We invest in stocks to get good returns beating the inflation. But Often we end up investing in dividend stocks to make a regular income from the stock market. if a company is not declaring a dividend or less dividend it is a bad company? Does it make sense to invest in stocks for Dividend? What should you look for when you invest in Dividend stocks?

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” – John D Rockefeller

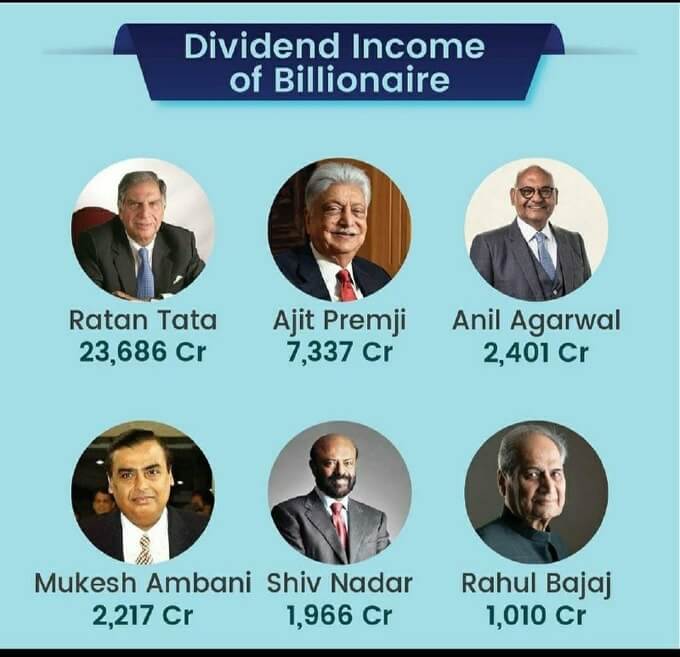

Dividend Income of the Billionaires in India

Table of Contents

How do you make money from stock?

There are 2 ways in which one makes money from the stocks

Stock price rises: You invest in the stock at Rs 100 and after its ups and downs it goes up to Rs 136.

Dividend: The company pays you some amount, a Dividend, for holding the stock. Say TCS declares a dividend, then all the stockholders of TCS will get the stock

Why are the dividends declared?

“It is an extra dividend when you like the girl you’ve fallen in love with.” – Clark Gable

Behind every company is a business. The company is running a business with the aim to make a profit. (Lets Ignore the PSU stocks)

If the company makes some profit then it can use the money in 2 ways

- One it can grow its business say make a new factory or make a new product. For example, Reliance diversified into Jio(Telecom), Retail etc. It is called as reinvesting in the business itself

- Or if the firm does not feel that it doesn’t have better investment opportunities, for example, if the company feels they have already created too many factories, they have already hired too many workers, there is just no use for us for this money right now. Then they might give the money back to the shareholders in the form of dividends

As a regular dividend is also a sign of a healthy company Most companies follow a middle path, distribute some as dividends, and invest some into business. So you get some benefits while you are invested in the company. In fact, many business owners, like Mukesh Ambani have not increased their salary in the last few years but they get a good amount as a dividend.

