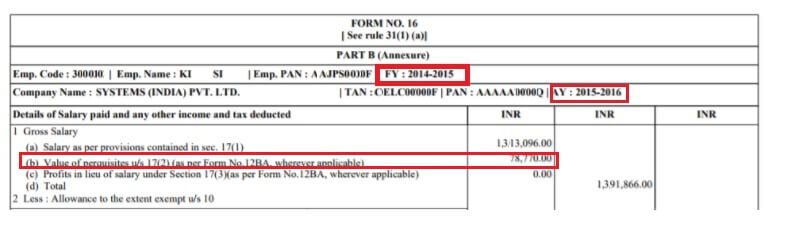

- the value of shares is considered as Perquiste in India and appears in Form 16. The market value of the shares vested (number of shares vested x Fair Market price X Conversion from Dollar to Indian Rupee) is added to the employee’s taxable income as perquisites. The price at which Stock is given to you is called as the Fair Market Value

- Tax might be deducted in the other country.

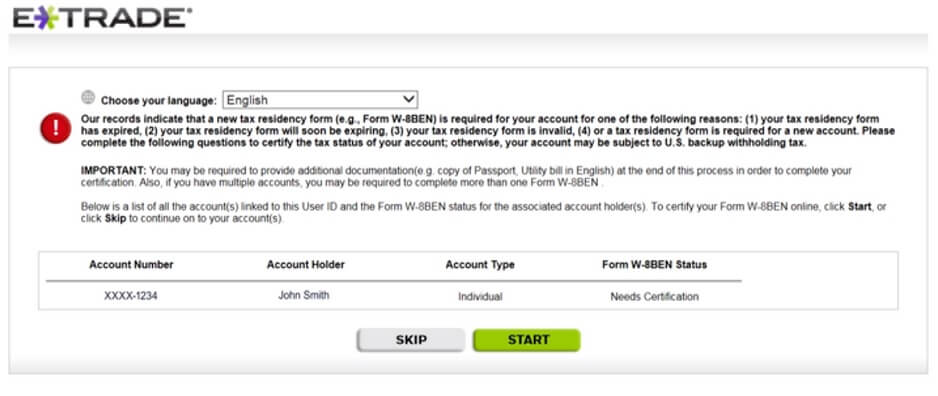

- US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes.

- Indian companies deduct % of shares as tax.

- There is no double taxation as tax is paid from the sale of shares.

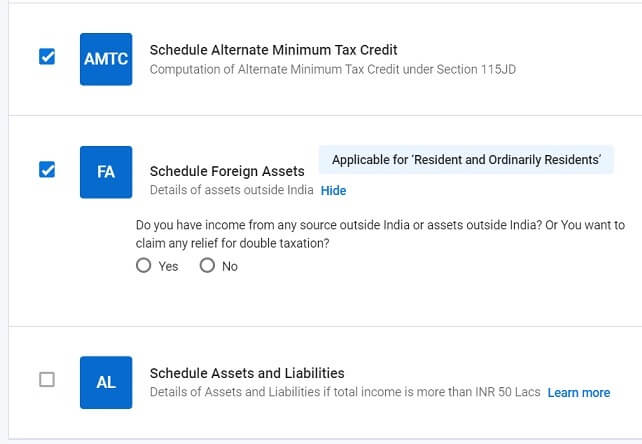

- One needs to declare shares received as RSU as Capital Asset in Schedule FA(Foreign Assets) of ITR2, ITR3, ITR4.

- ITR1 does NOT have the schedule for Foreign Assets. So if you RSU, ESPP in MNC you cannot file ITR1.

- You should fill in information about all the RSUs you have as of the financial year of the MNC

- You should show income you derived from it(Dividend, Capital Gains).

- If tax for RSU has been deducted by selling of shares, Number of shares mentioned should be after the deduction. So if 100 shares got vested and 30 shares were deducted then you need to show only 70 shares in Foreign Assets.

- One can only sell the RSUs that are vested. On the sale of the vested shares, the profit earned is a capital gain and is therefore taxable in India.

- For RSUs, the difference between the vesting price or the Fair Market Value and the sale price is the as capital gain

- For RSUs, the acquisition date is the vesting date.

- As the RSUs of the MNCs are not listed on the Indian stock exchange and no STT(Security Transaction Tax) is paid so the definition of a long term and short-term capital gains is different from the shares listed on Indian stock exchange like BSE and NSE.

- Short-term capital assets – when sold within 24 months of holding them. Short-term gains are taxed at employee’s income tax slab rates

- Long-term capital assets – when sold after 24 months of holding them. Long-term gains are taxed at 20% with indexation

- This capital gain must be declared in Schedule CG of ITR2 ITR3, ITR4 for tax purposes.

- Advance Tax should be paid for profit/capital gain of more than 10,000 Rs.

The reporting would be as below for foreign stocks on

- Schedule CG for Capital gain on Sale of Shares

- Schedule OS for Dividend income

- Schedule FSI and Schedule TR for claiming the foreign tax credit in case of double taxation relief

- Schedule FA: Details of holding of foreign shares/securities

RSU or Restricted Stock Units

RSU or Restricted Stock Units are shares of the company given to employee free of cost but with some restrictions(as the name suggests). The restriction is that though an employee is granted RSUs on a specific day (such as when he joins a company or gets a promotion) he gets ownership of the shares over a period of time. It is an incentive to the employee to stay in the company and to profit from the growth of the company. When the shares are awarded to the employee according to the schedule, it is considered as perquisite income and added to regular income. When one sells the RSUs one capital gain comes into play and one may have to pay tax depending on the period of holding of RSU. Terms associated with RSU.

- Grant date: The date on which the shares are allotted

- Vesting date: the date on which the shares get transferred to the employee.

Say if one is granted 100 RSUs to be vested over 3 years in the ratio 34%/33%/33% on 23 Nov 2013. Then 34 RSUs (34%) will vest on 23 Nov 2014 and 33 each (33%) on 23 Nov 2015 and 23 Nov 2016 respectively. If you leave the company on 1 December 2015, then you will be able to sell only 34 shares and the remaining 66 shares will go back to the company. If you stick around for another month, then you will be able to sell 67 shares (34 + 33) as another 33 shares will vest on 23 Nov 2015.

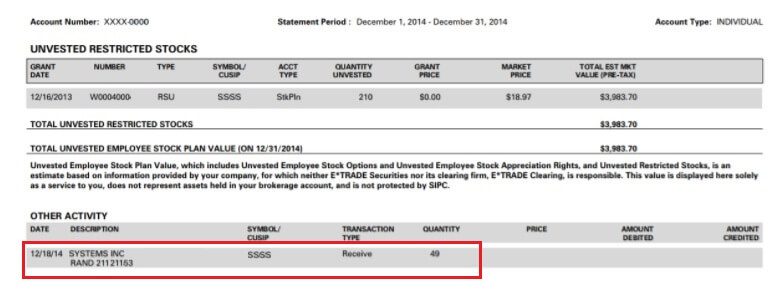

So if one is granted 100 RSUs to be vested over 4 years in the ratio 25%/25%/25%/25% on 16 Dec 2013. Then 25% of RSUs i.e 25 stocks of the company will vest on 16 Dec 2014, on 16 Dec 2015, 16 Dec 2016 and 16 Dec 2017 respectively. (If the vesting day is holiday then the stocks vest on next working day)

The other kind of incentives offered by the companies are ESPP and ESOP.

Our article What are Employee Stock Options (ESOP) explains ESOP in detail.

Our article Employee Stock Purchase Plan or ESPP explains ESPP in detail.

Tax when RSUs are Granted

On Granting of RSU no tax implication. It is just a promise by the employer.

Tax when RSUs are Vested

Vesting date is the date on which the predefined percentage of shares get transferred to the employee according to the predefined schedule. Say one is granted 100 RSUs to be vested over 4 years in the ratio 25%/25%/25%/25% on 16 Dec 2013. Then 25% of RSUs i.e 25 stocks of the company will vest on 16 Dec 2014. On the vesting day, the given percentage of RSUs are transferred to employee’s trading account, for example, eTrade or Charles Schwab account for an American MNC. On Vesting, one has to take care of following things

- one has to pay tax based on income slab.

- the value of shares is considered as income in India.

Tax on RSU

Companies are obligated to deduct taxes for RSUs vested. The most common method of deducting tax is share withholding, where the company withholds enough shares to cover the tax liability and deposits net shares to your brokerage account. This option is called as Sell to cover. Some companies permit other methods, such as cash or sell-to-cover transactions, which are explained below. Different methods may be supported by trading companies like Schwab or eTrade, but only the methods authorized by your company will be available to you.

The various options to deduct tax on broking site where the RSUs are held are as follows:

- A sell-to-cover This is the default option where TDS (as per your income slab) percentage of the vested shares are sold immediately and the amount is paid to the government as tax. The remaining 70% of the vested shares remain in your account and you can sell them later whenever you want. Actully tax deducted is as per the income slab but as in most of the companies, the RSUs are offered above a certain level where income comes in 30% income slab.

- A same-day sale: All the vested RSUs are sold immediately. Percentage of the sale proceeds are deducted and paid as tax to the government and the rest of money gets wired to your account. You don’t any shares after this.

- A cash exercise allows you to pay the tax and no shares are sold. The money to pay must be available in your brokerage account.

The default option is Sell to Cover hence If 70 RSUs are vested then you would get only 49 stocks in your account due to taxation. 30% of 70 = 21 which is taken as tax. So no of shares in the account becomes 70-21=49.

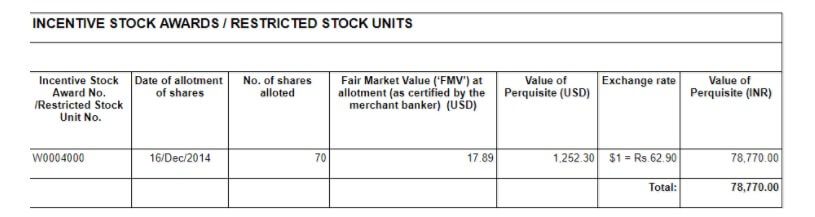

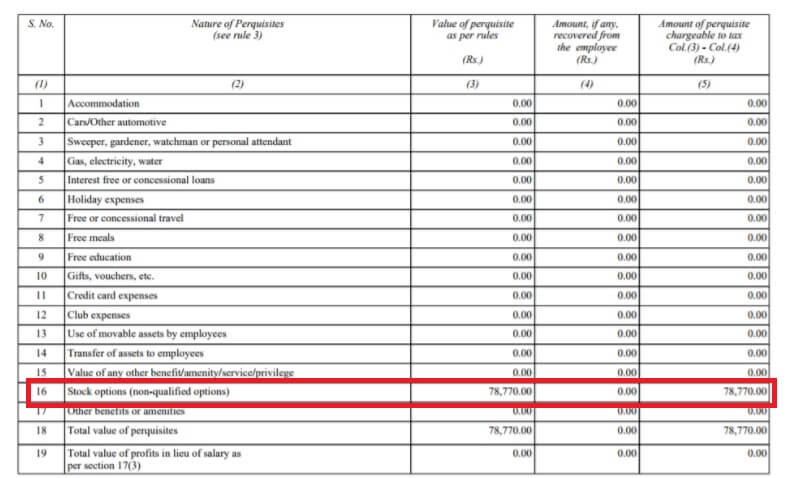

RSUs as Perquisite Income in India

For RSUs, the acquisition price or purchase price is zero and so the entire market value of vested shares is treated as income in India as a perquisite. The market value of the shares vested (number of shares vested x Fair Market price X Conversion from Dollar to Indian Rupee) is added to the employee’s taxable income as perquisites. The price at which Stock is given to you is called as the Fair Market Value. All the shares that are vested are used to calculate the Perquiste Income which includes the stocks which were sold for tax. if 70 RSUs are vested then you would get only 49 stocks in your account due to taxation but all the 70 shares will be used to calculate the perquiste income.

