Tax on Cryptocurrency depends on whether you talking about FY 2021-22(AY 2022-23) or FY 2022-23(AY 2023-24). Cryptocurrency gains could happen in multiple ways such as mining, or conventional buying and selling. While the Reserve Bank of India has not granted legal tender status to cryptocurrencies, there is no escape from paying tax on cryptocurrency investment gains. But How is Cryptocurrency Taxed? From 1 Apr 2022, Cryptocurrencies are taxed at 30%. But For previous Financial Years tax is either as Income from Capital Gains or As Income from Business or Profession, which depends on how you got your cryptocurrency, how long you hold

Cryptos are classified as a virtual digital asset (VDA) by Govt from 1 Apr 2022

Cryptocurrencies are unregulated in India though taxed.

Table of Contents

How are CryptoCurrency in India taxed for FY 2022-23

Taxed at 30%: From 1 Apr 2022, there is a flat tax of 30% on all gains, irrespective of the income level of the investor. This is very high compared to taxes on other assets and incomes. Capital gains from stocks and equity funds are taxed at 10-15% and non-equity investments, property, and gold are taxed at 20% or marginal rate. But every rupee earned from cryptos will be taxed at 30%, even if the investor has no other income.

Losses from one crypto can’t be adjusted against any other income or even the gains from another crypto. Losses cannot be carried forward to subsequent years. So the government gets 30% of the gains while the losses are borne by investors.

From 1 Jul 2022, the seller will have to deposit 1% of the transaction value as TDS

Gifting of digital assets will attract tax in the hands of the receiver

How are CryptoCurrency in India taxed for FY 2021-22

Cryptocurrency can be acquired in many ways such as Buying from the exchange, Mining, Trading, and getting it for services. Income Tax depends on the way the cryptocurrency is bought and sold. For FY 21-22 or AY 22-23 there is no specific guidance is available under the income tax act for the taxation of cryptocurrencies. So experts are divided in their opinion.

Depending on the way one gets cryptocurrencies, One has to prove that income from cryptocurrency is a business or an asset class income ie capital gains or just choose the safest mode of income from other sources.

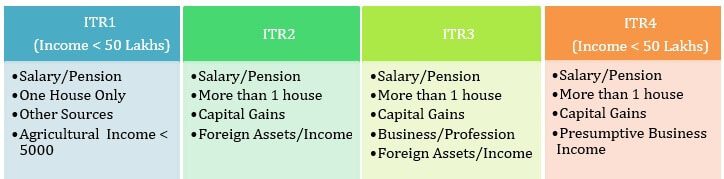

If you have Frequent transactions (P2P + Trading+ Mining) profits/loss will be classified as income from a Business or Profession, so you can use ITR2,ITR3.

If you have fewer transactions, then profits/loss will be classified as Capital Gain so you can use ITR2,ITR3.

- Short Term Capital Gains(STCG) if you held crypto currency for less than 3 years, which is taxed at your Income Tax Slab Rate

- Long Term Capital Gains(LTCG) – if you held crypto currency for more than 3 years. It is taxed at 20% with Indexation Benefit

For Interest earned on Crypto FDs, income is classified as Income from Sources. You can use any ITR.

Let’s explore various cases of Tax on Cryptocurrency and which ITR has to be filed. An overview of the various ITRs is given below

What is Tax when you haven’t sold Cryptocurrency

Let’s Suppose you bought Crypto in 2020 and 2021 and are still holding it. Do you have to pay tax on it?

The answer is No. As You don’t have any income from It. So there is no tax. You don’t need to show it in ITR.

What is the Tax on Crypto when you bought and sold it in limited transactions by 31 Mar 2022

if you bought crypto in a few transactions in 2021 or Before and sold it by 31 March 2022. Then you have to show it as Capital Gain. STCG or LTCG & Pay the taxes.

You can use Form ITR-2 or ITR-3 depending on other incomes.

What is the Tax on Crypto when you bought and sold it in frequent transactions

If you have been doing Frequent Transactions as P2P and have a turnover (buying or selling) then you need to show as Income from Business or Profession

if your turnover is more than 50 lakh or 1Cr and a minimum 6% Profit on that Crypto you require the Audit from CA.

