I am filing ITR1 and filling the same salary mentioned in Form16(Income chargeable under the head Salaries(3-5)). But on submitting, I am getting error the amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1

When we fill salary from the head Salary(#6 of form-16 which came after deduction of Sec 10) and the software is taking reference of the Salary as TDS1 which is ultimately creating the difference. Can we modify Salary Part in TDS1 accordingly after deducting Sec 10 amount as it seems like the root cause of the warning message.

In last week we have got several such messages. We were confused as to why people are getting this message. We tried various combinations in excel but could not reproduce it. Finally we restored to asking our readers to mail us the information to our email id. And one of our reader was kind enough to share. We then realised that Income mentioned in Form 26AS is not the income under the head salaries (Pt 6 in Form 16). Now question is why do we get the warning, how to fix the warning, do we change the income details and fix the warning and continue.

Short Ans:

It is just a warning you can submit your ITR. This is because your employer reported your gross salary in the TDS section which is higher than what you have filled in the Income from Salaries due to the bug that’s there in the sheet. To fix this error, just modify the TDS sheet column 4 and change the amount to what is there in the Income chargeable under the head salaries in Form 16(pt 6) .

Our reader Anubhav has a suggestion which also makes sense. Thanks Anubhav.

As per my understanding its not just a warning as its not allowing you to submit ITR. So this need to be rectify first before submission. Here is the way:

- Chargeble Income should be filled in B1 from Entry#6 of form-16 (INCOME CHARGEABLE UNDER THE HEAD “SALARIES” (3-5))

- Taxable Income should be filled in TDS1 from Entry#11 of form-16 (Total Income (8-10))

Naveen left a comment on our site ,

Finally, I have successfully submitted by closing (yes.. closing by ‘X’) the message . Do not hit ‘OK’ button on message box which turns in to error with expired session and make you to re enter all the information again.

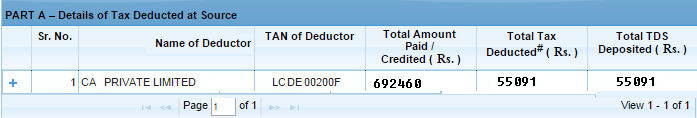

Income picked in Prefill from Form 26AS

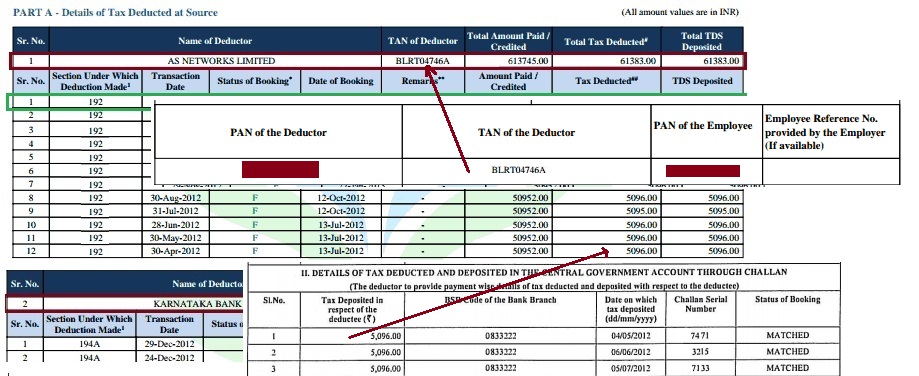

When you use the prefill option then income picked up, Total Amount Credited and Total tax deducted , from Form 26AS as shown in image below. So using prefill option 692460 will be picked up as your income from Salary and Rs 55091 as TDS deducted. As we mentioned in our article What to Verify in Form 26AS? PART A – Details of Tax Deducted at Source shows the TDS deducted from your salary / pension income and also TDS deducted by banks on your interest income. TDS deducted by each source is shown as a separate table. Clicking on + before the Name of deductor will show all the entries

- Entries are in reverse chronological order that means entry with later date will appear first. So if you have entry for date 31-Jul-2014 31-Aug-2014, 30-Sep-2014 then they will appear as 30-Sep-2014 31-Aug-2014 31-Jul-2014.

- Details of deductor match your Form 16,Form 16A.

- All entries for a deductor match the entries in your Form 16/16A. Check each entry for Section Under Which Deduction is made (192 for Salary, 193 for interest on Fixed Deposit from bank) , Date at which Transaction is made, Status of Booking.

- Status of booking is F or FINAL which shows that payment details of TDS / TCS deposited in bank by deductors have matched with the payment details mentioned in the TDS / TCS statement filed by the deductors.

