If you have invested in Mutual Funds, you have to sell some or all of the units of Mutual Funds to get your money back. This is called as Redeeming Mutual Funds. This article covers How to sell your investments in Mutual Funds? How will you get your money back? Many Mutual funds charge exit loads when you want to redeem or sell your investment before some predefined interval. For example for HDFC Equity fund Exit Load is 1% for redemption within 365 days. What is exit Load? How is it calculated? What else does not have to take care of before redeeming(selling) Mutual Fund?

Table of Contents

Redeeming Mutual Fund

Mutual fund redemption is a process where the investor intends to sell his investments in a particular fund.

When should you sell or redeem your mutual fund units?

Redemption needs clarity about the reasons for redemption. Investors often make such decisions based on sentiment. If the market is uncertain or their fund is underperforming, a reflex action is to redeem units. This might not be the best thing to do. The primary reason for redeeming your investments should be the fulfilment of your investment objective and goal. Apart from that, the underperformance of a fund is another important reason to redeem your investment.

Unlike the units of a close-ended scheme, open-ended schemes can be redeemed anytime. Schemes like Equity Linked Savings Scheme (ELSS) cannot be redeemed up to 3 years from the date of investment.

Based on the duration after which you are redeeming the funds, your transaction might attract a certain amount of taxes and exit loads.

What is the amount that I can get when I redeem my mutual fund units?

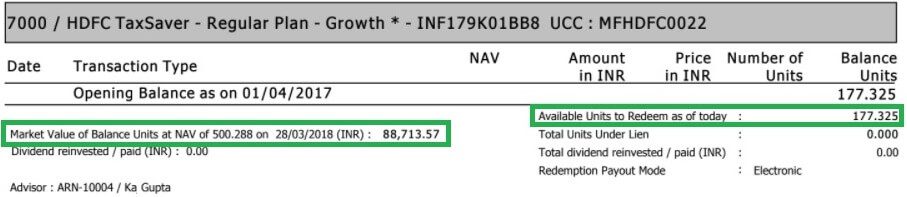

The number of units you have can be seen from your Mutual Fund account statement as shown in the image below

The amount you would get on selling your mutual fund investment is obtained by multiplying the number of units you requested to be sold on the day with the day’s NAV of that particular scheme on which you redeem. However the same could be subject to:

- NAV: The time of the day when your redemption request is received is crucial because the NAV (Net Asset Value) for each day is declared after the close of trading on that day. However, the NAV will be applicable only for redemption requests received up to specific time for example 3 pm on day. For example, if you submit your redemption before the cut-off time on a business day as defined in the scheme information document, you are entitled to the NAV of the same day. Else the next working day.

- Exit load, if any, of the scheme.

- Securities Transaction Tax (STT) as applicable to equity-oriented schemes.

The proceeds from the redemption will be credited to the registered bank account of the first named unitholder. The redemption proceeds are paid to the investors bank account provided the investor has provided the bank’s IFSC code and the bank is enabled for RTGS/ NEFT. If the fund house, does not have complete bank details, cheques are sent to the investor.

How to redeem Your Mutual Funds?

Mutual funds can be purchased and redeemed online.

If you purchased online, You have to go to the ‘Online Transaction’ page of the desired Mutual Fund and log-in using your Folio Number and/or the PAN, select the Scheme and the number of units (or the amount) you wish to redeem and confirm your transaction.

In addition, central service providers like CAMS (Computer Age Management Services Pvt. Ltd.), Karvy, etc. offer the option of redeeming mutual fund bought from several AMCs. You can download the form online or visit the nearest office. Please note that these agencies might not service all the AMCs.

In order to redeem funds through offline mode, the unitholder needs to submit a duly signed Redemption Request form to the AMC’s or the Registrar’s designated office. In the redemption form, one needs to fill in details like unit holder’s name, folio number, scheme name including the plan details, number of units to redeemed or the redemption amount desired. In addition, all the holders have to sign the Redemption form. Most of the Indian Mutual Fund companies have one common form for Transactions like buying additional units, Switching or Redeeming mutual Fund. A sample redemption form is shown below.

