Indian government levies taxes on its citizens to raise money for numerous purposes and for meeting the economy’s expenditure. This article talks about Direct and Indirect taxes, What is Cess? What is Surcharge? Difference between cess and surcharge. Whether Cess and Surcharge money has been used or not?

Some of the popular Cess that affects an ordinary man

- Health and education cess: Proposed in Budget 2018 by Finance Minister Arun Jaitley to meet the education and health needs of rural and rural and Below Poverty Line (BPL) families.

- The Comptroller and Auditor General (CAG) report observed that for 2018-19, out of the ₹2.7 lakh crore received from such levies, only ₹1.64 lakh crore were transferred to specific reserves and funds, the rest remaining with the Consolidated Fund of India.

Table of Contents

Direct and Indirect Taxes in India

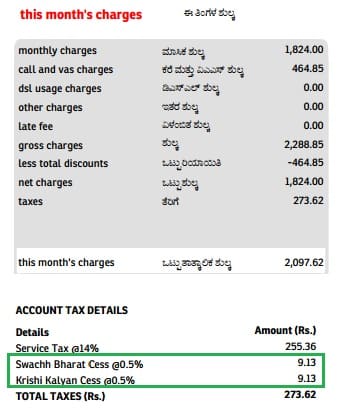

Indian government levies taxes on its citizens to raise money for numerous purposes and for meeting the economy’s expenditure. This tax is paid by every Indian citizen knowingly in the form direct taxes or unknowingly in the form of indirect taxes. Income tax is an example of direct tax. While service tax, VAT etc. are some types of indirect tax which we pay incautiously even while purchasing something as small as a matchbox. In addition to the tax one may end up paying cess and Surcharge. If you would have ever checked a bill of a restaurant or café you might have observed that in addition to the Service tax or VAT, Swatch Bharat Cess or Krishi Kalyan cess exists over and above the customary tax. While paying income tax, cess and surcharge is also calculated on the total tax payable. Just like taxes, cesses too peg up the cost of living for people like you and me. So, from an individual’s perspective, a cess and surcharge is as bad as any tax. The Infrastructure Cess (1-4 per cent) on motor vehicles has already led some car companies to announce price hikes, as they pass on the additional burden to their customers. Similarly, with the doubling of the Clean Environment Cess (from ₹200 to ₹400), electricity tariffs are expected to go up by 4-6 paise a unit. The 0.5 percent Krishi Kalyan Cess means that for every ₹100 worth of taxable services, you will be charged 50 paise as cess

- Direct Taxes are taxes that are directly paid to the government by the taxpayer. It is a tax applied on individuals and organizations directly by the government e.g. income tax, corporation tax etc.

- Indirect Taxes are on the manufacture or sale of goods and services. These are initially paid to the government by an intermediary, who then adds the amount of the tax paid to the value of the goods/services and passes on the total amount to the end user. Examples of Indirect Taxes are sales tax, service tax, excise duty etc.

| DIRECT TAXES : Central Govt | DIRECT TAXES : State |

|---|---|

|

|

The example of Indirect Taxes collected by Union and State Government are shown in table below.

| Indirect taxes (Union) | Indirect Taxes (States) |

|---|---|

|

|

What is Cess?

Cess is a tax that is levied by the government to raise funds for a pre-decided purpose. Collections from the Education Cess and the Secondary and Higher Education Cess, for instance, are supposed to be used for funding primary and higher and secondary education respectively. Likewise, money collected from the Krishi Kalyan Cess is to be used for funding agri development initiatives.

- A particular cess continues to be levied until the government raises enough funds for that purpose.

- Cess is not applicable on services that are in the negative list or are completely exempt from tax.

- Unlike taxes, cess can be easily introduced, altered or can be completely abolished without any trouble as it has to only raise a notification. Therefore government uses this as an effortless source of income to raise money for certain objectives.

The introduction of the The Goods and Services tax (GST) in 2017 led to most cesses being done away with and as of August 2018, there were only seven cesses that continued to be levied. These were:

- Cess on Exports

- Cess on Crude Oil

- Health and Education Cess

- Road and Infrastructure Cess,

- Other Construction Workers Welfare Cess,

- National Calamity Contingent Duty

- Duty on Tobacco and Tobacco Products

- The GST Compensation Cess.