It is declared in his Form 12BA for the year and is available in your Form 16, as shown in the images below. The Indian company adds it to employee’s Income and charges Tax accordingly.

Our article Understanding Form 12BA give details of Perquisites given to an employee in detail.

Our article Understanding Form 16: Tax on income explains the Form 16. Income Tax Form 16 is a certificate from the employer which certifies that TDS has been deducted from employee’s salary by the employe

Are RSU’s Taxed Twice?

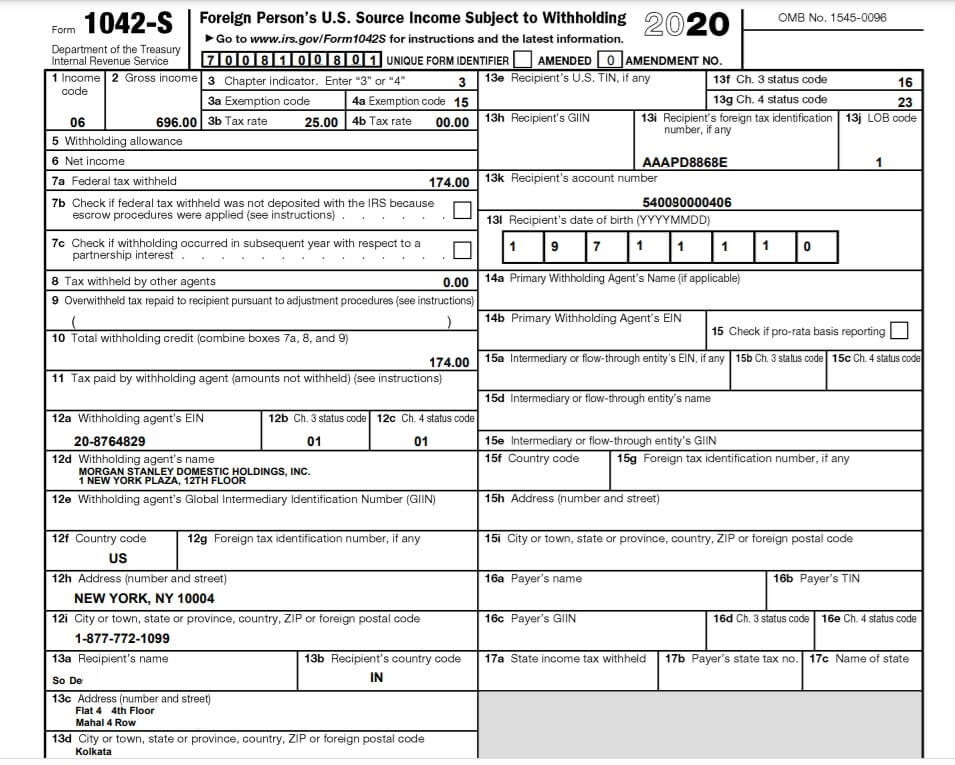

Short Answer is RSU’s are not taxed twice. If they would have been taxed twice you would have Govt document of the country deducting tax saying that tax has been deducted. Like Form 16/Form 16A provided by Indian Govt or Form 1042-S provided by US when the tax is deducted on the dividend of US compnaies.

An employee (Resident Indian) working in India in a subsidiary of a US Company is given RSU or Restricted Stock Units of the parent company.

When the stocks are vested, some stocks are withheld (Sell to cover) to meet tax liability in US and after reducing these stocks, the balance is given to the employee.

Indian company also calculates prerequisite based on FMV on the total number of stocks including withheld stocks and TDS is deducted. This is reflected in Form 16 partB.

So are RSUs are taxed twice. About 65.22% value is consumed in tax.

Is double taxation done by the company is correct?

Can DTAA benefits be availed for a refund?

No, RSUs are not taxed twice is what my company says. Just because you are seeing that in your Form 16 and your brokers statements, it doesn’t mean that its been deducted twice.

In the example above, Reader Smriti explained beautifully.

100* FMV was added to your prerequisite to show it as a part of income. it just means you were paid a 100*FMV amount by the company( in form of stocks).

66 stocks are deposited to your brokerage account.

The remaining stocks (100-66 = 34) are considered to be sold by the broker on your behalf and the amount obtained from this is paid as tax.

All these calculations are part of your salary prerequisite and hence, will show in your salary slip as the tax you are paying to Govt of India.

The employer is not deducting tax twice. it’s just adding all the details in the payslip.

We have heard that Proof is in the pudding or show me the proof. If the tax had been deducted by the foreign company then they need to provide documents like Form 16/Form 16A in India and Form 1042-S in the US. The Sample Form 1042-S from our article How are Dividends of International or Foreign Stocks taxed? How to show in ITR is shown below.

Dividend income from foreign stocks

Dividend income earned from foreign stocks is taxed as per Income Tax slabs under the head Income from Other Sources.

In Schedule TR, you need to provide a summary of tax relief that is being claimed in India for taxes paid outside India in respect of each country. This schedule captures a summary of detailed information furnished in Schedule FSI.

In the case of certain ESOPs, an individual may also receive dividend-equivalent income on unvested shares. These are generally taxed as part of salary income.To determine one’s taxation it is advisable to have a talk with your Employer or colleagues.

The Double Taxation Avoidance Agreement or DTAA is a tax treaty signed between India and another country so that taxpayers can avoid paying double taxes on their income earned from the source country as well as the residence country. At present, India has double tax avoidance treaties with more than 80 countries around the world.

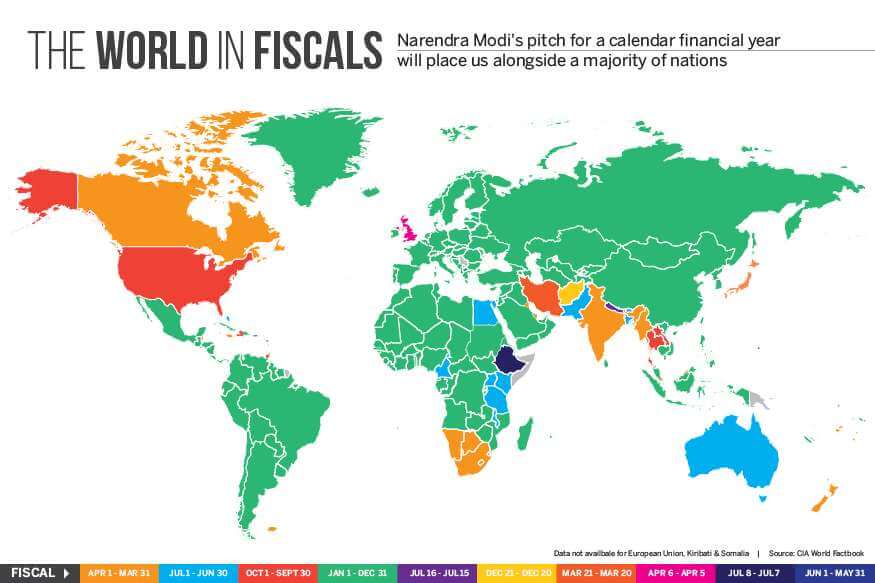

Financial years of different countries

“It is hereby clarified that a taxpayer shall be required to answer the relevant question (whether foreign assets are held or not) in the affirmative, only if he has held the foreign assets etc. at any time during the “previous year”(in India) as also at any time during the “relevant accounting period”(in the foreign tax jurisdiction), and fill up Schedule FA accordingly.”

Lets take an example of RSUs of a MNC headquartered in USA which has financial year from 1 Jan to 31 Dec. So only RSUs(ESPPs) acquired between 1 Jan 2022 to 31 Dec 2023 needs to be reported.

Financial years for popular countries are given below

1. United States: Financial year is from January 1st to December 31st.

2. United Kingdom: Financial year is from April 6th to April 5th.

3. Canada: Financial year is from January 1st to December 31st.

4. Australia: Financial year is from July 1st to June 30th.

5. United Arab Emirates: Financial year is from January 1st to December 31st.

For details checkout our article Difference between Assessment Year and Financial Year, Previous Year,Fiscal Year in World