Exit Load in Mutual Funds

An Exit Load is the fee charged by Mutual Funds if an investor sells or redeems his investment in Mutual Fund within a specified period from that fund. This charge is calculated as a percentage of the NAV and not on the amount you invest. When you sell or redeem your Mutual Funds within the time frame for which exit load is defined you will have to pay Exit Load. Hence you will get less amount back in your hands. It might seem small but if you are getting 1 lakh after redemption then exit load of 1% will take away 1000 Rs. Exit load are charged to act as a deterrent to quick withdrawals that could put pressure on fund managers to generate cash to meet the redemption.

- Exit loads vary from scheme to scheme but have to be within the limit prescribed by the market regulator, the Securities and Exchange Board of India (SEBI). There are many mutual fund schemes which do not charge an exit load. After the predefined period, most equity funds have zero exit load.

- Exit load is applicable if you invest a lump sum or the Systematic Investment Plan (SIP). In SIP, each instalment is taken as a new investment and, hence, you will be charged an exit load for it if you sell units alloted in each instalment within the predefined time.

- One has to pay exit load for mutual funds bought through Direct plans also. In Direct plans investments are not through a distributor and it works for existing & new schemes. Direct plans were introduced from 1st Jan 2013 and have a lower expense ratio.

How is Exit Load Calculated?

Exit Load is deducted from the NAV.

For example, If an investor is redeems 10 units with NAV of Rs 10 and the exit load specified is 1% if sold within an year. Then if he sells within the year selling price per unit will be Rs 9.9. It means that the amount of money that he will get is Rs 9.9 X 10 units or Rs 99.

Let’s see with another example. Assume you invest Rs. 10,000 on the 1st of January 2017 in a mutual fund with NAV of Rs 100 that charges an exit load of 1% for redemption within 1 year. In March you invested Rs. 5250 at NAV of Rs 105 more in the same fund.

How much would the exit load be if you opt to redeem in November 2018 when it’s NAV is Rs 110?

How much would the exit load be if you opt to redeem in February 2019 when it’s NAV is Rs 112?

How much would be the exit load if you opt to redeem in Apr 2019 when its NAV is 115?

- Number of units you bought in Jan 2014 are: Rs 10,000/100 = 100

- Number of units you bought in Mar 2014 are : Rs 5250/105 = 50

If you redeem in Nov 2018 you would have to pay exit load for both the investments. In Nov when NAV is 110, you would pay 1% of (100 * 110 + 50 * 110) = Rs. 165. You’ll get back Rs. 16335(minus STT of 0.001% if this is an equity fund)

If you opt to redeem in February of 2019 Since the first investment is past the 1 year mark. So you’ll don’t have to pay exit load for it. Exit load is to be paid for second investment only i.e 1% of 50 * 112 = Rs. 56. (And you’ll still pay STT on the whole amount, for equity funds).

If you opt to redeem in April of 2019 Since both the investments are past the 1-year mark. So you’ll don’t have to pay any exit load.

Is Exit Load different from Expense Ratio?

Mutual Fund companies charge investors for professional fund management and regular operational costs. It is an annual charge as percentage of the net assets of the fund and is called as Expense ratio or total expense ratio (TER). Expense ratio includes investment management and advisory fees, sales or agent commissions and service fees, legal and audit fees, registrar and transfer agent fees, fund administration expenses, and marketing and selling expenses. This is the AMC’s main source of income; it pays its fund manager’s salaries out of this portion. So yes Exit Load is different from Expense Ratio.

Equity funds can charge a maximum of about 3% of the net assets. Debt funds can charge a maximum of 2.75% of the net assets. Usually as the size of the mutual fund grows costs tend to go down. Earlier, AMC used to get a maximum of 1.25%. But in 2012, Sebi allowed fungibility of costs i.e of the 3% charge it gets to spend this money in any which way it wants.

Are there any other charges charged by Mutual Funds?

