WHAT IF something happens to you? Can your family live the way you wanted them to live? When a person dies who will get his money from bank accounts, mutual funds, property, etc? What happens to the Mobile Number, Aadhaar after the death of the person. What happens to credit cards, home loans after death. When a member of the family dies, a gap is left but life goes on and the family needs to pick up the financial pieces. Especially in the case of the bread earner of the family. Taking stock of the finances is an overwhelming task. While coping with emotional stress handling financial matters may be traumatic. Some planning when one is alive can reduce stress and help the family put its life back on track. Ignorance about procedures and legalities, Inability to locate documents or passwords, absence of a will, or lack of pre-emptive steps like appointing nominees are among the various reasons that people face problems. This article covers the aspects of a person’s financial life after death.

A person who dies without a will leaves back a list of 100 relatives

Table of Contents

Financial Tasks to be done when one dies

WHAT IF something happens to you? Can your family live the way you wanted them to live? Most of us assume that our family will get access to our investments, bank accounts when we are no more but the law doesn’t recognize things this way. It needs valid papers in the form of Survivorship mandate, Nominations, Will. And with everyone becoming tech-savvy almost everything is online and has a password.

Our book A-Z of PaperWork covers all the information in detail.

- Get a Death certificate (multiple copies) within 21 days.

- Employer: If a person is working: Contact the company(employer) for EPF withdrawal, insurance

- Will or No Will: Check if the person has left a will. If there is a will then arrange for the will to be read.

- Get the list of legal heirs. In India, it is based on religion.

- Pay the bills: pending bills(mobile), get them transferred if required.

- Loans: Check the loans person had taken for example personal loan, home loan, and car loans.

- Credit card: If the person is using the credit card. Pay the dues and close the credit card.

- Insurance: Get a list of all the insurance one had taken. Contact the insurance company(s) for claim.

- Investments: Get the list of investments: bank accounts, lockers, mutual funds, stocks, property and find who is the Nominee in the accounts.

- Income Tax: Check Income Tax details. File the ITR of the deceased on time.

- New Financial Plan: Get a new financial plan on how the family will now manage and how to invest money.

Where is all the information related to your financial life? Your policy details, FD, mutual funds, etc Is it stored in your head or hidden in your emails? You’ve kept the documents in the top cabinet of the steel almirah, but who knows about it! What about the insurance policies you have taken? And the locker keys? Do you have a money book that has all the information, that you can refer to?

Download the sample MoneyBook here

You can also enroll in our Master Class Hello Paper Work, A Gift for someone you love

Video on Financial Tasks to Do After Death

Our Video on Financial Tasks to Do After Death

Why will the family cry when you die?

Just finished seeing Pagglait starring Sanya Malhotra. Ashutosh Rana and Sheeba Chaddha as bereaved parents who are still trying to cope with their son’s untimely demise, and their own situation-fuelled greed left me moist-eyed. It made us aware of goings-on beyond the mourning among surviving kin: gossip, financial wranglings, and personal tensions, all while camouflaging awkward memories of the ‘dear’ departed. Did you watch Paggalit? Ram Prasad ki Tehrvi was another movie on similar lines. Check out the trailers below

Uma Shashikant, in her article Why you should keep financial assets organized and listed while you are alive, has written about her neighbor’s death and how she helped getting it in order

She passed away unexpectedly 15 days ago. Our neighbor, who lived by herself. But it is tough to decide when one is alive, my friend argued. Some die early and unexpectedly, which is sad. But for most of us, there is the process of living through old age. Why can’t we strategically prepare to go? Why can’t we give away, organise, list, and make it easy for others when we are gone?

What if I’m gone… suddenly?

Excerpt of the article from A calmer you: What if I’m gone… suddenly?

Today, it’s been exactly two months that my husband Ankur died of sudden cardiac arrest. He was a chartered accountant, and just 35 years old. Ours has been a fairly well-to-do, upper-middle-class nuclear family, and even though I am well qualified, I chose to be a homemaker to take care of my daughters who are eight and three years old. The day Ankur died so suddenly, my near-perfect world came crashing down. Ankur was a tech savvy person, very active in online banking and transactions. He’d also made investments in insurance policies, mutual funds, chit funds, etc and also given out some money to friends on interest. We were happy, and busy, and it never occurred to either of us that I should be made aware of all his finances. Frankly, it was never even discussed at home

Ten days after Ankur died, his dad, who lives in Chennai, asked me if I knew the details of the home loan and car loan instalments. There were EMIs to be paid. It might sound shameful but I then realised that I didn’t even know his bank account number. He only got e-statements for his bank and credit card transactions … and that threw me into an unending maze of passwords. Passwords that I did not know.