How to show RSU, ESPP, and Foreign Assets in ITR

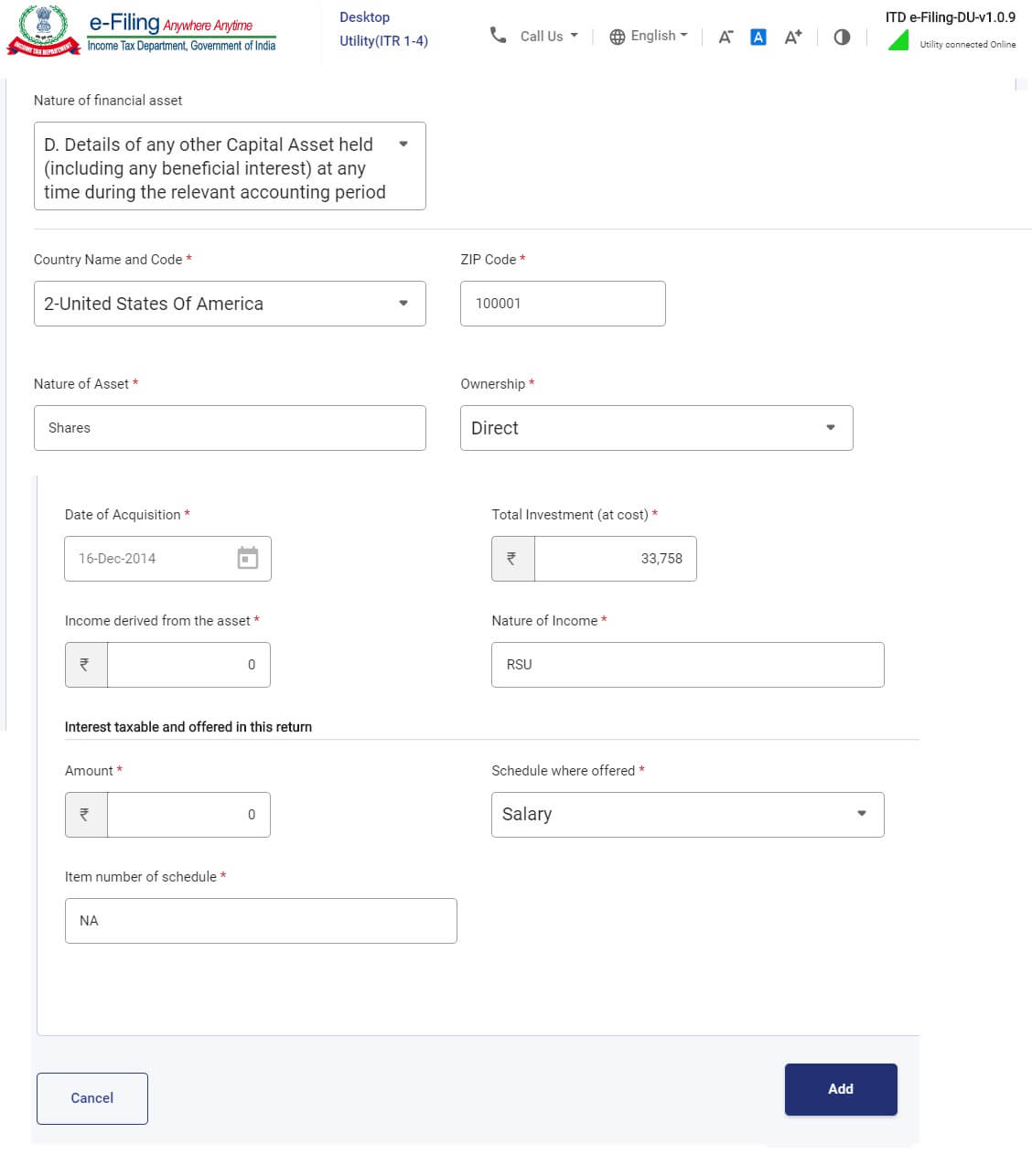

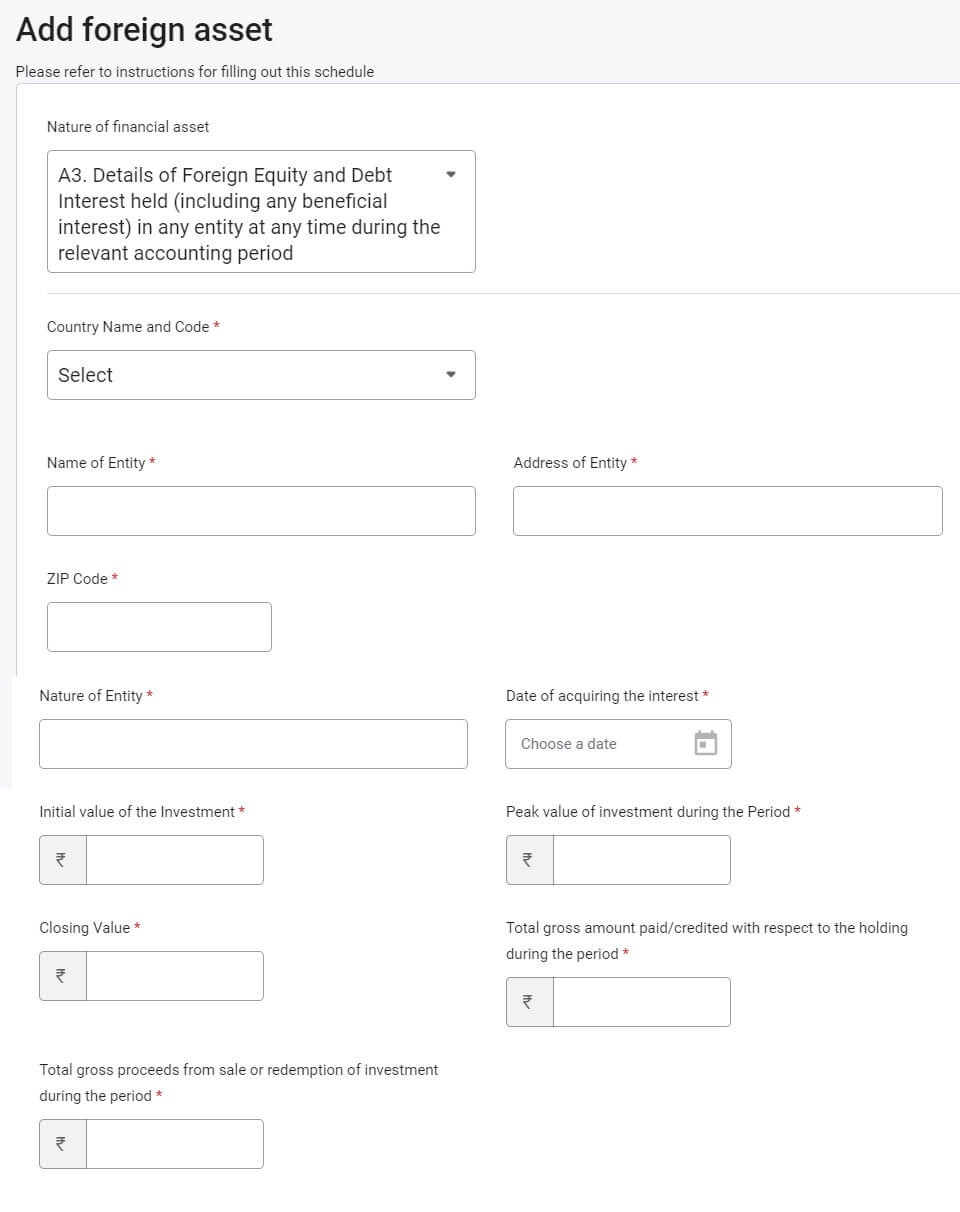

One needs to show shares received as RSU(ESPP/ESOP) as Capital Asset in Schedule FA(Foreign Assets) of ITR other than ITR1 such as ITR2, ITR3, ITR4 as shown in the image below. ITR1 does NOT have the schedule for Foreign Assets.

The image below shows the case of only when shares of a company in the US were allotted to the employee and the employee has not sold them till filing of the income tax return. To fill this please go through Perquisite on Stock Options report and the break up provided by your employer on stocks allotted to you.

If tax for RSU has been deducted by selling of shares, the Number of shares mentioned should be after the deduction. So if 100 shares got vested and 30 shares were deducted then you need to show only 70 shares in Foreign Assets. Total Investment values is the Number of shares in your account X Fair Market Value X US dollar stock price.

If you have got RSU at different times and you haven’t sold them then details about each allotment you had till 31 Mar of the financial year for which you are filing ITR has to be put in the Foreign Assets table.

For example, your 70 RSUs got vested in 2020 and 70 in 2021, the information about both the allotments should be in Foreign Assets.

Schedule for Foreign Income in ITR

Difference between Schedule Foreign Source Income (FSI) and Foreign Assets (FA)

Is Schedule FSI required to be filled in ITR2?

I am resident in India. I have been allotted stock options (of my parent US company), which have been shown in my Form 16. Do I also need to show this income in Schedule FSI or Schedule FA (Foreign Assets)? No Tax has been deducted in the US and I am not claiming any refund.

- In Schedule Foreign Source Income (FSI), you need to report the details of income, which is accruing or arising from any source outside India. FSI schedule is mandatory for residents who earned income from outside India and tax paid outside India and to claim the benefit of DTAA on such income.

How to select the Schedules?

Go to Schedule Selection

- Click Income to see the Income from Capital Gains Schedule. Select the Schedule

- Click Income to see the Foreign Source Income schedule. Select the Schedule

- Click Others to see the Foreign Assets Income schedule. Select the Schedule

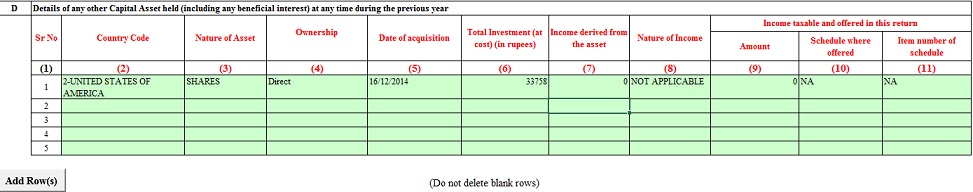

Details to be filled in Foreign Asset schedule in ITR2

Details to be filled are:

- Country Name and code: The Country where the exchange on which stocks are listed is traded. Ex for someone working in Amazon or Microsoft, it would be the USA. Code is available in the dropdown in ITR.

- Nature of asset: Shares

- Nature of Interest-Direct/Beneficial/owner/Beneficiary: Direct

- Date of acquisition: Date on which stocks were allotted

- Total Investment (at cost) (in rupees): Price at which RSU/ESPP was allotted. (Please deduct the number of shares that were credited to your account after-tax deduction. Say you were allotted 70 shares but because of tax only 49 stocks were credited into your broking account). In example 49*17.89(FMV)*62.90(USD Exchange rate)

- Income accrued from such :

- 0, if you haven’t sold the shares.

- If you have earned a dividend then declare the dividend received.

- If you have sold the shares then you have to show the profit/loss received from the sale of the shares.

- Nature of Income: What type of Income it is. For Foreign stocks not sold it is Income from Salary. For Foreign stocks sold it is income from Capital Gains.

Table A3 or Table D

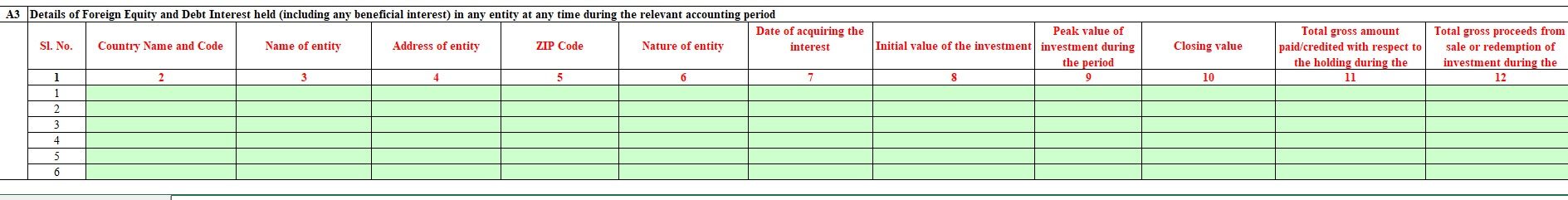

You can declare it in Table A3 or Table D of Foreign Assets as shown in the images below

Technically it should be declared in Table A3. Extra details required in Table A3 are the Peak Value of investment during the period, Closing Value. Closing Value should be as of 31 Mar. These details you can find from your broker.

In table A3, the initial value of the investment, the peak value of the investment during the accounting period, the closing value of the investment as at the end of the accounting period, gross interest paid, the total gross amount paid or credited to the account during the accounting period,and total gross proceeds from sale or redemption of investment during the accounting period is required to be disclosed after converting the same into Indian currency

But as it requires more details, many people do it in Table D, the rationale being we are declaring the income and account for it.

Table A3 and Table D in the old ITR

Table A3 and Table D in the old ITR

Our article Are ESPP, ESOP in MNC to be filed in ITR as Foreign Assets? discusses What are foreign assets? The Foreign Asset schedule in ITR2.

Tax On Sale of RSU

One can only sell the RSUs that are vested. On the sale of the vested shares, the profit earned is a capital gain and is therefore taxable in India.

For RSUs, the difference between the vesting price or the Fair Market Value and the sale price is the capital gains.

As the RSUs of the MNCs are not listed on the Indian stock exchange and no STT(Security Transaction Tax) is paid so the definition of a long term and short-term capital gains is different from the shares listed on Indian stock exchange like BSE and NSE.

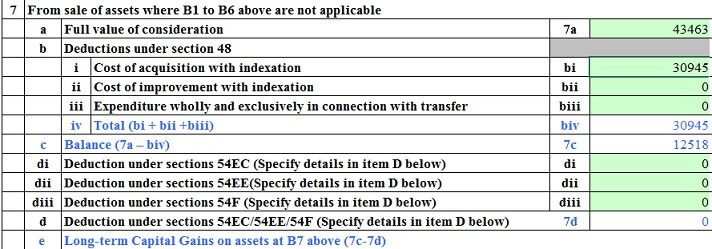

From FY 2016-17 i,e for the sale of unlisted shares on or after 1st April 2016 UNLISTED equity shares is given below. This capital gain must be declared in Schedule CG of ITR so that tax may be suitably charged

- short-term capital assets – when sold within 24 months of holding them. Short-term gains are taxed at employee’s income tax slab rates

- long-term capital assets – when sold after 24 months of holding them. Long-term gains are taxed at 20% with indexation (so section 48 which uses Indexation applies)

The income tax Act in India act differentiates between the tax on capital gains of listed and unlisted shares.