Entry load: It is a front-end charge deducted from the NAV at the time of investing in a mutual fund scheme. SEBI abolished entry loads in August 2009. These charges were around 2.25% for equity funds before abolition.

Transaction charge: Starting August 2011, SEBI has allowed Mutual Funds to collect a nominal amount as a one-time transaction fee. For the first time investor, Mutual Funds can collect Rs 150 as a fee if the investment is more than Rs 10,000 while the fee for an existing investor would be Rs. 100. For any amount less than Rs. 10,000 no fee will be charged. In the case of Systematic Investment Plans (SIPs), where the total commitment towards the SIP is more than Rs. Rs 10,000, a transaction charge of Rs. 100 will be levied payable in four equal instalments starting from the second to the fifth instalment.

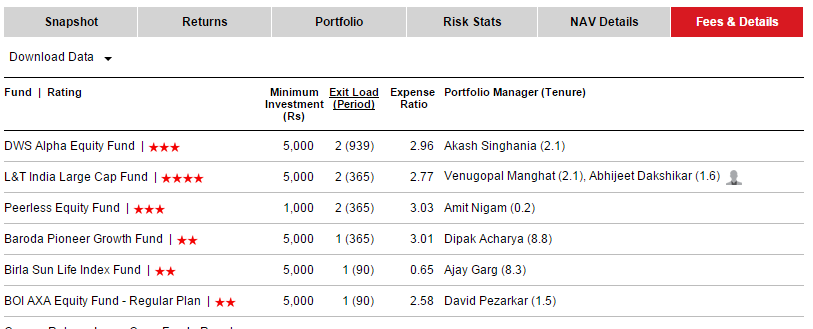

How does one find about these charges?

Information about these charges for mutual funds is easily available. You can check the Fees & Detail section on Valueresearchonline.com for the specific fund. A snapshot of charges are given below

Tax on Mutual Funds

Tax is imposed at the time when you withdraw your money from mutual funds and comes under the category of capital gains which are calculated as the difference between NAV on the date of sale and purchase.

For equity Fund:

- If you withdraw from an equity fund before one year, you pay 15% tax on your capital gains.

- From 1 Apr 2018, Any Long Term Capital Gains (LTCG) over Rs 100,000 per year on Equity Mutual funds will now be taxed at 10 percent

- From 1 Apr 2018, dividend distribution tax (DDT), a tax on distributed income by equity-oriented mutual funds, will be charged at the rate of 10 percent ( 11.648 percent including surcharge and cess)

- Dividends are tax-free.

For debt funds :

- Withdrawals from debt funds are taxed at your income tax rates if you withdraw your debt fund units before 3 years.(Change was brought in on Jul 10, 2014. Before that for debt fund it was 1 year)

- If you withdraw from debt funds after 3 years, you pay Long Term Capital Gain on Mutual Funds, 20% with indexation.

- Dividends are tax-free but dividend distribution tax (DDT) of 29.12%( before 1 Apr 2018 DDT was 28.325%) (including surcharge and cess) of the dividend amount is charged. So in effect, it’s you the investor who end up paying the tax.

Related Articles :

- Direct Investing in Mutual Funds

- Not All Mutual Funds Do Well -the Laggards

- Many Mutual Funds: Diversification or Diworsification

- Number of Mutual Funds

- Switching of Mutual Funds

- Investing in Mutual Funds for Beginner

A friend of mine had put money in debt funds before 10 Jul 2014 as saving for down payment of his house. Due to change in the taxation of debt funds, he exited from the funds. As it was within a year he ended up paying Exit Load as well as Short-term capital gains. So just like in airlines, one tells about exit routes before the flight starts, do know and understand your exit options before making the investment. Well, some things like change in tax structure are beyond your control.

Hi, I have a query.

If say I started a SIP of INR 500/- (Minimum SIP Amount) in a MF and after paying just one installment, I stop the SIP immediately. I then wait for one year and redeem it. Will i be penalized or charged any exit load for paying just one SIP and redeeming after waiting for one year?

Sir,

I have a query regarding redemption. If I will redeem my mf through mycams. It takes the same charge to directly redeem from AMC. Which is good method to redeem from AMC or mycams portal?

