UTI, Nippon India MF create a segregated portfolio of debt securities issued by Vodafone Idea. Segregated portfolio or Side Pocketing is a practice where mutual fund houses of debt funds isolate risky assets from the rest of their holdings and do not allow redemption in the segregated assets. In this article, we will explore the segregated portfolio in detail. How is it created? Does investor get the money back from Segregated Portfolio? What are the tax implications of it? Which all debt funds have created a segregated portfolio? Which all debt mutual funds have invested in Vodafone and Yes Bank?

Nearly ₹4000 crores has been side-pocketed by mutual funds out of which ₹3000 crores have been segregated by Franklin alone.

Asset managers have chosen to create more than 30 side pockets for their bond exposures to Yes Bank, Vodafone-Idea, Adilink Infra and Multi trading Pvt. Ltd, Altico Capital India, and Dewan Housing Finance Corp. Ltd.

Table of Contents

What is a segregated portfolio?

After the credit crisis in IL&FS and DHFL, SEBI, the market regulator, issued a comprehensive circular in December 2018, allowing the creation of segregated portfolios of debt and money market instruments subject to conditions like a downgrade of a debt or money market instrument to ‘below investment grade’ or suffer from a default.

Ratings give an idea of the likelihood of default and how safe your investment is. Any debt papers which are equal or above BBB- are considered as above investment grade while those lower than that are considered below investment grade.

- In case of difference in rating by multiple Credit Rating Agencies, AMC shall consider the most conservative rating.

- Creation of segregated portfolio shall be optional and at the discretion of Asset Management Company Ltd (‘AMC’). It should be created only if the Scheme Information Document (SID) of the scheme has provisions for a segregated portfolio with adequate disclosures.

- Investors subscribing to the scheme after segregation will be allotted units only in the main portfolio based on its NAV.

The original Portfolio, called Total Portfolio is split into two portfolios:

- Main portfolio is the healthy portfolio with good debts and can be redeemed by the investor at any point of time.

- Segregated portfolio is that part of the total portfolio which contains the bad, downgraded and illiquid debts. Units of the side-pocket are not redeemable.

The AMC will put in sincere efforts to recover the investments of the segregated portfolio. Upon recovery of money, whether partial or full, it shall be immediately distributed to the investors in proportion to their holding in the segregated portfolio. Any recovery of the amount of the security in the segregated portfolio even after the write off shall be distributed to the investors of the segregated portfolio. And yes there has been recovery. For example, On 10 Jul 2020, Vodafone Idea made payments of ₹2,850 crores to mutual funds and bank. Our article c tracks Mutual Funds that have segregated portfolio and the interest payment.

Impact on the Investors if a portfolio of Scheme(s) is segregated is as follows

- Existing investors in the Schemes, as on the day of creation of segregated portfolio(s), shall be allotted an equal number of units in the segregated portfolio(s) as held in the main portfolio(s).

- AMC will disclose separate NAVs of segregated and main portfolios from the date of creation of segregated portfolio(s).

- A statement of account indicating units held by the investors in the main and segregated portfolio(s) along with the respective NAVs as on the day of the credit event will be communicated to the investors within 5 working days of the creation of the segregated portfolio(s).

- Units of the segregated portfolio will not be available for subscription or redemption. However, AMC will enable listing of units of the segregated portfolio(s) on the recognized stock exchange within 10 working days of the creation of segregated portfolio(s) and enable transfer of such units on receipt of transfer requests

- Investors redeeming their mutual fund units will get proceeds based on the NAV of the main portfolio, while they will continue to hold units of the segregated portfolio.

- Upon recovery of money from the Issuer in the segregated portfolio(s), whether partial or full, it will be distributed to the investors in proportion to their holding in the segregated portfolio(s).

- Existing Investors redeeming their units in the main portfolio(s) will get redemption proceeds based on the Net Asset Value (NAV) of the main portfolio(s) and will continue to hold the units of the segregated portfolio(s).

- NAV of Main Portfolio + NAV of Segregated Portfolio = NAV of Total Portfolio of the Scheme

Simple Example of how segregated Portfolio is created

- Shyam invested Rs. 1,00,000 in a Credit Risk Fund Growth scheme on 1 July 2017 at NAV of Rs. 100. He received 1000 units.