He used to tell me that he keeps a record of financial details on his phone, but even that had a password. I contacted the bank and they were helpful, but wanted me to produce certificates — right from the marriage certificate, to the medical reports to a death certificate. All of which again required me to furnish details that I didn’t have. Both his laptops were locked with secure passkeys that I didn’t know.

Get a death certificate

A death certificate helps in closing bank accounts, claiming insurance, selling property of the deceased, or any work related to banks or financial institutions. It is also required for property transfer or property tax payment. Most financial institutions, insurance companies, and government agencies will not entertain your requests without a Death Certificate. Get Multiple copies of the Death Certificates.

The Registration of Birth and Death Act, 1969 mandates that birth and death, along with its cause, should be registered. Like birth certificates, death certificates are also issued by the government to establish or legally prove the death of an individual. Every death needs to be reported and registered within 21 days in the prescribed reporting forms.

The death certificate is a legal document that states the time, date, and cause of death of the deceased.

Who can apply it: While in some states the application for a death certificate can be made by any member of the society, in others, the applicant must have some relation with the deceased.

Documents required:

- Medical certificate for the cause of death: Evidence of death is required either in the form of a hospital letter where the death took place or a certificate from a civil official who certified the death at either the crematorium or burial grounds. The hospital asks for the exact name of the deceased, with the initials. Ensure you get this right, as this is what will go into the death certificate. Any deviation here will cause a lot of problems later.

- Documents for Proof of birth of the deceased an affidavit specifying the date and time of death The required fee in the form of court fee stamps A copy of the ration card

- The person who is applying for a death certificate is required to provide evidence of relationship with the deceased, complete address, and proof of nationality.

Where to apply: Death certificates can be obtained online at the Municipal Corporation’s official website of the respective states. One can also visit the Municipal Corporation office and apply physically as well.

- One has to apply for the death certificate within 21 days of the occurrence of death. After the cremation, about 10 days later, visit the municipal website and enter the date of death. A list of those who expired on that day appears. Select the name from there and download as many prints you want — at least 20!

- From 21 to 30 days after the death, the Medical Officer, Health(MOH) will certify, collecting a fine of Rs 25.

- After 30 days to within a year of death, only the Joint Director of Statistics can provide the certificate with a fine of Rs 50 and an affidavit.

- If the death is registered after a year, the applicant can get the certificate by order of a first-class magistrate only, which can be a lengthy process. For this, the applicant will need the Cause of Death Certificate, Cremation Certificate, and an Affidavit.

Withdraw money from ATM after death

It is illegal to use a deceased person’s ATM card to withdraw money from his account

If the bank or legal heirs files a complaint with the police one could be in trouble. It is punishable under section 379 of IPC for imprisonment up to 3 years or with a fine or both

For attracting any punishment, there should be a complainant who will lodge the said complaint and should be related to the matter else there is no legal leg to stand, If the money is withdrawn by one of the legal heirs and there is no dispute regarding the claim of funds among legal heirs and the bank does not take action, no criminal charges are levied.

If the deceased did not leave any nomination one has to apply for a succession certificate from the court to realize money lying in the deceased account

Difference between Nominee and Will

One should understand the difference between Nominee and Will

Nominee has no rights over the money or assets unless that is specified under the will. So nominee is a mere custodian of the assets. (S)He is a contact point for the investments. So in the event of a person’s death, a bank/mutual fund could get in touch with the nominee for further instructions to act on the account

A will is an official statement prepared by a person that describes how they want their assets to be divided among their heirs after their death. Preparing a clear will ensures that the heirs are left in no doubt about their inheritance

Our article Nomination, Will, Operation of Joint Account covers it in detail.

In the absence of a will, if there is no survivor amongst the account holders and a no nomination had been done by the holder(s) earlier, a Succession Certificate is be the primary document through which the heirs can stake a claim to the assets of a deceased relative Succession Certificate,Letter of Administration,Probate of Will

Inheritance Rights in India

If a person who dies didn’t leave a will, technically called intestate, then the assets would be distributed according to the law based on his or her religion. This is technically called as non-testamentary succession. As India has no uniform civil law and hence personal laws based on religion guide the rights.