- If Tax deducted by an employer is not reflecting in Form 26AS then employer should be approached to ensure filing of TDS statement with correct PAN.

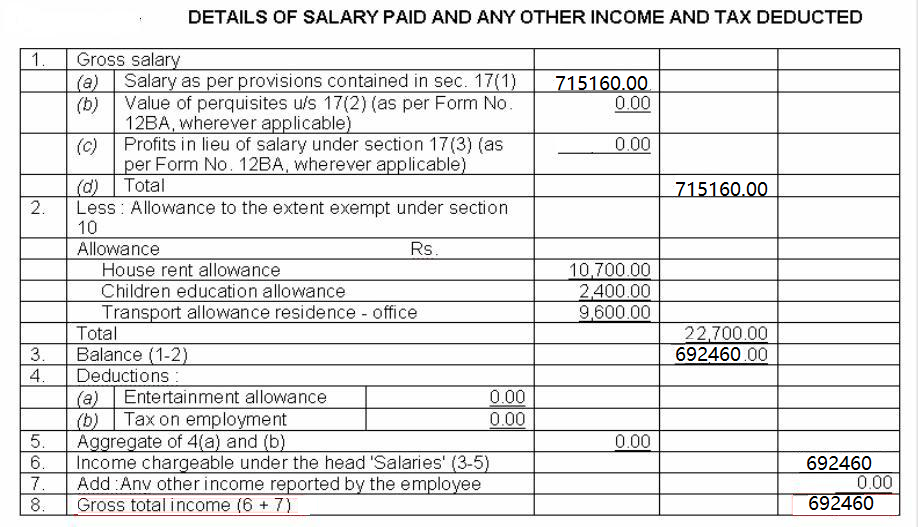

Income reported in Form 16 Part B

As discussed in article How To Fill Salary Details in ITR2, ITR1 it is recommended to fill Salary as mentioned in Pt 6 Income under the Head Salary, shown in image below. This salary is arrived from Gross Salary(Pt 1 in Form 16) where employers deduct allowance exempt under Section 10 such as HRA, Transport allowance and deductions usually Entertainment allowance and Tax on employment or Professional tax.

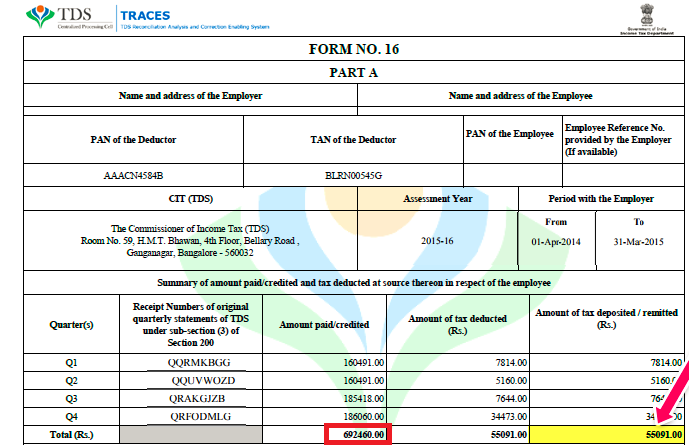

Now let’s look at the income and TDS submitted to government which is reported in Form 26AS and given to us as Part A of Form 16.

Please make sure that they match the details in Form 26AS as shown in image below