- Listed shares are those that are listed on Indian stock exchanges, such as TCS, HDFC Bank, etc.

- Unlisted shares are those that are not listed on Indian exchanges, regardless of whether they are of Indian companies or foreign companies listed on foreign exchanges such as Google, Microsoft, Apple, etc.

The tax treatment on capital gains that are unlisted in India or listed out of India is the same. So if you own shares of an American company, this company is not listed in India, hence it is considered unlisted for the purpose of taxes in India.

The period of holding begins from the vesting date up to the date of sale

The table below shows the example of Short Term Capital Gain and Long-term Capital Gain

| At the time of | Units | Date | FMV of share(USD) | Tax to be paid | In income tax return |

| Grant | 240 | 12-Dec-13 | Not Applicable | nil | Not Applicable |

| Vesting | 70 Vested

49 transferred |

12-Dec-14 | 17.89

1 USD = 62.90 Rs CII of year 240 |

Tax of 30% taken by selling 21 shares

Income Tax = 70 * 17.89* 62.90=78770 |

Perquiste Income as Income from Salary.

Taxed as per employee’s Income Tax Slab Rate |

| Sale of shares if unlisted | 20 | 31-Jul-15 | 20.96

1 USD = 63.60 Rs |

Short Term Capital Gain= 20* ((63.60*20.96)-(62.90* 17.89))= Rs 4,155.5 | Under Capital Gains (short term capital gains)

Taxed as per Income Tax slab of employee |

| Sale of shares if unlisted | 25 | 31-Jan-17 | 25.89

1USD = 67.15 CII of the year 264 |

Indexed purchased cost = 62.90 * 264/240 = 69.19

Long-Term Capital Gain with indexation= 25*((67.15 * 25.890)-(69.19* 17.89)) = =25* (1738.5135 -1237.8091) = 25*500.7044=12517.61 Long-Term Capital Gain tax(with indexation) = 20% of 12517.61=2503.522 |

Under Capital Gains (long term capital gains)

Long-Term Capital Gain without indexation= 25*((67.15 * 25.890)-(62.90* 17.89)) = 15330.8125 Long-Term Capital Gain tax(without indexation) = 20% of 15,330.8125=3066.1625 |

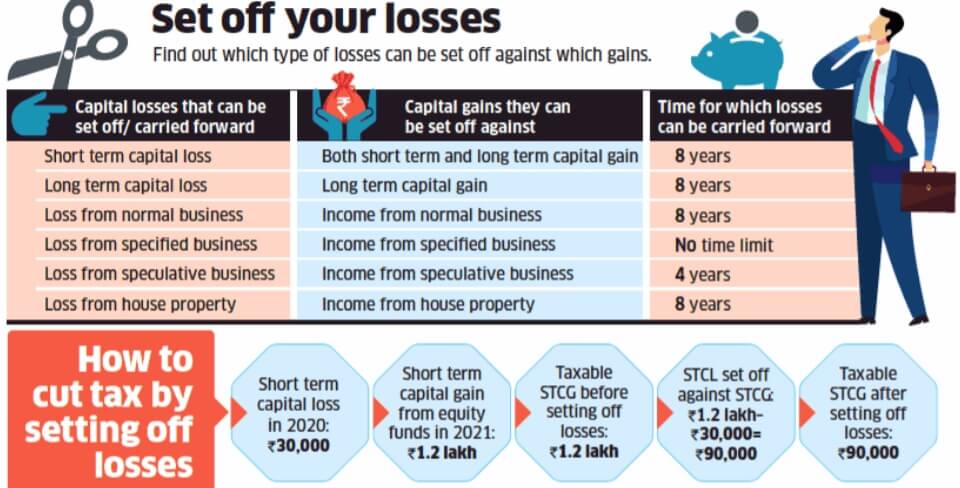

Capital Loss

What if there is loss on selling shares? Thankfully Income Tax Department gives benefit of Setting of Capital Loss.

Set-Off Losses means adjusting the loss against the taxable income earned; after that, remaining the loss can be carried forward to future years.

The taxpayer cannot carry forward losses to future years if the income tax return for the year in which loss is incurred is not filed on the Income Tax Website within the due date as per Sec 139(1).

If one has Short term capital loss, then it can be set off against short-term or long-term capital gain from any capital asset(real estate, gold, debt mutual funds).

If the loss is not set off entirely, then it can be carried forward for a period of 8 years and adjusted against any short-term or long-term capital gains made during these 8 years. But only if he has filed his income tax return within the due date.

Showing Capital Gains in ITR

Part A of the Capital Gains Schedule provides for computation of short‐term capital gains (STCG) from the sale of different types of capital assets. Out of this, item No. A3 and A4 are applicable only for non‐residents.

Part B of this Capital Gains Schedule provides for the computation of long‐term capital gains (LTCG) from the sale of different types of capital assets. Out of this, item No. B5, B6, B7, and B8 are applicable only for non‐residents

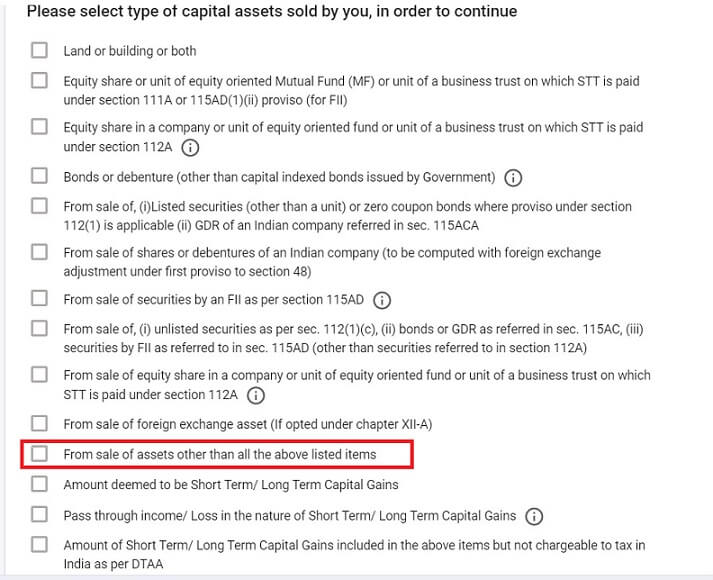

Choose the Schedule Capital Gains

In Capital Gain Schedule for sale of shares of MNC not listed on Indian Stock Exchange choose Sale of Assets other than listed. (in addition to any other capital gain you would have)

Then Choose Short Term Gain/Long Term Gain

- Short Term Gain if you held shares for less than 24 months

- Long Term Gain if you held shares for more than 24 months

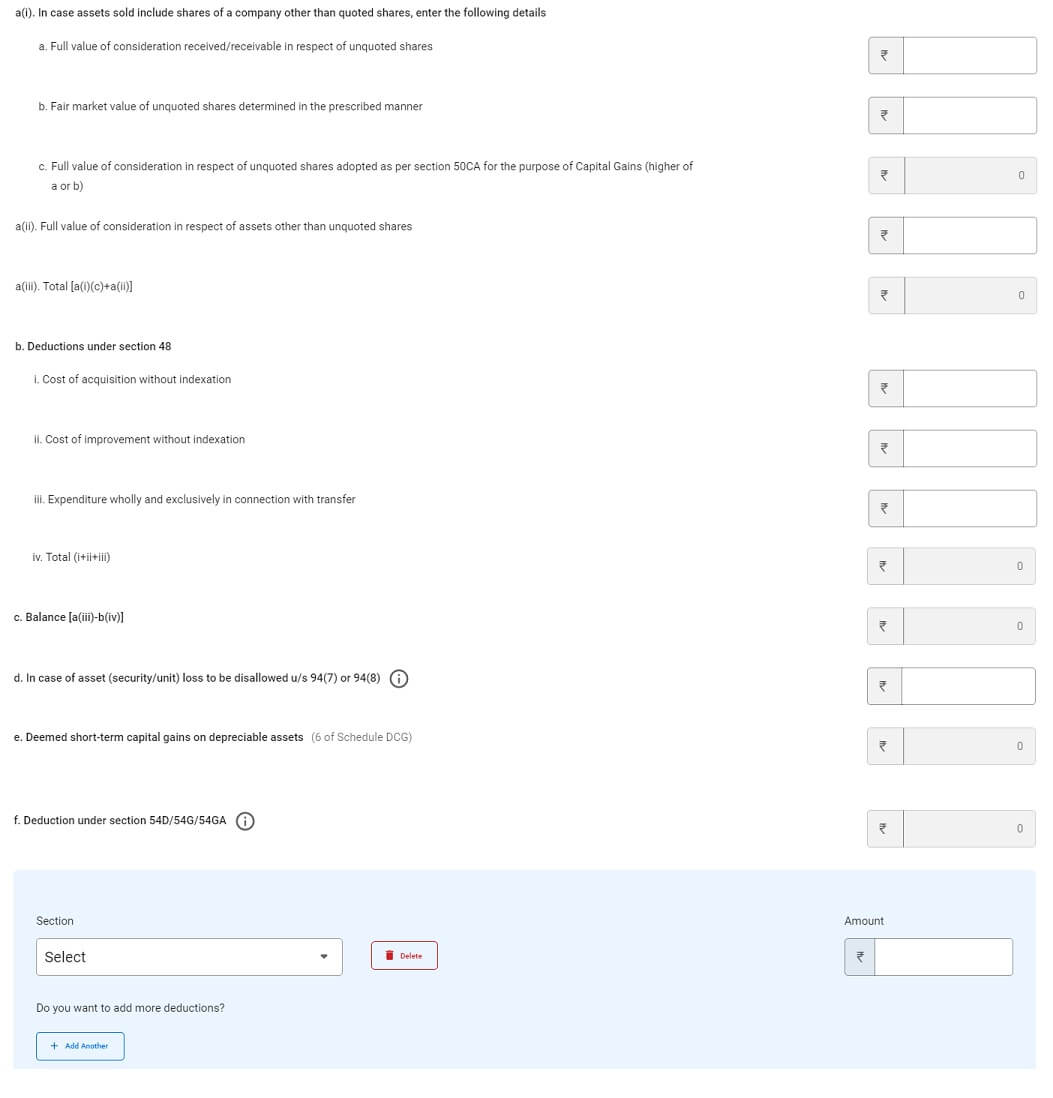

The new ITR Utility shows the details that need to be filled for Capital Gains

Capital Gains in Old ITR

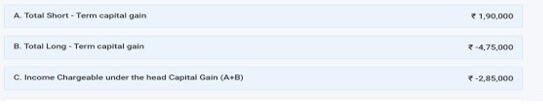

Setting of the Capital Loss

If you have a capital loss then in summary you would see the loss an example of which is shown in the image below. If there is a Capital Loss, it would be reflected as a negative value

Click on Schedule CYLA (Current Year Losses Adjustments). The details entered in Capital Gain Schedules will reflect in Set-Off/ Carry Forward Schedules.