- On 1 Dec 2019, the credit rating agency downgraded one of the securities which were 20% of total securities of the original portfolio.

- Segregation of the portfolio is done by the mutual fund.

- NAV immediately before segregated was Rs. 200.

- He gets 1000 units of the segregated portfolio at NAV of Rs 40 (20% of Rs. 200) and has 1000 units of the main portfolio at NAV of Rs 160 i.e 200 – (20% of Rs. 200)

- Cost of acquisition of the segregated portfolio is Rs. 20 i.e. 20% of Rs 100 and the main portfolio would be taken as Rs. 80 i.e. Rs. 100 – Rs. 20 respectively.

- Period of holding of the units of the main portfolio and the segregated portfolio would be from the original date of purchase i.e 1 July 2017

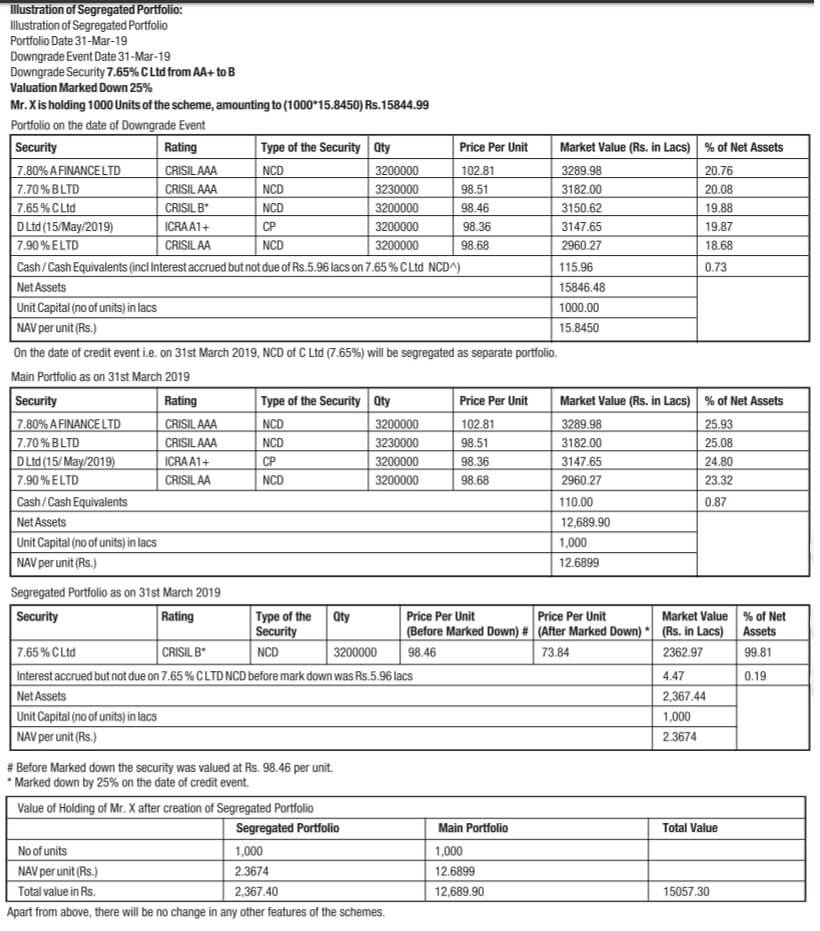

Example of how segregated Portfolio is created by AMC and its impact

This is an excerpt from Kotak Mutual Fund example of how a segregated Portfolio is created

SEBI Circulars on segregated Portfolio

Given below are SEBI Circulars about segregated Portfolio

- Creation of segregated portfolio in mutual fund schemes dated December 28, 2018

- Creation of segregated portfolio in mutual fund schemes dated November 07, 2019

Can a Mutual fund have multiple segregated Portfolio?

Yes, a mutual fund can create as many segregated portfolios as the number of defaults/investment degrade. For example, Franklin India Credit Risk Fund has 3 Segregated Portfolio as on 14 June 2020.

- Franklin India Credit Risk Fund- Segregated Portfolio 1- 8.25% Vodafone Idea Ltd-10JUL20

- Franklin India Credit Risk Fund- Segregated Portfolio 2- 10.90% Vodafone Idea Ltd 02Sep2023 (P/C 03Sep2021)

- Franklin India Credit Risk Fund – Segregated Portfolio 3 (9.50% Yes Bank Ltd CO 23DEC21)

Payout from Segregated Portfolio

As explained earlier, Upon recovery of money, whether partial or full, it shall be immediately distributed to the investors in proportion to their holding in the segregated portfolio.