The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1

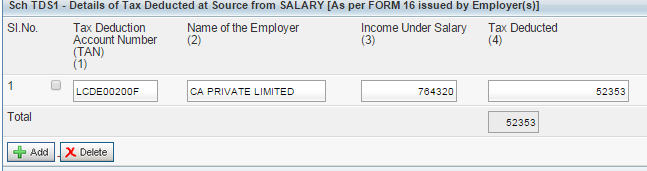

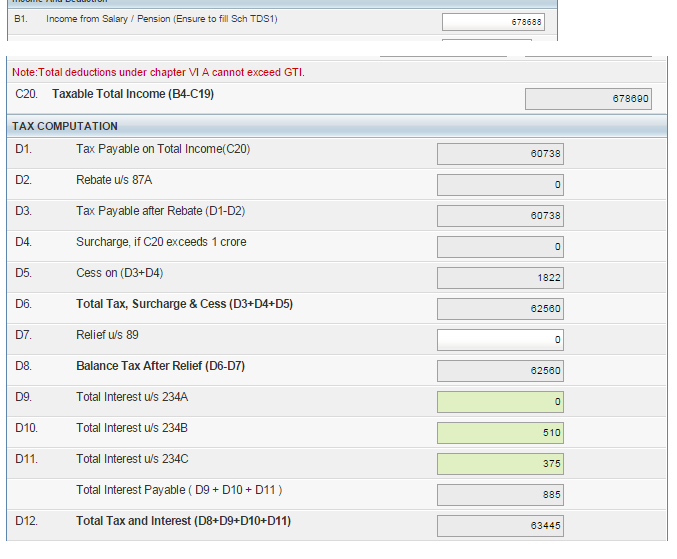

If you prefill from Form 26AS then if the salary you entered using pt 6 in Form 16 is less than 90% of salary reported in TDS1 which gets prefilled then you get the error message. For example if your salary from Form 16 is 678688 but Gross Salary total (pt 1 (d) in Form 16) is 764320 then as 6,78,688/7,64,320 is 88.79% you get the message that The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1

In the Schedule TDS1 you can change the Income under the Salary(3) . If you change it to salary in Income details you don’t get the message.

In calculation the income that it entered as Income from Salary is taken into account rounded off . For example 6,78,688 is rounded to 6,78,690. We have not included any deductions here.

Validation rules and Warning

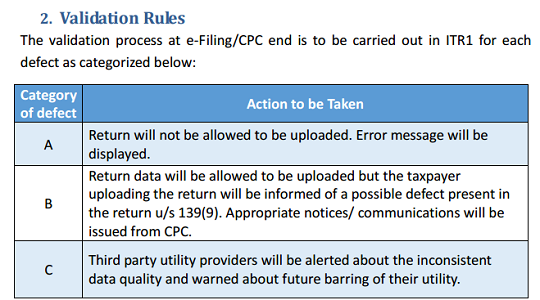

Many companies are making Income tax filing software.There are a lot of errors and poor data quality in the software due to which returns are either rejected or wrongly generated. Along with Excel,Java utility Income tax department also releases the rules,called Validation rules, that one needs to ensure in writing software for Income tax e filing. Below is the communication regarding the Validation rules

The Income Tax Department has provided free return preparation software in the downloads page as well as facility for online ITR submission for ITR 1 & ITR 4S which are fully compliant with data quality requirements. However, there are commercially available software or websites that offer return preparation facilities as well. In order to improve the data quality received through in ITRs prepared through such commercially available software, various types of validation rules are being deployed in the e-Filing portal so that the data which is being uploaded can be validated to a large extent. Taxpayers are advised to review the same to ensure that the software that is used is compliant with these requirements to avoid rejection of return due to poor data quality or mistakes in the return. Software providers are strictly advised to adhere to these rules to avoid inconvenience to the taxpayers who may use their software

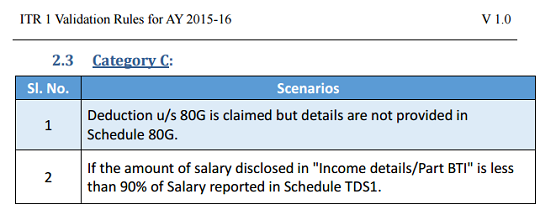

If you look at the Validation rules for ITR for example ITR 1 – Validation Rules for AY 2015-16 you will see the error/warning The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1 is in Category C.

And various categories are given below

Question is: why the salary in Form 16, Income chargeable under the Head salaries (3-5) does not match in Total Amount Credited in Form 26AS? For many of the readers and for us, it does. Is the workaround for that , editing the Income details in TDS1 section good enough? Or should employer re-file proper TDS details?

Related Articles:

- Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR

- Fill Excel ITR form : Personal Information,Filing Status or Filling Individual ITR Form: Fields A1 to A22

- How To Fill Salary Details in ITR2, ITR1

- HRA Exemption,Calculation,Tax and Income Tax Return

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

[poll id=”75″]

We are trying to find more information. If you have faced similar error or have some feedback or input, please do share. If you can email the name of your company to bemoneyaware@gmail, we would appreciate it. We are thinking of collating information and informing the companies that there might have to relook at the income files in Form 26AS. Your name would not be shared. Should we do it?

Hi Sir,

I am getting salary to my Account from my Employer, But I am not getting any Payslips and Not Form 16. Annual Income is around Rs.330000 .

So which ITR file among (ITR1 ~ ITR7) i shall file in incomeTax site ?

How can i pay the Tax in this Scenario ?

Please Suggest.