Note: Set off & carry Forward Schedules will fetch data from Capital gain Schedule. The taxpayer need not enter the details again in these schedules.

Click on Schedule CFL (Carry Forward Losses)

The unadjusted losses of that financial year will be carried forward.

In the following years ITR you can adjust your capital gains against this loss and reduce your tax liability.

DTAA and RSU

Double taxation refers to the situation when an individual is taxed more than once on the same income, asset or financial transaction.The Double Tax Avoidance Agreements (DTAA) is bilateral agreements entered into between two countries, in our case, between India and another foreign state. The basic objective is to avoid, taxation of income in both the countries (i.e. Double taxation of same income) and to promote and foster economic trade and investment between the two countries.

US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes. However, the taxes etc are deducted for the employees in India. These are reported in perquisites form. (as explained above). The image below shows how one has to certify W-8BEN form on ETrade for US. More details in the video here.

If any tax is deducted in US then US IRS department will send Form similar to Form 16 to your address.

Advance Tax on Capital Gain of RSU

Advance Tax rules require that one’s tax dues (estimated for the whole year) must be paid in advance. Advance tax is paid in installments. While the employer deducts TDS when your RSUs get vested, one may have to deposit advance tax if one earns capital gains.

Non-payment or delayed payment of advance tax results in penal interest under sections 234B and 234C.

You need to pay Advance Tax on RSUs only when you sell the RSUs and the profit is more than 10,000 Rs. You need to pay an appropriate percentage of it before the nearest due date. So if you sold between 16 June and 15 Sep you need to pay 45% before 15 Sep.

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax less advance tax already paid |

| On or before 15th September | 45% of advance tax less advance tax already paid |

| On or before 15th December | 75% of advance tax less advance tax already paid |

| On or before 15th March | 100% of advance tax less advance tax already paid |

However, it may be hard to estimate tax on capital gains and deposit advance tax in the first few installments if a sale took place later in the year. Therefore when advance tax installments are being paid, no penal interest is charged where installment is short due to capital gains. Remaining installment (after the sale of shares) of advance tax whenever due must include the tax on capital gains.

Depending on the time duration between the vesting date and the sale date, the profit can either qualify for short-term or long-term capital gains tax. For RSUs, the acquisition date is the vesting date.

Our article Advance Tax:Details-What, How, Why is about Advance Tax for individuals.

Disclaimer: This information is for educational purposes only. We have tried to provide the information to the best of our ability. But please consult your CA, tax consultant. Bemoneyaware.com is not responsible for any liability on information provided on the site.

Related Articles:

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Salary, Allowances, Dearness Allowance, Government Salary, Pay Commission

- Understanding Variable Pay

- Understanding Form 16: Part I

- How To Fill Salary Details in ITR2, ITR1

- HRA Exemption, Calculation, Tax, and Income Tax Return

- How are Dividends of International or Foreign Stocks taxed? How to show in ITR

Hope this article helped in understanding What are RSUs? Why are RSUs given? What is the vesting date? When are RSU taxed? Is there a capital gain on selling RSU? What is the capital gain from selling RSU? How to show these in ITR

Hello! I have received RSU units from my outside India Employer on a purely cash-settled basis, meaning the allotted RSU on vest was directly sold by my employer and I got it in salary as Cash Payout after TDS was deducted as usual, I never actually received the shares or hold any as seen in transaction statement. No RSU allotted info in Form 12BA as well.

I don’t have any other condition applicable for ITR 2 and usually fill ITR 1. Do I have to fill ITR2 in this case?

Thanks in advance!

Great Article!

I have one query,

suppose I have 100 RSUs allocated to me in 2014-2015 by a US MNC Listed and I still have them in 2022 -2023 thenIn table A3 and

1. for `the peak value of the investment during the accounting period’ – What should be the price of stock I need to use. Is it the peak price during 2014-2015 or 2022-2023 ?

2. `the closing value of the investment during the accounting period` – What should be the price of stock I need to use. Is it the closing price on Dec 31 2015 or Dec 11 2022 ?

Your advise will be immensely helpful!

Hello,

Thanks for a wonderful article it help me a lot. I have 2 questions.

1. I had sold my RSU in FY21-22, money is still in brokers account in US. Have not transferred it, and showed it as a capital gain in AY22-23. How exactly can I show this in AY23-24, currently the money is still in US?

2. In case of RSU the overall capital gain calculation can we account for the charges of wiring the money to India.

Thanks,

Prachi

Hello,

Thanks for a wonderful article it help me a lot. I have 2 questions.

1. I had sold my RSU in FY21-22, money is still in brokers account in US. Have not transferred it, and showed it as a capital gain in AY22-23. How exactly can I show this in AY23-24, currently the money is still in US?

2. In case of RSU the overall capital gain calculation can we account for the charges of wiring the money to India.

Thanks,

‘Sell to cover’ transactions, do we need to show this under Schedule FA and/or Schedule Capital Gains section?

Great article and something that will help many.

Can you clarify about recent changes in definition of accounting period by CBDT?

ITR talks about income/assets until 31Dec2021?

Should the sale of RSUs in Q4 2021-2022 (Indian financial year) ie. between Jan 2022- Marc 2022 be showed in AY 2022-23 or not?

Thanks

Thanks Praveen, could you spread the word around about our site

Interesting question.

The CBDT clarified that only foreign assets acquired as per the relevant accounting period of the foreign country have to be reported while filing income tax returns (ITRs)

Sale of the shares means you have income, hence selling of RSUs between Jan 2022-Mar 2022 should be reported in AY 2022-23

For instance, any foreign asset acquired and held, say, in May 2021, will need to be reported in the ITR for the financial year 2021-22. However, if a foreign asset is acquired, say, in January 2022, for which the relevant accounting year in the foreign jurisdiction is the calendar year 2022, the same may not require reporting in the financial year 2021-22. Although the asset acquired in January 2022 may not require reporting in the financial year 2021-22, the income earned from such asset during the financial year 2021-22 will have to be reported.

Dear Sir,

While working with an Indian subsidiary of an American Company, Mr A was awarded sweat equity of the parent Company. The Indian Company had shown this as Perquisite and deducted TDS on the vesting date.

Mr A is moving to the parent Company in USA.

He has not sold any of the sweat equity till now.

The Indian subsidiary is an eligible startup. So, while the man filed his ITR in India, the SYSTEM auto populated an amount as DEFERRED INCOME TAX and refunded it to him.

As per prevailing tax law in India the man should return the DEFERRED TAX amount “within 14 days of ceasing to be employee of the employer who allotted or transferred him such sweat equity.”

The issue in the above context

1.Is moving from Indian subsidiary to US parent Company is transfer OR cessation of employment from indian company and joining the USA company??

From this perspective, should he return the deferred tax amount now??

2. While residing in USA, he sells the sweat equity that was awarded in India.

He will have to show the Capital gain to Indian OR USA I. tax department.? Where will he be need to pay I. Tax. ??

I humbly seek your opinion on the afiresaid issues.

Thanks for the great article, this saved my life! I’ve a few questions,

1. For the assessment year 2022-23(filing for the Indian FY 2021-22), should I declare Foreign assets which were released on Feb 2022 as US follows calendar year for financial year?

2. If there were multiple vesting period, should I club them together or fill them separately?

Thanks in advance

3. I don’t find a forex rate(SBI TTBR) on the vesting date, should I select the value on the preceding date where rate is available?

For the sale value of RSU, the USD–>INR rate is decided by the bank where my money is transfered (wired) and the rate is different from the usual conversion rate.

On the other hand, for calculating the FMV, the USD-INR rate is considered in form12BA, but the same form does not break up the different RSU grant and also does not specify the USD-INR rate. Where can I get those details?

Thanks for the great article. I have calculated the capital gain/loss for RSU with the below example. Is my understanding correct?

For ease of calculation, I have considered 1 USD = 70 INR for all examples below.

Part 1 – RSU Perquisite and Tax calculation

1. 10 shares vested in 2019

2. Each share costs ~142 USD= 10K INR so the total share value is 1 Lakh

3. 4 shares were sold to cover the tax worth 40K INR

4. In form 16, 1 Lakh was added to salary income under the prerequisite 17 (2), and 40K INR was adjusted to tax paid

Part 2 – Short term

Short-term capital loss:

5. 6 shares were sold in 2020 at 160 USD (11,200 INR)

6. STCL calculation as follows:

6.1. Purchase Price =1 Lakh in 2019 (10 shares X 142 USD X 70 INR)

6.2. Sale price = 67,200 (6 share X 160 USD X 70 INR)

6.3. Loss= 32,800 (67,200-100,000)

Question – Although the selling price of the share (160 USD) is higher than the purchase price of 142 USD, it is still a loss. Is the calculation correct? Is anything else to be added or removed to calculate the loss?

Short-term capital gain:

7. 6 shares were sold in 2021 (less than 24 months) at 250 USD (17,500 INR)

8. STCG calculation as follows:

8.1. Purchase Price =1 Lakh in 2019 (10 shares X 142 USD X 70 INR)

8.2. Sale price = 105,000 (6 share X 250 USD X 70 INR)

8.3. Gain= 5,000 (105,000-100,000)

8.4. Tax = The 5K INR will be added to the overall income

For short-term holding (24 months) until the sale price is higher than the indexed cost of the purchase price, it will be a capital loss. Is it correct?

Part 1 – RSU Perquisite and Tax calculation

1. 10 shares vested in 2019

2. Each share cost ~142 USD= 10K INR so the total share value is 1 Lakh

3. 4 shares were sold to cover the tax worth 40K INR

4. In form 16, 1 Lakh was added to salary income under the perquisite 17 (2) and 40K INR was adjusted to tax paid

Part 3 – Long term

Capital loss :

9. 6 shares were sold in 2022 at 260 USD= 109,200 INR (18,200 INR)

10. LTCL calculation as follows:

10.1. Purchase Price =1 Lakh in 2019 (10 shares X 142 USD X 70 INR)

10.2. Indexed cost of purchase price = 114,530 (10 shares * 10,000 X 331/289) Note: Calculated with CII which is Purchase price X 2022 CII/2019 CII)

10.3. Sale price = 109,200 (6 share X 260 USD X 70 INR)

10.4. Loss= 5,330 (109,200 -114,530)

Capital Gain

11. 6 shares were sold in 2022 at 300 USD= 126,000 INR (1 USD = 70 INR for ease of calculation)

12. LTCG calculation as follows:

12.1. Purchase Price =1 Lakh in 2019 (10 shares X 142 USD X 70 INR)

12.2. Indexed cost of purchase price = 114,530 (10 shares * 10,000 X 331/289) Note: Calculated with CII which is Purchase price X 2022 CII/2019 CII)

12.3. Sale price = 126,00 (6 share X 300 USD X 70 INR)

12.4. Gain= 11,470 (126,000 -114,530)

12.5. Tax= 2,294 INR ( 11,470 X 20% Tax)

For long-term holding (>24 months) until the sale price is higher than the indexed cost of the purchase price, it will be a capital loss. Is it correct?

Hi,

Really Wonderful Article clears a lot of doubt. However, I still have two clarifications or final take is needed from you.. a) If i have shares held in US MNC listed in US stock exchange, can i show it under Table D of Schedule FA, or

b) Secondly, sale of shares listed in US Stock exchange whether STCG will be covered U/s. 111A after amendments made from AY-18-19.

