Only Verified KYC such as Aadhaar, PAN which are digitally approved will be considered for availing any services, says UAN EPF website.KYC means to know your customer. If you have your KYC details in your UAN and they are approved by your employer then dependency on the employer goes away. Then To withdraw or take a loan from EPF you can directly approach EPFO online. This article explains the KYC associated with UAN account.

Table of Contents

UAN KYC

Before proceeding adding KYC, please note that you will require an active UAN number to log in. If you have a new UAN number and yet to activate it, please read the article UAN or Universal Account Number and Registration of UAN

If you have created the UAN number using Aadhaar then you cannot add KYC like PAN and Bank account unless you start working because these KYC details need to be verified by the employer. So you will have to wait till you join your employer who provides EPF.

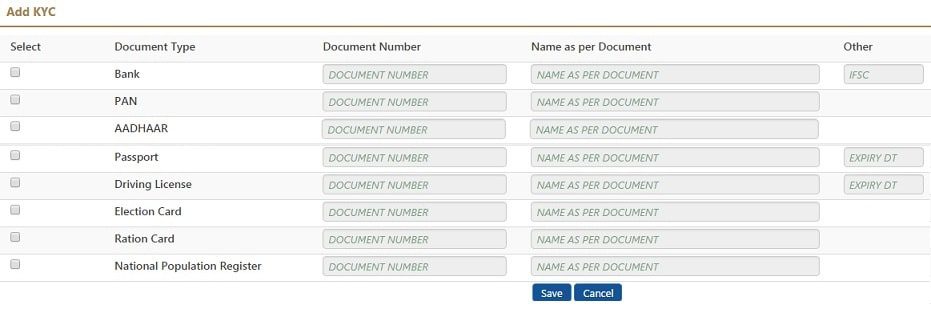

After logging on to UAN Website (https://unifiedportal-mem.epfindia.gov.in/memberinterface/) you can click Manage->KYC to see or add your details. You can add details like PAN, Aadhar, and Passport for KYC. To add KYC you can upload the document and related information.

Following documents are considered for KYC

• National Population Register

• AADHAR

• Permanent Account Number

• Bank Account Number

• Passport

• Driving License

• Election Card

• Ration Card

Our article Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online explains it in detail.

- Select the Document Type. Minimum you should have following documents approved for KYC.

- Bank Details

- Aadhaar

- PAN. Mandatory if you do withdrawal before 5 years of EPF contribution as TDS is deducted. If an employee withdraws his PF before 5 years of service, a TDS of 10% is levied against the amount if PAN is updated in the account. In case PAN is not updated, TDS charged increases to 34.608%.

- Add the details of the document, Document number, Name as per the document.

- If you add Passport/Driving license then you need to add details like Expiry date

- For Bank, you need to add IFSC code for Bank.

Click on Save

If document details don’t match then you will get errors. Correct the errors if possible and try again.

If there is no error, then these documents appear in Pending KYC section. You have to wait for the employer to approve the KYC details.

In case you do not want your details to be updated, you can cancel the KYC process by clicking on the X sign marked against the document before it is verified by the EPFO.

UAN KYC: Employer Approval of KYC

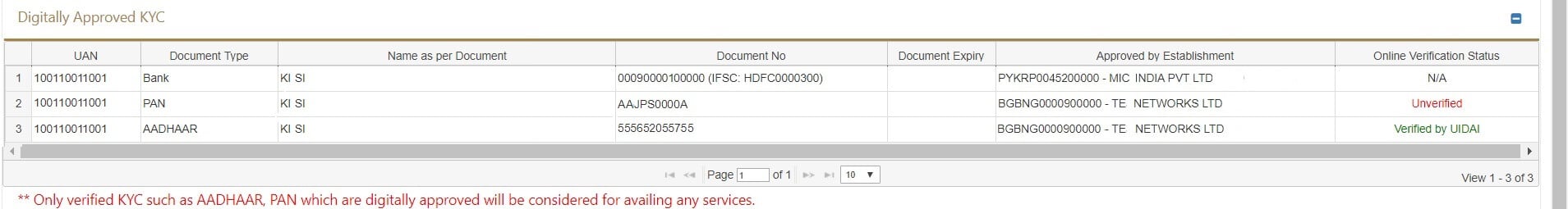

After uploading your employer has to approve the KYC. Your employer needs a digital signature in order to authorize your KYC. Once employer approves it appears in Digitally Approved KYC.

You can get the Aadhaar Linked by going to the eKYC portal but PAN and Bank account have to be approved by the employer. So we recommend waiting for your employer’s approval.

eKYC Portal of EPF Link UAN with Aadhaar without Employer explains how to do link Aadhaar with UAN.

