In this article, we will give an overview of how to show income earned from the rent of a house i.e rental income which is Income From House Property. In the Union Budget presented on 1 Feb 2019, No tax on notional rent on Second Self-occupied house has been proposed. Currently, income tax on notional rent is payable if one has more than one self-occupied house. So, you can now hold 2 Self-occupied properties and don’t have to show the rental income from the second house as notional rent.

Table of Contents

Computation of Income From House Property

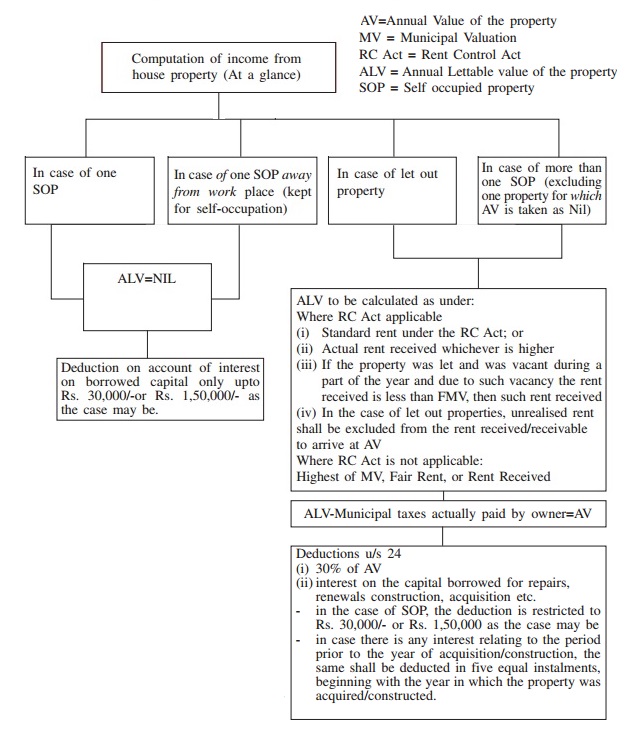

Computation of income from house property can be broadly divided into the following cases :

- One Self Occupied Property. Our article Tax and Income From One Self Occupied property explains it in detail

- Self Occupied Property aware from the workplace: Ex A person may own a house property, say in Bangalore, which he normally uses for his residence. He is transferred to Chennai where he does not own any house property and stays in rental accommodation.

- Let out Property. Our article Tax and Income from Let out House Property explains it in detail.

- Many Houses (including one property in which person is staying). Our article Income From House Property for more than 1 house explains it in detail

- Pre-Construction Home Loan Interest and ITR explains What is Pre-construction period? How to calculate pre-construction period interest on home loan? How to claim tax benefits or deductions on interest payments of an under-construction house or Property?

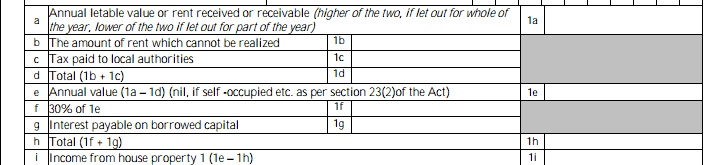

The computation of income from House Property in a glance is shown in the picture below and how to show it in ITR is explained in our article Income from House Property and Income Tax Return

Example of Computation of Income from House Property

For Mr Iyer, income details are as follows

- Salary Rs. 1,80,000

- Interest from bank Rs. 51,000

- Interest on Fixed Deposit Rs.9,000

- He has deposited Rs. 24,000 in the Public Provident Fund.

He owns a house which he has let out.

- Municipal Valuation Rs. 1,20,000 p.a.

- Rent on which property has been let out Rs. 20,000 p.m. Rs 2,40,000 p.a.

- Period for which property remained vacant 2 months

So Gross Annual Value (GAV ) would be = Maximum (Rent Received – Loss due to vacancy, Municipal Valuation) = Maximum(2,40,000-40,000, 1,20,000)= Rs. 2,00,000.

