When an investor decides on an investment, the most important criteria are the returns. Every investor wants to earn the highest returns on their investment. This is why investors tend to look at alternative investment options and weigh them based on their returns.

Ideally, investors should lay out a rational investment plan and the investment decision should be prominently based on their long-term financial goals. Due to the lower risk and higher return in the past, mutual funds are a highly preferred investment option for many. They invest into debt and equity securities that reduce risk and diversify the portfolio. The funds are managed by fund managers who have a thorough knowledge of the market and strive to generate higher returns.

There are two methods of investing in mutual funds—systematic investment plan (SIP) and lump sum. The major difference between SIP vs. lump sum is the outflow of cash. Both the investment options are discussed in detail below.

Systematic Investment Plan

A SIP allows the investor to invest regularly and inculcates financial discipline. The cash outflow is limited and is planned in advance. It has a fixed frequency where a monthly investment may be laid out, which will be automatically transferred from the bank account to the mutual fund investment.

- Reduced transaction cost

With a SIP, investors may avail of lower costs of the transaction since the purchase price of the units varies. Additionally, the market movement has an impact on the net asset value (NAV) of a fund; investors may gain the benefit of purchasing the units when the markets are low. This will not only reduce the overall cost of the portfolio but will also offset the problem of market volatility.

- Optimized gains due to market movement

Many investors tend to leave the market when the market falls; this causes them to suffer losses on their investment. Similarly, when the market is high, certain investors try to time their entry in order to benefit from the upswing of the market and end up purchasing the fund at a higher NAV. With a SIP, there will be a timely investment that will ensure that the impact of market movement is smoothened out. With an automated process, the investor will be able to make the most of the market movements over the long term.

- Hassle-free fund management

A SIP reduces the time and stress of managing an investment portfolio. Based on the current financial situation and the expected future savings, an investor may set up a plan which will continue, unless advised by a consultant to stop the same. The fund managers will invest the amount into different schemes and the investor will only have to monitor the returns in the long run. This eliminates the mental stress of the investor in terms of where and when to invest.

Lump sum investment

A lump sum investment is a one-time investment made ina fund. Investors who have excess cash in hand may choose to make a lump sum investment. Similarly, those investors who are not confident of their savings in the future should opt for this option.

- Buy low

A lump sum investment may help catch the market at its low and generate higher returns in the long run. But this could also mean that an investor makes a wrong move and invests when the market is highly volatile.

- Gain from compounding of interest

Since a lump sum will remain invested for a longer duration, the benefit of compounding of interest will be higher.

SIP vs Lump Sum: What should you choose?

As an investor, you should choose between a SIP vs lump sum based on your financial position. Keeping your long-term financial goals in mind, and taking into account the availability of excess funds, you must make an investment decision. Salaried individuals should learn how to invest in a SIP since it will allow them to save a particular amount each month and will ensure that the same is invested in funds. Investors with excess liquid cash or those holding a seasonal business should make a lump sum investment in order to ensure that the amount is parked into the right investment avenue. However, there is no guarantee of generating higher returns in any case.

In case you are looking for some useful financial recommendations, try the Angel Wealth mobile application. It offers you customized investment guidance based on your requirements. The user-friendly app features an ARQ investment engine, which runs on technology-driven algorithms and is free from any kind of human intervention.

Download the app today and learn how to invest in SIPs.

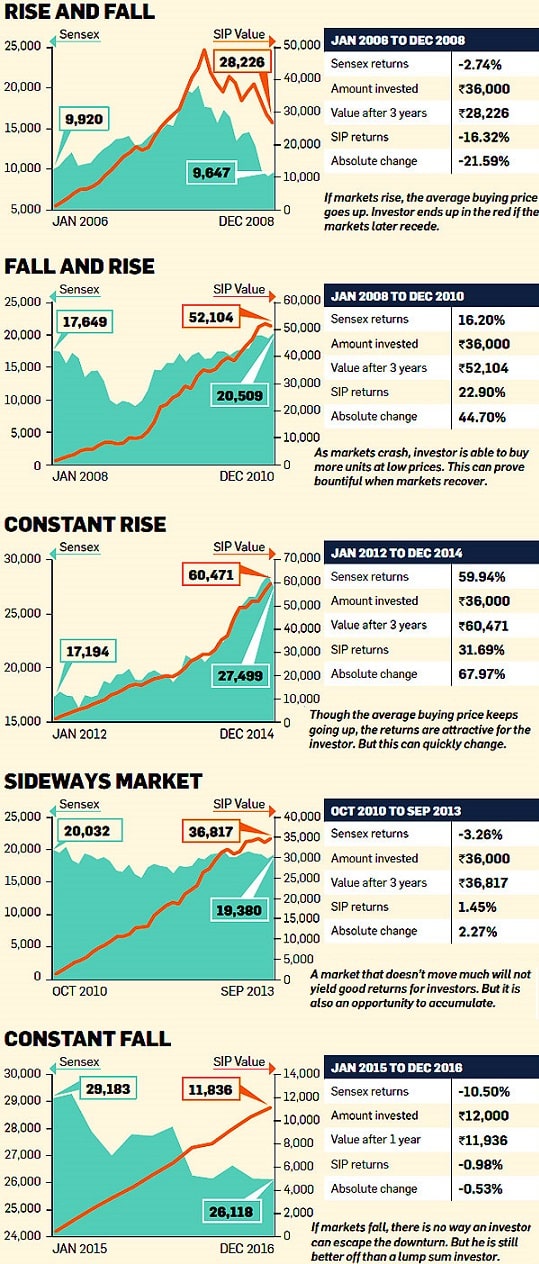

In the examples below, we have considered a SIP of Rs 1,000 in the Birla Sun Life Equity Fund. (Ref. Times Of India). When markets turn volatile, investors start having second thoughts about their equity investments. Though SIPs are a great way to build wealth, some small investors tend to get swayed by interim market volatility and redeem their SIP investments too soon. Lakhs of SIP accounts were either discontinued or redeemed during 2008 and 2011 when markets weren’t doing well. This is the worst thing an investor can do to his portfolio. Stopping SIPs when market is down defeats the whole purpose of systematic investing.

Related Articles:

- Top Mutual Funds in India

- How to sell or redeem Mutual Fund Units: Online, Exit Load, Cut off,SIP

- Understanding Equity Saving Funds, Arbitrage, Taxation

- What is SIP and how to invest in Mutual Funds using SIP?

- Systematic Transfer Plan or STP in MF: What is STP,How to invest

Investing in SIP is very convenient for anyone. It is also a way to invest in funds by taking a lower risk. You can start investing even with 500 rupees. This gives flexibility to your investment. Also, Investing with a lumpsum amount will need you to first arrange that much of amount and if that investment fails you will face a heavy loss of money. Whereas in SIP if you think that this fund is not working you can stop your investment and sell your fund with whatever you have invested.