The Satyam Scam is touted as the biggest accounting fraud in India done by the chairman Satyam Ramalinga raju and his family members. A confessional statement by Ramalinga Raju on fudging of accounts by his company on January 7, 2009, following the aborted acquisition of Maytas Properties and Infra, shook the corporate world. The most shocking aspect of the scam was that the company was being audited by one of the Big Four, Price Water Cooper. It also brought into focus the role of independent directors.

What is Satyam Scam?

Satyam computers were established in the year 1987, by Byrraju RamalingaRaju who came from a farming family.

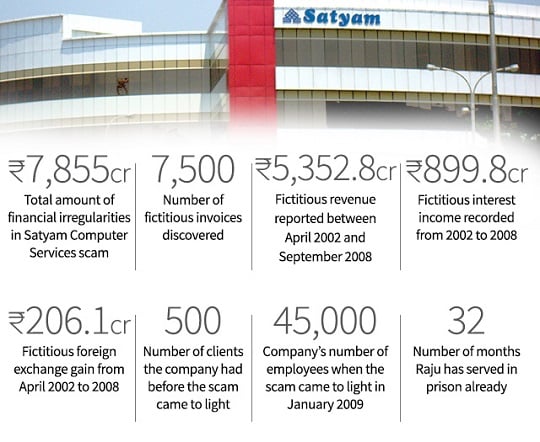

Satyam scam is about corporate governance and fraudulent auditing practices allegedly with auditors and chartered accountants. The company misrepresented its accounts both to its board, stock exchanges, regulators, investors and all other stakeholders. It is a fraud, which misled the market and other stakeholders by lying about the company’s financial health. Even basic facts such as revenues, operating profits, interest liabilities and cash balances were grossly inflated to show the company in good health.

The role of external third party auditors, who were tasked to ensure that no financial bungling is undertaken to carry out promoters’ interest or hide facts, have also been brought to question.

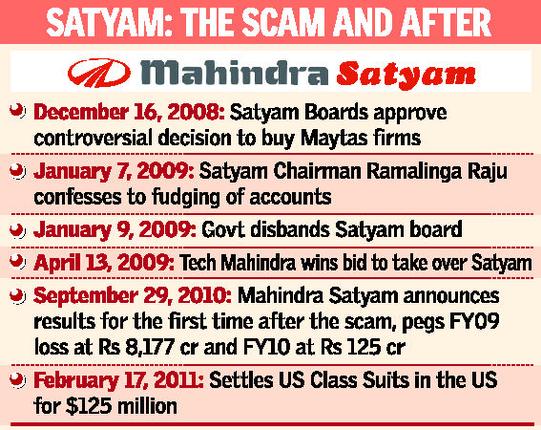

On 16 December 2008, Satyam said that it would buy out two group companies, Maytas Properties and Maytas Infra. Satyam had to abort the move after investors, both domestic and foreign, objected and pummelled the stock down.

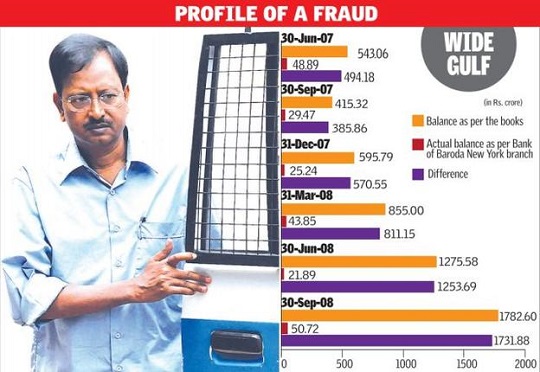

On January 7, 2009, B Ramalinga Raju, then chairman of Satyam, admitted to manipulating his company’s account books and inflating profits over many years to the tune of several crores of rupees. In a letter, the company informed the stock exchanges that its chairman has with “deep regret” disclosed that its balance sheet as of September 30, 2008, had a non-existent cash and bank balances of Rs 5,040 crore, accrued interest of Rs 376 crore, an understated liability of Rs 1230 crore and overstated debtors position of Rs 490 crore. “What started as a marginal gap between actual operating profit and the one reflected in the books of accounts continued to grow over the years,” he said. He also said the aborted acquisition attempt of Maytas Properties and Maytas Infra was a last ditch effort to fill the gap.