I am also facing this error. its very wierd, I have no idea what to do. pls help.

Hi, I am filing ITR 1 assessment Year 2018-19 but i am getting the error “Since the amount disclosed in Income chargeable under the Head Salaries is less than 90% of Salary reported in TDS1, please ensure to fill details in Others in Exempt Income”.

I have put the correct details from form 16 and form 26as.

After deducting HRA + Transport Allowance + Medical Expenceses, my Gross Total Income is 19% less then Total income credited in TDS1. How to solve this issue.

Example: Salary 10,00,000 and TDS1 is credit Income 10,00,000

Gross Salary Head Income after deduction: 8,15,800

HRA 1,50,000

Medical Exp 15,000

Transport Allow 19,200

From above example, my Sary Head Income is 81.42% of TDS1 Credit Income.

Please Help? How to file ITR1 form without error?

Can you send the form filled or snapshot of all details to bemoneyaware@gmail.com

Try filling the details of HRA/LTA/Conveyance allowance in second last page, in section just below income exempted from agriculture. There is a box called ‘others’, here you can select the type of exempted income i.e. HRA/LTA etc and give the amount.

Hi,

This year, the form has changed again.

Now, in the computation of income page, you have to give the salary excluding exemptions like HRA, Conveyance allowance and LTA etc. Professional Tax is to be filled in u/s 16 section on same page.

However, as mentioned in the article, this will throw an error. For this, fill the details of HRA/LTA/Conveyance allowance in second last page, in section just below income exempted from agriculture. There is a box called ‘others’, here you can select the type of exempted income i.e. HRA/LTA etc and give the amount.

For folks who are still getting the error, simplest solution is to enter the following details in the last page in “other income” section who was meant for reporting purposes

1. Choose section 10(13) for HRA.

2. Choose section 10(14(ii)) for conveyance.

I have filled my ITR1 using the above and dint get the error prompt after entering the above details. Hope this helps.

Regards,

Chaitanya

Thank you,

Do you know what is the difference between section 10(14(i)) and section 10(14(ii)) ?

Regards

Sahib S.

Section 10 (14) (i):

Under Section 10 (14)(i), allowances are exempted to the extent of the amount received as allowance or amount spent on certain duties, whichever is the lower figure.

Allowances covered in this category are:

Daily Allowance: Daily allowance is given to employees to meet the daily charges incurred when on tour or for the duration of a transfer in the job. This type of allowance is granted when the employee is not in the usual place of duty.

Travel Allowance: Travel allowance covers costs related to travel while on tour or on transfer while on duty. This allowance also includes travel costs incurred while getting transferred to another location, including packaging or transport of personal objects.

Research/ Academic Allowance: Allowance granted for the purpose of encouraging academic and research related training, education or professional duties is termed as academic or research allowance.

Conveyance Allowance: Allowance for conveyance is granted to employees in case of expenses incurred while travelling for duties of office. However, the employer does not pay for travel from home to work as it is not considered as a duty of the office. This allowance comes under a different section called as ‘Transport allowance’ and is not exempt from tax.

Helper Allowance: Sometimes your employer allows you to appoint a helper for performing official duties of the office. In such cases, helper allowance is granted.

Uniform Allowance: Allowance when given for the purchase or maintenance of uniform, required to be worn while on duty is referred to as uniform allowance. This allowance can be opted for only when an office duty prescribes a specific uniform.

Usually, it is not required to furnish details of the expenses incurred under this category of allowance unless the expense are disproportionate to the salary or unreasonable in reference to the duty performed by the employee. At most times, it is not required for you to keep a proof of documents and a simple declaration serves the purpose.

Section 10 (14) (ii):

Under this section, allowance granted to employees for working under certain set of conditions while on duty. The amount exempted is either the amount received as allowance or the limit mentioned, whichever is lesser.

The types of allowances in this category and exempt in allowances are listed below:

Compensatory allowance for working in areas of high altitude or hilly areas, also known as climate allowance:

Hilly areas of HP, UP, J&K and North East – Rs.800

Siachen are of J&K – Rs.7000 per month

Common places above 1000mtr or above – Rs.300

Scheduled or tribal or agency areas allowance:

Karnataka, West Bengal, MP, Assam, Orissa, Tamil Nadu, Bihar, UP and Tripura. – Rs. 200

Allowance for duty in border area or remote area or any difficult/disturbed areas:

Allowances ranging from Rs.200 to Rs.1300 pm are exempt under the Rule 2BB.

Allowance for children education: Rs.100 pm for each child and a maximum of two children.

