Only death and tax are certain. If you have an income you need to pay tax. The Income-tax Act has various sections taxpayers can use to reduce their tax outgo every year. If you are able to avail all these sections you can have even income more than 2.5 lakh tax-free (some say Rs 10 lakh or some even 11.1 lakhs). We also hear about how much we can save such as 44,000 or 78,000? All of us do not need to save the same tax as tax depends on income one earns i.e income tax slabs. Many of us, especially salaried people save some tax by contributing to EPF or NPS. So we need to know how much tax we need to save? We also need to understand what are the practical options to save? And how can we invest in these options, easily and get the proofs too!

Table of Contents

How much Income tax do you have to pay? What are income tax Slabs?

Not everyone in India pays the same Income Tax. Over and above tax, surcharge and education cess are also charged. Taxes on your Income depend on factors such as

- Your age: Those below 60 years, Senior Citizens between 60-80 years and Super Senior CItizen (between 60-80 years)(In FY 2019-20. In FY 2020 tax slabs are same across all age groups) Our article Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21 talks about the new tax slabs introduced in FY 2019-20

- Your Income: less the income, less the tax. Our article Understanding Income Tax Slabs, Tax Slabs History talks about the various tax slabs and their history.

- If you have an income up to 2.5 lakh you don’t have to pay any tax. This is called exemption limit

- If your income is between 2.5 lakh to 5 lakh then you need to pay Rs 12,500 + 20% of( total income -minus 2.5 lakh) + 4% cess but you get rebate.

- How much deductions and exemption you have taken: More the deductions are taken, less your taxable income hence less tax.

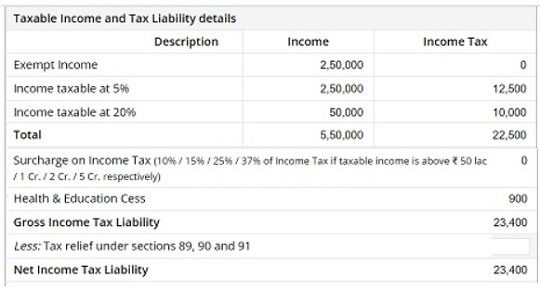

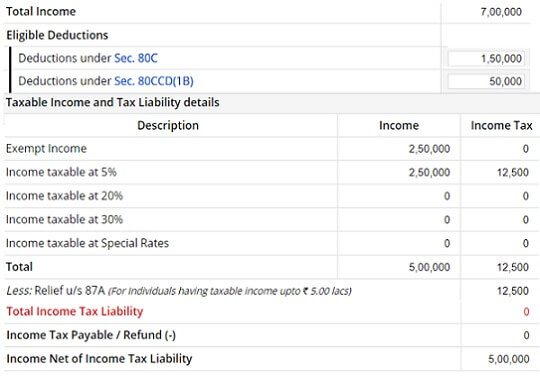

For example, if your income is Rs 7,00,000 then you need to pay a tax of 22,500 Rs and with Cess 23,400.

So if you save tax of Rs 22,500 then your tax liability will become 0. So if you invest 1.5 lakh under 80C and 50,000 either in NPS or in 80D Medical then you will save tax of 22,500.

The calculation is shown in the image below

How to Save Income tax?

The common and popular deductions are given below. Our article Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24 discusses these tax saving options in detail.

- Exemption under section 80C – Up to Rs 1.5 lakh for investment in Life Insurance premium(term plan, endowment plan), Provident fund (EPF, PPF), ELSS(equity-linked savings scheme ), school fees, and principal repayment on housing loan

- Deduction on Home Loan interest under section 24(B)– Up to Rs 2 lakh

- Exemption under section 80D – for Health Insurance, Up to Rs 25,000 (For senior citizens Rs 50,000). These are maximum limits specified under Section 80D. If the actual premium paid is less than the limits, then the benefit will be limited to the actual premiums paid only.

- Exemption under section 80CCD(1B) for 50,000 in Tier1 account of NPS

- Standard deduction – Rs 50,000 for salaried.

- Allowances like HRA, LTC for salaried.

- Additional deduction on Home Loan interest on affordable houses u/s 80EEA – Up to Rs 1.5 lak

How much Income Tax to save?