The succession of Hindu, Jain, Buddhist, and Sikh is governed by the Hindu Succession Act. Muslim succession is governed by Muslim Law and Christians are governed by the Indian Succession Act. Our article Inheritance Rights in India covers it in detail.

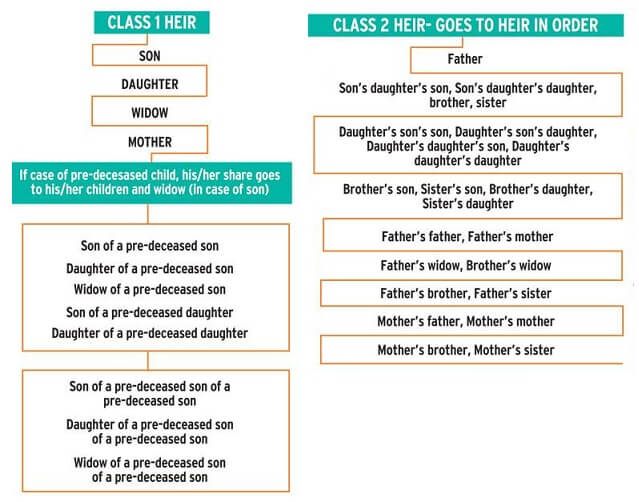

When a Hindu man does not leave behind a will, what happens?

The property can be claimed by 4 types of heirs – Class I, Class II, Agnates (who are related by blood or adoption wholly through males), Cognates (who are related by blood or adoption not necessarily through males). The table below shows the overview of Class I and Class II heirs and image below explains it in detail

What to do with Mobile Number after death

Mobile is our connection to the world. For Finances all accounts are linked to the mobile number, messages, OTPs from the bank come to our mobile. UPI transactions through PhonePe, PayTm, Google Pay all are done through Mobile.

The phone company does not keep track of the life of the subscriber. They are concerned about bills being paid.

There is nothing like succession in the case of mobile numbers.

Telecom companies deactivate a phone number after 90 days of no usage and then may assign it to new subscribers after a month or so. So unused phone number may get assigned to a new person within 4–6 months, whether the subscriber is dead or alive.

Aadhaar is linked to the Mobile. We know that Aadhaar numbers have a mobile number mapped and are used by UIDAI for sending OTPs during authentication. UIDAI allows a mobile number to be changed in UIDAI records ONLY IF the Aadhaar holder visits an Aadhaar center and performs a fingerprint authentication and well that is not possible after death. Can a fraudster misuse a dead person’s Aadhaar number. The phone number owned by a dead person may get assigned to someone else six months after their death, but UIDAI will never find out that this phone number no longer belongs to that dead person.

But when one dies what to do with a Mobile number?

Once you tell them the subscriber is deceased and they need to close the deactivate process.

If you wish to continue using the mobile number of a deceased family member, you may do so after settling any outstanding dues on the account.

You can visit the Customer service center with your documents and get them transferred to your name. People have found it is easier to use the Mobile Number Portability process to get the number transferred(Often going postpaid at first)

For an individual customer following documents may be asked:

- POA(Proof of Address) and POI(Proof of Identity) for both customers (Existing and new customer).

- Death Certificate or No Objection Letter from all family members (Required if the SIM change required to another family member instead of Legal heir)

- LOA (Letter of acceptance) from the new customer.

What to ask from Employer after the death

Most employers provide various benefits to their employees such as provident fund, gratuity, National Pension System, Gratuity, Group Insurance etc

One should get in touch with a friend/colleague of spouse in the office and talk to the HR/Payroll department.

The family or legal Heirs are eligible to claim the pay and allowances due to the employee or the leave salary upto the date of death(on earned leave) and any arrears. They can also claim Gratuity if employee has worked for more than 5 years.

Many companies also provide Insurance(Group), so please enquire about it to

People working in private organisations, contributing to EPF, can withdraw the EPF amount, insurance under EDLIS, and are eligible for pension under the Employees’ Pension Scheme (EPS).

- Upon the death of an EPF member, the Employees Provident Fund amount is paid to the nominee mentioned in EPF. If there was no nominee assigned then the EPF amount is paid to the immediate members of the family (legal-heirs).