You do not need to do anything to get your dues. The fund house will credit the amount to your registered bank account. If there is no registered bank account in your folio, then the fund house will send you a cheque.

Let us look at the Interest payout distribution of Franklin Templeton receiving money from Vodafone in the Segregated Portfolio 1 which holds the Vodafone Idea 8.5% (July 2020) investment. Note: this Payout is different from the issue of Franklin closing down its six debt mutual fund schemes.

In Jan 2020, Vodafone Idea was downgraded.

Various schemes from Franklin Templeton held the debt investment of the company in their portfolio. One of them was Vodafone Idea 8.5% with maturity on July 10, 2020.

Vodafone Idea paid out interest in Franklin India Income Opportunities Fund – Segregated Portfolio 1 – 8.25% Vodafone Idea Ltd. (10-July-2020). Which is 7.58% of this total recoverable amount.

FT distributed this amount to the investors in the segregated portfolios.

- Shyam had 10,000 units in the Franklin India Income Opportunities Fund – Segregated Portfolio 1 – 8.25% Vodafone Idea Ltd.,

- then 758 units(7.58% of 10,000) will be redeemed/extinguished

- And a payout at the rate of Rs. 1.4325 units will be made.

- This is about Rs. 1,085 approx. (758 units * Rs. 1.4325 partial payment per unit).

- The total no. of units will reduce by the number of redeemed units. So In our example of 10,000 units, the balance units in the segregated portfolio of Shyam will be (10000 – 758), that is, 9,242 units.

How did Franklin come up with payout ratio

- The total amount receivable from 8.25% Vodafone Idea Ltd. (10-July-2020) (includes principal & interest): INR 51.17 crores

- The above includes:

- Interest for the period 12 June 2019 to 11 June 2020 and received on 12 June 2020: INR 3.88 crore

- Interest for the period 12 June 2020 to 9 July 2020 receivable along with principal on 10 July 2020.

- The proportion of coupon received on 12 June 2020 as % of the total amount receivable: INR 3.88 crores /INR 51.17 crores = 7.58%

| Plan |

Partial payment price per unit (INR)

|

| Growth Plan |

0.3820

|

| Dividend Plan |

0.1771

|

| Direct Growth Plan |

0.4039

|

| Direct Dividend Plan |

0.1897

|

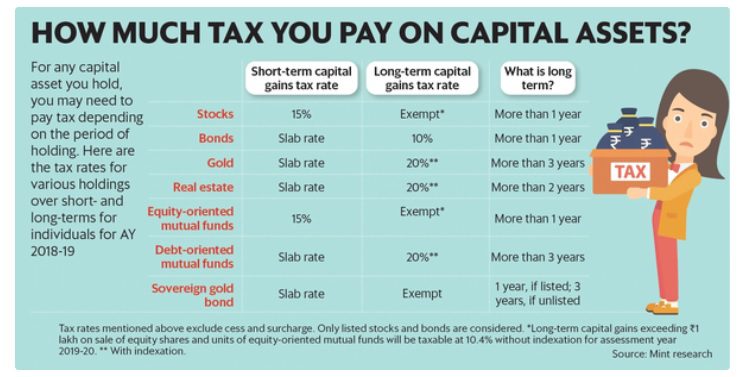

How are segregated units taxed?

As long as no payment is made in segregated units, you don’t have to pay any tax.

When you get the payment for segregated units then it is considered as the redemption i.e sale of segregated units. It is taxed like debt mutual funds and you need to calculate capital gain tax based on the date of purchase of original investment (even if you have redeemed units from the main portfolio any time) and NAV of the segregated portfolio.

Date of Purchase of old units is the date of the original investments.

So If you got payout in the original scheme for less than three years, you need to pay a short-term capital gains tax as per your income tax slab.

But if you had bought units of the original scheme, for more than three years ago, you have to pay a long-term capital gains tax.

To calculate gains on the segregated units, one needs to get the purchase cost of the segregated unit. There is the NAV of the Segregated Units.

The Cost price of the segregated units should be ?? The sale price of the segregated units?

