The International Monetary Fund warns that the coronavirus pandemic will cause a recession in 2020 as bad as the global financial crisis. The two most important questions you will hear during any recession are “When will it end?” and “How quickly will we recover?” Unlike other recessions caused by systemic flaws such as the debt bubble of 2008, this has been brought upon by a medical emergency. It is unintentional and unavoidable. What is a Recession? What are the types of Recessions? Shapes of Recovery: V Shape, U Shape, W Shape and L Shape?

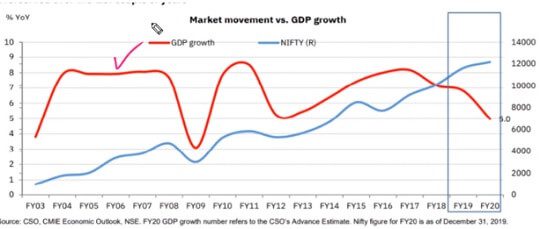

India has never recorded a drop in real GDP growth since 1979. There have been four “negative growth” periods in India since independence: late 1950s, 1965 (-2.6 per cent), 1972 (-0.5 per cent) and 1979 (-5.23 per cent). Will Covid-19 push India into full-blown recession? What type of recovery it will be?

Table of Contents

What is a recession?

Recession means a drop in the Gross Domestic Product (GDP), that is there is degrowth in the country’s economy. For Example, the country’s (economy) GDP was at $2.5 Trillion last year and GDP has come down to $2.45 Trillion current years. Recessions are visible in industrial production, employment, real income, and wholesale-retail trade. Economists define a recession as two consecutive quarters of contraction of economy (ie. decreasing GDP). Here, Economic growth slips into negative territory during a recession.

An economic slowdown is merely a decline in the growth rate of the Gross Domestic Product (GDP). For example, the country’s GDP growth rate was 7% last year and this GDP growth rate has come down to 4.5% this year. That is GDP growth rate is falling, although the overall country’s economy is growing but at a slower pace. While in case of an economic slowdown the economy does not contract. It continues to expand, but at a sequentially slower pace. Slowdown also called as a ‘growth recession’,

A depression is a deep and long-lasting recession. While no specific criteria exist to declare a depression, unique features of the Great Depression included a GDP decline in excess of 10% and an unemployment rate that briefly touched 25%. Simply depression is a severe decline that lasts for many years.

The economic pain caused by recessions, though temporary, can have major effects that alter an economy. This can occur due to structural shifts in the economy as vulnerable or obsolete firms, industries, or technologies fail and are swept away; dramatic policy responses by government and monetary authorities, which can literally rewrite the rules for businesses; or social and political upheaval resulting from widespread unemployment and economic distress.

Economists say there has been 33 recession in the United States since 1854 through to 2018 in total. Since 1980, there have been four such periods of negative economic growth that were considered recessions. Well, known examples of recessions include the global recession in the wake of the 2008 financial crisis and the Great Depression of the 1930s.

Video on What is a recession?

What exactly is a recession? CNBC’s Tom Chitty explains.

Shapes of Recovery

What happens when the government asks factories to shut down because people should stay at home? What happens when the government asks construction activity to stop overnight because areas with large gatherings have to be emptied out? What happens when restaurants and shops are ordered to shutter down for long periods?

Type of Recovery in Stock Market depends on the severity of the preceding recession. The stock market recovery is directly dependent on the performance of the economy or in other words the GDP of the country. Recessions/Recovery come in many shapes and sizes. However, economists tend to refer to the following four shapes the most:

- V-shaped recovery

- U-shaped recovery

- W-shaped recovery

- L-shaped recovery

V-Shaped Recession/Recovery

V-shaped begins with a steep fall but then quickly find a bottom, turn back around and move immediately higher. A V-shaped recession is a best-case scenario. Normally this type of recovery happens when there is no impact on consumer spending/demand or income after the fall Ex In US The recession of 1990 to 1991 and the recession of 2000 (both of which only lasted eight months) are considered to be V-shaped recessions.

The economy climbs back as quickly as it had fallen, aided by a government stimulus that pushes up demand. Income and output rise, demand grows and higher spending by households prompt companies to add capacity lines and hire more.

