Loan Eligibility means how much loan amount you can get. Just because someone is earning a lot of money, does not mean that he is eligible to get loan of any amount. There are various other factors which will come into picture. How to calculate Loan Eligibility? What are the tips to improve your loan eligibility?

Many seek financial support from their social circle of family and friends during a cash crunch. However, this may lead to strained relationships in case of a failure to repay. A wiser option would be borrowing from financial institutions such as banks and Non-Banking Financial Companies (NBFCs).

You may borrow a personal loan to meet your financial needs such as foreign education, an international trip, consolidation of debt, and medical emergencies, besides others. The borrowed amount has to be repaid through Equated Monthly Installments (EMIs) over a period of time along with a certain interest.

How to Calculate Loan Eligibility

Loan Eligibility means how much loan amount you can get. Just because someone is earning a lot of money, does not mean that he is eligible to get a loan of any amount. Think as if you are a lender and you have to give a loan to someone. You would verify that the money you will get back the money lend. There are banks which use different formulas and calculations, but all of them will revolve around these factors.

What is your Income? A bank looks at your income statement such as salary slips, tax returns, bank statements. It will calculate your total monthly income by adding up your salary, interest income, rental income, if any etc.

What is the Amount you Save? Savings depend on a variety of factors like income level, lifestyle etc. Banks assume you are able to save between 30-50%. Different banks apply different rules. Say a bank assumes that you are able to save 30%. So if your income is Rs 50,000 per month, so at 30 percent bank assumes you are able to save Rs 15,000 per month.

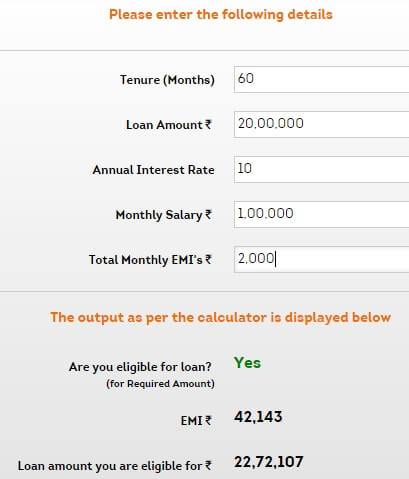

What is the Loan amount and Tenure? What is the loan amount and for how long do you want the loan? The longer the tenure the lower the EMI, and the shorter the tenure, the higher the EMI. A backward calculation is done to find out the amount of loan that would result in an EMI equal to the amount that you can save. The lender uses the latest interest rate to calculate this. So if your monthly net savings is Rs 12,600, the bank assumes that that is the amount available to pay off the EMI. If the prevailing interest rate is 10 percent and you have applied for a loan tenure of 10 years, you will be eligible for a loan of Rs 9.5 lakh.

Do you have any other loan? If you have If you are already paying some other EMI, that amount will be reduced from the savings. So if you are saving Rs 15,000 per month and you are paying an EMI of Rs 2,400 on your car loan, the bank will arrive at a figure of Rs 12,600 as your net savings.

Your credit report: To check your ability and willingness to pay the loan Lender will check your credit report. A credit report will give the image of what kind of a borrower you are. If you have not done credit card payment timely or you have failed to pay the amount to the lender, then your eligibility for the loan will be pulled down. So, it’s very essential to maintain a good credit score. Our article Understanding CIBIL CIR report talks about how to understand the CIBIL CIR report.

How to improve your Loan Eligibility?

Many think that gaining approval of a loan is difficult. Keep the following tips in mind to improve your loan eligibility.

- Co-apply with your parents or spouse

Higher the income, greater is the chance of getting your loan approved. Submitting your loan application with your parents or spouse increases your loan eligibility. This is due to the fact that their income supplements your earnings.

- Check your credit score

Credit Information Bureau (India) Limited (CIBIL), a credit information company in India collects and maintains loan and credit card payment records of individuals. Based on this information, a Credit Information Report (CIR) and credit score are generated. On request, CIBIL provides banks with such information for the purpose of approving loans. You may, therefore, check your score to identify your chance of gaining a loan approval. A high credit score indicates greater creditworthiness. This increases your loan eligibility and also allows you to secure attractive interest rates.

- Show your rental income

Not many are aware of this fact, but leasing a property increases your loan eligibility. The amount earned on your rental apartment can be shown as an additional source of income. This enhances your loan value and assures the lender of your ability to repay the borrowed amount.

- Make timely repayments of your existing debt

Lenders approve loan applications only once they are convinced of your ability to repay. If you have an existing debt and are not making timely EMI payments, chances are that you may not repay your future debt. Banks may then disapprove your loan application. It is, therefore, imperative to make timely payments towards EMIs and credit card bills in order to improve your loan eligibility.

- Enhance your relationship with your bank

If you are an existing account holder at a particular bank, approach your bank. Chances are that you may get an instant personal loan. Besides, keeping good relations with your bank will also help you avail of other attractive terms such as higher borrowing amount, extended loan tenure, and flexible repayment plans, besides others. Some banks also waive off certain fees and charges for existing account holders.

The above tips will help you improve your loan eligibility and gain access to funds. You may then use the disbursed amount to meet your financial goals and obligations.

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- Understanding CIBIL CIR report

- Terms associated with Home Loan

- Paying Credit Card Bill, Understanding statement,Paying Just Minimum

- What’s The Price Of Cool?

- Understanding Loans

- What happens when credit card is swiped?

Good article to share with the user about loan eligibility and improvement tips.

Very Informative Blog!!!

I believe a loan can be closer to reality if you live a financially disciplined life. You need to cultivate the habit of saving to fund your monthly EMIs. Cut short your expenses on lavish items & use it for productive investment purposes.