Setting goals is a very important in life in general and it is very important in financial planning too. We are living in a world where there are countless options. For example, in investing you can invest in Fixed deposits, stocks, mutual funds, money back plans, ULIPs etc. If you don’t set the financial goals you would get overloaded. You should spend time thinking about and then setting goals in life including personal finance. For example, would you like to start a business or would you like to save for a holiday or how much would you like to save for your house or your children education or marriage. A random collection of investments does not make an investment plan. But when you take time to consider what you want to achieve it will guide you and help you invest with purpose. What are the questions that can help you in achieving the investment goals in your life so that?

What is your time horizon? What is your risk tolerance? What are your liquidity needs? Answers to these questions help you define the primary financial goals such as safety of your principal amount, growth and income and stability. They help in determining the specific investments that are appropriate for your happy financial life.

Table of Contents

Financial Goals and Time Horizon: When do you need the money?

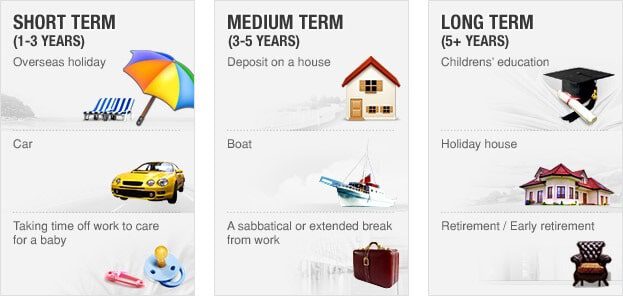

The first question you should ask before investing is When will you need the money or What is your time horizon? Are you investing for your retirement 30 years away or for your young child’s college education? Or do you want to buy a house in three years or start your business in 5 years?

If your time horizon is short then you may want to invest where you get lower return but reassurance that you will get the money when you need it as shorter time frame does not give you time to recoup your losses. The general rule is longer the time horizon, more risk you can take. If your time horizon is long you can ride out the fluctuations in your investments.

Financial Goals and Risk Tolerance: How much risk can you take?

How comfortable are you with seeing the value of your investments fluctuate or a possibility of a loss. Many would leave the possibility of gain if there is a possibility of a large loss. Such investors are risk-averse. But the risk takers are more willing to take a chance of a large loss if there is a possibility of a large gain. Most of us are somewhere in between. And it’s not always easy to determine where you stand on risk-taking. Many of us consider ourselves to be risk takers until we experience a loss that gets too painful.

Time horizon affects your risk tolerance. You can take more risk for say retirement which is 30 years away than if you need money 2 years down the lane. If you know your risk profile it will help you to stick to your investment plan.

Financial Goals and Liquidity: How quickly your investment can be converted into cash?

Liquidity means how quickly you can get your hands on your cash. In simpler terms, liquidity is to get your money whenever you need it. If one can sell an asset or easily convert it to cash it is called liquid. Cash is among the most liquid of assets since you can use it to buy just about anything. While there are assets such as real estate, which can take months or even years to convert into cash. On the other hand, stocks tend to be relatively liquid, though you might suffer a loss if you need to sell when the market is down.

The liquidity you need affects the type of investments you might choose to meet your investment goals. Like your risk tolerance, your time horizon affects your liquidity needs. If you don’t have short-term liquidity needs, you can probably invest in less liquid investments where the potential for gain is much higher. However, if you have children going to college in the next couple of years, you probably don’t want all of their tuition money invested in less liquid assets.

When considering your liquidity needs, don’t think about your liquidity needs for a given financial goal, but your overall liquidity needs. If you have a stable income, excellent job prospects, an emergency cash reserve, and no pressing financial obligations, you may have fewer concerns about liquidity than someone with a family and no emergency fund who works in an industry that’s experiencing layoffs.

Financial Goals and Tax: Do you need to save tax? How will the returns be taxed?

What is your tax slab? Your income level determines your tax rate; certain investment choices may be more attractive because of their relative after-tax appeal. Do you need to invest to save tax? If the income earned is taxable, tax will eat into your returns. Fixed deposits are safe but the interest earned gets added to your income and so is fully taxable. Same is the tax with the tax-saving financial products like the NSC (National Savings Certificate), 5-year time deposits with banks and post offices, SCSS (Senior Citizen Savings Scheme). So, even though they help you save tax for the current year, the interest income becomes a tax liability each year till the end of the tenure.

For someone who pays 30.9 percent tax, the post-tax return on a 5-year bank fixed deposit of 7 percent is 4.8 percent per annum! While PPF currently (subject to change every three months) offers 7.8 percent per annum. For someone paying 30.9 percent tax (highest income slab), it translates to nearly 11.28 percent taxable return.

Bajaj Allianz Life Insurance Bloggers Meet

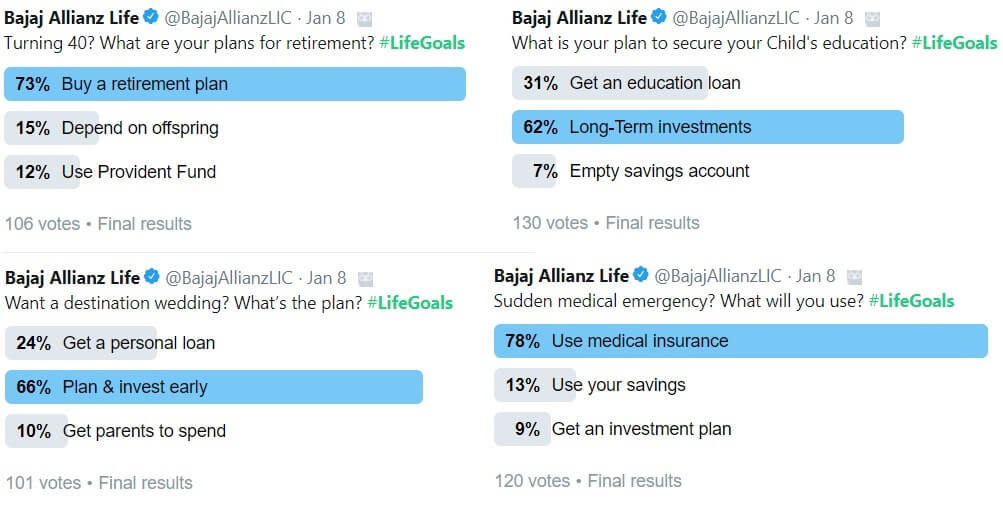

When we attended the Bajaj Allianz Life Insurance Bloggers meet on 8 Jan 2018 in Mumbai, questions about goals, goals-oriented investments were the focus. An apt time when people are all geared up to make their new year resolutions. Comedian Suresh Menon did a hilarious take on #LifeGoals and mistakes he made while selecting the best way to invest. MD Tarun Chugh and CIO Sampath Reddy shared their views on how to #invest for achieving your LifeGoals. Bajaj Allianz Life Insurance also had polls on twitter asking about LifeGoals and how to achieve them, shown below.

All About Insurance : Life Insurance, Health Insurance, Car Insurance, LIC

Lifegoals should be an integral part of your life and to them nurture them requires planning so that one can #JiyoBefikr. Bajaj Allianz Life Insurance is proposing the best insurance and investment option for you. Keep watching this space for more.