- On the death of the member, the family (spouse and thereafter two below-25 children) is entitled to receive monthly family pension. It is not a big amount, maximum of 7500 per month but every penny helps.

- A nominee or legal heir of an active member of EPFO gets a lump sum payment of up to Rs 6 Lakhs in case of death of the member during the service period (active EPF member).

One can submit PF death claim forms online by the member’s beneficiary but for that you need the employees UAN and password.

Note: Any lump sum payment made gratuitously or by way of compensation or otherwise by the employer to the widow or other legal heirs of an employee who passes away while still in active service, is not taxable as income under the Income-tax Act, 1961. While the circular refers only to a lump sum payment, a few judicial precedents have held that periodicity of payment cannot determine the taxability of the payment received and it is the true nature of that payment that decides its taxability. Details in Mint article

What to do with Aadhaar after death

What happens to someone’s Aadhaar once they pass away?

There is no process to handle an Aadhaar holder’s death. The Unique Identification Authority of India (UIDAI), the issuing authority, is planning to digitally bury the Aadhaar too once the person dies but no details as yet.

The problem is Aadhaar is linked to the Mobile. We know that Aadhaar numbers have a mobile number mapped and are used by UIDAI for sending OTPs during authentication. UIDAI allows a mobile number to be changed in UIDAI records ONLY IF the Aadhaar holder visits an Aadhaar center and performs a fingerprint authentication and well that is not possible after death.If the family does not keep the mobile number, the phone number owned by a dead person may get assigned to someone else six months after their death, but UIDAI will never find out that this phone number no longer belongs to that dead person. A fraudster can misuse a dead person’s Aadhaar number.

Article Death of an Aadhaar-holder talks about the issue of Aadhaar after death in detail.

What you can do is to Lock the biometrics

Visit the UIDAI website, and lock the Aadhaar number’s biometrics from being used. Locking biometrics requires OTP authentication and does not require the family member to visit the Aadhaar center, so you can do this from home as long as you have access to the deceased person’s phone number.

What about income tax return after death

Even when a person dies, the assessment of his income is to be done up to the time of his death. This is for an individual and is covered under Section 159 of the income tax act. The legal representative of the deceased has to file the income tax return for the income of the deceased. Usually, the spouse or close relative of the deceased takes charge as the legal representative. Else, in case of will of the taxpayer who has passed away, the executor is held responsible. Our article Income Tax Return of Deceased discusses it in detail

The income earned in the year of death is classified into two categories:

- Income earned from April 1 till the date of death

- Income earned thereafter till the end of the financial year.

What to do to PAN after death

When a person passes away and has a PAN card, the PAN card needs to be surrendered. The process of surrendering PAN is to be done by the family member of the deceased who is his legal representative. One needs to submit a death certificate along with a letter for surrender of the PAN Card to the last jurisdictional Income-tax Officer where the expired person was assessed. The letter must contain details such as legal heir name, contact details. Our article Income Tax Return of Deceased discusses it in detail

What happens to Bank Account on Death

If the deceased has a joint account one just needs to remove the deceased person’s name from the account and continue with it.

If there is a nominee, the bank will give a nominee claim form that needs to be filled.

It is the same process for fixed deposits (FDs), and mutual funds (MFs).

The legal heir has to file the income tax returns for the deceased and pay tax if required.

In the absence of nomination and when there are no disputes among the claimants, the bank will pay the amount outstanding in the account of the deceased person against joint application and indemnity by all legal heirs or the person mandated by the legal heirs to receive the payment on their behalf without insisting on legal documents up to the limit approved by the Bank’s board. This is to ensure that the common depositors are not put to hardship on account of delays in completing legal formalities.

What happens to Credit Card on death

Any continued use of the card after the death of the main cardholder could be termed fraudulent

Typically, a relative of the deceased person is expected to notify any lenders, including credit card companies, when that person dies.

The bank requests a death certificate. There is a specific closure code for death.

The onus for the payment of outstanding debt on the death of the cardholder lies with the legal heir. So, to the extent there has been a property inherited, the legal heir needs to pay the amount outstanding on the credit card with interests and all other charges, as applicable.

One can talk to the bank and try and resolve matters or complain to the banking ombudsman in case of harassment. The bank or the financial institution has to file a civil suit for recovery and then the legal representative of the cardholder has to make the payment from the property of the deceased person.