- The Finance Minister Nirmala Sitharaman introduced a new cess — a Health Cess of 5% on imported medical devices — in the Finance Bill for 2020-2021.

The following image shows the Broadband bill with Cess before 1 July 2017

Revenue from all taxes collected by Government is kept at Consolidated Funds of India(CFI) that can be used for any purpose, unlike cess which is credited to CFI but is used only for the purpose for which it was raised. For example, the proceeds are kept as Central Road Fund (CRF) as in the case of fuel cess where this revenue collected is initially credited to the CFI and after adjusting for the cost of collection, Parliament through its appropriation bill credits such proceeds to the Central Road fund.

Types of Cess that are levied

Cesses seem to be emerging as the favourite form of taxation to fund the pet schemes of the government. After the Swacch Bharat cess, the Budget of FY 2016 introduced two new cesses — the Krishi Kalyan Cess and the Infrastructure Cess, while the Clean Environment Cess was doubled. But to ward off criticism, 13 cesses, each yielding less than ₹50 crore a year, were abolished too.

The cess was first implemented in 2015. It took the form of a 0.5% surcharge on all services. According to information received in response to the RTI, Rs 20,632.91 crore was collected in Swachh Bharat Cess between 2015 and 2018.

| Cess | Purpose | Current Rate | Calculation of cess: | Money collected |

| Health and Education Cess

From 1 Apr 2018 |

To take care of the needs of education and health of BPL and rural families

And Education |

4% of individual’s total income tax payable | Let us assume income tax payable for Mr. A is Rs. 100000 Therefore cess payable will be 100000*4/100= Rs. 4000. Total tax payable= Rs. 104000. | |

| Education Cess

Till 31 Mar 2018 |

Promote education-related work | 2% of individual’s total income tax payable or 2% of the service tax wherever applicable. | Let us assume income tax payable for Mr. A is Rs. 100000 Therefore cess payable will be 100000*2/100= Rs. 2000. Total tax payable= Rs. 102000. | |

| Secondary and higher secondary cess

Till 31 Mar 2018 |

Improvising secondary and higher secondary education in India | 1% of the total income tax payable or 1% of the service tax wherever applicable. | Let us assume income tax payable for Mr. A is Rs. 100000. Therefore cess payable will be 10000*1/100= Rs. 1000. Total tax payable= Rs. 101000. | |

| Swatch Bharat Cess

(Abolished as of July 1, 2017 with the introduction of GST). |

Financing and promoting Swatch Bharat Abhiyan or Clean India Mission | 0.5% of the value of service. (this excludes any service tax or any other applicable tax) | Restaurant bill: Rs. 500. Therefore SBC payable = 500*0.5/100= Rs. 2.5 | The cess was first implemented in 2015 and abolished in Jul 2017. It took the form of a 0.5% surcharge on all services. According to information received in response to the RTI, Rs 20,632.91 crore was collected in Swachh Bharat Cess between 2015 and 2018. |

| Krishi Kalyan Cess

(Abolished as of July 1, 2017 with the introduction of GST). |

Financing and promoting initiatives to enhance agricultural sector | 0.5% of the value of service. (this excludes any service tax or any other applicable tax) | Restaurant bill: Rs. 500. Therefore KKC payable = 500*0.5/100= Rs. 2.5 | The KKC was implemented in the year 2016. a total of Rs 10,502.34 crore has been collected under the KKC since 2016 – Rs 7,572.08 crore was collected in 2016-17, Rs 2,779.79 crore in 2017-18 and Rs 150.48 crore in 2018-19 till January 2019

Govt has spent on the government’s crop insurance scheme, Pradhan Mantri Fasal Bima Yojana (PMFBY), and subsidies on loans to farmers. |

| Infrastructure Cess

(Abolished as of July 1, 2017 with the introduction of GST). |

Welfare of automobile segment. | 1% on petrol, LPG, compressed natural gas (CNG) cars which are less than 4mts in size made with engines of maximum 1200cc. 2.5% on diesel vehicles that are less than 4mts in size and less than 1500cc engine, cess will be charged at 2.5% 4% on vehicles with higher capacities. | ||

| Clean Environment Cess | Flat rate of Rs. 400 on every tonne of coal. |

Abolition Of Cess since 2015

There are 42 cesses that have been levied at various times since 1944. The very first cess was levied on matches

Post Independence, the cess taxes were linked initially to the development of a particular industry, including a salt cess and a tea cess in 1953.