After the Employer approval, the documents appear in Digitally Approved KYC as shown in the image below.

Video on adding KYC to UAN site

How Employer approves the KYC

Just like Employees have UAN portal, employers too have a UAN website where they need to register their establishment.

Our article New UAN Unified Portal for Employers discusses UAN Portal for employers in detail.

The employer has to login to the website and approves the KYC using his registered digital signature.

If Employer does not approve KYC

Approach the Employer or Director directly

Usually, HR takes care of all the EPF matters of a Company. Hence if the approval of KYC is urgent and has to be done within 15 days then approach HR again. If still it doesn’t get approved you can escalate the matter and approach senior members such as the Director of the Company

Complain to the EPF department: EPF Grievance

The employee can complain to the EPF authority. The complain website is http://epfigms.gov.in/. The employee needs to have UAN to complain.

The article How to register EPF complaint at EPF Grievance website online discusses it in detail.

Related Articles:

- UAN or Universal Account Number and Registration of UAN

- How to change UAN password

- Online EPF Withdrawal: How to do Full or Partial EPF

- How to Transfer EPF Online on changing jobs

- How to register EPF complaint at EPF Grievance website online

- How to check Member Ids or PF accounts linked to UAN

The bank account linked with this account is also linked with the following UANs : 10072474XXXX (with different demographic details). If these UANs are yours, then please get the basic details corrected in your other UANs and link them with your Aadhar for transfer of your accounts to the present one. If this bank account is not yours then please add your correct bank account and get it approved by the employer to avail online claim facility.

My bank account is already maintained by EKYC my company, yet why am I being harassed? I have done my KYC, yet why am I being harassed, my money is not coming out. Please help me, please help me I am having a lot of trouble. Help me on behalf of the PF Department. UNA 100698345207 DSNHP00194510000017230.

Bank KYC is for Bank.

EPFO KYC is for EPFO.

You have to complete your KYC.

What trouble are you facing?

Please don’t put your personal details in any public site. It can fall in the hands of fraudsters.

Ramchandra Ram

My UAN 100639270551

Bank account approved nhi ho raha hy

My kyc updated h ki nhi mere ko janna h and. Member name nhi show kar raha h

Mykyc update Karo sir please

Name ramanna Nigappa Rotti

AC 32731795271

IFC code SBIN0005413

My aadhar no 290007186741

My pan card no BGOPR3399L

sir my pf kyc update no

I want to withdraw my Old PF account Establishment ID: TNMAS0051445000. I need to update Pan Card, details with my old Company : CHOLA BUSINESS SERVICES LTD. uan no 100279535994 to withdraw my PF money.

Have you not transferred your old EPF account to new Account?

If your new company is showing up in the Service history then you cannot withdraw old PF account.

You would have to transfer the old EPF account.

Please go through our article Why should one transfer old EPF account to new employer? which talks about it

CONTACT YOUR EMPLOYER THEY WILL APPROVED YOUR KYC

pan no not updated in our uan portal kindly updated and help mem

UAN N0- 100531686548

Pan-DGKPS5190G

Name-Sandeepa KP

need to mobile number change existing mobile number not available and password need forget. …. so I can’t login. .. please suggest me

Try using forgot Mobile number Overview of Steps to Change Mobile Number in UAN if forgotten Password

Sir mera bank account aprovd nhi kiya employers ki or se.. But bank account digitaly aproved me pehle hi a..kya main delet krdu bank accounts.. Pending me se.

pan no not updated in our uan portal kindly updated and help mem

UAN N0- 100531686548

Pan-DGKPS5190G

Name-Sandeepa KP

SIR UAN ACCOUNT MEPAN CARD AND BANK ACCOUNT KAISE ADD KARE

Sir, i have changed two companies. My first company verified my kyc in uan but second company have not done yet. Also second company is not reachable for me. Is their any way to verify my kyc. It happened due to change in bank accounts as i changed from previous company to next one

After nearabout one years pf deduction,now I am out of gujatath, can I apply for epf withdrawal my pf ammount just submitt throw offline ?

Good Information Sir

Bank account details not Updated in epf

Contact your employer

I’ll update bank details and pan card but it’s showing N/A any help

I am glad to be one of many visitants on this

great internet site (:, regards for putting up.