Allowance for working in a transport system for personal expenses, while on duty: 70% of allowance up to Rs.10,000 pm.

Field area allowance:

Areas of Nagaland, J&K, HP, UP, AP, Sikkim and Manipur – Rs.2600 pm

Allowance for employee’s children’s hostel expenses: Rs.300 pm for each child up to two children.

Allowance granted to armed forces for cases of counter insurgency: Rs.3900 per month.

Transport allowance to physically disabled employee on duty to travel to work: Rs.1600 per month.

Transport allowance for commute between work and residence: Rs.1600 pm.

Compensatory allowance for duty in modified field area:

Specific areas of West Bengal, North East, Rajasthan, J&K, UP and HP – Rs.1000 pm.

Island Duty allowance granted to armed forces in Andaman & Nicobar and Lakshadweep: Rs.3250 per month.

Allowance for working in underground mines: Rs.800 per month.

Special compensatory highly active field area allowance: Rs.4200 pm.

Allowance for armed forces in a high altitude region:

9000 – 15,000ft – Rs.1060 pm

Above 15,000 ft – Rs.1600 pm

I am getting this error when I am trying to claim HRA that is not being adjusted by the employer. Should we ignore this or do something else? Please advice.

It depends on how you are claiming it.

Please go through http://bemoneyaware.com/show-hra-not-accounted-employer-itr/#How_to_fill_Salary_Details_without_HRA_in_Form_16_in_ITR2A_ITR2_ITR3_ITR4S_ITR4 for more details.

“Please ensure to fill exempt income pertaining to salary”

This message display in ITR3 during save my file.

Whats will do.

Thank You very Much

I couldn’t able to submit ITR1 form almost more than 10 times because of warning message – “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1.”

Finally, I have successfully submitted by closing (yes.. closing by ‘X’) the message . Do not hit ‘OK’ button on message box which turns in to error with expired session and make you to re enter all the information again.

Thanks Naveen for the tip.

We have updated the article

Sir can u tell it clearly

Just desire to say your article is as astonishing.

The clarity for your put up is just great and i could suppose

you are a professional in this subject. Fine along with your permission allow me to grab your feed to keep updated with forthcoming post.

Thank you one million and please continue the gratifying

work.

I am getting the same error even this year wasn’t that fixed am I supposed to change the income under tds1 to Total Income(8-10) from Form 16.

Unfortunately, there is no clarity on this. As I know of, in Tds1 you are supposed to fill the amount indicated in 26AS which is supposed to be same as 1d in form 16.

And in BTI, you are supposed to fill amount shown at ser no 6 in form 16.

I submitted last year following above process in spite of the message and ITR was processed without any problem.

No one is able to comment with authority on these points. Sadly ITD is also not clarifying this, so, you have to take your own decision.

Instead of approaching companies as suggested in bemoneyaware comments, I feel an explanation for benefit of all should be sought from income tax dept.

Bemoneyaware may use their resources to get this.

I believe this should be Entry#8 instead of 11 as we have separate fields for deductions under chapter VIA (like 80 C, 80 D etc.)

Taxable Income should be filled in TDS1 from Entry#11 of form-16 (Total Income (8-10))

“Income claimed under the head Salaries in Part B TI, but Schedule

Salary is not filled”

How can this error be validated in ITR-2??

It is just a warning you can submit your ITR.

I have got this error “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”. But however I have submitted. will there be any issues/problems? Please guide

Hi,

I was facing the same issue while submitting the return,after googling it on the net I was bit confused so I called the Income tax dept. help line no.(18001023738)and they told me to make changes in TDS1 salary figure.i.e.fill the same value as mentioned in Box B1 of Income details & it worked & I have successfully submitted the return.

Thanks Ram for your input. We appreciate you taking time out to update us and our readers.

Congratulations on submitting your Income Tax return. Hope you have e-verified.

I have got this error “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”. But however I have submitted. will there be any issues/problems? Please guide

Hi,

I was facing the same issue while submitting the return,after googling it on the net I was bit confused so I called the Income tax dept. help line no.(18001023738)and they told me to make changes in TDS1 salary figure.i.e.fill the same value as mentioned in Box B1 of Income details & it worked & I have successfully submitted the return.

Thanks Ram for your input. We appreciate you taking time out to update us and our readers.

Congratulations on submitting your Income Tax return. Hope you have e-verified.