“Every effort to fill the gap failed,” the letter said, adding “It was like riding a tiger, not knowing how to get off without being eaten.”

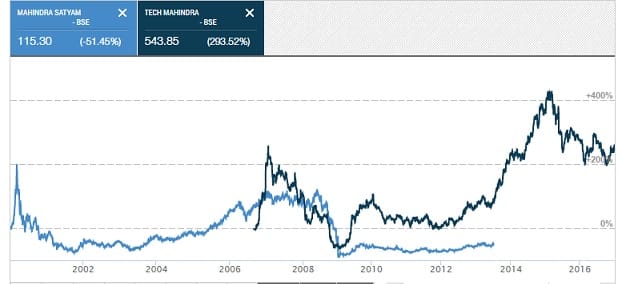

At the time the scam broke out, the company had 40,000 staff (Raju claimed 53,000), 185 Fortune 500 companies as clients and presence in 66 countries. Ironically, only four months before Raju confessed to the fraud had the company received the Golden Peacock Global Award for Excellence in Corporate Governance from The World Council for Corporate Governance. The shares of Satyam ruled at about Rs 544 in 2008, which fell to Rs 11 or so on 10 January 2009, a day after Raju confessed to the fraud.

After Raju disclosed the manipulation, the government swung into action. It asked the Institute of Chartered Accountants of India and Institute of Company Secretaries of India to probe the role of auditors and company secretaries in the scam. Within two days, the board of Satyam was superseded by the government.

On 13 April 2009, via a formal public auction process, a 46% stake in Satyam was purchased by Mahindra & Mahindra owned company Tech Mahindra, as part of its diversification strategy. Effective July 2009, Satyam rebranded its services under the new Mahindra management as “Mahindra Satyam”. After a delay due to tax issues. Tech Mahindra announced its merger with Mahindra Satyam on 21 March 2012, after the board of two companies gave the approval.The companies are merged legally on 25 June 2013.

The case was transferred to the Central Bureau of Investigation in 2009. In six years, the special court trial judges marked 3,000 documents and examined 226 witnesses.There are 10 accused in the case. Raju, his brother and Satyam’s former Managing Director B Rama Raju, former Chief Financial Officer Vadlamani Srinivas, former PwC auditors Subramani Gopalakrishnan and T Srinivas, Raju’s another brother B Suryanarayana Raju, former employees G Ramakrishna, D Venkatpathi Raju and Ch Srisailam and Satyam’s former internal chief auditor V S Prabhakar Gupta. They were charged under various sections of IPC for cheating, criminal conspiracy, forgery and breach of trust.

In December 2014, a Hyderabad court sent Raju and his brother Rama Raju to six months in jail, and also imposed a fine of Rs 5 lakh on each of them. Earlier in July 2014, SEBI slapped a 14-year ban on Raju, Rama Raju, Vadlamani Srinivas, former Satytam Vice-President – Finance G Ramakrishna, and former head of internal audit VS Prabhakara Gupta from buying or selling of stocks. They were also asked to disgorge an aggregate Rs 3070 crore as penalty, including 12 percent interest. Investopedia defines disgorgement as “a repayment of ill-gotten gains that is imposed on wrong-doers by the courts”. In January last year, 21 relatives of Ramalinga Raju, including his wife Nandini Raju and sons Teja Raju and Rama Raju were convicted by a Special Court for Economic Offences for default in income tax payment.

On Apr 2015 B Ramalinga Raju was found guilty of embezzling from the IT company. He was sentenced by Special CBI Court Judge BVLN Chakravarthi to seven years in jail and fined Rs 5 crore for his part in falsifying the firm’s books to the tune of Rs 7,136 crore. His brother Rama Raju received identical punishment while eight others — his relatives, employees and executives of audit firm PriceWaterhouse — were each given jail terms of 7 years and asked to pay Rs 25 lakh as fine.