Not many economists, though, are predicting a V-shaped rebound this time around, given Covid-19’s pervasive spread and the lockdowns’ biting impact on the broader economy.

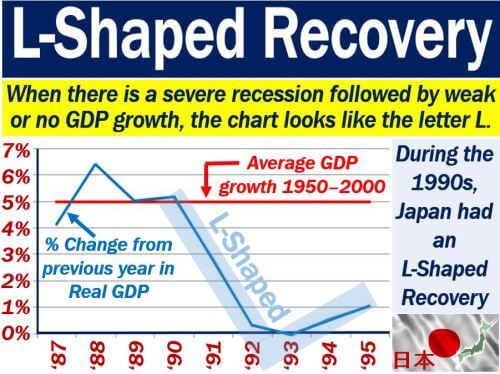

L-Shaped Recession/Recovery

L-shaped recessions are recessions that fall quickly and fail to recover. This is the worst-case scenario for any economy as there is a severe impact on consumer spending and income. The Japanese economy in the 1990s, which stagnated for a “lost decade” after an asset bubble burst, is a prime example of this. L-Shaped recession is also sometimes described as the “hockey stick” slump.

U-Shaped Recessions/ Recovery

U-shaped recessions are recessions that begin with a slightly slower decline but then remain at the bottom for an extended period of time before turning around and moving higher again. This is somewhere between a V and an L. U shape recovery is longer than V type recovery. It normally lasts 2-3 quarters. There is a drop in consumer spending but there is NO impact on the income of the consumer. The recession in the US from 1971 through 1978, when both unemployment and inflation were high for years, is considered a U-shaped recession.

It happens when the recovery is a fairly lengthy affair when output, demand and income remain flat for a very long period of time. Consumers will cut spending, defer planned purchases, driven by plummeting financial asset values, making the broader economy’s recovery painfully longer, despite a series of fiscal and monetary aids.

W-Shaped Recession/Recovery

These recessions occur when growth in the economy is bumpy, characterised by frequent upturns and downturns, resembling the letter W. W-shaped recessions are recessions that begin like V-shaped recessions but then end up turning back down again after showing false signs of recovery. W-shaped recessions are also called “double-dip recessions”, “second leg down” and “roller-coaster recession.” because the economy drops twice before a full recovery is achieved.

The recession of the US in 1980 that double dipped in 1981 and 1982 is a great example of a W-shaped recession.

A W-shaped recession is painful because many investors who jump back into the markets after they believe the economy has found a bottom end up getting burned twice—once on the way down and then once again after the false recovery.

Square root-shaped recovery/Recession

Some economic slides and recoveries follow a peculiar pattern: rising quickly for a few quarters from a sharp recession, before hitting a plateau and flattening for long period that could extend upto years. This could happen when consumer spending rapidly gathers pace shortly after the restrictions move away because of pent up demand. The sudden surge in spending, however, doesn’t carry on beyond a few quarters.

The initial torrent in household spending helps companies empty out the inventories, but the demand is not strong enough to push companies to add more capacity lines.

As companies do not expand, wages and salaries remain flat or crawl at a very slow pace, resulting in stagnant growth in the broader economy, resembling the shape of a mathematical square root

Video on Types of Recovery?

Covid 19 and Recession

How long will the coronavirus pandemic last along with the deep economic recession it has created? Consider three possible scenarios.

- First, with effective medical and economic responses, the crisis might rise explosively and then rapidly peter out. A deep recession in the first half of 2020 could be followed by a sharp V-shaped recovery.

- In Scenario 2, the virus and recession will continue till September, with correspondingly higher deaths and bankruptcies. The economy will suffer long and hard despite government rescue packages. GDP growth may recover a bit but still be hobbled till end 2020.

- In Scenario 3, the virus will take ages to control, and may return in a second wave even after it initially seems controlled. If so, the crisis will continue into 2021, wreaking more havoc than the 2008 Great Recession.

I believe the chances of Scenario 1 are no more than 30%, of Scenario 2 maybe 60%, and of Scenario 3 maybe 10%. Details in the Swaminomics Article How long will the pandemic last? 3 Covid scenarios

Video on Great Depression of US in 1929

The Great Depression was the worst economic downturn in US history. It began in 1929 and did not stop until the end of the 1930s. The Great Depression started in the United States after a major fall in stock prices that began around September 4, 1929, and became worldwide news with the stock market crash of October 29, 1929, (known as Black Tuesday). Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By 1933, unemployment was at 25 per cent and more than 5,000 banks had gone out of business.