Normally gross salary as appearing in 1d of form 16 is reported in 26AS. If you change this to income under head salary at sr 6 in form 16, you wont get the message, but when return is processed the figure you have filled in TDS will not match with 26AS and it mostly would result in a notice for mismatch of data.

Those who have designed software must be knowing all that. The question then is why have they incorporated this warning!Is there a purpose?

Any comments.

It’s a definite oversight by the product owner/team.

Firstly they don’t provide a section for deductions u/s 10 and then do this blunder of cross checking on the amount mentioned by employer under TDS tab as Total Earned Income, leading to all this confusion.

Well said..but do you have any suggestion on how one can avoid it?

No way around it through the validations that they have put in without changing the values.

I followed the step as suggested in the blog

” To fix this error, just modify the TDS sheet column 4 and change the amount to what is there in the Income chargeable under the head salaries in Form 16(pt 6) .”

Had you got return successfully that year?

Income chargeable under the head ‘salaries’ (3 – 5) should never match with total amount credited in form 26AS because of a simple reason

total amount credited in form 26AS = Gross salary (Form 16 1.d). So please do not modify any details.

It is not the case , I have seen Form 26AS with income mentioned in Form 26AS is same as Income in Salaries (3-5)

>>I have seen Form 26AS with income mentioned in Form 26AS is same as Income in Salaries (3-5)

It can be same only when, you are not claiming

1) HRA

2) Conveyance

3) Medical

4) LTa

5) children education

6) telephone expenses

Income chargeable under the head ‘salaries’ (3 – 5) should never match with total amount credited in form 26AS because of a simple reason

total amount credited in form 26AS = Gross salary (Form 16 1.d). So please do not modify any details.

It is not the case , I have seen Form 26AS with income mentioned in Form 26AS is same as Income in Salaries (3-5)

>>I have seen Form 26AS with income mentioned in Form 26AS is same as Income in Salaries (3-5)

It can be same only when, you are not claiming

1) HRA

2) Conveyance

3) Medical

4) LTa

5) children education

6) telephone expenses

I agree with Sushant.

The question then is why this warning?

My saving bank wrongly mentioned the TDS in 26AS because of that I was getting the error.

“The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”

if I put wrong data which bank has provide into return form then error gets removed.

But now bank have corrected it and I can see that in form26as.

But still I am getting the error. My guess is income tax still taking old data. In this case what should we do. should I submit like that only?

My saving bank wrongly mentioned the TDS in 26AS because of that I was getting the error.

“The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”

if I put wrong data which bank has provide into return form then error gets removed.

But now bank have corrected it and I can see that in form26as.

But still I am getting the error. My guess is income tax still taking old data. In this case what should we do. should I submit like that only?

Hi,

While trying to efile my return, I noticed that Form16 (pt 6) TDS1 which will be Income Under Salary (3) amount is not matching with the form 26AS amount (Total amount Paid/Credited) although the TDS deducted is exactly the same. In such case whether i should overwrite the data or i should be using form 26 AS data.

I can see a similar post unanswered could you please advice me on this.

Yes Sushil there are no standard way of what income is being reported in Form 26AS. Typically for Income from Salary Pt 6 of Form 16 is used.

Hi,

While trying to efile my return, I noticed that Form16 (pt 6) TDS1 which will be Income Under Salary (3) amount is not matching with the form 26AS amount (Total amount Paid/Credited) although the TDS deducted is exactly the same. In such case whether i should overwrite the data or i should be using form 26 AS data.

I can see a similar post unanswered could you please advice me on this.

Yes Sushil there are no standard way of what income is being reported in Form 26AS. Typically for Income from Salary Pt 6 of Form 16 is used.

I want to know as to resolving following error while uploading the ITR 4.

“Income details” and “Tax computation” have not been provided but

details regarding “Taxes Paid” have been provided.

What should I do to rectify this error? I don’t know which fields I need to fill up

for providing income details and tax computation.

Ensure that macros are enabled.

Fill in all the sheets esp the Income details and Tax computation

I want to know as to resolving following error while uploading the ITR 4.

“Income details” and “Tax computation” have not been provided but

details regarding “Taxes Paid” have been provided.

What should I do to rectify this error? I don’t know which fields I need to fill up

for providing income details and tax computation.

Ensure that macros are enabled.

Fill in all the sheets esp the Income details and Tax computation

Hello,

The difference is coming (in my case at least) because in form 16 partA company is reporting gross income paid which goes into 26AS. In form 16, part B exempt benefits for salaried employees like LTA, medical, HRA, perquisites – company car etc, are given in detail. In ITR part B – TI and schedule S #7, only has taxable salary, exempt details are in Sch S #2, perquisites in #4 etc. If there are lot of exempt benefits difference will show and the warning. Warning is for 3rd party softwares also as a check.