Link https://www.incometaxindia.gov.in/tutorials/14-%20stcg.pdf

Excerpts from the above link – Page No. 7

Illustration

Mr. Poddar is a salaried employee. In the month of December 2020 he purchased 100

equity share of ABC ltd. @ 70 USD per share. These shares were sold in August 2021 @

85 USD per share. No security transaction tax (STT) was payable on transfer of shares as

same were listed in recognised stock exchange located in an International Financial

Services Centre.

**

Section 111A is applicable in case of STCG arising on transfer of equity shares through

recognised stock exchange and such transaction is liable to securities transaction tax.

STCG covered under section 111A is charged to tax @ 15% (plus surcharge and cess as

applicable).

However, with effect from Assessment Year 2018-19, benefit of concessional tax rate of

15% shall be available even where STT is not paid, provided that

– transaction is undertaken on a recognised stock exchange located in any

International Financial Service Centre, and

– consideration is paid or payable in foreign currency

In the given case, Mr. Poddar sold shares of ABC Ltd. which were listed in recognised

stock exchange located in an International Financial Services Centre (IFSC). Further,

consideration is paid in foreign currency.

Thanks.

Yes, you can show it in Table D if you are more comfortable with it.

You need to show Your Foreign Assets to be Income Tax Compliant.

Coming to your second question

the stock of your MNC was listed in US stock exchange and the transaction was not done through IFSC

And so Section 111A does not apply

What are IFSC? The Gift City in Ahmedabad is an IFSC

For example, recently one can buy stocks of US company through NSE in Gift City

Financial centers that cater to customers outside their own jurisdiction are referred to as international (IFCs) or offshore Financial Centers (OFCs).

All these centers are ‘international’ in the sense that they deal with the flow of finance and financial products/services across borders.

Gujarat International Finance Tec-City (GIFT City) multi-services special economic zone (SEZ) has set up the first International Financial Service Centre in India (IFSC)

Hi,

Thanks for the article, it clarifies most of the things on RSU vest.

I’ve a question, lets say I sold my RSU’s of Company listed in NYSE in Jan 2022.

The total amount after conversion in INR is above 1CR what would be the tax implication on this? (All are sold after a year holding)

Is it still counted at 30% Salary slab? or is there any different treatment will be applied on this?

Also please let me know for earnings in below brackets as well.

0-50Lacks

50lacks to 1 Cr

1CR to 1.5 CR

and 1.5Cr to 2 CR

Thanks in Advance

On the sale of the vested shares, the profit earned is a capital gain.

Basics

As the RSUs of the MNCs are not listed on the Indian stock exchange and no STT(Security Transaction Tax) is paid so the definition of a long-term and short-term capital gains is different from the shares listed on the Indian stock exchange BSE and NSE.

Short-term capital assets – when sold within 24 months of holding them. Short-term gains are taxed at employee’s income tax slab rates

Long-term capital assets – when sold after 24 months of holding them. Long-term gains are taxed at 20% with indexation

Capital gain on selling shares = Number of Shares *(Selling Price – FMV )

Coming to your question:

As you sold the stocks in 1 year so it comes under Short term capital gains

This would be added to your total income and you have to pay tax as per your income slabs

And then surcharge etc will kick in

Total Income = Income from Salary

+ Income from House Property(Rental Income)

+ Income from Business/Profession

+ Income from Other sources (FD interest, Interest from Saving Bank account)

+ Income from Capital Gains(Short term & Long Term)

For example, if someone’s total income is less than 2.5 lakhs but got say 12 lakhs by selling shares then

he would have to pay 30% tax as per the old tax regime

If one’s total income (excluding share’s capital gain) is say 30 lakhs and one gets Rs 50 lakhs then total income becomes 80 lakhs

and is sold accordingly

43 shares of US Mnc was vested to me. 14 shares were deducted as tax to be paid in US and 29 credited to my trading acc. Perquisite value of 43 shares were added to my income and taxed.

Isnt there double taxation? 14 shares as tax on 43 shares and again 43 taxed as perquisite?

What proof does one have that tax was deducted?

Was tax deducted in the US?

No, As one signs W-8BEN

Was tax deducted in India?

Yes, Form 16 shows the TDS

SO Company recovers the TDS by selling your shares.

Hi,

My RSU’s were granted while I was employed in Singapore. They vested in India after I relocated to India. By Singapore tax laws, these unvested/unexcersised RSU’s were taxed as part of my employment cessation and tax clearance. Will I be able to claim refund under DTAA ? Thank you in advance.

-Suresh

When the RSUs were vested were you an Indian or NRI?

Does it appear as Perquisite in your Form 16?

If yes, then you can claim DTAA

Suppose Indian resident got RSU listed in US stock.Supose he got Dividend income 100 USD.US govt will deduct 25% tax so 75USD as dividend will be there only now .For that US govt will issue form 1042-S .Now in India we file form 67 showing 100USD income (let say 7500) and claim credit of 25USD tax deducted in US. After that while filing ITR someone need to show total dividend income like 100USD and also claim 25USD US tax deduct credit under section 90.

Somethinbg else need to show.I am seeing still 25USD tax is not considered and asked to pay full tax on 100USD(7500 INR) .Something I am missing

Hi,

Very Nice and informative post.

I have a question,

Do we need to report unsold ESPP/RSU got in past fiscal years in subsequent ITRs?

If past ITRs contain the declaration of only that year instead of cumulative,

can this be corrected by reporting cumulative ESPP/RSU in subsequent ITR?

Hello Bemoneyaware Team,

Thanks for this wonderful article on RSUs. It helped me get a better overview of RSU taxation in India.

But I still feel one specific query is not clearly addressed in the article:

I have a scenario where I had been awarded few RSUs of a US MNC in the last FY. Each of those RSUs vested one at a time. Each time a single RSU vested, it was sold to cover for taxes (As I had chosen sell to cover). I had my W8BEN certification as well. So no double taxation.

So by the end of the FY, I did not own any RSUs at all. All my RSUs have been reported in my Perquisite section of Form 16 and taxes have been withheld through TDS. In this case should I report anything at all in Schedule FSI/Schedule FA section while filing ITR if I do not hold any RSU that vested in last FY?

Thanks for all the help and guidance.

Hello Sir,

Thanks a lot for your kind words.

The question you have to answer was did you at any time in the year own stocks of MNC?

If yes then you have to report it in FA.

One becomes the owner of the RSUs when they were vested.

In our example when 100 RSUs vested 30 were sold to cover the tax hence the employee became the owner of the 70 stocks

If the employee does not sell any of the 70 stocks then he is the owner of the stocks, hence report it in the FA section.

If the employee sells any of the 70 stocks, there would be a capital gain or loss, that has to be also reported in the Capital Gain section and FA section.

Appreciate. But the way you mentioned how to fill Schedule FA is very unlcear.

Thanks for the feedback?

What should we add?

I have question related to declaration of RSUs vested in older FY viz., 2018-19, 2019-20.

I had in previous FY declared RSUs vested during those period. One of my friend told all RSUs already vested in previous years should be declared in ITR.

In the Schecule FA should RSU vested in FY 2020-2021 alone be declared or all previously vested RSUs ?

Note : I haven’t sold any vested RSUs.

I am an employee in India receiving RSU of my company. When I sell those RSUs, I understand we need to pay taxes. I went through the various articles to understand about LTCG (stocks held for more than 24 months) and STCG. Majority of the articles says we need to use SBI TT Buying rate for reporting such income. But when I sold RSUs, I used my broker’s wiretransfer facility to send the funds directly to my Indian account for which FX rate is ~1.6% less than SBI TT Buying rate or Google FX rate. What should be the rate used for tax computation purpose?

Can I use broker provided FX rate instead of SBI TT Buying rate?

Does the sale of RSUs follow FIFO method for capital gain calculation? My brokerage allows me to select the lot and sell. So, I can choose the latest to minimize taxation. Could you please help here?

Interesting Question.

Noticed it but didn’t pay much attention to it.

Did a little digging around, and found this

(though my colleagues or I have not used it)

US stocks can be sold on the following basis

https://www.investopedia.com/articles/05/taxlots.asp

For individual stocks and bonds, you can use:

FIFO(First in First Out)

LIFO (last in, first out)

The specific-shares method

So you can sell any lot for US stocks.

Great article. Question – Is there a scope for tax refund here. As in if 30% of shares were withheld for tax and my tax bracket falls in 20% then is there a way to claim refund while filing ITR ?

Good question.

Yes, of course, you can claim TDS

TDS deducted will show up in your ITR (if not fill it from your Form16)

Very helpful article. Thanks much.

Just one thing that you are referring to tax payer as ‘he’ and ‘his’. Females and non-binary folks also get RSUs and file tax returns. Just take care from next time.

Hi, Thanks for the detailed information. If ‘sell to cover taxes’ was done at a higher FMV whereas when I actually sold the “sellable” shares at a lower stock price, is the difference considered as ‘short term capital loss’ and can it only be adjusted against any capital gains or some other way of re-claiming these additional taxes that were paid ?

I am also waiting for the answer

Sell2Cover sometimes happens at lower price than the price at which the shares were vested – depending on any holidays and the price movement.

Can this also be adjusted against any capital gains, because for perquisite calculation, the price at which vested is used.?

What if there is loss on selling shares? Thankfully Income Tax Department gives the benefit of Setting of Capital Loss and carrying forward of loss

We have updated the article. Are we missing anything?

Set-Off Losses means adjusting the loss against the taxable income earned; after that, remaining the loss can be carried forward to future years.

The taxpayer cannot carry forward losses to future years if the income tax return for the year in which loss is incurred is not filed on the Income Tax Website within the due date as per Sec 139(1).

If one has Short term capital loss, then it can be set off against short-term or long-term capital gain from any capital asset(real estate, gold, debt mutual funds).

If the loss is not set off entirely, then it can be carried forward for a period of 8 years and adjusted against any short-term or long-term capital gains made during these 8 years. But only if he has filed his income tax return within the due date.

Thanks for the detailed article. This really clarifies lot of questions. I have the same question as SK.

On the day of vesting where I chose sell to cover or sell-all there will be small difference between FMV and selling price also there will be transaction charges which needs to be deducted. Based on the computation if there is capital gains do we need to pay taxes? and if there is losses can we carry forward?

Please note that date of acquisition and date of sale in this case will be same.

The basic rule of income tax is If there is income there is tax.

So it’s better to report it in ITR whether you have profit or loss

If there is the capital gain you need to pay tax accordingly.

How to know whether the shares which I sold comes under Capital Gain or not…Is there any form to show this? I manually need to check on the Broker website what was the vested price and sale executed price from multiple statements…Is there any consolidated way to see it? By the way on the day it got vested will have a different USD2INR range compared to the day it was sold? How to deal with this?

sadly currently there is no way to have all information in one place.

You need to take care of USDtoINR rate on the respective dates.

This is a great compilation thank you. I have one query. If someone is holding RSUs from previous years and again received RSUs in current year. How to declare in this case? Which section, we need to use for declaration?

Thanks for kind words. It made our day

If you have got RSU at different times and you haven’t sold them then details about each allotment you had till 31 Mar of the financial year for which you are filing ITR has to be put in the Foreign Assets table.

For example, your 70 RSUs got vested in 2020 and 70 in 2021, the information about both the allotments should be in Foreign Assets as separate entities

Hai sir,

One small query in extension to the above one.

In case I have got 70 shares alloted in Aug 2020.

And I have sold all of them(70no) immediately.