Subsequently, the introduction of a cess was motivated by the aim of ensuring labour welfare.

Some cesses that exemplified this thrust were the iron ore mines labour welfare cess in 1961, the limestone and dolomite mines labour welfare cess of 1972 and the cine workers welfare cess introduced in 1981.

The Central Government in the three General Budgets viz 2015-16, 2016-17 and 2017-18 gradually abolished various cesses on goods and services in order to prepare the ground for smooth roll- out of Goods and Service Tax (GST) from 1st July, 2017. The Central Government took this step in stages by abolishing various cesses so that it is easier to fit in various goods and services in different tax slabs for GST.

| S. No. | Name of the Cess | Date of Abolition |

| 1 | Education Cess on taxable services | 01.06.2015 |

| 2 | Secondary & Higher Education Cess on taxable services | 01.06.2015 |

| 3 | Education Cess on excisable goods | Exempted with effect from 01.03.2015. Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act, 2017. |

| 4 | Secondary & Higher Education Cess on excisable goods | Exempted with effect from 01.03.2015. Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act, 2017. |

| 5 | The Mica Mines Labour Welfare Fund Act, 1946 | 21.05.2016 |

| 6 | The Salt Cess Act, 1953 | 21.05.2016 |

| 7 | The Merchant Shipping Act, 1958 | 21.05.2016 |

| 8 | The Textile Committee Act, 1963 | 21.05.2016 |

| 9 | The Limestone and Dolomite Mines Labour Welfare Funds Act, 1972 [2 Cesses] | 21.05.2016 |

| 10 | The Tobacco Cess Act, 1975 | 21.05.2016 |

| 11 | The Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines Labour Welfare Cess Act, 1976 [3 Cesses] | 21.05.2016 |

| 12 | The Cine-workers Welfare Cess Act, 1981 | 21.05.2016 |

| 13 | Cess on cement [by notification] | Exempted in 2016. Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act, 2017. |

| 14 | Cess on strawboard [by notification] | Exempted in 2016. Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act, 2017. |

| 15 | Research & Development Cess | 01.04.2017 |

| 16 | The Rubber Act, 1947 – Cess on Rubber | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 17 | The Industries (Development and Regulation) Act, 1951 – Cess on Automobile | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 18 | The Tea Act, 1953 – Cess on Tea | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 19 | The Coal Mines (Conservation and Development) Act, 1974 – Cess on Coal | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 20 | The Bidi Workers’ Welfare Cess Act, 1976 – Cess on Bidis | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 21 | The Water (Prevention and Control of Pollution) Cess Act, 1977 – Cess levied on water consumed by certain industries and by local authorities | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 22 | The Sugar Cess Act, 1982, The Sugar Development Fund Act, 1982– Cess on Sugar | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 23 | The Jute Manufacturers Cess Act, 1983 – Cess on jute goods manufactured or produced wholly or in part of jute | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 24 | The Finance Act, 2010 – Clean Energy Cess | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 25 | The Finance Act, 2015 – Swachh Bharat Cess | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

| 26 | The Finance Act, 2016 – Infrastructure Cess and Krishi Kalyan Cess | Abolished with effect from 01.07.2017 by the Taxation Laws (Amendment) Act |

Cess Amount collected and Utilised

Swatch Bharat Cess: The cess was first implemented in 2015 and abolished in Jul 2017. It took the form of a 0.5% surcharge on all services. According to information received in response to the RTI, Rs 20,632.91 crore was collected in Swachh Bharat Cess between 2015 and 2018.