Can we ignore this warning, if we r using official ITR utility. As long as we include all allowance details in Sch S I think we are OK. Any CA here to comment?

Thanks

Manish

Sir what readers have reported that this does not allow them to submit their returns. If it does then that’s also an option. Please do let us know if with the warning you can submit your returns

I have not uploaded yet… but as Sumit says – as per ITR1 – Validation Rules for AY 2015-16 – this error falls in Category C ; only category A error will sop uploading of return.

Hello,

The difference is coming (in my case at least) because in form 16 partA company is reporting gross income paid which goes into 26AS. In form 16, part B exempt benefits for salaried employees like LTA, medical, HRA, perquisites – company car etc, are given in detail. In ITR part B – TI and schedule S #7, only has taxable salary, exempt details are in Sch S #2, perquisites in #4 etc. If there are lot of exempt benefits difference will show and the warning. Warning is for 3rd party softwares also as a check.

Can we ignore this warning, if we r using official ITR utility. As long as we include all allowance details in Sch S I think we are OK. Any CA here to comment?

Thanks

Manish

Sir what readers have reported that this does not allow them to submit their returns. If it does then that’s also an option. Please do let us know if with the warning you can submit your returns

I have not uploaded yet… but as Sumit says – as per ITR1 – Validation Rules for AY 2015-16 – this error falls in Category C ; only category A error will sop uploading of return.

I just pressed submit twice by ignoring the error and guess what, it was submitted. And now I am reading this article.

So can anyone tell me, how would I go and modify my TDS1 now? Do I need to fill revised IT return?

Anyone?

@ Makrand

Through whatever i have gained knowledge, you just sit relax. Income tax dept knows the difference. Section 24 under Form 26AS differentiates between gross salary and income chargeable under head salaries.

You will get to know about ITR processed details in a month or two time if you e-verified your return. Only then take action.

Yes..its just a warning.

[…] Backlink […]

[…] Backlink […]

Hello All,

The fix to this issue is under the TDS tab where it ask for Income Chargeable Under Salaries the amount should not be your total “Income Under the head Salary Amount” from your Form 16. It should be the amount as reflected in your form 26 AS which would be different for each tax deduction. Put that amount in the respective tab and you are all set. Thanks.

Hello All,

The fix to this issue is under the TDS tab where it ask for Income Chargeable Under Salaries the amount should not be your total “Income Under the head Salary Amount” from your Form 16. It should be the amount as reflected in your form 26 AS which would be different for each tax deduction. Put that amount in the respective tab and you are all set. Thanks.

Dear Author,

Thank you very much for the nice blog.

I’ve gone through each line of the blog and understood the problem and fixed it submitted my returns successfully. (Not used the excel sheet but filled online ITR1)

My problem solved by applying your suggestion “”””In the Schedule TDS1 you can change the Income under the Salary(3) . If you change it to salary in Income details you don’t get the message.””””

Simple yet POWERFUL.

Once again Thank you for your time and detailed explanation.

Best Regards,

Rupesh

have you check tax amount. it shows almost double.

Dear Author,

Thank you very much for the nice blog.

I’ve gone through each line of the blog and understood the problem and fixed it submitted my returns successfully. (Not used the excel sheet but filled online ITR1)

My problem solved by applying your suggestion “”””In the Schedule TDS1 you can change the Income under the Salary(3) . If you change it to salary in Income details you don’t get the message.””””

Simple yet POWERFUL.

Once again Thank you for your time and detailed explanation.

Best Regards,

Rupesh

Up to you. I submitted my return without making any changes to TDS1 (it had Gross Income). As per ITR1 – Validation Rules for AY 2015-16 – this error falls in Category C.

Will update my comment incase my refund is not processed or if I receive any communication from IT department.

Hey Guys, As I said earlier I will update my comment if my refund is not processed or if I receive any communication from IT department. The good news is – My refund is already credited to my bank account!

So the bottom line is you can ignore the error “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”

Thanks for update. Appreciate it and Congratulations

Hi sumit , How did website allowed you to submit return ?

I tried to submit after error message , then i got session expired , please try again error

Please help…

Hey Sachin, It looks like your session might have expired due to inactivity or you didn’t save all changes made and tried to submit the declaration, I can only make some guess here.

However, I can assure you that you can file the return ignoring the warning message.