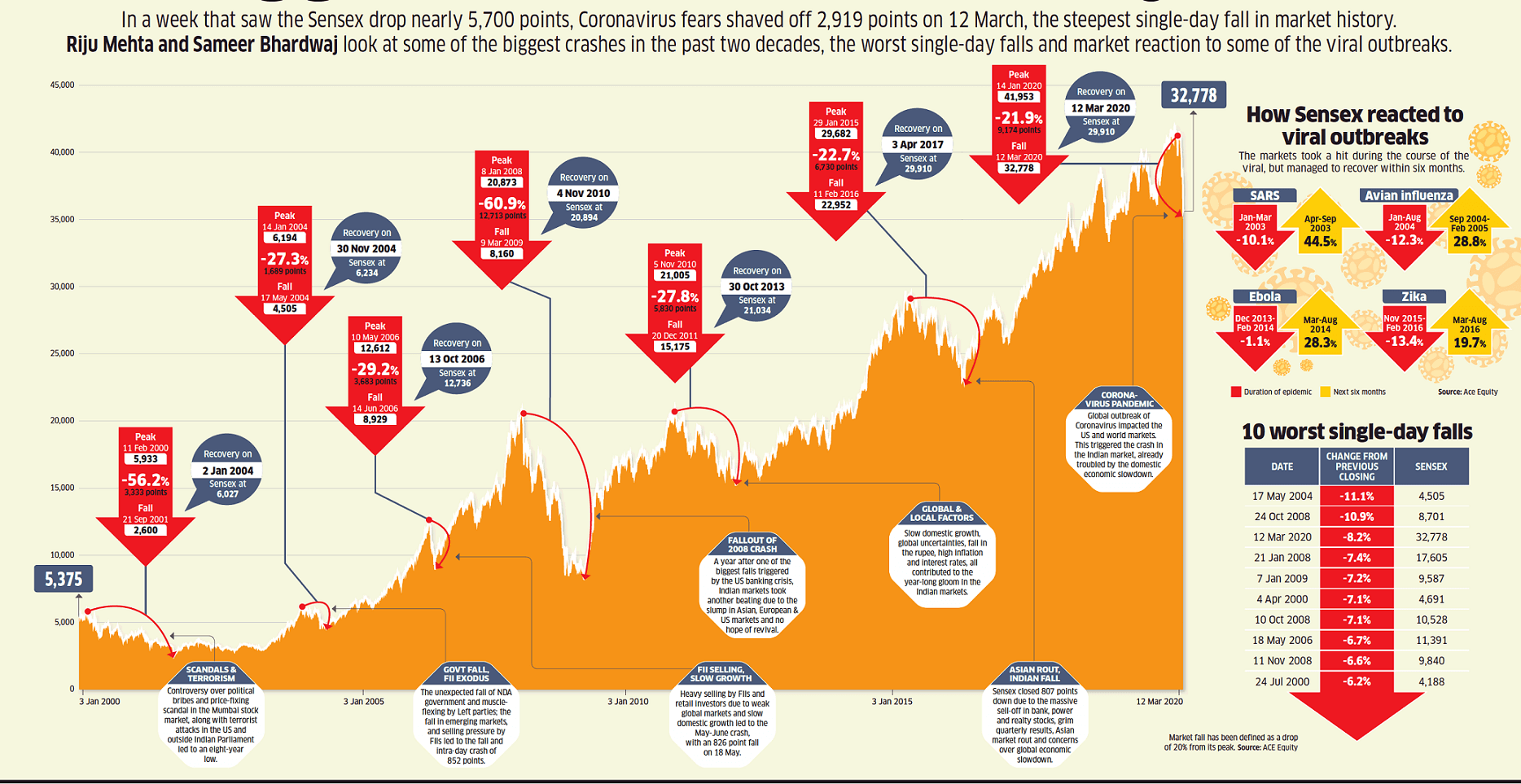

Infographic of Sensex Falls, Reasons and amount

Will the world, and the Indian economy, pass through multiple peaks and troughs spanning several quarters before reaching a steady growth state?