My bank account are senn NA dikha raha hai baki aadhe or pan verify dikha raha hai bank huva hai ii nahi pls batvo

mera v PAN aur ADHAR verified dikha rahe h lekin bank account me NA dikha raha he aur do account dikha raha he.Aur kyc pending me v bank account dikha raha he.Pending wala delete karna padega kya? Plz reply

Bank account tab tak pending rahenga jab tak Employer approve nahin karta.

Aap jo bank account nahin chahiye use delete kar dijiye.

Dosar approve kara dijiye

My UAN number is activated.& In the KYC details Bank account number & PAN numbers are updated. But my Aadhar number is not updated.& These shows the error that ‘Pls update your aadar’ . Pls help me sir how can I update my aadar in KYC.

Aap Uan login karke aasani se kar sakte he.login honeper ek chart dikhega usme nam, pancard,Bank account,aur Aadhaar card .side me blu colour ka ek tag hoga wo dabaye.fir aap details bhar shakte he.mene kiya he.

Kyc pending hai

MY NAME IS NOT MATCH WITH PAN CARD

Sir my uan activ but dob not match my dob 30/1/1978

Sir, muj ko PF k full money withdraw Karna h but apply kr n s phale muj ko kya check Karna chayen….?

Sir Mai mail check kr chuka hu Adhar, PAN, or bank details kaha jakar update Karna h?

UAN number

Password

OR KYC Ka Document Bhenj do

WhatsApp number

7491885157

Sir, muj ko PF k full money withdraw Karna h but apply kr n s phale muj ko kya check Karna chayen….?

Pls sir solution my Pf pan card verification updated

Sir mera EPF pan card verification field pan card to update kaise link Karen ka bataayee a pls sir 101396791674 Name MUBARAK PATHAN pls sir solution

Sir mera pancard UAN se

Name missmach bata raha hai

Aur Aadhar card me DOB.

Aur Gender aur name missmach bata raha hai

Jo ki sir mujhe paisa nikalna

Bahut jaruri hai

Koi subhah Denali kripakare

Sir/ my Dob 26/11/1984 rot

Rong my Dob 14/09/1980

Please help me sir

sir my ekyc is pending but digitaly not aproved for my company so my uan no.101084721938 plz help me

My account No. is not verify yet. Who will be verify Bank account.

I LOST MY MOBILE .SO HOW CAN RESISTER ANOTHER PHONE NUMBER.

Sir my dob 20/09/1993 is correct .24/08/1997 is rong .

Aap pf office se ek jointdecelarsion form bharke . Birth certificate ki ek copy link karke company ke stamp karvake pf office me dedo.ho jayega

Mera pf nahi mil pa raha hai kaise niklega

Sir

Please solve my problem !

My name English spelling and date of birth is different .

My epf account name- Ajit Kumar Ray and date of birth is 01/01/86 .

But my banking details-Ajeet Kumar .date of birth-12/02/1984.

Because my father name is same both stage.

While adding bank account as UAN KYC please enter the name in the bank account as Ajeet Kumar.

Birth od date don’t have to match

Sir uan number rigistred Kate samy Mera bank account number Galt ho gaya hai online kyc Kar par bhi member I’d se bank account think nhi ho Raha hai please help me sir

Phir ek naya bank account ko add karen jiska account number sahin hain.

My name is Mahinder sijapati Aadhar Number is not activ. Please activate karoo sir

Are you Aadhaar number details missing in UAN Member website or they are not approved?

unable to update PAN card no plz Help mi

Dear sir

My sbi bank account number verified, but online pf withdrawal reject & claim rejected massage sbi cheque book before add zero bank account number,

& Sbi home branch request cheque book bank account number before add zero and you bank manager not add zero cheque book.

Please help my problem.

Sir date of birth link with adhar link with pan

My name Sunil bank me name Sunil Kumar mera pf nikal payga kya

Father name kaise activate kare

Hi sir

mera sab details ok h. but pan card, dob, aur adhar no. galat bata raha h, isliye mera kyc update nahi ho pa raha h, so please help me

you have manually get it updated in PF office.

Sarname wrong date of birthday

Sir my UAN is active but i will process to the steps KYC part will be filled..

But pan card error-pan card failed as per UAN doses not match youer data

Aadhar error- Aadhar card failed Aadhar card no name and DOB not matching with register data

So plz need youer help

Sad to hear it.

Please submit the application to your Regional EPFO office with correct PAN and Aadhaar.

Please go through this article How to find your employer’s EPFO office and EPFO office Phone Numbers to find the Regional EPFO office.