Krishi Kalyan Cess: The KKC was implemented in the year 2016. a total of Rs 10,502.34 crore has been collected under the KKC since 2016 – Rs 7,572.08 crore was collected in 2016-17, Rs 2,779.79 crore in 2017-18 and Rs 150.48 crore in 2018-19 till January 2019Govt has spent on the government’s crop insurance scheme, Pradhan Mantri Fasal Bima Yojana (PMFBY), and subsidies on loans to farmers.

According to the Comptroller and Auditor General of India (CAG), while 17 cesses and other levies were subsumed into the GST, 35 levies still remained in force.

- The CAG report has also observed that for 2018-19, out of the ₹2.7 lakh crore received from such levies, only ₹1.64 lakh crore had been transferred to specific reserves and funds, the rest remaining with the Consolidated Fund of India.

- The fund of ₹1.25-lakh crore raised from the cess collected on crude oil has not been transferred to any oil industry development body, it was meant to finance.

- The new 5% Health and Education Cess on income tax was partly deployed towards education, but no fund was created for health.

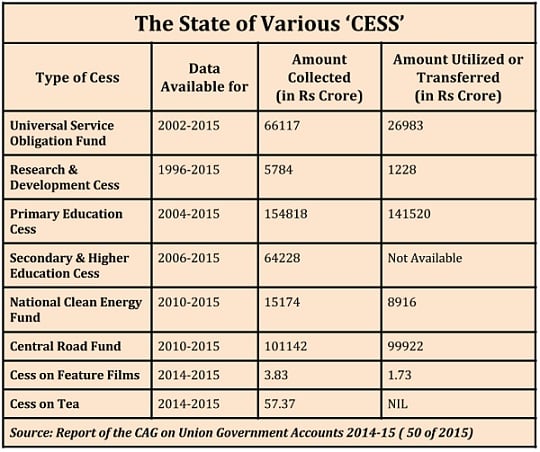

Cess is collected by the government and is then supposed to be transferred to the specific fund setup for the purpose. But according to the Annual audit report of the CAG, significant portions of the cess remains unutilized and not transferred to the fund or kosh setup for the purpose intended for. Large part of the Cess collected for Primary Education & Central Road Fund have been transferred or utilized. The status of the Secondary & Higher Education Cess is unknown since no fund was designated to deposit the proceeds of this cess. No scheme was also announced that would be funded by this cess. The image below shows the State of Various Cess, how mauch amount has been collected, how much has been utilised.

What is Surcharge?

The Surcharge is a charge on any already existing tax. Surcharge basically is an additional tax. In India Surcharge on income tax is an extra tax on high income. It is charged on the individuals and businesses. Earlier only the businesses had to pay Surcharge but after the budget of 2013, it is applicable to the all taxpayers.

- The rate of surcharge is different for the different class of taxpayers. It is highest for the individuals.

- For an individual, the surcharge is levied on the income above Rs 1 crore. The rate of surcharge remains same above Rs one crore.

- In a case where the surcharge is levied for the individuals, Education cess of 2% and Secondary and higher Education Cess of 1% will be levied on the amount of income-tax plus surcharge.

- However, marginal relief is available from surcharge in such a manner that in the case of a person having net income exceeding Rs. 1 crore, the amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore

Rate of Surcharge on different class of Tax Payers

The rate of surcharge is different for the different class of taxpayers.

- Income Tax Surcharge on individual and HUF: The income tax surcharge is highest for individuals and HUF.

- For the FY 2016-17, AY 2017-18 .It is 15% of the income tax.

- Till the financial year 2014-15, It was 10%. But in the FY 2015-16, the Government abolished wealth tax and increased the income tax surcharge by 2%.

- In Budget 2016, finance minister increased the surcharge on income tax levied on individuals earning income of Rs 1 crore or more from 12% at present to 15%. This move is aimed at taxing the super rich

- Marginal Relief in Surcharge, is applicable

- For the FY 2016-17, AY 2017-18 .It is 15% of the income tax.

- Surcharge on Income Tax for LLP, Partnership Firm, Cooperative Society and Local Authority: The income tax surcharge for LLP and Partnership firm is similar to the individuals. It is 15% of the income tax.

