One invests in the stock market either by buying individual stocks or equity mutual funds or exchange-traded funds. Now investors can use smallcase to buy a portfolio of stocks, built around a theme, in one shot. How is smallcase different from Mutual Funds? What are charges associated with small case? What are pros and cons of investing through smallcase?

10 lakh people use smallcase to make better investment decisions. More than 5000 crores invested through smallcase.

We want to make investing as easy as booking a cab, says Vasanth Kamath, founder of smallcase

Table of Contents

What is Small Case?

A smallcase is a basket of stocks that reflects an idea. Some baskets are created by SEBI registered experts of smallcase company, some by experts(bloggers, YouTubers) and you can create the baskets or small cases yourself too. Investing in multiple stocks protects you against volatility in a specific stock.

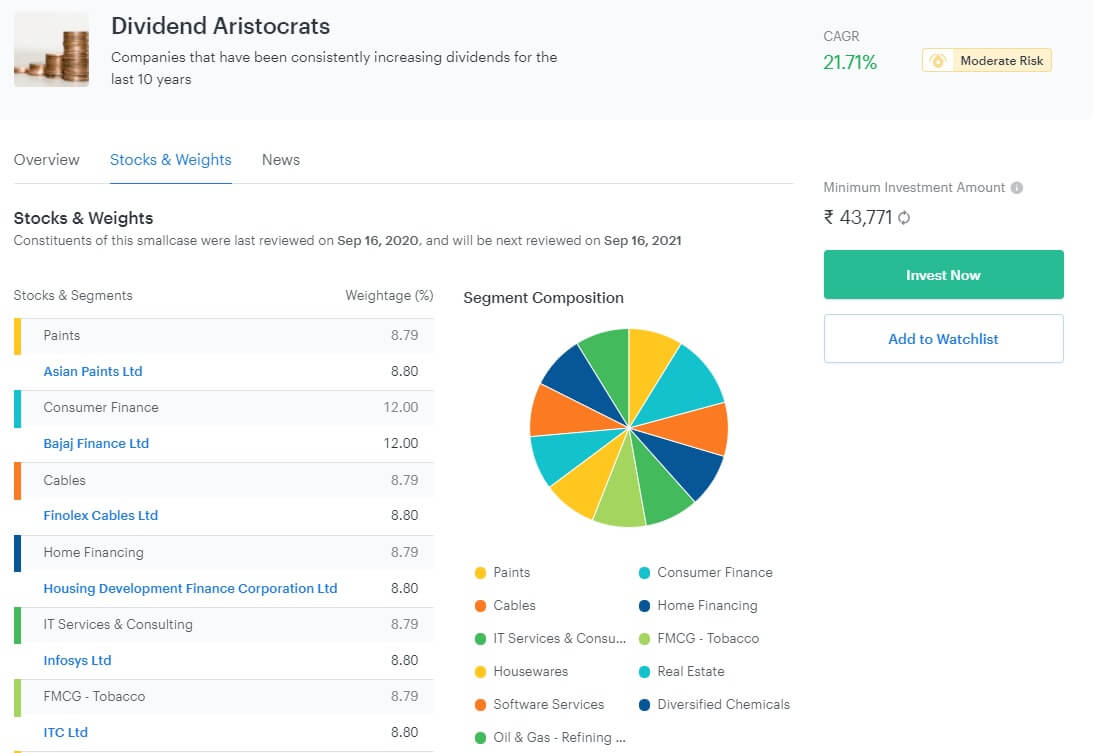

For Example, Dividend aristocrat’s small case is collection of stocks that are focused on stocks with good dividends. There are different stocks in different weightage to make a portfolio.