Sir I try to Withdraw my pf amount for construction home I am working the same company 7 years I just submit my clime thorough epf and it’s reject my pan card is wrong in epfo I need to update what I want to do please help

i m already add to bank details but not verify .now pending show one week

Please speak with your employer. Employer needs to approve it

company discontinue his business

Hi sir ,

My name is sunil kumar uan no is 101253526593 i said my employer several times to approve my bank account and pan no , they people not respond well , i made a complaint through epf grevience also ,so please check and do needfull.

Dear Sir I Have Updated My aadhaar & D.O.B But S til Note Proved Pending Request Kindly Do Sum thing No Any Reply From PF Office

I had two uan numbers generated one with my previous employer,now I want to transfer old one to present uan ,for that I need to update bank details ,but it is pending for approval with my old employer .what can I do in that case,without approaching old employer

did you try the transfer? What error are you getting?

No I am getting error like details not matching .,so I tried updating bank details in old uan,and it’s pending with old employer

Can you try the offline approach?

how?

Anina connect with pf branch….my case is same with your case..but solve don’t worried..if not solved then connect me..9256331000

I am trying to update my Bank Account number but it is giving SQL Error. at the time of Saving.

Tried many times but getting same error

Mera bank details approved nahin ho Raha hai

Aapne apne employer se baat kee kya ki weh approve kyon nahin kar rahe hain?

If I have siftted my bank account in other branch.my bank account number is same there but IFSC have been changed,in EPF Account my same account number and old IFSC updated,if I will withdraw online it will be procss or not.

Hi

Am having 2uan No’s.

1is from previous org,-inactive

2nd is from current org. -active

To activate 1st one it is unmatching dob even it is correct also…could you please help to activate this what I can

sir

my kyc portal not able to upload pan card ,its coming mismatching but its correct

One of the reason for the failure of PAN Verification could be that Gender details in PAN did not match those in UAN database.

If you look at PAN Card you will not be able to see the Gender. But if you log in to the income tax website and go to Profile->Pan Details you will the Gender as explained in our article How can an employee Verify PAN in UAN website

Else you can raise EPF grievance

as explained in our article How to register EPF complaint at EPF Grievance website online

Sir Meri kyc ho chuki Hai par jab mein last digit fill Kar raha hu in withdrawal process it shows error that it is. Not verified and you cannot proceed but Meri bank account detail mein Mera Naam mistake Hai Kya ehi reason Hai ja phir koi Hor error hai

Please apne UAN ke details

aur KYC ki picture

aur error ki picture

humare email id bemoneyaware@gmail.com par bheje

Please update name correction , add Adhaar , pan card

101047508887 Please

Pan card update

CQYPD4706L

Sir mere uan number se kyc nahi ho Raha hai.and usame hame Bank account number or pan number activities karana hai.kaise hoga sir jee

Kya problem aa rahi hai aapko KYC karne mein?

Sir i activated my uan bt whn i fill my kyc form they are showing aadhar and pan not verified what should i do my employer said approve by our side dont knw what to do plz help sir can i mail ss of kyc prb

Epfo withdrawal Help please send your metter on whatsapp no 9717976120

Hi Sir

For My UAN 100897003078 I have 2 PF Accounts associated to it. I was able to update KYC for Pan Card, Bank and Aadhar details with my current Company : Cognizant Technology Sol India Pvt Ltd Establishment ID: TNMAS0031309000

But, I am facing difficulty updating KYC for Pan Card, Bank and Aadhar details with my old Company : Foray Software Pvt Ltd. APHYD0072782000 . Whenever I try to update it’s been updating with Establishment ID: TNMAS0031309000.

Kindly help to resolve the issue.,

Establishment ID: APHYD0072782000

Establishment ID: TNMAS0031309000

KYC is associated with UAN and not member ID or PF account number.

Did you transfer your old PF account?

You can check out the 3 min video to understand the difference between UAN and Member Id

No, I want to withdraw my Old PF account Establishment ID: APHYD0072782000. I need to update Pan Card, Bank and Aadhar details with my old Company : Foray Software Pvt Ltd. APHYD0072782000 to withdraw my PF money.

Does your Service History show the old PF account details?

Is the old EPF account linked to the new UAN or some other UAN?

Sir please my Ekyc approvel is pending employeres but not accpet my approvel update … uan is 100943342910….

Please try to find why your employer is not approving.

You can raise EPF grievance but we would first suggest talking to your employer.

Resp/sir

update my epf kyc

Please Sir

Sadly We cannot do so.

Please submit the request officially and wait for employer/EPFO to update

please may u a n no alotment MD FIROJ PF NO HR/31441/081372

Change my una password

Please follow the steps mentioned in the article.

If you face any problem do let us know

Change my una password

helpful informative post sharing

Thanks for kind words