First, you need to decide how much tax you need to save, how much you have already saved(salaried employee contributing to EPS, NPS, Tuition Fees for your school-going children, EMI of home loan)

Total tax-saving limit – Existing investments = Tax that needs to be saved

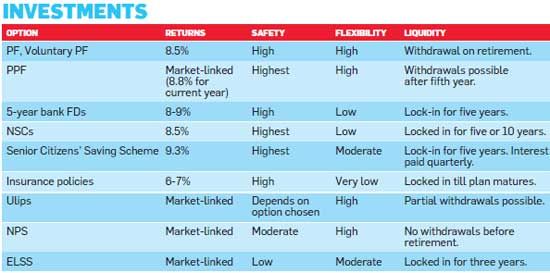

Once you know how much tax you need to save you can look at options available for saving tax based on Returns, Safety, Flexibility, Liquidity

Our article Choosing Tax Saving options : 80C and Others talks about How Tax Saving works, and how you should choose your tax-saving investments and when you should choose. The image below shows various tax saving options based on Returns, Safety, Flexibility, Liquidity.

How to buy Income tax saving options

Different platforms are available to invest in the tax-saving schemes, many online, some offline. Some you can do directly, some you invest through distributor or agent.

EPF: If you are contributing to EPF, the employee portion comes under 80C. The employer deducts this from the salary and information is available in your Form 16.

For PPF/Sukanya Samridhi account you need to open an account in Post office or Designated banks like SBI, HDFC Bank, ICICI Bank, Axis Bank. The passbook shows the amount invested and when which can be used as proof.

For ELSS Mutual Funds You need to invest through a distributor or directly. Our article Direct Investing in Mutual Funds talks about how to invest directly.

For Life/Health Insurance you need to contact an insurance agent or insurance company or websites like policybazaar.com that are aggregators of insurance. Once you invest in Insurance you get a receipt for premium paid.

For NPS: You have to get a Tier 1 account opened either through eNPS(online) or through designated banks called POPS. You get an account statement which shows the amount invested in a Tier1 account and that can be used as proof.

Though you don’t need to give the proofs while submitting ITR, Documents needed to claim deductions need to be carefully stored for atleast 7 years. Our article Paper Work A Necessary Headache covers the documents required in detail.

| Tax saving Option | Proof |

| EPF | Form 16 from Employer |

| PPF | Pass book |

| 5 year Fixed Deposit | FD certificate |

| Insurance Policies | Premium Receipt |

| Pension Plans | Premium Receipt |

| NSC | Certificate |

| ELSS | Mutual Fund Account Statement |

ETMoney App: One stop window for your Income tax needs

ETMoney App promises to be a one-stop solution for all your financial needs-Direct Investing in Mutual Funds, Loans, Spend Tracker, Insurance, Buying Gold and More. Everything on ET Money is paperless. Our article ETMoney App: Features, Review, Direct Investing in MF, Loan Pass, Spend Tracker and more talks about ETMoney App in detail.

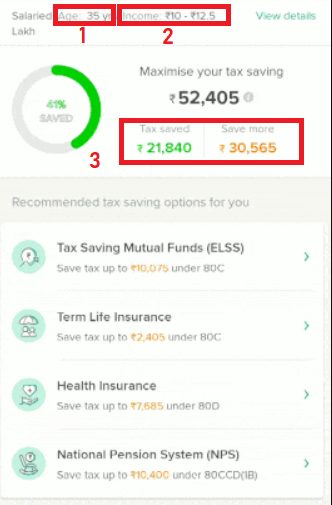

Through the ETMoney app you can invest in Life Insurance, Health Insurance, NPS and ELSS mutual funds in one place. It also helps to find out how much you need to save and what are the options as shown in the images below.

Interview with Santosh Navlani of ETMoney

We had a telephonic chat with Santosh Navlani, CTO of ETMoney and excerpt of interview is given below

Most people believe that the magic number of tax savings is Rs. 46K. Very few percentages of people realise there’s beyond Section 80C in life. We launched NPS a few days ago, and we are surprised people don’t know that NPS allows them tax saving over and above 80 (C). Of course, there’s eNPS, and the rest of it, but people somehow want a user-friendly fintech app to be able to do that

Health insurance is also not a mass phenomenon in the country as the salaried audiences probably get it from the employer, and don’t have the motivation to buy, while the self-employed guys don’t have too many financial products, being self-employed. The core problem has been two-fold – firstly people have not been aware, and even if they are aware, the lack of accessibility of these things many a time has made people postpone their decision. However, the core thing that we will solve is not to dumb-sell products to people, and we’re not known for that, fortunately. To differentiate, we are getting people to know their own personal max amount possible. Some people, because of the mass communication believe everyone can save that.

