Have you heard of one or more of the following conversations(or similar ones):

- Look at state of the country-These politicians are taking our country to doldrums

- Look at the youth of today – so wrapped up in themselves, no respect for elders. God save them!

- I was late because of traffic.

- My boss is making me work hard. I have been so busy that I haven’t been eating right or exercising so that is why I put on a few pounds.

- My company isn’t paying me enough, so I cannot save.

- People are there to just take money from you. I was talked into making this investment by my friend/relatives/parents/TV shows

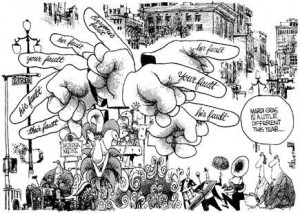

Choices are made each day, and these choices have consequences. When the results come in less than favorable, somehow it is easier to push the blame toward someone or something else. Often people are quick to point the finger. We blame the politicians, the economy, boss, spouse, children, weather or anyone or anything other than us.. Your problems begin when you “let somebody talk you into…” anything. This is especially true with finances. And It’s not just an individual even the governments too do it!

Table of Contents

Government Finger Pointing

There was so much finger-pointing and heated rhetoric about the US federal debt and the debt ceiling last few days. The dialogue was around assessing blame for our current situation. However, this situation did not occur over the last two months or last two years. And raising the debt ceiling just delayed the situation. Indian Government is also not far behind. Take the LokPal Bill or the removal of CM in Karnataka.

There was so much finger-pointing and heated rhetoric about the US federal debt and the debt ceiling last few days. The dialogue was around assessing blame for our current situation. However, this situation did not occur over the last two months or last two years. And raising the debt ceiling just delayed the situation. Indian Government is also not far behind. Take the LokPal Bill or the removal of CM in Karnataka.

Why are people so quick to blame others or circumstances for their problems? Like Homer Simpson (of American animated sitcom Simpsons

The Race

Everyone is busy these days. We have so much on our platter -the job, spouse, children, their education, social events, Traffic, Email, Facebook, Twitter, now Google+. Even 24 hrs seem less. So Much To Do, And No Time To Deal With life leave alone Money. We act upon things like pressing problems, deadline-driven projects. . Marne ki bhi phursat nahin hain bhai!(No time to die also).

Everyone is busy these days. We have so much on our platter -the job, spouse, children, their education, social events, Traffic, Email, Facebook, Twitter, now Google+. Even 24 hrs seem less. So Much To Do, And No Time To Deal With life leave alone Money. We act upon things like pressing problems, deadline-driven projects. . Marne ki bhi phursat nahin hain bhai!(No time to die also).

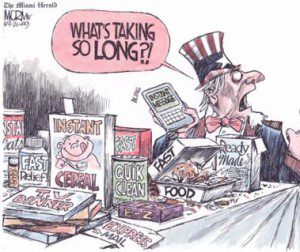

Instant gratification

We live in an age of instant gratification. We expect rapid result (like a hot cup of coffee) by investing a minimum of effort (like pushing a button). No wonder 2 minute Maagi is so popular!! But we cannot eat it everyday, roz tu roti dal chaihye(Every day need Roti and Dal). Furthermore, people are motivated by the desire for a quick fix to some problem or discomfort in their lives. Our goal is a BandAid rather than healing and growth.

No education

I am not talking about academic or professional education. I mean the financial education. Few of us are trained to deal with our own money. Studies show that parents are more comfortable talking to their children about sex than money. Learning is being done through personal experience. We would not allow a student to get in the driver’s seat of a car without requiring driver’s education, and yet we enter the complex financial world without any financial education. An uneducated(financially) individual armed with a credit card and access to a mortgage can be just as dangerous to themselves and their community as a person with no training who is given a car to drive.

Do you you an assured way of doubling your money instantly!Interested? Of course you bet I’m. Hold your breath.

“The quickest way to double your money is to fold it over and put it back in your pocket”

Jokes apart!! What’s the easiest way of of earning money?

Watching some TV channels/read some newspaper/magazine and follow their advice to buy or sell stocks/mutual funds. One loves turning on CNBC or logging onto the computer to see how much is stock market up (or down) today. It is so exhilarating. We do not realize that top tips and top picks by experts is a time-tested method that all the biz channels adopt to keep the investors glued to their television screens. An interesting article on this is You deserve to be cheated,

Listening to the people involved in selling financial products. Ask a mother how is her child..and pat will come the reply best in the world. Is she right ..yes of course she is . Her child is best in the world but for her! A realtor will tell you what a great investment a home! Car salesmen focusing on a monthly payment, mortgage broker calculating a mortgage payment…all quoting your max ability to pay and acting as if you are crazy not to use that full borrowing ability to buy the biggest most expensive car/home you can, a bank relationship manager selling you to a mutual fund to meet ..ou guessed right, his targets.

Everyone that provided financial education/advise has an agenda. They are selling a book, selling seminars, making a fee off advice, a commission off a sale…etc. I am reminded of quote of Warren Buffet, the legendry investor,“Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway“

First thing you have to do is realize they all have skin in the game. Second is stop playing the victim.

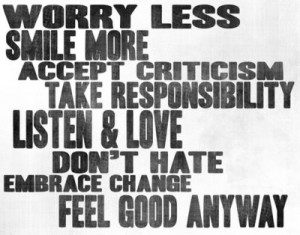

Stop playing the victim

You could have maintained or lost weight if you re-prioritized your schedule. You could have saved for retirement if you cut back on spending. There is always a cause-and-effect relationship. Many people get into financial trouble because of greed, laziness, or lack of commitment. Quit blaming others. When you consistently point fingers at others, you look at yourself as a victim. Have you ever seen a rich victim? They are not very common. I have seen many poor victims. These are people who are poor and blame others. They blame their lack of financial success on circumstances and people around them. Harboring negative emotions and anger about your financial situation diminishes financial progress. Your financial problems can begin to eat away at you little by little.

If you want to be really successful, then you will have to give up blaming and complaining and take total responsibility for your life – that means all your results, both your successes and your failures.

Solution

All of life’s problems can be solved with discipline . Our Books, such as Road Less Travelled(Scott Peck), Monk who sold his Ferrari(Similar ones from Robin Sharma) to name a few say Four Foundational Tools of Discipline are:

- Acceptance of Responsibility

- Delayed Gratification

- Seek Truth and

- Balance

Taking that first step, though, is unbelievably humbling. Looking in the mirror, do we like everything that we see? It’s going to take some hard work to correct course if we don’t, and it requires immediate action. Remember It’s a lot easier to be in denial.

Where to start financial education

To learn about basics of money such as banks, credit cards, investing you can start with my website bemoneyaware.com, read personal finance magazines, Outlook money is my favorite, visit sites which explain personal finance such as (in no particular order): onemint.com, jagoinvestor.com, tflguide.com, subramoney.com. There are many more sites which I follow religiously …shall take it up in future post soon.

Note: these are our recommendations only. If you know about other such sites, please share with us we would be obliged.

Remember There are no shortcuts to any place worth going.

You have really interesting blog, keep up posting such informative posts!

Thanks..your comments encourage us to write more..

I am so happy to read this. This is the kind of info that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this beneficial content.

thanks we shall look into it.