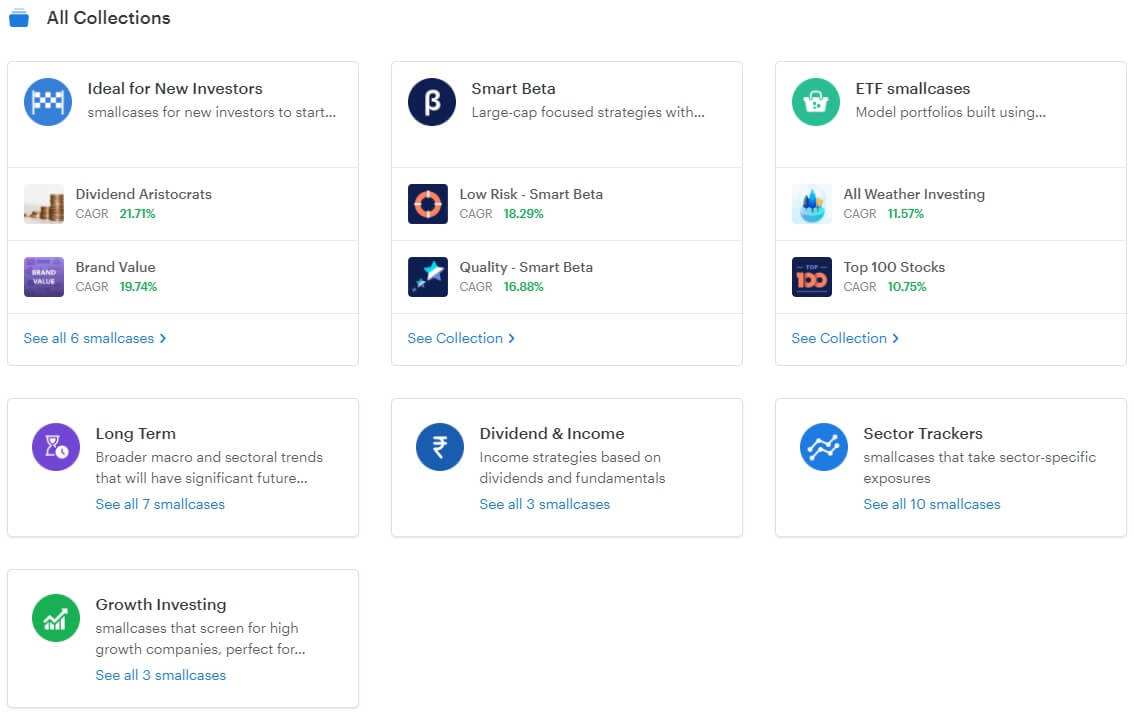

The different smallcases including asset allocation, smart beta, model-based and sectoral strategies. For example, All-Weather (offers exposure to equity, gold and fixed income via ETFs), Smart Beta (largecap stocks oriented).

One can invest in all the stocks in the selected smallcase in 1 click.

Mutual funds are market capitalization based(large-cap, mid-cap & small cap, multicap, flexicap) or sector based(ex Pharma, IT). But smallcase enables you to invest in ideas. For example, one can invest in companies that are working towards affordable housing projects if the focus of the government is on providing affordable housing to all. The stocks can be of different market capitalization or sectors.

One can track & manage smallcase easily. One can add or remove stocks anytime with the ‘manage’ option.

It is safe as, When you invest in smallcase, money is debited from your trading account and stocks are credited to your Demat account.

There is no lock-in period as you hold the stocks directly and they can be sold any time.

Investors can even make SIP investments in Smallcase portfolios. Periodic and regular amounts can be invested in a chosen basket built around a particular theme.

However, please ensure that you don’t sell any smallcase stocks directly on the trading platform.

Charges of using Small Case

One-time fees are associated with using readymade small cases. For further orders in the same smallcase, no extra charges will be applicable. For example,

For All Weather Investing and Smart Beta smallcases: Rs 50 + GST

For all other smallcases (thematic/sectoral/model-based, equity & gold smallcase): Rs 100 + GST

Standard taxes and charges ex:STT, associated with equity transactions will also be applicable

Standard brokerage charges are applicable depending on the broker. For Discount brokers with zero delivery no charges other than that of exchange while regular brokers might have delivert charges and other charges ex STT.

However, no additional fees are required for re-investments, SIPS, to rebalance the portfolio and likewise

The small case is different from mutual funds, where you don’t have ownership rights in the stocks that form your mutual fund portfolio but you hold units of the portfolio. Poor man portfolio management services,

Brokers associated with smallcase

A brokerage account is mandatory to trade in smallcases. Since one invests in stocks directly, a trading account and a Demat account is required.

Many popular brokers offering smallcase such as Zerodha, 5paisa, HDFC Securities, Kotak Securities, Edelweiss, Axis Securities,

When you invest in smallcase, you are buying stocks, money is debited from your trading account and stocks are credited to your Demat account.