The core idea of ETMONEY was to encourage people to buy products right for them based on their income tax bracket. We have created a tool based on a prioritisation logic that guides people based on their financial need. Once they realise their need, they can choose to execute it in a matter of minutes in a seamless manner on the app. The biggest thing about ETMONEY is that it’s paperless and gets things done in less than 10 minutes for all 4 products, and you get instant proofs as well.

I am surprised there’s no other app, apart from banks like ICICI or HDFC offering all-in-one solutions. However, in their case, they will push their own products, like ICICI Lombard, but we work with 3 people and get you the best of all 3. The idea is to not dumb down products, but recommend them products that are right for you and add value to your financial lives.

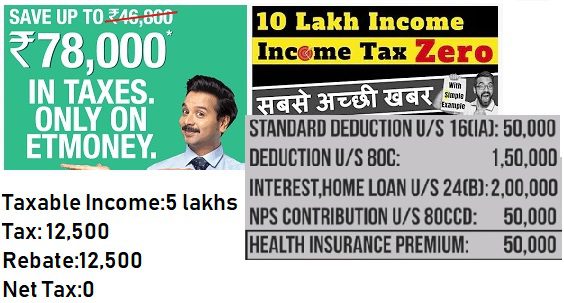

Decode the Tax saving Videos/Ads

You would have come across the advertisements/videos such as below. For 10 lakh of Income, how can one have 0 tax?

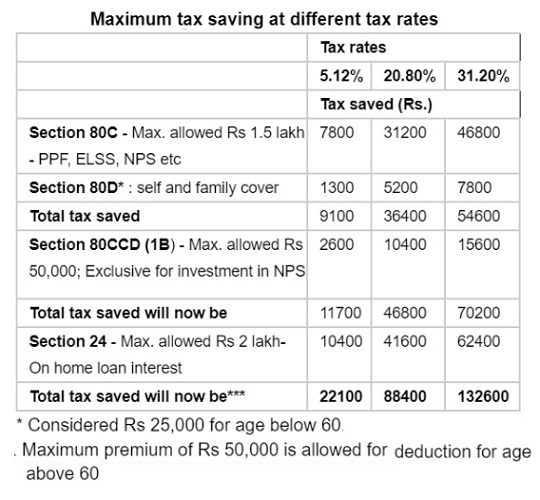

How can one save 78,000 of tax using ET Money? Why was it only 46,800 only? Answer below the image

if you are in 30% tax slab, using maximum saving, shown above, One can Use 1.5 lakh in 80C(Using ELSS, Term Insurance), which saved 46,800 And now with NPS of Rs 50,000 and Health Insurance one can save up to 78,000 Rs

New Tax Slabs in FY 2020-21 without tax saving exemption

FM, Nirmala Sitharaman, proposed to introduce simplified tax regime, new tax slabs with reduced rates for an annual income of up to Rs 15 lakh for those not taking exemptions and deductions. Now taxpayer has a choice to Take Deductions and stick with the old tax slabs and not take deductions and opt for new tax slabs. You can choose between the new and old tax regime in every financial year while filing ITR provided you do not have business income.

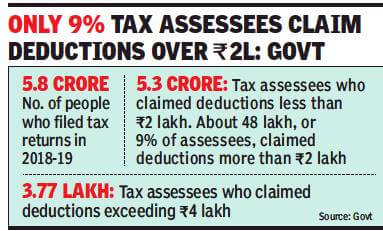

In an interview with Times of India, revenue secretary Ajay Bhushan Pandey said that the assumption that all exemptions be taken into account for all slabs did not reflect in actual filings. Data available with the tax department showed thataround 5.8 crore people who filed returns for fiscal year 2018-19, 5.3 crore claimed I-T deductions of less than Rs 2 lakh

Related Articles:

Understand Income Tax: What is Income Tax,TDS, Form 16, Challan 280

Everything about Income Tax: Basics,How to fill ITR, Income Tax Notices

- Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21

- Income Tax for FY 2019-20 or AY 2020-21

- How and where to save Income Tax and what proofs to submit to Employer

- How to Deposit NPS using eNPS

Wow! amazing information in this article. thanks for this post. You can also visit my website chennaitender for business related info.