What happens to Home Loan when one dies

Co-applicant: If a home loan was taken jointly then the home loan gets transferred to the co-applicant

A married couple usually opts for a joint home loan as joint applicants. If the primary applicant passes away, the liability for repaying a loan is passed on to the surviving co-signer or joint debtor. If a loan commitment is not honoured by the living co-applicant, the lender can take legal recourse in the civil court, Debt Recovery Tribunal, or under the SARFAESI Act, depending on the facts and circumstances. A co-borrower accepts the responsibility for repaying a loan with the primary applicant eve thought no ownership rights.

The surviving partner needs to intimate the creditor about the death and provide a copy of the death certificate. I

Home loan insurance: If the borrower bought a home loan insurance and has been diligently paying the premium, the insurer would settle the remaining amount with the banks, and the property would become free of all encumbrances. It is important to note here that home-loan protection plans are linked with the re-payment and the cover reduces along with the re-payment. This means if the borrower has already paid Rs 30 lakh of the Rs 50 lakh loan amount, the insurer would settle the remaining Rs 20 lakh with the bank if the borrower dies owing to an unnatural cause.

If there is no home-loan insurance and no co-applicant then the legal heir

The responsibility to repay the loan shifts to the legal heirs. The pending home loan dues would have to be cleared despite the loss of income that the family suffers.

While the legal heir may opt for a one-time settlement, they may also get the loan transferred in their name and serve the loan on the existing terms and conditions.

If the legal heir shows his inability to repay the loan that the bank would go for repossessing the property in order to recover losses and sell it in the open market. If the property is worth more than the pending loan, the remaining amount would be paid to the legal heir. If the loan is more than what is earned through the sale, the legal heir would be responsible to bridge the gap.

What happens to Bank Locker on Death

It makes sense to operate lockers in a joint-holding or nomination-based mode. This ensures that in case of death of the person, the lockers can still be operated or the contents smoothly handed over to the legal heirs.

Claims after the death of the holder are settled according to The Model Operational Procedure(MOP) for Settlement of Claims of Deceased Depositors published by Indian Bank Association(IBA).

If a joint account is opened as an ‘Either or Survivor‘ or ‘Anyone or Survivors‘ or ‘Former or Survivor‘ or ‘Latter or Survivor‘ basis, the bank will permit the surviving account holder(s) to have unimpeded access to the credit balance in the account for withdrawal if one of the co-account holders dies.

It is expected that information relating to the death of a joint depositor is intimated in a reasonable time.

What happens to Property on Death

If the deceased has left a property will, then there is clarity as the person(s) who is mentioned inherits the property.

In case a deceased owner of the property does not leave behind a will, the legal heirs will inherit the assets which depends on the religion.

It is highly recommended to get the property transferred to the legal heir names and apply for property transfer at the sub-registrar’s office.

You should also apply for mutation of the property title. It is done to record the transfer of a title of property from one person to another inland revenue records. This is needed for the purpose of payment of property taxes, or to transfer of utility connections in the name of the new owner. It also adds evidentiary value in respect of the title to the property. Mutation of property records takes place at the local municipal authority office in whose jurisdiction the inherited property is located. The documents required and the fees for mutation of property differ from state to state.

This process requires detailed paperwork and you should contact your lawyer to get the list of documents that need to be traced regarding the property, right from the sale deed, or encumbrance certificate (EC), Will, Succession Certificate

What happens to Life Insurance

A claim is a formal request to an insurance company asking for a payment based on the terms of the insurance policy. Each company has a different protocol. Insurance claims are reviewed by the company for their validity and then paid out to the insured or requesting party (on behalf of the insured) once approved. Many companies have online services, so you could check through that. If your parent had a separate folder for insurance, that could save time

Check if the insurance has been taken through an agent or from the company directly. But the death certificate and legal heirship are the starting points.

After the letter of authority, you would need to clear the loan if there is any on the deceased person’s car.

What happens Vehicle on Death

When a person dies, all the assets are transferred to the legal heir. So the car of the deceased person can be legally transferred to the heir or sold. The car insurance policy also needs to be transferred to the name of the legal heir, provided the policy is still valid.