- Income tax Surcharge On Domestic Company: The surcharge on domestic company is 7%.

- Tax Surcharge on Foreign company: The surcharge rate is lowest for the foreign company. Surcharge rates are as follows:

- Upto 1 Crore Nil

- One Crore to 10 Crore 2%

- Above 10 Crore 5%

Surcharge Calculation on Income Tax

The surcharge is levied on the income tax of the taxpayer. It is not levied on the income of the taxpayer. So calculate the income tax first and then calculate the surcharge.

Surcharge: 15% of the Income Tax, where taxable income is more than Rs. 1 crore. Education Cess : 3% of the total of Income Tax and Surcharge.

Tarak earns more than Rs one crore. The surcharge calculation on the income of Tarak is shown below.

| Description for FY 2016-17, AY 2017-18 | Amount |

| Total Taxable Income | Rs. 1,00,01,000 |

| Total Tax payable | 28,25,300 |

| Surcharge @ 15% | 42,37,95 |

| Total Tax payable (incl Surcharge) | 32,49,095 |

| Education Cess @ 3% on Total Tal Payable | 9,74,728.5 |

| Total tax Payable After the cess | 42,23,823.5 |

Marginal Relief on Surcharge

When an assessee’s taxable income exceeds Rs. 1 crore, he is liable to pay Surcharge at prescribed rates on Income Tax payable by him. However, the amount of Income Tax and Surcharge shall not increase the amount of income tax payable on a taxable income of Rs. 1 crore by more than the amount of increase in taxable income. For Example In the case of an individual assessee (< 60 years) having taxable income of Rs. 1,00,01,000 calculation of Marginal Relief is shown below.

| Description | Amount (Rs) |

| Income | 1,00,01,000 |

| Income Tax | 28,25,300 |

| Surcharge @15% of Income Tax | 42,37,95 |

| Income Tax on income of Rs. 1 crore | 32,49,095 |

| Incremental salary (more than Rs 1 crore) | 1000 |

| Tax on salary- Tax on 1 crore (excluding the Surcharge) | 28,25,300-28,25,000=300 |

| Maximum Surcharge payable (Income over Rs. 1 crore less income tax on income over Rs. 1 crore) | 700 (1000 – 300) |

| Marginal Relief in Surcharge | 4,23,095(42,37,95-700) |

| Income Tax + Surcharge payable | 28,26,000(28,25,300+700) |

| Education Cess @ 3% of (Income Tax + Net Surcharge) | 84,780 |

| Total Tax payable | 29,10,780 |

Difference between cess and surcharge

- Both surcharge and cess go to the consolidated fund of India but Cess is an earmarked fund while surcharge is collected and spent on any welfare purpose.

- A common feature of both surcharge and cess is that both need not be shared with the states.

- If the purpose for which Cess was implemented is fulfilled, cess should be ideally eliminated. Surcharge has no such condition.

- Surcharge is imposed on the tax payable or on the total value of service and cess is calculated on surcharge.

Related Articles:

- Which ITR Form to Fill?

- Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Paying Income Tax Online, epayment: Challan 280

- How To Fill Salary Details in ITR2, ITR1

- Examples of Income Tax Calculation

Thanks

For describe wonderful blog.

Great point,Very informative…

Where to fill the cess amount and how to deposit on whose name

Is education surcharge is a direct tax? or Indirect tax in India?

A very tricky question.

Direct tax are those which are paid directly to the government by the taxpayer.

But we also pay education cess along with Income tax. 2% of individual’s total income tax payable or 2% of the service tax wherever applicable.

Education cess is tax but called cess.

Though Shakespear had said what’s in a name. It does make a difference in understanding.

But whether it is tax/cess you have to pay it!

As always Kirti! A very informative post. Thanks for writing on these subjects

Thanks Debashree. We financial bloggers have to make finance simple for people.

You are also doing a terrific job.

May our breed spread.

Very nice and wise collection of words to describe the importance of topics.

Very grateful for this clearly written information. Thanks..