The stock price movement of Satyam and Tech Mahindra are given in image below

Lessons learns from Satyam Scam

Nasscom described the fraud as a “one-off case”. Satyam rocked corporate India and laid bare many alarming truths about the inadequacies of the country’s corporate governance standards. The government reacted to the fraud by overhauling the regulatory framework, with the new Companies Act 2013, which fixed liabilities of the auditor and independent directors, among other changes. In 2014, market regulator SEBI amended Clause 49 of listing guidelines to improve corporate governance.

Satyam today is a cautionary tale to companies, auditors, and authorities, but has it really improved India’s corporate governance standards?

- There is now greater awareness and respect for the various facets of corporate risk among companies and boards. Most organisations have digitised their business processes and strengthened internal controls to prevent and detect frauds. Boards have also started linking the compensation and incentives of top executives to how well they manage mission-critical exposures.

- Board/audit committees of companies have powers of increased oversight of corporate governance.

- Boards must have at least one woman director.

- Audit firms now have to be rotated every 10 years beginning April 2017. Auditors have come under intense scrutiny – they have to see to it that every internal financial control (IFC) prescribed under the Companies Act is followed by a company, among other things.

- The Satyam scandal also effected sweeping changes in auditing practices. In the case of Satyam, four auditors who were then working with Price Waterhouse (PW), part of PwC India, were convicted along with Raju.

- Big Four -Deloitte, PwC, EY and KPMG- and other major auditors now conduct a risk assessment before accepting an audit. Auditors are increasingly dropping companies as clients when they discover dirt.

- Many auditors are also using algorithms to help discover “unusual patterns” in the books.

- In the Satyam scandal, auditors relied on bank statements worth Rs 3,800 crore provided by the company. It turned out be fabricated. Under the new rules, auditors are required to check the authenticity of bank statements.

- Raju had also disguised the pledging of Satyam shares. Today, promoters who pledge shares must disclose it to Sebi.

- The Companies Act has forced companies to embrace a whistleblower policy. Indian companies are roping in specialists to manage their whistle-blowing mechanisms.

- Internal Financial Control(IFC) too has improved oversight. Under the Companies Act, an auditor is required to state whether a company has an adequate internal financial controls system in place and its operating effectiveness. Companies themselves are doing their bit. In an attempt to usher more transparency, many are reducing human interference and turning to technology. Some bring in their risk assessment teams before they make strategic decisions like acquisitions and expansion

Despite Satyam, companies are more concerned with just ticking the boxes. India has a long way to go to match the corporate governance standards of evolved markets. True, there has been no scandal like Satyam. But the number of frauds has not dropped sharply in the years though many pertain to individual fraud. Companies obey the letter of the new rules, but not the spirit. Take the whistleblowing mechanism. Firms put safeguards to ensure revelation of whistleblowers do not backfire, according to experts. The same is true of independent directors. SIS Systems, a Gujarat-based company, is accused of a fraud worth Rs 2,000 crore. The promoter was arrested but no independent director faces charges

The main obstacle is that most Indian companies are controlled by promoters, according to industry watchers. Independent directors are only independent on paper. Directors are picked from an “old boy’s network” – they are people close to a promoter or from a familiar circle. Relationships/connectivity between promoters and independent directors and also high remuneration levels can often undermine true independence of directors

Related Articles:

- Investing in Stock Market: Open Demat account and Trading account

- Stock exchange: What is it, Who owns, controls

- Stock Market Index: The Basics

- Why people Lose Money in Stock Market

- News that affect the Stock Market

- Ups and Downs of Sensex

- Cricket:BCCI , BCCI Finances and Lodha Committee

- Pay and perks of Indian MP, MLA and Prime Minister

Very informative and helpful information sharing through your blog.

I recently found your page and so far I love it. Keep up the good work. You have done an excellent job with your writing.

Awesome and much useful information. Nice and detailed explanation.

Thanks for sharing this excellent info and tweeted 🙂

Absolutely Dorina. Vigilance should be our watch word in the digital age. Imagine 24.5million online fraud last year alone, which is frightening. We should not be caught up at all. Many thanks for visiting our site.s All the best to you always.

This is very informational.

It would be good draw a parallel with the Hedge Funds.

Any parallel with Big Short!!