Thanking you.

There is no difference when you redeem through mycams or AMC.

Hi As per below information for above post

If you opt to redeem in February of 2015? Since the first investment is past the 1 year mark. So you’ll pay not pay exit load for it. Exit load is to be paid for second investment only i.e 1% of 50 * 112 = Rs. 56. (And you’ll still pay STT on the whole amount, for equity funds).

Need to know below query

1. What STT?

2. If i did SIP for a year, each investment have exit load for 365 days and if i want lumpsum withdraw after 1 year, then is it short term or long term capital gain tax

I have a small query, Let’s say I have a SIP of 5k per month say in a Mutual fund of NAV Rs. 100. Giving me around 50 units per month (say for the sake of simplicity that it is same every month). Over 2 year window, I have accumulated around 50*24 units = 1200 units. Now I want to sell around 300 units. Will the exit load apply on this? (If the period for exit load is 1 year)

Hi Satyam,

In ur case as specified ( SIP of 5K per month and NAV is Rs 100 /- ) this means after 12 months u would be having 600 units on 13th months ur 1st month units are now in long term position .And as u specified after 2 yrs u want to sell let me give u an example.

Say u started ur SIP on 1 Jan 2015 and today is 2nd Jan 2017 as per your example , on today basis u can sell all those brought between 1st Jan 2015 to 1st Jan 2016 i.e. 650 units ( 13 months as 1st Jan 2016 is also in long term )

Hi, I am a new investor now planing to start with SIP, Still looking for good scheme, i have one question, every one have some Fixed expenses every months like House rent DTH recharge, Mobile bill and other utility bills, can i partially redeem my unit whenever a requirement date comes, pls let me know is there any charge for redeem MF Units or i can redeem as we want. Like i am investing on every months 1st around 50K, and i will redeem some unit when House rent comes and same like when other requirements come.

Hi sandeep there are different types of mutual fund in which their is exit load after one year and in some schemes exit load is nill as money market scheme. you divide your 50k requirement as yearly expense and monthly expense. and than invest according.

you can whatsapp me at 9849188544 for more information

Is exit load applied to investing “fund of funds” schemes too .. especially when both schemes are part of the same fund house. I am expressly considering Quatum Multi-Asset fund that invests in Quantum Long Term Equity and other Quantum funds.

Hello,

Please let me know if the below argument is correct.

I start a SIP for 1 year from Jan 2016 to Jan 2017. According to your post, each SIP is a fresh investment. If I redeem the units on Feb 2017, then exit load is applicable on all 11 installments(from Feb 2016 to Feb 2017) right?If I were to avoid the exit load on all 12 installments, then I should stop the SIP on Jan 2017 and redeem the units on Jan 2018, right? (So effectively it is 1 year of investments and 1 year of waiting period to redeem, to avoid exit load)

Am I right?

You can withdraw every investment after 365 days. If you want all 12 lumpsum withdrawal, then yes. Or else you can opt for systematic withdrawal.

All funds have exit load mentioned. For example for Tata PE fund exit load are in the details mentioned at value research at Tata PE fund details with Exit Load

Very helpful article with critical information, as always!

Thanks Sir.

I have purchased Tata mutual fund(TMF) units in the Scheme TATA Equity P/E Fund – Regular Plan (G) ON 10-07-2014. Any exit load will be charged if redeemed after one year. What are SEBI guidelines in this regard. I intend to know as I have redeemed the units on 2-9-15, the TMF has charged exit load. Pl. advise. Thanks

my email id is bpsoneji@yahoo.com

On 30 Jun 2014 Tata Equity Fund had revised Exit load from 1 per cent for redemption within 365 days to 1 per cent for redemption within 540 days Tata MF: Changes in Exit Load and dividend declaration

Number

As number of days for you are 1 years 54 days < 540 days Tata Fund is justified in deducting the exit load.

Sir,

Could you please mail the site address in which EXIT LOADs of Mutual Funds are published.

Regards.

google it you will find in moneycontrol.