In respect of this property, the assessee incurs following expenses during the year :

- Municipal taxes (including Rs. 2000 relating to the previous year) Rs. 9,000

- Repairs Rs. 12,000

- Interest on money borrowed for construction of the house from Bank Rs. 28,000

- Repayment of Loan for house Construction to Bank i.e Principal Rs. 24,000

- Chowkidar & Mali’s pay Rs. 20,000

Computation of Income from property i.e Annual Value

| 1 | Gross Annual Value (GAV) | 2,00,000 |

| 2 | Municipal taxes | 9,000 |

| 3 | Net ALV (1-2) | 1,91,000 |

| 4 | Standard deduction@30% | 57,300 |

| 5 | interest on loan | 28,000 |

| Annual Value (3-4-5) | 1,05,700 |

Computation of Tax on Income of Mr Iyer inclusive of property income will be as under:

| 1 | Income From Salary | 1,80,000 |

| 2 | Income From House Property | 1,05,700 |

| 3 | Income from other sources | 60,000 |

| Bank Interest + Fixed Deposit Interest | ||

| 4 | Gross Total Income (1+2+3) | 3,45,700 |

| 5 | Deduction under 80C | 48,000 |

| PPF Contribution(24,000)+ Principal on Loan(24,000) | ||

| Total taxable income (4-5) |

Income From House Property

The Income Tax Act of India classifies income in five heads of which “Income from House Property” is one of them. It comprises of income earned by a person through the property(s) owned by him/her. When one sells/transfers his Property and earns profit, it is taxable under Capital Gain in the year of transfer. Our article On Selling a House, Capital Loss on Sale of House discusses Capital gain in detail. Three conditions are to be satisfied for property income to be taxable under this head.

- The property should consist of buildings(house, office building, godown, factory, hall, shop, auditorium, etc) or lands appurtenant thereto i.e any land attached to the building (ex compound, garage, garden, car parking space, playground, gymkhana, etc.)

- The assessee should be the owner of the property.

- The property should not be used by the owner for the purpose of any business or profession carried on by him.

Please note that Levy is on income and not on property hence

- The existence of a building is an essential prerequisite for taxation of income from house property.

- If the letting out is only of the vacant land, the rent received from such letting out of land is not taxable under the head “Income from house property”. It may be taxable under the head “Income from business or profession” if the business of the person is to let out land or may be taxable as “Income from other sources” if letting out of land is not the business of the person.

- The purpose for which the building is used by the tenant is also immaterial. It does not make any difference at all if the property is owned by a limited company or a firm.

- Where property is owned by two or more persons and their respective shares are the definite and ascertainable share of each person in the income from the property shall be included in each of their income.

- Income from house property is taxable in the hands of owner/deemed owner of the property. An owner is a person who is entitled to receive income from the property. Income is chargeable in the hands of person even if he is not a registered owner i,e a deemed owner. A deemed owner is an owner by implication, although he may not be the owner in whose name property is registered. For example An individual who gifts property to his spouse or minor child will be treated as the deemed owner of that property. Here, though legally the owner of the property is his spouse or minor child, any income from that property will be treated as his income. For more details on Deemed owner, one can read Economic Times Deemed owner and tax liability

- The tax is based on the potential of the property to generate income for the assesee(ex rent) which is also called Annual value (AV).

- This is the only head of income, which taxes notional income. The taxability may not necessarily be of actual rent or income received but the potential income, which the property is capable of yielding. So if a person owns a property which is lying vacant, notional income with respect to such property may be liable to tax even though the owner may not have received any income from such property. Further, if the property is let out and the rent received is less than the potential rent which the property is capable of yielding, the tax would be payable on the rent which the owner is capable of getting and not on the actual rent.

- The following deductions shall be allowed from the annual value under Section 24:

- 30% of the annual value as computed.

- Interest paid/payable on borrowed capital acquired for the purpose of acquisition, construction, repairs, renewals or reconstruction of house property subject to conditions and limits as mentioned later.

- For a self-occupied property rental income is taken as zero. So you will not get credit for any municipal taxes paid nor will there be any standard deduction. But yes, you can deduct the interest paid on the loan availed subject to a specified limit . Discussed later

Any residential or commercial property that you own will be taxed as well. Even if your piece of real estate is not let out, it will be considered earning rental income and you will need to pay tax on it.tax you on the capacity of the real estate to earn income and not the actual rent. This is called the property’s Annual Value and is the higher of the fair rental value, rent received or municipal rent.