The family needs to ensure who is the rightful owner of the car according to the will of the deceased person. To sell a car, one would need a letter of authority which is allotted by the regional court or the SDM(SSub-divisional magistrate)

After the letter of authority, one needs to clear loan if there is any on the deceased person’s car.

You would need to NOC from the bank or financial institution in order to remove hypothecation form the RC

When the vehicle owner has to be passed onto the first legal heir of the deceased person, it is necessary to have a valid death certificate.

The application to the zonal officer/SDM must be submitted within 30 days of death, else a penalty of Rs 100 will be charged on a monthly basis

What happens to Mutual Funds on Death

As discussed in Claiming Deceased’s Mutual Fund Units Your mutual funds are passed on to your nominees. the process of is called ‘transmission’.

Investment in a mutual fund can be made in a single name or in a joint mode (with upto three people). The mode of holding can be anyone/survivor or joint.

If mutual fund is held in joint account, In case of the demise of the first holder, units will be transferred to the surviving unit holder(s)

In the case of the demise of one of the joint holders (other than the first), the units will continue to remain in the name of the first unit holder. The first unit holder has the option to register any other person as a joint holder, for which the documents are required to be submitted:

- Letter from the surviving unit holder(s) intimating the death of the joint holder.

- Copy of the death certificate of the joint holder duly certified in original by bankers/AMC.

- Name, PAN, signature of the new holder.

- Know Your Customer(KYC) of the new holder.

Demise Of Single Holder with Nomination

In case there is only a single holder, and there is a nomination registered.

- Letter from claimant nominee(s) to the AMC/ Mutual Fund requesting for transmission of units.

This has to be accompanied with an attested copy of the death certificate.

Proof of identity of the nominee (passport, ration card, driving licence, etc) Bank Account Details of the new first unit holder as per specified format.

KYC of the claimant(s),

Declaration and indemnity against any other claims. .Each bank has it’s own Indemnity form. Sample at AMFI(pdf). Banks require it on a stamp paper.

Copy of the statement of account issued by the Asset Management Company(AMC) may also be asked.

Demise Of Single Holder without Nomination

If there is a single holder and there is no nomination, then it depends on whether deceased has left or not left a will. If the deceased has left a willtechnically it is called as Testamentary (Presence of Will) . If the deceased has not left a will, technically called as Intestate (Absence of Will)

- Letter from claimant(s) to the AMC/ Mutual Fund requesting for transmission of units,

- Death Certificate(s) in original or photocopy duly notarized or attested

- Bank Account Details of the claimant (new first unit holder) as per specified format

- KYC of the claimant.

- Indemnity against any other claims.

- Copy of the statement of account issued by the Asset Management Company(AMC) may also be asked.

What happens to Stocks after death

Stocks and shares can be passed on to nominees by submitting a death certificate copy attested by a notary/gazetted officer. This form must be registered to the appropriate custodian such as NSDL or CDSL. If the nomination is not registered, the heirs must submit either:

- Probate of Will

- Succession Certificate

- Letters of Administration

You can access the form for transmission of shares and other financial securities here.

What happens to NPS after death

Your NPS balance will pass on to your heirs.

You can find and download the form for the NPS claim, in the event of death, here.

If one was receiving an annuity under NPS, check with the insurance company. many do provide for payment to the spouse/return of annuity purchase price. However if you have purchased a ‘simple annuity’, the same cannot be inherited.

Gold

Physical gold can simply be passed on through a will. If there is no will, letters of administration/succession certificate will be needed. Electronic gold will follow the same process as the inheritance of stocks/shares.

What happens to PPF after death

On the death of a subscriber, the balance in the PPF account is paid on-demand to his nominee or successor. Any loans or interests on loans to be repaid by the subscriber will be deducted before the credit is transferred to the appropriate person(s).

To claim the PPF amount, on Death of PPF account holder Form G has to be filled up,

Our article Death of PPF account holder: How to Claim using Form G explains it in detail.

What about Income Tax after Death

In the event of the death of the assessee the income tax returns on behalf of the dead person have to be filed. In the case of a deceased person, the legal heir of the deceased person has to file an income tax return for the financial year. He has to register as a Legal Heir to do e-Filing on behalf of the deceased.There is no change in Income tax computation and procedure of filling an income tax return. Our article Income Tax Return of Deceased discusses it in detail.

There is no inheritance tax or estate duty in Indian law.

