Inflation, Inflation , Inflation! Media, Newspapers keep on talking about inflation. Are we affected by inflation? Yes as the value of our money is eroding over period of time. In the Question and answer format we have tried to explain What is inflation? How is it calculated? What causes inflation? Kinds of inflations and price indexes? Who tries to control the inflation in India? Inflation relationship with interest rates? How does it affect your investments? What have been inflation in India and returns from various asset classes?

Table of Contents

What is inflation?

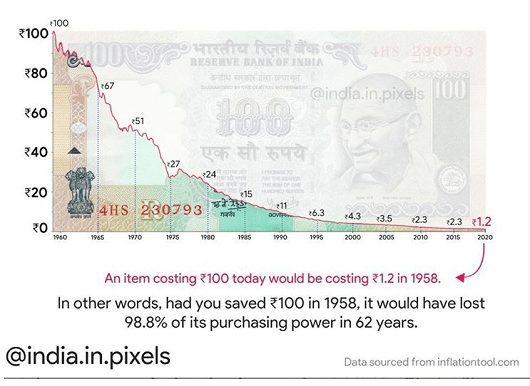

Inflation is an increase in the price of a basket of goods and services that is representative of the economy as a whole. A movie ticket was for a few paise in my parents’ time, few rupees when I was growing up. Now it is more than 100. What you could buy some time ago for Rs.10, after some time(days, year) will be available for more than Rs 10, the worth of money has reduced! he image below shows how the purchasing power of money in India has reduced Rs 100 in 1958 is worth Rs 1.2 only. This is what inflation is, the price of everything goes up or worth of money reduces. A famous quote on inflation is

Inflation is when you pay Rs. 100 for the fifty rupee haircut you used to get for 25 rupees when you had hair

How is inflation calculated?

Inflation is calculated by government agencies. To do this, a number of goods that are representative of the economy are put together into what is referred to as a “market basket.” The cost of this basket is then compared over time.

Say index consists of one item and cost of that item goes from 100 in 2000 to 198 in 2012. To calculate the change we would take the difference (198 – 100). The result would be 98. So we know that from 2000 until 2012 prices increased (Inflated) by 98 points.Well, we know that prices almost doubled in 12 years, since it was 100 and it is almost 200 but other than that we don’t know much. We still need something to compare it to. We compare it to the price it started at (100). We do that by dividing the increase by the first price or 98/100. the result is (.98). This number is still not very useful so we convert it into a percent. To do that we multiply by 100 and add a % symbol. .98 x 100= 98

For example, assume that the price for a kilogram of rice in 2000 was Rs 20 and in 2010 was Rs. 25. Therefore, the Price Index for the year 2010 is :

(Price of rice in 2010 – Price of rice in 2000) / (Price of rice in 2000) * 100

(25 – 20) / (20) * 100 = 25

In this way individual Price Index values for the remaining basket of goods are calculated and then the using a defined mathematical operation(usually weighted average) of individual Price Index figures are found out to arrive at the overall Price Index, which is the cost of the market basket today as a percentage of the cost of that identical basket in the starting year.

What kind of goods and services are used in calculating price index?

Based on the goods and services used for calculation there are two kinds of price indices:

- WholeSale Price Index (WPI) : is the index that is used to measure the change in the average price level of goods traded in wholesale market. It includes all the important and price-sensitive goods, which are traded in wholesale markets across the country.

- Consumer Price Index (CPI) : CPI is a statistical time-series measure of a weighted average of prices of a specified set of goods and services purchased by consumers.

India uses both the Wholesale Price Index (WPI) and Consumer Price Index (CPI) to calculate inflation. Most countries(like USA, UK Japan and China) use the Consumer Price Index (CPI) to calculate inflation.