As per Franklin Templeton,

For Income Tax purposes, the cost of acquisition of units allotted in the segregated portfolio Franklin India Income Opportunities Fund – Segregated Portfolio 1 – 8.25% Vodafone Idea Ltd. (10-July-2020) is Nil. We request you to obtain expert professional advice with regard to specific tax implications.

As per subramoney Akhilesh of Mutual Fund Guide, a brilliant Chartered accountant has to say…

The amount received by them is nothing by the redemption of units. FT shows the units redeemed on 15th June 2020. The cost of acquisition is NIL. Thus, the whole receipt is capital gains in this FY.

Next Question: This capital gain is ST or LT? Depends on when the original units were bought. The length of holding of segregated units won’t be from the date of creation but from the date of purchase of original units. Accordingly, pay include this income to pay advance tax.

Keep track of this income. It is clear that this income is capital gain. Will the entire amount received be taxed as capital gains? Or we can use NAV of the segregated portfolio and apply the indexation benefit and save tax.

We would say that be happy you got your money. (bhagte bhoot ki langooti sahi) and pray that you get more such amount, from all the segregated portfolios.

We shall update this as we get more clarity. Keep watching this space for more!

Ratings of the Bonds

Credit rating evaluates the creditworthiness of the borrower which can be business or government or individual. Credit Rating Agency provides ratings on the debt instrument of the institution to the individual and investor. The agency gives grades to a borrower. A high grade affirms that the borrower will be able to pay back the interest and lower grade represents a company may be not able to payback. These agencies assist individual and investors to take decision according to the grade. Following are the rating scale used by ICRA, CARE & CRISIL

| RATING DEFINITION | CRISIL | ICRA | CARE |

|---|---|---|---|

| HIGHEST SAFETY | CRISIL AAA | ICRA AAA | CARE AAA |

| HIGH SAFETY | CRISIL AA | ICRA AA | CARE AA |

| ADEQUATE SAFETY | CRISIL A | ICRA A | CARE A |

| MODERATE CREDIT RISK | CRISIL BBB | ICRA BBB | CARE BBB |

| MODERATE DEFAULT RISK | CRISIL BB | ICRA BB | CARE BB |

| HIGH DEFAULT RISK | CRISIL B | ICRA B | CARE B |

| VERY HIGH DEFAULT RISK | CRISIL C | ICRA C | CARE C |

| DEFAULT | CRISIL D | ICRA D | CARE D |

Which Mutual Funds have invested in Vodafone?

According to the Department of Telecommunications (DoT), Vodafone owes Rs 53,000 crore towards AGR dues. However, the company’s initial assessment, as per reports, pegs the amount at a much lower range of Rs Rs 18,000-23,000 crore. At the same time, speculations are also rife on the possibility of Vodafone Idea defaulting on its dues and filing for bankruptcy. Following image shows the Vodafone debt exposure

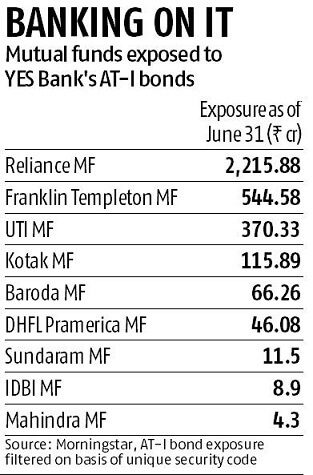

Which mutual funds have invested in Yes Bank?

The MF industry’s exposures to the additional tier I (AT-I) bonds of Yes Bank — which were downgraded by two notches and termed ‘riskier’ by ICRA – stood at Rs 3,394 crore as of June 2019.

Capital Gain Tax

Capital Gain Tax rules differ based on asset and holding period. Capital gains are classified as short and long term capital gains. The following image shows how much tax you pay on various types of investments. Covered in detail in Capital Gains and Income Tax Return. One can use our Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

Related Articles:

Mutual Funds and Segregated portfolios, Interest Payment: Franklin, Nippon, UTI

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- Debt Funds Crisis: ILFS, Zee, DHFL, Ballarpur, JSPL

- What is IL&FS Crisis? Why the Government had to rescue IL&FS

Hope you have a better understanding of side pocketing and segregated portfolio. What do you feel about debt mutual funds? Do you invest in debt mutual funds? What do you feel about AGR issue of Vodafone?