Equity Linked Saving Scheme or ELSS Mutual funds offer a choice to investors of providing equity exposure along with tax deduction benefit under Section 80C but come with a three year lock-in. These funds are an alternative to other tax saving instruments like NSC, PPF and fixed deposits. Let’s understand theELSS Funds in detail.

What are Equity Linked Saving Schemes (ELSS)?

Equity Linked Saving Schemes or ELSS are diversified equity mutual funds(it invests more than 65 per cent in equity) in which investments are eligible for tax exemption under section 80C of the Income Tax Act. Under Section 80C, you can invest up to Rs 1.5 lakh in a set of investments, one of which is ELSS funds. In Equity funds it is suggested to remain invested for long term. This long-term imperative is compulsorily enforced because under the tax laws, investments made into these funds are locked in for at least three years. ELSS Funds offer you a simple way to get tax benefits, while aiming to make the most of the potential of the equity markets. They offer the twin benefits of tax deduction and capital appreciation.

You can find information about the ELSS Funds from Valueresearchonline Equity Tax Planning or Moneycontrol ELSS Funds

What is the lock-in period of ELSS Funds?

All tax-saving investments have lock-in periods which range from 3 to 15 years. ELSS funds have a lock-in period of three years, the shortest among all Section 80C investment options. While this reduces liquidity and prevents the investor from making changes, it can be a blessing in disguise. It also means that redemptions are not a worry for the fund manager and he can take long term investment decisions.

For the investors who take the SIP route, each monthly instalment is treated as a separate investment and gets locked in for three years. So, the SIP started in Oct 2014 will be eligible for withdrawal in Oct 2017. Similarly, the SIP invested in Dec 2014 will be open for withdrawal only in Dec 2017.

What is the taxability of ELSS Funds?

ELSS funds fall under the exempt-exempt-exempt (EEE) category.

- Investments get tax deduction under Section 80C, so you don’t have to pay tax on the amount invested in the ELSS fund.

- The capital gains generated by the fund are also exempt from tax as the investments are not withdrawn.

- Finally, withdrawals are also tax-free because there is no tax payable on long-term capital gains from equity-oriented mutual funds as more than 65% is invested in equity. Since the holding period necessarily exceeds one year, there is no capital gains tax.

The Employee Provident Fund and the Public Provident Fund are the only other investment options that enjoy the EEE tax treatment.

Risks associated with Equity Linked Saving Schemes or ELSS Funds?

Equity Linked Saving Schemes or ELSS funds are essentially diversified equity funds and hence carry the same risks. In fact, the risk is higher in ELSS funds because you cannot exit before three years. There is wide variety within this category with funds that have a mid-cap tilt at one end and those with a small-cap tilt at the other. While the best performing ELSS fund has given 21.7% annualized return in the past five years, the worst performer has given only 3.8%. So, choosing the right fund is crucial.

Should one go Growth or dividend option in Equity Linked Saving schemes (ELSS) ?

Like any mutual fund scheme, You can opt for the growth, dividend payout or dividend reinvestment plan. The growth plan is the cumulative option under which your investment will keep growing till you redeem it. In the dividend plan, the fund gives some amount back to if the fund’s NAV has risen. The dividend received by the investor are tax-free.

Please note that if you opt for the dividend reinvestment plan, under which the dividend payout is reinvested to buy more units of the scheme. Every time this happens, the new units get locked in for another three years. So when you want to exit, there will always be some units still locked in. If you are stuck in the dividend reinvestment plan, you can write to the fund house and shift to the dividend payout plan.

Comparison of ELSS with other Tax saving options?

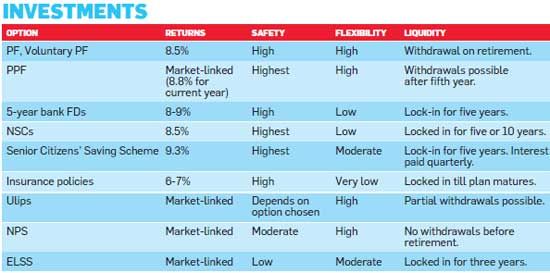

Most equity funds have a minimum investment limit of Rs 5,000, but ELSS funds have a lower limit of Rs 500 only. Unlike an insurance plan, you don’t have to commit multi-year investments. Even a one-time investment of Rs 500 can be held till perpetuity. In the PPF, the investor must make at least one contribution in a year or pay a penalty. However, there is no such compulsion in ELSS funds. Our article Choosing Tax Saving options : 80C and Others discusses and compares the various tax saving options. Comparison of Tax saving options in terms of returns, safety, flexibility, liquidity are as follows .

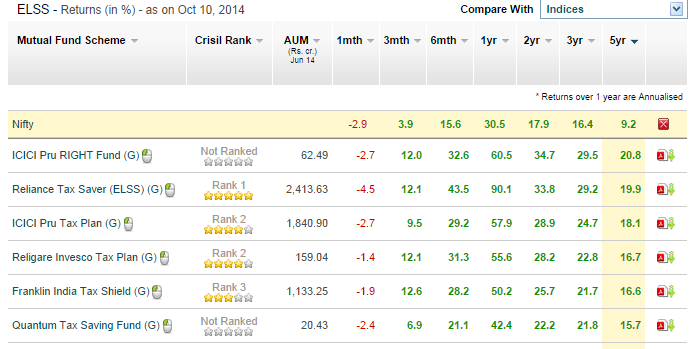

How have Equity Linked Saving schemes or ELSS Funds performed over the years?

Valuereserachonline.com The Many Advantages of ELSS Funds shows the performance of ELSS funds, expense ratio and Net Assets from 2009 to 2014. There is wide variety within this category with funds that have a mid-cap tilt at one end and those with a small-cap tilt at the other. While the best performing ELSS fund has given 20+% annualized return in the past five years, the worst performer has given only around 3%. So, choosing the right fund is crucial.

Top ELSS funds from Moneycontrol.com are

Worst ELSS Funds based on 5 year returns are:

[poll id=”71″]

Related Articles:

- Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

- Choosing Tax Saving options : 80C and Others

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax Overview

- Paper Work A Necessary Headache

ELSS Funds is suitable for all types of investors who are not risk averse and need to invest in tax planning instruments. Newbie investors who want to test the waters before jumping in equity mutual funds will find this especially useful.Though there is no age to get started on an ELSS, it is good investment to have for those who are just starting their careers as it can help them shed their inhibition about investing in equities through mutual funds .

10 Differences between Tax Saving Tools like PPF and ELSS.

More info@ https://www.moneydial.com/blogs/10-differences-between-tax-saving-tools-like-ppf-and-elss/

Hi, I got the best information about Equity Linked Saving Schemes or ELSS. It is really beneficial and useful for beginners. It is very good scheme and useful for us. Keep share good information with us. Thanks you very much.