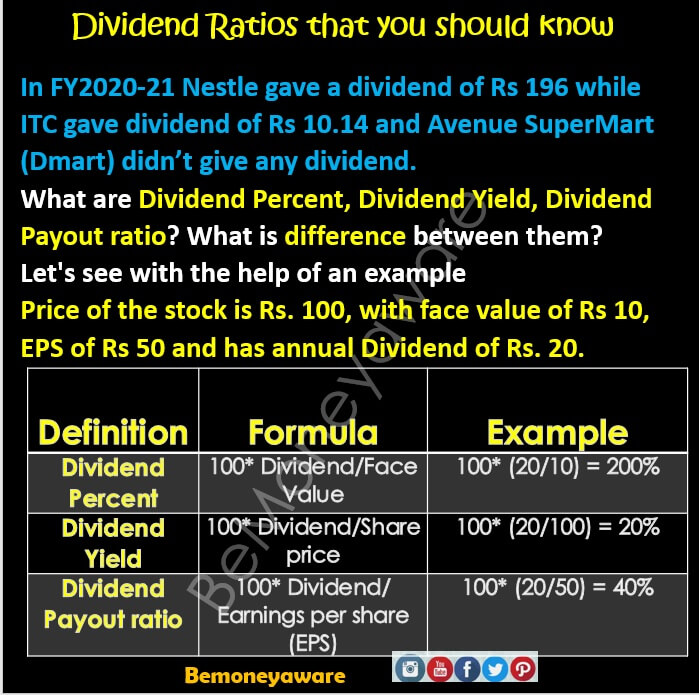

Nestle gave a dividend of Rs 90 in the year 2022 while ITC gave a dividend of Rs 5.25(data till 18 Apr). Can we compare dividends based on just the amount? Nestle’s stock price in 2021 was between 16,255 and 20,609.15 while ITC’s stock price was between ₹ 199.10 to ₹ 273.15. To make a fair comparison we need to look at Dividend Yield, Dividend Payout, etc, and the terms associated with Dividends.

What is Dividend Percent?

A dividend Percent can be understood as the percentage of the face value of a stock.

For example, let’s say the price of the stock is Rs. 100 and its face value is Rs 10 then 200% of the Dividend declared equals Rs. 20.

Note: Dividend percent is not calculated on the stock price rather it is based on the face value of a stock.

What is Dividend Yield?

Dividend Yield is calculated as the ratio of a company’s dividend to the market price of the share. The result is then multiplied by 100 to express it as a percentage.

Note: The Dividend in is calculated by adding all the dividends that a company gives in a year like the interim dividend and the final dividend.

For example, a company gives a dividend of Rs. 20 with a market price of the share is Rs. 200 then the Dividend Yield comes out to be 10%.

Dividend Yield i is dynamic since the market price of a share keeps on changing regularly. If the stock price crashes then the dividend yield would come down as the dividend given by the company would also come down.

What is Dividend Payout Ratio?

The Dividend Payout Ratio (DPR) is the fraction of net income a firm pays to its stockholders in dividends. The dividend payout ratio measures the percentage of net income that is distributed to shareholders in the form of dividends. The payout ratio is a way to measure the sustainability of a company’s dividend payment stream.

Payout ratio = dividends per share (DPS) / earnings per share (EPS)

Let’s say a company has earnings per share of Rs 100 and gives a dividend of Rs 10. Its payout ratio would be 10%.

Difference between Dividend Yield & Dividend Payout

Dividend yield refers to the rate of return earned by the shareholders on their investment.

Whereas the dividend payout ratio represents that portion of the earnings which the company distributes as a dividend.

High-yielding stocks pay out a large chunk of their earnings as a dividend. This is also why they are referred to as income stocks.

As a thumb rule, avoid investing in companies with a very high dividend payout ratio. This is because a high payout ratio means the company is not retaining enough money for its expansion or growth. In other words, be cautionary if the payout ratio is greater than 70%.

What are ratios associated with Dividend

What Does a high dividend yield signify?

Do high dividend yields indicate attractive investment opportunities?

For example, Coal India has a good dividend yield, when in FD one gets only around 5% as dividend yield, Should you invest in it?

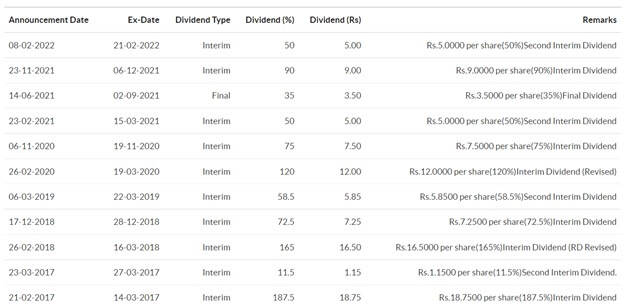

Let’s look at Coal India’s Dividend history of Coal India. The dividend looks so good right!

But let’s look at its stock price movement in the last few years, from 2018 to 2022.

So if you had purchased stock any time before Dec 2019, you might have made a loss though you would have got a dividend and also paid tax on it.

The key takeaway is that the stock price is much more important than the dividend.

That is a mistake that many investors make. They just simply go after a high dividend-paying stock and miss out on the point around the stock price.