Any transfer of property qualifying as a capital asset (shares, units of mutual funds, property), upon inheritance, does not normally give rise to a taxable event.

- The tax liability arises in the hands of the successor only at the time of sale of these assets.

- The tax liability will be based on the period of holding of the asset. The asset is held for a period of long-term (beyond one year for shares, debentures, units of mutual funds; or beyond three years in case of other assets), or short-term.

- In order to determine the period of holding in the case of inherited assets, the period of holding of the previous owner is to be taken into consideration

Life Insurance: Under the provisions of section 10(10D) of the Income-tax Act, 1961, Death claims proceeds of life insurance policy, including the sum allocated by way of bonus on such policy is exempted from income- tax.

Fixed Deposit: If the account is closed and payment made then it is not taxable in hands of the successor. But if FD is continued then interest from FD from the date of death to maturity will be added to the income of the successor. Tax on interest before the date of maturity would be added to the liability of the deceased.

Video on Why We should have a Will

Many realize they don’t have time to mourn and grieve for the person with whom they spent so many years. Because they were busy sorting all the paperwork.

In this video, PV Subramanyam covers the experience of a young chartered accountant after the death of her husband in an accident and cost of not making well!

Money Book Record

Where is all the information related to your financial life? Your policy details, FD, mutual funds, etc Is it stored in your head or hidden in your emails? You’ve kept the documents in the top cabinet of the steel almirah, but who knows about it! What about the insurance policies you have taken? And the locker keys? Do you have a money book which has all the information, that you can refer to? This Money book will help you while filing returns, doing review of your financial life, and also your family in time of emergency or when you are not around them. The excerpt is given below. Download the sample MoneyBook in Excel form here or check out the money book released by HDFC Mutual Fund.

Details discussed in our article Make Money Book . What should be in your Money book

- List of important documents and their locations, eg., Passport, Driving licence, PAN etc.

- Important contacts, like the doctor, CA, your stockbroker and their details.

- Your EPF/NPS details, Your stocks options, along with office insurance policy and contact of your collegaue.

- Your bank details

- Your bank locker details

- Your credit card details.

- Your property details, Property taxes, rent etc.

- Your insurance policy details

- Your mutual fund investment details

- Your stock details, at least the platforms through which you invest

- Your Income tax return details

- Loans that you have taken, given. Paperwork of it.

- Your will or Important instructions for them to carry out, once you are dead. Eg., insurance claim process, steps to selling off some property, claiming the bank account, investments etc.

Summary of the list of things to do on Death of a person

In the article Things to Do After the Death of a Parent, the author explains To sum up, I wish I had some awareness of the things I needed to be prepared for.

In retrospect, I would ensure the following:

1. Bank accounts/FDs/MFs to be made jointly with the spouse, shared ATM numbers with spouse. Ideally, account or investment should be with one bank for the sake of simplicity of handling. Where is the bank locker key kept and what is its number?

2. Who are the deceased’s auditor/ lawyer?

3. Do I have any contact with the local tehsildar office?

4. Is there one diary that captures all investment details/ important phone numbers of the deceased? Do I have access to it?

5. Where are the original property documents kept?

6. Which bank does his/her pension get credited? Has the deceased put the spouse as a nominee? Does the spouse have an account in the same bank?

7. Does CGHS carry the nomination of the spouse?

7. Many forms need attestation or witnesses. Who can do that? Line up at least two of them.

8. Where are the deceased’s ID proofs, like PAN Card or Passport, kept? And the colour passport-size photos?

Download the sample MoneyBook here

You can also enroll in our Master Class Hello Paper Work, What Married Women/Men should know about money

Related Articles:

- On Inheriting, Tax of Property, Mutual Funds, Shares,FD etc

- Right Paper Work For Those You Love: Part 1, Will: Right PaperWork For Those You Love-Part II

- Claiming Deceased’s Mutual Fund Units

- Bank Account,Term Deposit,Locker:Paperwork Required For Claim

- Succession Certificate,Letter of Administration,Probate of Will

- Nomination, Will, Operation of Joint Account

- Transfer Of Shares on Death Now Same as Physical Shares

- Inheritance Rights in India

If you are over 30 and working, WRITE A WILL. Death comes suddenly for a lot of us. It’s a great parting gift.

[/et_pb_text][/et_pb_column][/et_pb_row] [/et_pb_section]