Up to you. I submitted my return without making any changes to TDS1 (it had Gross Income). As per ITR1 – Validation Rules for AY 2015-16 – this error falls in Category C.

Will update my comment incase my refund is not processed or if I receive any communication from IT department.

Hey Guys, As I said earlier I will update my comment if my refund is not processed or if I receive any communication from IT department. The good news is – My refund is already credited to my bank account!

So the bottom line is you can ignore the error “The amount of salary disclosed in Income details/Part BTI is less than 90% of Salary reported in Schedule TDS1”

Thanks for update. Appreciate it and Congratulations

Hi sumit , How did website allowed you to submit return ?

I tried to submit after error message , then i got session expired , please try again error

Please help…

Hey Sachin, It looks like your session might have expired due to inactivity or you didn’t save all changes made and tried to submit the declaration, I can only make some guess here.

However, I can assure you that you can file the return ignoring the warning message.

I think we should not edit the details in the TDS tab as it comes pre-filled. Can we discuss about this further.

In my case, although that pop-up is coming, but its allowing me to save after clicking ok.

I’m using the java version of ITR-2.

I think we should not edit the details in the TDS tab as it comes pre-filled. Can we discuss about this further.

In my case, although that pop-up is coming, but its allowing me to save after clicking ok.

I’m using the java version of ITR-2.

On “ITR-1” Form

It is required to enter exact Salary Amount on “Income Details” Tab (B1) and “Tax Details” Tab [Income Under Salary(3)].

On Income Details Tab if salary written on B1 = 232628 then

on Tax Details Tab Column third (Income Under Salary(3)) should be 232628.

On “ITR-1” Form

It is required to enter exact Salary Amount on “Income Details” Tab (B1) and “Tax Details” Tab [Income Under Salary(3)].

On Income Details Tab if salary written on B1 = 232628 then

on Tax Details Tab Column third (Income Under Salary(3)) should be 232628.

As per my understanding its not just a warning as its not allowing you to submit ITR. So this need to be rectify first before submission. Here is the way:

1. Chargeble Income should be filled in B1 from Entry#6 of form-16 (INCOME CHARGEABLE UNDER THE HEAD “SALARIES” (3-5))

2. Taxable Income should be filled in TDS1 from Entry#11 of form-16 (Total Income (8-10))

Its Done to Procedd further !

So you are suggesting modifying the taxable income in TDS1, it should not be the Gross income but Entry#11 of form-16. As Company pays tax on that calculation.

As per my understanding its not just a warning as its not allowing you to submit ITR. So this need to be rectify first before submission. Here is the way:

1. Chargeble Income should be filled in B1 from Entry#6 of form-16 (INCOME CHARGEABLE UNDER THE HEAD “SALARIES” (3-5))

2. Taxable Income should be filled in TDS1 from Entry#11 of form-16 (Total Income (8-10))

Its Done to Procedd further !

So you are suggesting modifying the taxable income in TDS1, it should not be the Gross income but Entry#11 of form-16. As Company pays tax on that calculation.

THanks a lot this is the right one otherwise it just logs you out you should take the income after the 150000 deduction (11.Total Income(8-10))otherwise it doesn’t work out .

pls see “ITR1 – Validation Rules for AY 2015-16 issued by the department in June 2015 on this issue

pls see “ITR1 – Validation Rules for AY 2015-16 issued by the department in June 2015 on this issue

The message that u got is a warning. It means that the income in 26AS doesnt match the income that you have filled in under gross/total. This is validation for you to double check in case u hv missed any calculation.

Click okay and continue filing. It is only a warning and not an error 🙂

The message that u got is a warning. It means that the income in 26AS doesnt match the income that you have filled in under gross/total. This is validation for you to double check in case u hv missed any calculation.

Click okay and continue filing. It is only a warning and not an error 🙂

Hi,

In my case also the “Income chargeable under the Head salaries (3-5) does not match in Total Amount Credited in Form 26AS”?

What should I do, should I fill up the form using the above workaround or submit the form like it is? because after submitting the form when this validation popup comes up if you click on “ok” it asks for finally submitting the form.

Please help me.

Many Thanks!

Avnish

Hi,

In my case also the “Income chargeable under the Head salaries (3-5) does not match in Total Amount Credited in Form 26AS”?

What should I do, should I fill up the form using the above workaround or submit the form like it is? because after submitting the form when this validation popup comes up if you click on “ok” it asks for finally submitting the form.

Please help me.

Many Thanks!

Avnish