Income Tax Sections related to Income from House Property

The scope of income charged under this head, Income from House Property, is defined by section 22 of the Income Tax Act and the computation of income falling under this head is governed by sections 23 to 27. The various sections and their descriptions are given below.

| Sections | Description |

| 22 | Income from House Property – Chargeability and Basis of Charge |

| 23(1) (a),(b) & (c) | Annual Value determination |

| Explanation to Sec 23(1) | Treatment of unrealized rent |

| 24 | Deductions from income from house property |

| 25 | Interest when not deductible from income from house property |

| 25A & 25AA | Special provisions for cases where unrealized rent allowed as deduction is realized subsequently |

| 25B | Special provisions for arrears of rent received |

| 26 | Property oco-ownerscoowners |

| 27 | Deemed ownership |

Annual Value

Annual Value of a home is the capacity of the property to earn income i.e sum for which the property might reasonably be expected to be let out from year to year. Computing income from house property is shown in the table below :

| Gross Annual Value | **** |

| Less: Municipal Taxes (if paid by owner) | **** |

| Net Annual Value | **** |

Less: Deduction under Sec.24

|

**** |

| Income from house property | **** |

Calculation of Gross annual value depends on the following four factors :

- Municipal Value: The municipal value of your property is the value the municipal authorities assign to it to charge taxes. The municipal authorities have a host of factors which they consider to arrive at a municipal value of your property on which municipal taxes are then levied.

- Fair Rental Value: The rent which a similar property in the same or similar locality would have fetched is the fair rental value of the property.

- Standard Rent: Rent Control Act was an attempt by the Government of India to eliminate the exploitation of tenants by landlords. Rent legislation tends to providing payment of fair rent to landlords and protection of tenants against eviction. Under the Rent Control Act, the standard rent is fixed and it is expected that an owner should not receive rent higher than that specified in the Rent Control Act. The rent control laws applicable in various states in India are different with respect to various aspects. For example there is Maharashtra Rent Control Act, Delhi Rent Control Act, Tamil Nadu Rent Control Act, Karnataka Rent Control Act. For details on Rent Control Act read Rent Control Laws in India A Critical Analysis(pdf)

- Actual Rent Received or Receivable: The actual rent received by an owner from a tenant, depending on who pays the water, electricity and other bills, is also an important factor in calculating the annual value of a property.

GROSS ANNUAL VALUE(GAV) is the highest of

- Rent received or receivable

- Fair Market Value.

- Municipal valuation.

If however, the Rent Control Act is applicable, the GAV is the standard rent or rent received, whichever is higher.

If the property is let out but remains vacant during any part or whole of the year and due to such vacancy, the rent received is less than the reasonable expected rent, such lesser amount shall be the Annual value. For the purpose of determining the Annual value, the actual rent shall not include the rent which cannot be realized by the owner.

Net Annual Value: From Gross Annual Value Municipal Taxes paid by the landlord are deducted to arrive at Net Annual Value.

Net Annual Value (NAV) = Gross Annual Value – Municipal Taxes Paid

Deductions: To arrive at the income taxable under Income from House Property two deductions are allowed which come under Section 24 of Income Tax Act.

- Statutory deduction: 30 per cent of the net annual value will be allowed as a deduction towards repairs and collection of rent for the property, irrespective of the actual expenditure incurred. But if Annual value is Nil (zero) or negative then the deduction is not allowed.

- Interest on borrowed capital: The interest on borrowed capital will be allowable as a deduction on an accrual basis if the money has been borrowed to buy or construct the house. Amount of interest payable for the relevant year should be calculated and claimed as deduction.

- If Loan is borrowed on or after 1-Apr-1999, construction is completed within three years from the financial year in which the loan was taken then actual interest amount or Rs 1,50,000 whichever is less. In other cases Rs 30,000 or actual interest which is less.

- In case the property is let out, the entire amount of interest accrued during the year is deductible.