What is the Tax on Crypto when you mined it

if you have mined the Crypto and earned monthly regular profits then you need to show it as Income from Business or Profession and Expenses with Balance Sheet and Profit & Loss Account and Pay the Taxes.

You should use ITR-3 to file your ITR.

What is the Tax on Crypto when you are get interest from it

Many crypto exchanges provide a facility to investors to earn interest on crypto without staking or locking up their digital currency.

For example, you leave one Bitcoin(worth $50,000) in an account on Vauld for one year or 52weeks, where you can earn a 4.60% – 6.70% APY compounded weekly. Your first week of interest would total out at $44.23 ($50,000 x (0.046 / 52)). if you continue to roll your profit back into the original $50,000 for an entire year, you would earn interest on crypto totaling $2,300.

So, if you are holding the Crypto and earning the Interest as regular income then you need to show it as Other Income from other sources, like FD.

You can file it in any ITR ITR-1,2,3,4 Pay the taxes on that just like regular interest on Fixed Deposit.

What is the Tax on Crypto when you have earned for your work

if you were paid Crypto as your payment for your work then you need to show it as either your Income from Salary or if as a Freelancer, you need to show it as a Income from Business or Profession.

- File ITR1/ITR2/ITR3/ITR4 if shown as Income from Salary

- File ITR3/ITR4 if you have considered it as Freelancer Income.

TDS on Crypto from 1Jul 2022

From 1 Jul 2022, 1% TDS on Crypto will be applied. TDS will be deducted only when the value or total value of the transactions by the persons exceeds Rs.50,000 during the financial year.

The buyer of a virtual digital asset (VDA) is required to deduct 1% TDS from the amount paid to the seller. If the PAN of the buyer is not available, then TDS will be 20%. If the seller has not filed his tax return, TDS will be 5%.

If the transaction is directly between buyer and seller with no third party (exchange) in between, the buyer will deduct TDS if the amount exceeds the threshold limit of Rs.50,000 in a financial year.

If the deal is routed through an exchange, the exchange will have to deduct tax at the time of transferring payment from the buyer to the seller of the VDA. If the payment is done on the exchange through a broker, then TDS can be deducted either by exchange or broker.

To ensure that TDS is not deducted twice, there can be a written agreement between the exchange and broker. The broker shall be responsible for deducting tax on such credit/payment.

If the transfer of VDA happens via an exchange and VDA is owned by the exchange, then the buyer of VDA will be required to deduct tax at the time of making payment. However, it may happen that the buyer does not know that VDA is owned by the exchange.

In such cases, the exchange may enter into a written agreement with the buyer or his broker that in all such transactions the exchange would be paying the tax on or before the due date for that quarter.

Is CryptoCurrency Banned in India?

In 2018, the Reserve Bank of India (RBI) banned the use of cryptocurrency as legal tender in India.

In March 2020 this decision was overturned by the Indian Supreme Court, permitting banks to handle cryptocurrency transactions from traders and exchanges.

The government has not yet brought the taxability of cryptocurrencies into the statute books. are no clear rules or guidelines defining taxability for cryptocurrencies

The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 was tabled by the government in the parliament.

But The Ministry of Corporate Affairs (MCA) has made it mandatory for companies to disclose cryptocurrency trading/investments and the amount of cryptocurrency they hold in their balance sheets during the financial year from 1 Apr 2021. Minister Anurag Singh Thakur, clarified that “the gains resulting from the transfer of cryptocurrencies/assets are subject to tax under the head of income, depending upon the nature of holding of the same”.

On 11 Jun 2021, The Enforcement Directorate (ED) issued a notice to India’s crypto exchange WazirX over possible Foreign Exchange Management Act (FEMA) violations for transfers worth INR 27.91 billion (US$372.4 million).

Tax if one Invests in CryptoCurrency: Capital Gains

Countries such as the UK and USA have laid down that cryptocurrencies should be treated as capital assets.

If you are buying and selling a few times in the year then you are an investor. A few times have to be evaluated on a case-to-case basis.

To be treated as Capital assets, Cryptocurrency has to be bought from cryptocurrency exchanges using Indian currency and stored in digital wallets. Unicorn, Bitxoxo, Zebpay, Coinbase, etc., are some of the bitcoin exchanges of India.

Note that buying one cryptocurrency using another cryptocurrency is a grey area with respect to taxation.