Then in Feb 2021, I received 50 new shares.

Which I have not sold.

So in this case, do I need to declare 70+50 = 120no shares in SCHEDULE FA or I have to declare only the outstanding shares as on March 2021(i.e., 50no)

I have declared the capital gains received from sale of 70no of shares in SCHEDULE CAPITAL GAIN

You would have to declare both in Foreign Assets schedule.

As explained in the article , Details to be filled are:

Income accrued from such shares

0, if you haven’t sold the shares.

1 If you have earned a dividend then declare the dividend received.

2 If you have sold the shares then you have to show the profit/loss received from the sale of the shares.

Nature of Income: What type of Income it is. For Foreign stocks not sold it is Income from Salary. For Foreign stocks sold it is income from Capital Gains

Indeed great article. really appreciate your efforts. on above replay #2 “income derived from the assert” should be total amount received from the sale of these shares? I believe we still need to declare “Total investment (at cost)” column under FA, right? please clarify.

Just a clarification/confirmation please. When you say “details about each allotment you had till 31 Mar of the FY for which you are filing ITR”, do you mean the all the allotments in that FY or even the previous FYs?

Just to be clear with an example, if the RSUs allocated to me have been vesting for past 3 financial years and I haven’t sold any of them, should I have separate entries for all three FYs in the schedule FA?

If your answer is ‘Yes’, I have a follow-up question that, since in the previous years, I had been only declaring the ones vested (or ESPP brought) in corresponding financial-years, what would be appropriate information to fill-in for the FY 2020-21?

Option1: I fill again only for FY 2020-21.

Option2: I fill details of allotments/vestings for FY2020-21 and previous FY2019-20.

Option3: I fill all the entries from starting (in the above example, starting FY 2018-19).

Which option is best?

Hey, i have been looking for such clear info about filling capital gains (foreign stock esp) for quite some time, but your article is like an eye opener. You must have worked very hard to acquire this skill.

I could finally submit the ITR2 today on my own. thanks a lot.

I have shared your article with my friends as well.

Do you give paid financial advice as well. i would like to avail.

Thanks for your kind words. It made our day.

We are in the same boat as you(we have some foreign stocks through RSU and ESPP) and over a period of time have collected this information.

We are not from the financial background so we don’t offer finanical advice.

But if you have a specific question you can shoot us an email at bemoneyaware@gmail.com

“Not from financial background”, may be thats why you shared such an info for free, for which any tax expert would charge thousands. 🙂

In that case, keep up the good work my friends.

I will keep visiting your blog for further info.

Fantastic….You have nailed in explaining sequentially…..Keep it up…

Thanking you…

Out of many articles I read on how to declare and submit shares allocated to employees and that are of Unlisted shares are documented well here. I would rate this in top 3 – as many places they haven’t mentioned as detailed as here. I like your mission and vision. I also like your statement on not taught in schools on financial. I guess that is important to all of us. Thank you for detailing this

Thanks a lot for your encouraging words.

Glad we could be of help.

If you could share this on Social media that would be great.

Hi. Can we transfer the cash after selling vested stocks(RSUs) in US Market into some US brokerage for further investments in ETFs etc? I heard somewhere that cash sold from stocks needs to be repatriated to India within 90 days.

Hello

This is very good article and helped in filing ITR.

Could you please also write article about “Process to transfer the money after sale of these RSU’s to Indian Bank Account ? with some examples

I have some RSU’s of US MNC in fidelity brokers and want to know the process of transfer it to Indian Bank Account .

Do we need any separate bank account OR can it be transferred to Saving bank account etc.. ?

Good question.

Most US brokers allow transfer to your regular Saving Bank Account.

You need to give Swift the number of the bank along with the account number.

Thanks for the reply.

Do you know which banks allow direct transfer to Indian saving account ?

To transfer in indian HDFC or ICICI bank saving account , does it need ” intermediary (or correspondent) bank” ?

Following options getting in the form during setting up transfer instruction.

===

Do you need intermediary (or correspondent) bank?

Sometimes it’s required for international transfers.

Contact your receiving bank to find out.

SWIFT Code (automatically populates bank name on the next page)

==

Both HDFC Bank and ICICI Bank allow SWIFT Transfer

Check with your bank (but don’t be surprised if they can’t help)

Best is if you check with your colleagues

Perfect explanation by the author but IT department still has to clear some doubts on this topic.

Yes. Thanks for the encouraging words.

Can you spread the message around

As a small percentage of Indians are affected by it, Income Tax Department does not focus on it accept sending Notices at time.

very well explained. Thanks

Thanks for the encouraging words.

Hello Sir,

Where is the short term sale of ESPP to be reported in ITR-2? Is it Schedule CG : A5.a.i OR A5.a.ii?

Both.

Sorry Sir. I should have been more clear in my question. Shares are of US based company listed on NASDAQ offered as ESPP for which perquisite tax is already deducted by employer. The shares are being sold within one year. I would like to know the specific section of Schedule CG applicable in ITR-2.

A5 has 2 sub categories:

a(i). In case assets sold include shares of a company other than quoted shares, enter the following details

a(ii). Full value of consideration in respect of assets other than unquoted shares

Which one among above 2 options are applicable in this case?

Hi

You may find this question very familiar but there is a twist

Say i was given 100 RSUs and while vesting 70 shares were given to me.

My company in India calculated the price of 100*20.72*73= INR 1,51,256 and added in the form 16. On this 1.5L they deducted another 30% as the tax and paid it to GoI

I guess this is double taxation. One 30 shares where withheld in US and second on full value another TDS was deducted by employer and amount paid to GoI. Do we have provision to get this amount refunded by filling ITR refund claim. Please suggets

Check with your employer and file Form W-8BEN. By filing this form the US company will not withhold any taxes.

Alternatively, if the US company has withheld the tax and the Indian company has also done so, this will be double taxation and you can claim something called as Foreign Tax Credit by filing Form 67. The same will be in accordance with DTAA.

Thanks for suggestion

Nice Article. So informative.

Have a question here. If 100 shares are vested, 1/3rd of the shares will be withheld as tax so only 66 shares will be credited in the account to sell. But perquiite added in india will be for 100 * fmv * conv rate.

Is there any option for us to limit the taxable income in india to only 66 shares * fmv * conv rate or is it possible to claim exception for 34 * fmv * conv rate. It is unfair to pay tax on the amount that is not credited to you right?

A good question.

The short answer, you are not taxed twice for the same shares

Employer reports the shares total allotted as the Prerequisite Income in Form 12B

The tax on the shares and TDS is not deducted by the employer from your salary income.

It is adjusted by deducting your shares.

In your foreign assets you have to show only the shares you own i.e 66

And when you sell the capital gain is also on these 66 shares only.

Does this help!

In my case TDS is deducted for 100 * fmv * conv rate. So what should i do now?

First Ask your payroll department why it was so?

Thank you for educating me on this…let me check with them

100*fmv was added to your perquisite to show it as a part of income.

it’s just means you were paid 100*fmv amount by company( in form of stocks).

66 stocks are depositied to your brokerage account.

the remaining stocks (100-66 = 34) are considered to be sold by broker on your behalf and the amount obtained from this is paid as tax.

All these calculation are part of your salary perquisite ans hence,

will show in your salary slip as tax you are paying to GOI.

Employer is not deducting tax twice. it’s just adding all the details in payslip.

You have summarised it beautifully!

In our case also company has deducted TDS on full amount of 100 shares. However in ITR that TDS amount is showing as return amount. This blog cleared the place where we need to put the RSUs in FA schedule ( Section D). Thanks,

What do you mean by Return amount?

Does it show up in your Form 16 part A?

Yes the rsu amount was added in my income and taxed fully. while filing the return excess tax is showing as return.

and just now my company accepted the mistake and they are fixing it for this year and issuing a fresh form 16.

Nice Article. So informative.

Have a question here. If 100 shares are vested, 1/3rd of the shares will be withheld as tax so only 66 shares will be credited in the account to sell. But perquiite added in india will be for 100 * fmv * conv rate.

Is there any option for us to limit the taxable income in india to only 66 shares * fmv * conv rate or is it possible to claim exception for 34 * fmv * conv rate. It is unfair to pay tax on the amount that is not credited to you right?

very good detailed information , I have not found this info on many other forums, many thanks for sharing this information.

Say if one is granted 100 RSUs to be vested over 3 years in the ratio 34%/33%/33% on 23 Nov 2013. Then 34 RSUs (34%) will vest on 23 Nov 2014 and 33 each (33%) on 23 Nov 2015 and 23 Nov 2016 respectively. If you leave the company on 1 December 2015, then you will be able to sell only 34 shares and the remaining 66 shares will go back to the company. If you stick around for another month, then you will be able to sell 67 shares (34 + 33) as another 33 shares will vest on 23 Nov 2015.

In above example I am not able to understand how leaving the company on 1 December 2015 makes 66 shares go away. By this time 34 and 33 shares would have vested on 23 Nov 2014 and 23 Nov 2015 respectively. The shares to go away should be 33. Am I missing something?

Also, another query is what happens if employee has vested shares and he leaves or get terminated without selling the vested shares. Are those settled by the employer in final settlement of employment?

This has been very helpful. The info is given in quite detail. Thank you so much.

Thanks a lot for your kind words

Appreciate it

First of all, would really appreciate and thank the author for such detailed article. 🙂

Got a follow up question, do I need to declare RSUs vested in the previous FY too.

For ex.

– 2 units got vested in FY18-19 and 3 units vested in FY19-20.

– Do I need to declare 2 units from FY18-19 while filing ITR for FY19-20 period in below 2 scenarios?

a) 2 units already declared in previous ITR (for FY18-19)

b) 2 units not declared in previous ITR.

TIA

Thanks for the kind words.

Good question. We have updated our article

If you have got RSU at different times and you haven’t sold them then details about each allotment you had till 31 Mar of the financial year for which you are filing ITR has to be put in the Foreign Assets table.

For example, your 70 RSUs got vested in 2020 and 70 in 2021, the information about both the allotments should be in Foreign Assets.

Hi, This is a very in-depth presentation of the topic. I previously commented for RSU declaration under schedule FA as well.

Now, in this document I would like to correct one thing:

The short term capital gain tax is specified as according to slab rate of the tax payers because no STT is paid for this capital asset. But there is something wrong here.

Actual rule is if the capital asset is specified under section 111A, then they are charged according to 15% and not slab rate. Now coming to RSU stocks (these are not UNLISTED Stocks, they are listed in Foreign stock exchanges) so they are coming under 111A even if the STT is not paid. Hence they should be taxed as 15% rate and not slab rate.

Reference: https://www.incometaxindia.gov.in/Pages/tools/income-tax-calculator-234ABC.aspx

Please confirm and verify once. And if you find it true, please update the document otherwise this will mislead people. Comment if you are not convinced.

Thanks

link to verify: https://www.incometaxindia.gov.in/_layouts/15/dit/pages/viewer.aspx?grp=act&cname=cmsid&cval=102120000000041670&k=&isdlg=0&grp=act&cname=cmsid&cval=102120000000041670&k=&isdlg=0

There is another reference: https://www.youtube.com/watch?v=7pf5bN8T_fA&t=204s

Just saw one previous comment over here and realized that this still could be true. And that this document is correct on that regard.

Although the definition of “International Financial Services Centre” is not very clear on SEZ 2005 act. And what if the US company, whose RSU stocks are listed in NASDAQ, is residing under SEZ. Probably an example of such usecase is required. Anyway if you find anything on this regard, please clarify so that we can conclude on this. Thanks in advance.