Difference between WPI and CPI

Difference between WPI and CPI is as follows;

|

Basis For Comparison |

Wholesale Price Index (WPI) |

Consumer Price Index (CPI) |

| Meaning | WPI, amounts to the average change in prices of commodities at the wholesale level | CPI, indicates the average change in the prices of commodities, at the retail level. |

| Published by | Office of Economic Advisor (Ministry of Commerce & Industry) | Central Statistics Office (Ministry of Statistics and Programme Implementation) |

| Measures prices of |

Goods only | Goods and Services both |

| Measurement of Inflation | The first stage of the transaction | The final stage of the transaction |

| Prices paid by | Manufacturers and wholesalers | Consumers |

| How many items covered | 697 (Primary, fuel & power and manufactured products) | 448(Rural Basket)

460 (Urban Basket) |

| What type of items covered | Manufacturing inputs and intermediate goods like minerals, machinery basic metals etc. | Education, communication, transportation, recreation, apparel, foods and beverages, housing and medical care |

| Base year | 2011-12 | 2012 |

| Used by | Only a few countries including India | 157 countries |

| Data released on | Primary articles, fuel, and power (Weekly basis) &

overall (monthly basis since 2012) |

Monthly basis |

What is rate of inflation?

We usually want to know by how much do the prices go up but at what rate do the prices do up?We want to know how much prices have increased since last year, or since we bought our house, or perhaps how much prices will increase by the time we retire or our kids go to college. The formula for calculating the Inflation Rate looks like this:

((B – A)/A)*100

Where “A” is the Starting number and “B” is the ending number. So if exactly one year ago the Price Index was 178 and today it is 185, then the calculations would look like this:

((185-178)/178)*100 = (7/178)*100 = 0.0393*100 = 3.93%

The rate at which the prices of everything go up is called the rate of inflation. If the price of something is Rs 80 then after a year with a rate of inflation of 4% the price go up to (80 x 1.04) = 83.2.

The method of calculating Inflation is the same, no matter what time period we desire. We just substitute a different value for the first one. So if we want to know how much prices have increased over the last 12 months (the commonly published inflation rate number) we would subtract last year’s Price Index from the current index and divide by last year’s number and multiply the result by 100 and add a % sign.

What happens if prices Go down?

If prices go down then “A” would be larger than “B” and we would end up with a negative number. So if last year the Price Index was 189 and this year the PI is 185 then the formula would look like this:

((185-189)/189)*100 = (-4/189)*100 = -0.0211*100 = -2.11%

There is negative inflation over the sample year of -2.11%. Negative inflation is called deflation.

What are variations of inflation?

There are several variations of inflation:

- Deflation is when the general level of prices is falling. This is the opposite of inflation.

- Hyperinflation is unusually rapid inflation. In extreme cases, this can lead to the breakdown of a nation’s monetary system. One of the most notable examples of hyperinflation occurred in Germany in 1923, when prices rose 2,500% in one month!

- Stagflation is the combination of high unemployment and economic stagnation with inflation. This happened in industrialized countries during the 1970s, when a bad economy was combined with OPEC raising oil prices.

What causes inflation?

Because inflation is a rise in the general level of prices, it is intrinsically linked to money. Inflation is caused by a combination of four factors:

- The supply of money goes up.

- The supply of other goods goes down.

- Demand for money goes down.

- Demand for other goods goes up.

Imagine a world that only has two commodities: Oranges picked from orange trees, and paper money printed by the government.

- In a year where there is a drought and oranges are scarce, we’d expect to see the price of oranges rise, as there will be quite a few dollars chasing very few oranges.

- Conversely, if there’s a record crop or oranges, we’d expect to see the price of oranges fall, as orange sellers will need to reduce their prices in order to clear their inventory.

We can also have inflation and deflation by changing the amount of money in the system.

- If the government decides to print a lot of money, then money will become plentiful relative to oranges, just as in our drought situation. This increases the purchasing power of people which often raises the demand for goods and services; however, in the short run, the supply of such goods and services may not rise in equal proportion to meet the demand. This would lead to a rise in prices. Thus inflation is caused by the amount of money rising relative to the amount of oranges (goods and services).

- Deflation is caused by the amount of money falling relative to the amount of oranges.

These scenarios are inflation and deflation, respectively, though in the real world inflation and deflation are changes in the average price of all goods and services, not just one. Two theories are generally accepted by Economists for what causes inflation are:

Demand-Pull Inflation – This theory can be summarized as “too much money chasing too few goods”. In other words, if demand is growing faster than supply, prices will increase.

Cost-Push Inflation – Cost-push inflation basically means that prices have been “pushed up” by increases in costs of any of the four factors of production (labor, capital, land or entrepreneurship) when companies are already running at full production capacity. With higher production costs and productivity maximized, companies cannot maintain profit margins by producing the same amounts of goods and services. As a result, the increased costs are passed on to consumers, causing a rise in the general price level (inflation).