If Cryptocurrency is treated as Capital assets then taking the safest option, it is best to consider it Like Debt Funds and Gold Assets.

- So capital gain on cryptocurrency may be treated as long-term assets when held for a period exceeding three years and short-term assets otherwise.

- Short-term capital gains may be taxed at slab rates applicable to the taxpayer.

- Indexation allowed on cost of acquisition allowed.

- 20% of tax on the Gains

- If there are capital gains then One cannot file ITR1. An individual can then use ITR2

Tax on Trading in Cryptocurrency, Business Income

If you are buying and selling cryptocurrencies many times in the year then you are a trader.

Trading in Cryptocurrency may be treated similarly to trading in shares. And hence would be taxed as Business Income.

- Business income is taxed as per the prevailing slab rates plus applicable surcharge and cess.

- One can claim expenses like purchase cost for, depreciation on computers/laptops, salary, rental expense, the cost for maintenance of accounts, etc.)

- Accounts may be audited after the threshold is crossed

- If the turnover crosses a specified threshold, a doubt regarding GST applicability may arise.

- For individuals having a business income, ITR-3 is to be used.

- But there are doubts whether loss from the sale of crypto assets can be set off or carried forward

The way forward would probably be to provide a little more clarity in the law with regards to its taxation.

Tax on Mining Cryptocurrency

“Mining” crypto is when an individual miner solves complicated algorithms and records data on the blockchain.

Can Mined cryptocurrencies be treated as self-generated capital assets taxed as capital gain but Section 55 of the I-T Act 1961, which deals with the cost of acquisition and improvement, does not recognize it. Hence the capital gains computation mechanism may not be accepted following the Supreme Court decision as in the case of B.C.Srinivasa Shetty.

Then the income tax authorities may choose to tax the value of cryptocurrencies from mining under the head “Income from other sources” or as business income.

It needs to be noted that you can avail of a business deduction for the equipment and resources used in mining. The nature of those deductions varies depending on whether you mined the cryptocurrency for personal gains. If you are running a mining business, you can avail of deductions to cut your tax bill. But you cannot avail of these deductions if you have mined cryptocurrencies for personal gain.

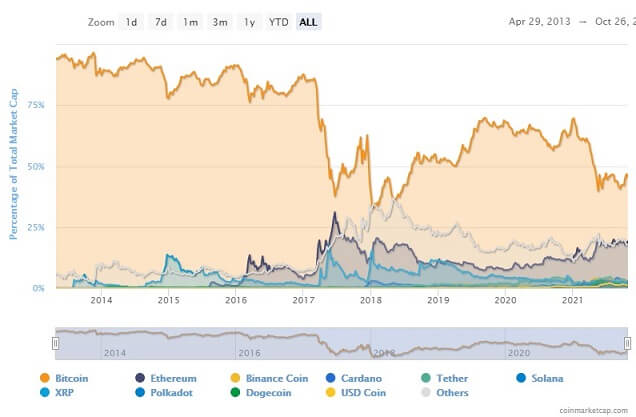

Market share of CryptoCurrency

There were over 4,000 different cryptocurrencies in circulation worldwide, including the market giants Bitcoin, Ethereum, Litecoin, and Dogecoin.

As of May 2021, the aggregate value of all the cryptocurrencies in the world stood at US$2.8 trillion. How it is distributed across the various cryptocurrencies is shown in the image below?

As per data from blockchain analytics firm Chainalysis, Indian investments in the cryptocurrency have surged to US$6.6 billion in 2021.

As per a report, over 10 million crypto investors were added by India in 2021

In terms of ownership, in India the top five preferred currencies are bitcoin, with a total share of 75%, followed by dogecoin at 47%, ethereum at 40%, Binance’s coin at 23%, and Ripple’s XRP at 18%.

Best cryptocurrency exchange apps in India WazirX, Unocoin, CoinDCX, Zebpay, CoinSwitch Kuber

Disclaimer: All the provided details are for knowledge purposes only. Please consult your Tax consultant or Chartered Accountant (CA) for more details.

There is no official announcement or guidelines till now on cryptocurrency and tax on it. There are conflicting opinions as to how cryptocurrency in India is taxed. Don’t ignore to report the gains on cryptocurrency.