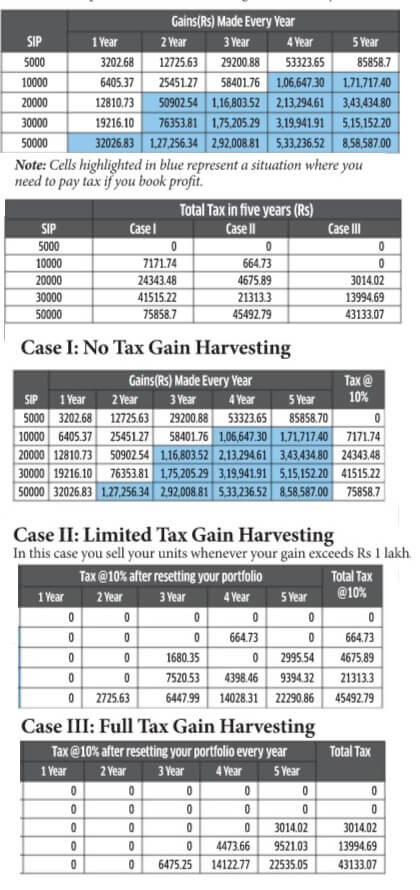

Tax-harvesting is using the tax-free window of Rs 1 lakh to lower your overall LTCG(Long term capital gain tax). You redeem, and then re-invest, a portion of your equity investments that are over one year old, and hence are long-term in nature. Equity holdings(stocks, equity mutual funds) for more than 1 year are considered Long term capital gain (LTCG), taxed 0% for first Rs 1 lakh and @10% exceeding Rs 1 lakh. The image below shows the result of three cases, Case 1 when you sell your investments after 5 years, case 2 you book profits when the gain in a year is more than 1 lakh, and case 3 when you book profit every year and reset your portfolio irrespective of how much your portfolio has gained. This article explains what is tax harvesting for stocks, how does it work?

Though analysis shows that Case III, when you sell everything and reinvest, gives you the best post-tax return. Though it helps you to take advantage of capital gain exemption every year it also makes one miss out on growth.

Table of Contents

Capital Gain Tax on Stocks & Equity Mutual Funds

When you invest in stocks or equity mutual funds, you either make capital gains or losses. Overview of the Capital Gain Tax from our article is given below.

For the stocks listed on the Indian stock exchanges(BSE/NSE) as STT(Securities Transaction Tax) is applicable on all shares which are sold or bought.

A mutual fund is considered equity-oriented if at least 65% of the investible funds are deployed into equity or shares of domestic companies.

- Equity holdings for more than 1 year are considered Long term capital gain (LTCG), taxed 0% for first Rs 1 lakh and @10% exceeding Rs 1 lakh

- Equity holdings between 1 day to 1 year with a low frequency of trades is considered Short term capital gain (STCG), else in case of a high frequency of trades it should be considered as non-speculative business income.

- short term capital gains are taxed at 15%

- Business Income is taxed as per the Income Slabs after deduction of business expenses.

You can be an investor, trader, or both.

In LTCG tax harvesting you sell the stocks/equity mutual funds that are eligible for LTCG and reinvesting it

In tax-loss harvesting, you sell your stocks/equity mutual funds units at a loss to reduce your tax liability on capital gains

LTCG Tax Harvesting

The idea of LTCG tax harvesting is to sell the stocks/equity mutual funds that are eligible for LTCG and reinvesting it

- The holding period for stocks/ mutual fund investments (either in part or in full) should be greater than 12 months (which is the definition of long term duration).

- There should be price appreciation (hence a long term capital gain) on holdings.

One bought 3000 shares at Rs 100. If one sells after 5 years at the cost of Rs 161.051 then the total sale value is Rs 483,153.

Capital Gain = 4,83,153-3,00,000 = 1,83,153

Capital gain more than 1,00,000 i.e 83,153 is taxed at 10% i.e 8,315

Our article Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator, explains it in detail.

But by using tax harvesting, selling, and buying shares every year, one could have saved this 8,315 tax.

Let’s see it in detail.

In First year, Sale price is Rs 110 so the Capital gain is Rs 3,30,000 – 3,00,000 = 30,000 which becomes tax free.

These 3000 units are bought back at 110, the total purchase price becomes 3,33,000

In the second year, the Sale price is Rs 121, so the capital gain is 3,63,000 – 3,30,000 = 33,000 which again becomes tax-free.

These 3000 units are bought back at 121, the total purchase price becomes 3,63,000

In the third year, the Sale price is Rs 131, so the capital gain is 4,39,230 – 3,99,300 = 39,230 which again becomes tax-free.

These 3000 units are bought back at 146, the total purchase price becomes 4,39,230

In the fourth year, the Sale price is Rs 161, so the capital gain is 4,83,153 – 4,39,230 = 43,923 which again becomes tax-free.

So by using tax harvesting, selling and buying shares every year, one could have saved tax of Rs 8,315.

The image earlier shows the result of three cases, Case 1 when you sell your investments after 5 years, Case 2 you book profits when the gain in a year is more than 1 lakh, and case 3 when you book profit every year and reset your portfolio irrespective of how much your portfolio has gained.

Though analysis shows that Case III, when you sell everything and reinvest, gives you the best post-tax return. Though it helps you to take advantage of capital gain exemption every year it also makes one miss out on growth and add to paperwork.

Tax Loss Harvesting

Tax-loss harvesting starts with the sale of the stock or an equity fund that is experiencing a consistent price decline. You feel that the security has lost most of its value and chances of a rebound are bleak. Once the loss is realised, you offset it against capital gains that your portfolio has earned over the period.

While setting off losses using tax-loss harvesting, you need to keep the following points in mind:

- Long-term capital losses can be set-off against only long-term capital gains. You cannot set-off long-term capital losses against short-term capital gains.

- Short-term capital losses can be set-off against either short-term capital gains or long-term capital gains.

Let’s understand this with an example.

Suppose in a given financial year your portfolio made an STCG and LTCG of Rs 1,00,000 and Rs 1,05,000 respectively. The short-term capital losses were Rs 50,000.

Tax payable (Without tax loss harvesting) = [(Rs 100,000 * 15%)+{(105,000-100,000)*10%}] = Rs 15,500

Tax payable (With tax loss harvesting) = [{(Rs 100,000-Rs 50,000) * 15%)}+{(105,000-100,000)*10%}] = Rs 8,000

Tax-loss harvesting is a vital tool to save a lot on taxes. It doesn’t help to nullify the losses, but it can reduce your suffering by helping you save taxes.

Video on LCCG Tax Harvesting

This 7-minute video by ET Money Tax harvesting talks about A way to save taxes on your capital gains!

Related Articles:

Income Tax on Selling Shares: Trading, Capital Gains, ITR

Savings due to LTCG tax harvesting might seem small at the first look. However, as your portfolio builds and the wealth accumulation period increases, these small amounts can quickly add up to become big numbers.