Tax on Dividends

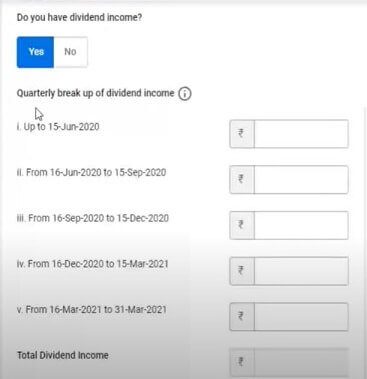

Dividend received on or after 1 April 2020 is taxable in the hands of the investor/shareholder.

The dividend is taxable, comes under Income from Other sources, and is taxed at the income tax slab rates

As Its Income from Other Sources, it can be filled in any ITR, as shown in the image for the new Utility. It has to be shown for every quarter(because of Advance Tax).

For a resident Indian, there is a 10% TDS on dividends if it is more than Rs 5,000 from a company or mutual fund under section Section 194. But as a COVID-19 relief measure, the government had reduced the TDS rate to 7.5% for distribution from 14 May 2020 until 31 March 2021. Though TDS is deducted the Dividend is still taxed as per your Income Slab Rates. So you need to claim the TDS, if deducted, in your ITR.

For non-resident shareholders, TDS is deducted at the rate of 20%, subject to the beneficial tax treaty rate, if available.

If the total tax liability(for which Tax is not deducted), including Dividends, exceeds Rs 10,000 in the relevant year. You will have to pay Advance tax installments

The company will provide a certificate for a tax deduction in Form 16A for tax deducted at source.

The dividend will appear in your AIS(Annual Information Report) & TIS /Form 26AS along with TDS deducted. You can get your AIS form from the income tax website with your login credentials (with valid PAN) at TRACES or e-filing website of the Income-tax department of India at the links https://www.tdscpc.gov.in/app/

Our article Do I Need to Pay Tax on Dividend Income? How to Report Dividend Income in ITR? explains it in detail.

How are Dividends of International or Foreign Stocks taxed? How to show in ITR explains in detail about foreign stocks

How to show Dividend Income in ITR

So one should not invest in Dividend stocks?

Yes and No. It Depends.

We need all kinds of stocks

Football is played by a team of 11 players – GoalKeepers, Defenders, Mid-fielders, and Forwards, who play in different positions, and have different skills. hence different responsibilities

The cricket team includes cricketers at the following positions-Top Batsman/Leading scorer, accumulators, International Player, All-rounder, Slogger

Your portfolio should also be constructed with different types of stocks like consistent compounders,growth stocks, stocks in sunrise sectors, and dividend stocks.

What type of dividend-paying stocks you should be purchasing.

My parameters are given below. This is not investment advice.

- The dividend yield should be greater than 3%.

- ROCE – Return On Capital Employed should be greater than 15%. if the company’s RO is more than 15%, it is generally considered to be a good company because that company is making money from its operations, reinvesting it, and generating good returns on the capital that it is deploying.

If you apply these you would get a basic list of companies that you could consider buying, as shown in the image below. Further research needs to be done. But this way you will not be buying bad companies.

- Create a list.

- Refine that list

- Finally, you must remember that whatever stocks you are purchasing, even from a dividend point of view must fit with your portfolio. It should not happen that you are purchasing all FMCG stocks only, all banking stocks only, all It stocks only, and all small-cap companies only. So it should fit with your portfolio.

Also, remember that Dividends are taxed. It is taxed as per your income slab.

Related Articles:

- Income Tax Annual Information Statement (AIS), TIS, How to use it to File ITR

- Do I Need to Pay Tax on Dividend Income? How to Report Dividend Income in ITR?

- How are Dividends of International or Foreign Stocks taxed?

- How should beginner start making their Stock Portfolio? Rs 1 Lakh Portfolio

So what is the essence of this entire discussion?

Invest in good companies where the stock price appreciation is good. Do not focus too much about dividend income.

Yes in case you’re someone who is dependent on the stock market for regular income it is okay to define your list and start investing in sensible companies that are giving decent dividends but under no circumstances you must purchase stocks because they are high dividend-paying stocks. That is just a very bad way of making investments.

Do you invest in stocks for dividends? Which stocks have you chosen and why?