How does a company having its office in SEZ affect the Shares of the company.

They are independent

Shouldn’t they be?

Hi,

The blog is really helpful and got to know many things.

Only 1 doubt is remaining.

Can you please tell under what section in Schedule CG I need to mention my short term capital gain from selling foreign stocks? Please let me know the exact section where I should mention this.

Thanks in advance 🙂

I am holding RSU’s granted in the finanical year and also, I am investing in ESPP. Note that company deducted taxes accordingly for above RSU and ESPP already. But I have not sold single share from above. Do I need to provide details of RSU and ESPP in my returns?

I am using a third party consultant to file returns and as per them, given I have not sold anything and my form 16 contains the total amount I got due to ESPP/RSU and amount of tax deducted from that, I am good.

If you have RSU/ESPP of a foreign company, ie MNC listed in US etc

you need to declare your RSU /ESPP in ITR as Foreign Asset

You might get ITR notice.

If it is company listed in India/not listed then you don’t need to declare RSU/ESSP.

How to decide on Exchange rate and where to find them as RSU and ESPP were sold multiple times.

Your stock exchange broker should give you the details of RSU & ESPP sold.

Under the India income tax law, exchange rate for conversion of income earned in foreign currency into Indian rupees is the telegraphic transfer buying rate (TTBR) issued by State Bank of India.

You will get TTBR for the relevant FY at SBI’s forex division.

Or you can try eximin.net site that gives TT buying rate and one can choose a date to get historical rates

Or https://mksco.in/forexrate

I have a question wrt reporting ESPP in the ITR.

(FMV – alloted price) * num_shares * USD-ex-rate => this is already added to total perquisites.

But actually, I have sold at a lower price than the FMV, which means taxes cut on above perquisites already done more and added to form-16.

Now, when I file ITR – do I need to remove it from perquisites and add it to STCG (unlisted equity) and give the details there?

But if I do that, how will the matching happens wrt form-26AS, because 26AS has got the earlier perquisites added, and if I remove it from there and add to STCG, total income is going to go down, and after processing its going to show mis-match.

How do I deal with it?

Thanks

Deepak

You don’t have to remove from salary.

You have to report it as a capital loss in the capital gain section.

You can carry this loss for 8 years.

Refer to our article http://bemoneyaware.com/capital-loss-on-sale-of-house/ for more details on capital loss.

Hi ,

I have some LTCG from RSU of a US listed company . I have purchased a residential apartment in 2017 and got possession of it in 2020 Feb , registration is yet to happen . All the proceeds from the RSU sale was used for interior work , payment towards clearing the house loan .

Can I claim LTCG exemption under section 54F

Thanks

Geo

Yes you can claim deduction under section 54F provided,

On the date of sales, the taxpayer does not own more than one house property.

A new Residential House is purchased before 1 year or after 2 years from the sale of the long term capital asset

the Amount of Exemption under Section 54F will be available as per the following formula:

Exemption = Cost of new asset x Capital Gains / Net Consideration

Maximum Exemption is up to Capital Gains.

Please remember The lock-in period of 3 years is applicable when exemption u/s 54F of the income tax act is claimed.

Hi, is the exemption allowed only once for the said residence?

For eg if i sell the rsu and intervals, can i claim them everytime?

Hi,

I have invested in ESPP in my company. But I am not sure how to declare that in FA for in ITR2. The scenario is as such:

1. I purchased 20 stocks in a period of 1 year at price of $40 each(Grant price).

2. The purchase price was $90.

3. The taxation which my organization is calculating, is on the difference in grant and purchase price like ($90-$40)*20 = $100

4. With conversion rate of INR 70 my taxable amount becomes = 100 * 70 = 7000

5. Now what amount must be declared in following fields in the FA form:

Total Investment, Income Derived from asset, Income taxable amount,

Schedule where offered, Item number of schedule

Request you to please help me with this.

P.S. – I have not sold even a single share till this time.

You can declare it in Table A3 or Table D of Foreign Assets.

Technically it should be declared in Table A3 but as it requires more details, many people do it in Table D.

Rational being we are declaring the income and there is not much information on how to declare.

In Table D

Country Name and code :

Nature of asset : Shares

Nature of Interest-Direct/Beneficial/owner/Beneficiary : Direct

Date of acquisition : Date on which stocks were allotted

Total Investment (at cost) (in rupees) : Price at which RSU/ESPP was allotted. (Please deduct the number of shares that were credited to your account after tax deduction. Say you were alloted 70 shares but because of tax only 49 stocks were credited into your broking account). In example 49*17.89(FMV)*62.90(USD Exchange rate)

Income accrued from such :

0, if you haven’t sold the shares.

If you have earned dividend then declare the dividend received.

If you have sold the shares then you have to show the profit/loss received from the sale of the shares.

Nature of Income :

Not Applicable or NA if you haven’t sold any shares

If you have earned a dividend then declare the dividend recived. You need to declare divided as Income from other sources

If you have sold the shares then you have to show them in Long Term Capital Gains/Short Term Capital Gains section

Here you mention that the “nature of income” can be specified as “Not Applicable”, if no shares have been sold. But, in the article, for RSUs, in the screenshot, where the various fields are filled, you show it as “RSU”, but later in the screenshot below of the xls, in the “Nautre of Income” column, it shows “Not Applicable”. There seems to be some inconsistency in the two screenshots, please correct.

Hi lokesh, can you please clarify on DTAA part.. Why it is included in perquisites & also shares are withheld for tax

DTAA is usually applicable for TDS ex when the dividend is paid by the MNC.

For ESPP, RSU etc the tax is deducted it the form of shares and hence DTAA is not applicable

Quite informative and useful information. I couldn’t find this anywhere else.

I can just say “Thank You” for what I was looking for.

Have a small query with respect the accounting period.

Example, 10 shares for US mnc vested in October 2019, 3 shares vested in January next year say 2020. So Oct 2019 (7 got released to my account 2 withheld), Jan 2020 (2 got released and 1 withheld).

Now US accounting period is probably Jan to Dec where in India it is Apr to Mar.

Now In Schedule FA should I declare shares of only October released stocks?

or Should I declare all the stocks (October + January) i.e. 9 stocks in Schedule FA?

Reference: https://economictimes.indiatimes.com/wealth/tax/reporting-of-foreign-assets-in-income-tax-return-cbdt-issues-clarification/articleshow/70890105.cms

Stocks that you hold as on 31 Mar 2020.

Thanks a lot for your kind words.

Do we also have to declare the name of the Brokerage firm like eTrade or Fidelity who is holding our RSUs in our returns?

Second question, if Dividend is held in Brokerage account but not yet wired to my India account, should I still reveal Dividend in ITR and pay tax?

Same situation here. I have foreign asset dividend in my brokerage account and it is below 1$, and i couldn’t withdraw, Do i need to show in ITR?

On sale of RSU shares, is there any time limit by which we have to transfer the cash proceeds (say from USD) to India inr.

I am working in an MNC. I got transfered last Jul to its indian office. I am again transfered back to foreign country on 1st of jul this year. I have been an NRI for last 25 years and currently RNOR. But for the next Finacial year I will be NRI again as I will be away for more than 182 day in Tax year. Now My RSU is getting vested on 2nd JUL. I receive the RSU payment in Foreign country and need to pay tax there. Should I pay tax for RSU in india?

Advance thanks for your advice.

For RNOR tax liability in India is restricted to the income they earn in India.

They need not pay any tax in India on their foreign income.

It seems RSU payment would be foreign income.

But better to verify with your Tax accountant/CA

I think there is a small mistake in calculation steps here:

Indexed purchased cost = 62.90 * 264/240 = 69.19

Here, you have taken 62.90 which is the INR conversation to $ on the day of vesting instead of the actual price of the stock. I think it should be 17.89 * 264/240 = 19.679.

So, Long-Term Capital Gain with indexation= 25*((67.15 * 25.890)-(62.90* 19.679)) = 25 * (1738.5135-1237.8091) = 25* 500.7044 = 12,517.61 (you have got the final computation right. please correct me if I’m wrong.

What is the difference between Direct and Beneficiary Owner in Nature of Income in Schedule FA for RSU

Please use direct as the shares are in your name in your brokerage account.

A beneficial owner is a person who enjoys the benefits of ownership even though the title to some form of property is in another name.

It also means any individual or group of individuals who, either directly or indirectly, has the power to vote or influence the transaction decisions regarding a specific security, such as shares in a company.

The definition we got from a CA is as follows

1. Beneficial owner in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset and where such asset is held for the immediate or future benefit, direct or indirect, of the individual providing the consideration or any other person.

2. Beneficiary in respect of an asset means an individual who derives an immediate or future benefit, directly or indirectly, in respect of the asset and where the consideration for such asset has been provided by any person other than such beneficiary.

In case you are both a legal owner and a beneficial owner, please mention direct owner in the column of ownership.

Hi,

If technically you say one needs to fill table A3, in the TR-FA section for declaring shares vested, can you please provide the values of following fields,

1. Initial value of the Investment : -> Perquisite amount in your form 16 ?

2. Peak value of investment during the period : -> Max. closing value of the share in the year * No of shares ?

3. Closing value : ->Closing value on 31st march * No. of shares

4. Total Gross amount paid/credited with respect to the holding : Same as Perquisite if not sold ?

Are these values to be filled even if one has not sold any shares ?

The people I know are filling in Table D.

If you have held Foreign Assets between 1 Apr 2018 and 31 Mar 2019 then you have to fill it in.

We have given an example of where shares are not sold. So columns of Income offered etc are 0 or NA.

What is the difference between Direct and Beneficiary Owner

What does initial value of investment mean in schedule FA, A3? Is it value at start of accounting year? Or cost of acquisition?

1. It’s given that the LTCG kicks in after 24 months of vesting of the stock. Please confirm it’s 24 months as I guess some recent changes have made it 36 months.

2. In the LTCG indexation calculation, I find only the Rupee/dollar conversion is indexed and computer but not the actual price. Please check and Clarify

Please share the article for 36 months.

2. The indexed price is used for actual calculation

Indexed purchased cost = 62.90 * 264/240 = 69.19

Long-Term Capital Gain with indexation= 25*((67.15 * 25.890)-(69.19* 17.89))

Is total investment field (“33758”) in section D of schedule FA, total benefit value for which company had already paid tax as per slab?

No. It is as per what you own in your broker’s account as on 31 Mar 2019

Hi,

Is this the value of the vested RSUs at time of vesting? Basically in your example , is this the value of those 70 RSUs (30 RSUs used to pay the perquisite tax)?

Since the MNC RSUs are treated as unlisted sharesd, should this be reported in the very page “PART A – GENERAL” under

“Whether you have unlisted shared at any time during the previous years…”?

How do you specify the value of shares – Is it the INR value of the US stocks on day of filling ITR?

Regards

I got the answer for later part of my question. It is already answered in your earlier reply – value as on 31st Mar 2019.

Can you provide clarification for the first part?

No it is not unlisted.

As explained in the article http://bemoneyaware.com/cbdt-faq-itr-income-tax/

Question. 4: I have held shares of a company during the previous year, which are listed in a recognized stock exchange outside India. Whether I am required to report the requisite details against the column “Whether you have held unlisted equity shares at any time during the previous year?”

Answer: No.

Specify value in INR.

No, it is not the date of filing ITR. Which section are you filing?