- In cases where the house is owned by more than one person and is also self-occupied by each co-owner, each co-owner shall be entitled to the deduction individually on account of interest on borrowed money up to a maximum amount of Rs. 1.5 lakh or 30,000. If the house is given on rent, there is no restriction on this amount. Both co-owners can claim deductions in the ratio of ownership.

- A fresh loan may be raised exclusively to repay the original loan taken for purchase/ construction etc., of the property. In such a case also, the interest on the fresh loan will be allowable.

- Interest payable on interest will not be allowed. For example, if one had not paid loan EMI on time and interest was charged for late payment. Such interest will not be allowed as deduction u/s 24 of Income Tax Act 1961

- Brokerage or commission paid to arrange a loan for house construction will not be allowed.

- The interest paid/payable for the pre-construction period is to be aggregated and claimed as a deduction in five equal installments during five successive financial years starting with the year in which the acquisition or construction is completed.

ANNUAL VALUE is the NAV less the deductions available under section 24.

Annual Value (NAV) = Net Annual Value – Deductions

The above provisions may result in a loss from house property, which may be set off against income from another house property or against incomes under the other heads. The balance loss may be carried forward, to be set off against the income from house property, upto a maximum of eight assessment years.

If there is a Loss from House Property, the same can be set-off against income from any other head in the same Assessment Year.

If the Loss cannot be set-off against income from any other head in the same Assessment Year, the Loss is allowed to be carried forward and set-off in 8 subsequent Assessment Years against income from House Property only.

References: Income Tax Department’s Assessment of Income From House Property (pdf), Bhavin Pathak’s Income From House Property, Delhi University course material Income From House Property(pdf)

Related Articles :

- On Selling a House,

- Capital Loss on Sale of House

- Income Tax for Beginner

- Income Tax Overview

- Paying Income Tax : Challan 280

In this article, we gave an overview of how income tax on house property is calculated. We shall explain about a tax on income from house property in cases like Self Occupied property, multiple properties, let out property in our forthcoming articles.

very nice blog..which provide the information need to know: http://verderesidences.com/luxury-flats-in-pune.php

Very informative. I have a doubt, if interest of House loan is greater than GAV, my income from House property will be negative, which means I would be saving Tax on that amount right? if yes is there any Cap on that?

A very good question Sainath.

If income from house property is negative it means you have loss. There is no cap on the loss.

If there is a Loss from House Property, the same can be set-off against income from any other head in the same Assessment Year as per the provisions of Section 70

If the Loss cannot be set-off against income from any other head in the same Assessment Year, the Loss is allowed to be carried forward and set-off in 8 subsequent Assessment Years against income from House Property only as per the provisions of Section 71B.

With example we have tried to explain it in Tax and Income From One Self Occupied property

Very informative. I have a doubt, if interest of House loan is greater than GAV, my income from House property will be negative, which means I would be saving Tax on that amount right? if yes is there any Cap on that?

A very good question Sainath.

If income from house property is negative it means you have loss. There is no cap on the loss.

If there is a Loss from House Property, the same can be set-off against income from any other head in the same Assessment Year as per the provisions of Section 70

If the Loss cannot be set-off against income from any other head in the same Assessment Year, the Loss is allowed to be carried forward and set-off in 8 subsequent Assessment Years against income from House Property only as per the provisions of Section 71B.

With example we have tried to explain it in Tax and Income From One Self Occupied property

Simple and Superb Kirti.

But i have one doubt. While calculating tax for Mr.Iyer you have included Dividend received as Taxable income. Is that correct?

Thanks for pointing out the error. You are absolutely right, Dividend received is NOT Taxable income. Shall correct it

Simple and Superb Kirti.

But i have one doubt. While calculating tax for Mr.Iyer you have included Dividend received as Taxable income. Is that correct?

Thanks for pointing out the error. You are absolutely right, Dividend received is NOT Taxable income. Shall correct it

Very informative. You write so simply without using jargon that even a lay man could understand what you say.

Thanks Easwar. It may be because I am not from financial background and cannot follow jargon’s .

Very informative. You write so simply without using jargon that even a lay man could understand what you say.

Thanks Easwar. It may be because I am not from financial background and cannot follow jargon’s .