Is SmallCase safe?

You do Earn dividends, view how each stock is performing & invest without lock-in periods

Though, the regular brokerage and other charges for buying and selling stocks will be deducted for every order.

Difference between Mutual Funds & Small case

Unlike mutual funds, with smallcases you get:

- Cost Efficiency – No expense ratios

- Transparency – See what’s inside the portfolio at any time. Mutual funds portfolios is updated monthly.

- Full Ownership – You buy the stocks into your account directly (not just units)

Mutual funds are market capitalization based(large-cap, mid-cap & small cap, multi cap, flexicap) or sector-based(ex Pharma, IT). But smallcase enables you to invest in ideas. For example, one can invest in companies that are working towards affordable housing projects if the focus of the government is on providing affordable housing to all. The stocks can be of different market capitalization or sectors.

Mutual funds have an expense ratio that includes fund management, distributor’s commission, and other expenses. This expense ratio is annually deducted from your investment and is around 1-2 percent of the investment.

On investing in mutual funds one gets fund units at NAV, and not the stocks that make up the portfolio of the fund, so one does not become a shareholder of a company when one invests in a Mutual Fund. While when one invests through small case one gets shares in one’s Demat account. The main difference between Small case vs Mutual Funds is the same as the difference between Stocks and Mutual Funds, who owns the shares. In case of Mutual Funds, mutual funds owns the shares and gets all benefits like Dividends, Bonus.

When a Mutual Fund buys or sells any stock from their portfolio the tax burden is not carried by the Mutual Fund Investors. But when a Small case is bought or sold tax comes into play based on the holding period.

Small case founders

We want to make investing as easy as booking a cab, says Vasanth Kamath, founder of smallcase

The Bengaluru-based startup was founded in 2015 by IIT Kharagpur graduates Vasanth Kamath, Anugrah Shrivastava, and Rohan Gupta. Smallcase was started to introduce a new generation of investors to the Indian equity markets using technology.

They have received funding from HDFC Bank(in Dec 2020), DSP Group, Sequoia Capital, Blume Ventures and many others.

The Smallcase team states:

“We’re on a mission to change how India invests. Smallcase is a Fintech company building a trusted financial ecosystem together with investors, advisors, brokers and other market participants. From individual investors to big AMCs, our products are used every day across India’s capital markets.”

Pros of Smallcase

- Invest based on a strategy.

- You don’t have to invest efforts in the analysis of a particular stock. You get a stock basket

- You can do SIP

- re-balance of portfolio

Cons of Investing in SmallCase

Smallcase is poor man’s PMS (Portfolio Management Services) where the minimum ticket size is Rs 50 lakh.

- Total Investment amount per smallcase is very high when compared to other modes of equities investments like ETFs, Index Funds, Mutual Funds etc. For example investing in default Dividend Aristrocat smallcase requires Rs 43,000. While one can invest with Rs 500 in a mutual fund. Few Smallcases for less than Rs 5000 is also avialable.

- All stocks in the smallcase are bought at the same time, irrespective of the current price. Typically buying a stock at lower price gives more returns.

- NO clear idea behind the research team involved and whether the stocks included based on the rationale behind the strategy adopted was correct. (You must blindly believe in an idea/strategy/sector relying on the smallcase research team expertise which can go wrong)

- NO clear idea on the RISK metric attributed to a smallcase

- NO proven track record of the past (Smallcase statistics are mostly based on the recent bull run market until 2018)

- NO support to rebalance all of your smallcase portfolios at once. (you may happen to sell and buy the same stocks in different smallcases as an intraday trader incurring a loss. Also, the rebalancing creates churn, as well as a tax liability.)

Video on SmallCase

Related Articles:

- How can Indians Invest in US Stock Market: International Mutual Funds

- What is ETF, Difference between ETF and Mutual Fund, ETF vs Index Fund, How to buy or sell ETF

For a semi-active investor who wants to invest directly in stocks and can’t find enough time to research but want a strategy small case is a good option. Smallcases as a concept is good only for well-informed investors

Nicely plagiarised article from Money Premier.

“The main difference between Smallcase vs Mutual Funds is OWNERSHIP.”

Tell me that you came up with words?

Our intention is not to copy any article.

If we would have copied we would have copied more than just words.

And we have removed the words.