For more details one read Investopedia Cost-Push Inflation Versus Demand-Pull Inflation

How to control inflation?

There are broadly two ways of controlling inflation Monetary measures and fiscal measures.

Monetary Measures : The most important and commonly used method to control inflation is monetary policy of the Central Bank. Most central banks use high interest rates as the traditional way to fight or prevent inflation. Monetary measures used to control inflation include:

- Bank Rate Policy : Central Bank lends to the commercial banks to help the banks meet depositor’s demands and reserve requirements for long term. The Interest rate the Central Bank charges the banks for this purpose is called bank rate. When the central bank raises the bank rate, it is said to have adopted a dear money policy. The increase in bank rate increases the cost of borrowing which reduces commercial banks borrowing from the central bank. Consequently, the flow of money from the commercial banks to the public gets reduced. Therefore, inflation is controlled to the extent it is caused by the bank credit.

- Cash Reserve Ratio (CRR) : To control inflation, the central bank raises the CRR which reduces the lending capacity of the commercial banks. Consequently, flow of money from commercial banks to public decreases. In the process, it halts the rise in prices to the extent it is caused by banks credits to the public.

- Open Market Operations (OMO). Open market operations refer to sale and purchase of government securities and bonds by the central bank. To control inflation, central bank sells the government securities to the public through the banks. This results in transfer of a part of bank deposits to central bank account and reduces credit creation capacity of the commercial banks.

Fiscal Measures: Fiscal measures to control inflation include taxation, government expenditure and public borrowings. The government can also take some protectionist measures (such as banning the export of essential items such as pulses, cereals and oils to support the domestic consumption, encourage imports by lowering duties on import items etc.) Ref: IndiaInfoLine How to control Inflation?

Relation between Inflation and Interest Rates

Whenever you hear the latest inflation update on the news, chances are that interest rates are mentioned in the same breath. In India, interest rates are decided by the Reserve Bank of India (RBI). The RBI meets eight times(?) a year to set short-term interest rate targets. During these meetings, inflation are significant factors in the RBI’s decision. At one extreme, an economy that is growing too fast can experience hyperinflation. At the other extreme, an economy with no inflation has essentially stagnated. The right level of economic growth, and thus inflation, is somewhere in the middle. It’s the RBI’s job to maintain that delicate balance. By changing interest rates, RBI tries to achieve maximum employment, stable prices and a good level growth.

Interest rates directly affect the credit market (loans) because higher interest rates make borrowing more costly. As interest rates drop, consumer spending increases, and this in turn stimulates economic growth. A tightening, or rate increase, attempts to head off future inflation. An easing, or rate decrease, aims to spur on economic growth. Keep in mind that while inflation is a major issue, it is not the only factor informing the RBI’s decisions on interest rates. For example, the RBI might ease interest rates during a financial crisis to provide liquidity (flexibility to get out of investments) to financial markets, thus preventing a market meltdown.

How does inflation affect investments?

Inflation affects common man by reducing the purchasing power of money i.e how much can you purchase with it. If inflation was 4%, an item costing Rs.100 today will cost Rs.104 a year from now. So what you can buy with today’s Rs.100, you will only be able to buy with Rs.104 a year from now. If you keep Rs 1000 in the safe today, after some time what you can purchase with it will be less. The more money you keep stagnant the more money you will be loosing. So if you invest, your money will grow.

Suppose that a year ago you invested Rs 1,000 in some investment and over a year, you make Rs. 1100, then you rate of return is 10% ( 100* (1100-1000)/1000 ) . Is Rs 100 (10%) return real? We have to take into account the chunk inflation has taken out of your return.

So your return is really 6%(10% – 4%). If you invest Rs.100 in the market today and you make money at a 3% “rate of return” in one year you will have Rs.103. But now, since the rate of inflation is at 4%, and your investment has only made 3% so in effect, you are loosing money! Silently, inflation has eaten into your money or your purchasing power has reduced.

What are nominal interest rates and real interest rates ?

The above example highlights the difference between nominal interest rates and real interest rates. The nominal interest rate is the growth rate of your money, while the real interest rate is the growth of your purchasing power. In other words, the real rate of interest is the nominal rate reduced by the rate of inflation.

In our example, the nominal rate is 10% and the real rate is 6% (10% – 4% = 6%).

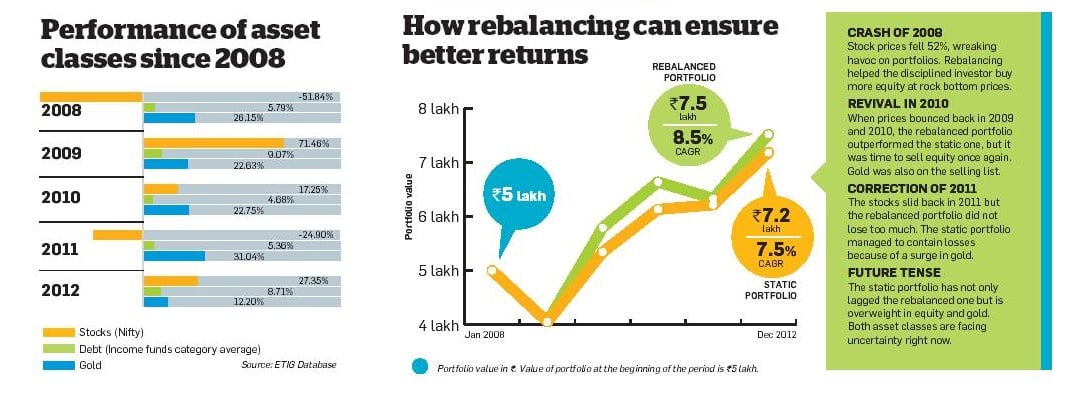

Inflation erodes your returns and decreases your buying power over time. When creating plans for the future with investments, it is important to consider inflation, and attempt an asset allocation that will help you beat inflation.

How to calculate Inflation adjusted future expense ?

To plan and invest accordingly to the future requirements, one needs to calculate the inflation adjusted future expense compared to present expense. Suppose your monthly expense is 5000 and the inflation rate is 7%, you want to know what will be the monthly expense after 15 years ? It can be done by using below formula.

Future Amount =Present expense amount * (1+inflation%)^number of years

= 5000 * (1+7%)^15 = 13,795

13,795 is the amount you require per month after 15 years instead of present 5,000, with an inflation rate of 7%. If the inflation rate is more, the amount also increased accordingly.

Inflation for India

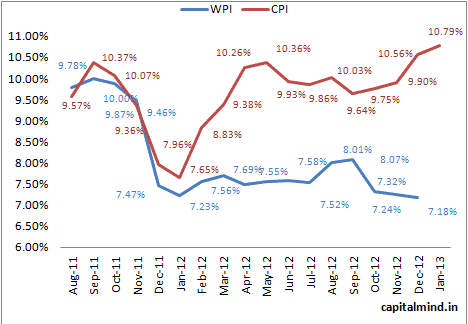

India is a moderate inflation country with average annual inflation rate as measured by changes in the wholesale price index (WPI) increased at a rate of 6.7 per cent per annum. The inflation rate stayed near double digits during 2010-11 and 2011-12 before showing some moderation in 2012-13. There have been phases of sharp spikes in inflation emanating from war, drought and commodity price shocks. Supply shocks when accompanied by demand pressures further amplified inflationary pressures. But the inflation rate has reverted to its trend following policy response and improved supply conditions. The inflation figures from CapitalMind’s Urban CPI Inflation Above 11% With Both RBI and Government Insensitive

Some good references for inflation

- Videos: Salman Khan’s Tutorial on inflation (Salman Khan not the actor, nor the choreographer/winner of Dance India Dance)

- Reserve Bank of India’s Indian Inflation Puzzle, Perspectives on Inflation in India

Related Articles :

- Understanding GDP of India

- Understanding Gross Domestic Product or GDP

- Time Value of Money

- Understanding Returns: Absolute return, CAGR, IRR etc

- Understanding Loans

In the Question and answer format we have tried to explain inflation. What do you feel about inflation? How do you fight with inflation?

Thanks, i took the future expense calculator and the infographics you referenced. thanks for referring.

Thanks lakshmipathy for your feedback. We are planning to have common calculators up on our website soon!