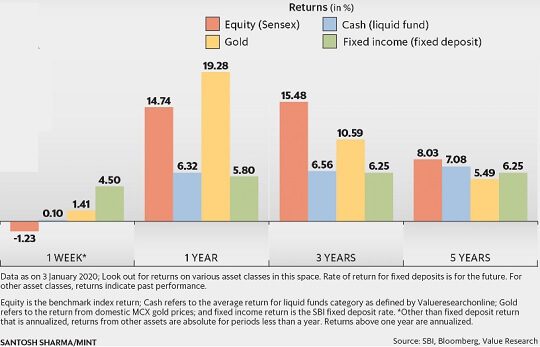

There are various kinds of investment products such as Real Estate, Equity, Mutual Funds, Fixed Deposits, Post Office etc. Investment products are often called investment vehicles. One should invest in different types of investment products based on one’s financial goals, as each investment product gives different types of returns, which is why a portfolio must have an ideal mix of financial products. This lists articles about all Investing options to investors in India. Here’s a look at how four commonly used asset types—equity, cash, gold and fixed income—have done in different periods.

Returns of Gold Equity FD over years

Table of Contents

Different Investing Options

Different vehicles fill different needs – to go from Bombay to Kolkata flight is the fastest option but to go from Netaji Subhash Chandra airport in Kolkata to the hotel a taxi or bus is appropriate. Understanding the various investment options helps one in realizing whether one should invest in it or not. There are many different investment products, or vehicles, because there are many different people with different investment ‘needs’, just as a family with five children has different needs than a single person or a farmer.

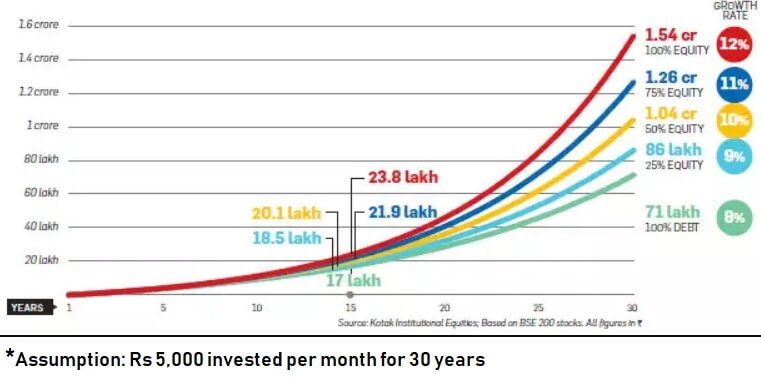

One should invest in different types of investment products based on one’s financial goals, as each investment product gives different types of returns, which is why a portfolio must have an ideal mix of financial products. One must also keep in mind the volatility risk of the asset class, liquidity, lock-in rules and taxation. In 30 years Rs 5000 invested every month for 30 years will grow to 1.54 cr at 12% growth rate and 71 lakh at 8% growth rate as shown in the image below

How much 5000 Rs invested for 30 years will grow at different rates

Comparison of Investment Options

The image below compares various investment classes in terms of Risks, Tenure, Liquidy, Returns and Taxation.

Investment Options in India

Concepts of Investing

- First lesson in financial education:Compound Interest

- Why Is Investing Confusing?An infographic

- What is Investing?

- Journey to Wealth : Start Early

- Beginner To Investing

- Beginner to Investing – Approaches, Plan, Psychology

- Think about Liquidity,Safety,Returns,Risk,Tax

- Oops I did it!,

- Goals Based Financial Planning

- Money Awareness for Beginners

- Time Value of Money

- Mis-Selling or Mis-Buying: It’s My Money, My Responsibility

- Fact or opinion:Do Due Diligence

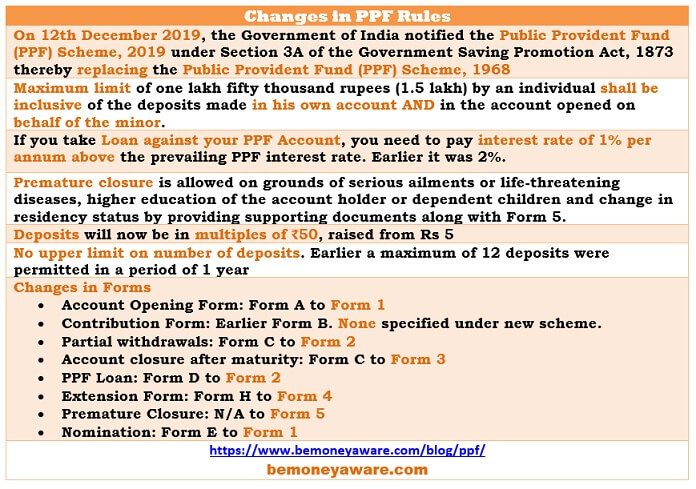

Public Provident Fund

Public Provident Fund (PPF) is a long-term, government-backed small savings scheme of the Central Government started with the objective of providing old-age income security to the workers in the unorganized sector and self employed individuals as they do invest in Employee Provident Fund (EPF).

Understanding Public Provident Fund, PPF

- Overview of PPF

- How to invest in PPF

- Interest Rate on PPF

- Dormant PPF

- Interest Rate on PPF

- Risk in PPF

- Show PPF Interest in Income Tax Return

- Withdrawal from PPF

- Premature closure of PPF

- Loan from PPF

- Nominee in PPF

- Duration of PPF account

Changes in the PPF from Dec 2019

Fixed Deposits

Fixed Deposit is one of the simplest and most used Investment product in India. Fixed Deposits are bank deposits for a fixed or specified period chosen by investor or depositor at a fixed rate of interest. You can deposit money for as short a period as 7 days and upto 10 years. When you open a fixed deposit with the bank then you are lending money to the bank and it pays you interest. As interest rate and time period are fixed this investment product is called a Fixed Deposit. Deposit up to Rs 1 lakh in any bank is protected under the Deposit Insurance & Credit Guarantee Scheme of India

- Details about Fixed Deposits covers Fixed Deposit in detail

- Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund covers Tax and TDS on FD

- Premature withdrawal or Breaking of Fixed Deposit

- Senior Citizen,Fixed Deposits and Tax

- Joint Ownership

- Avoid TDS : Form 15G or Form 15H

Investing in Mutual Funds

A mutual fund is a professionally managed investment scheme that pools money from many investors and invests it in stocks, bonds, short-term money market instruments and other securities in accordance with objectives as disclosed in the offer document.

| What are Mutual funds | Types of MF | Stocks Vs Mutual Funds |

| Direct Investing in MF | Tax and MF | Choosing MF |

| Exiting from MF | Returns | Nominate and Claim |

Direct Investing in Mutual Funds

There are many Apps/Website available in which you can invest directly into Mutual Funds, other than investing through Mutual Fund websites. Our articles

- Direct Investing in Mutual Funds: Difference, Expense Ratio, How to Invest, Apps explains the difference between direct plan and a regular plan, How To Know If You Are Invested In Regular Plans Or Direct Ones

- Compare Direct Mutual Funds Investing Platforms, compares some of these platforms in detail,

- How to invest directly in HDFC Mutual Funds shows how to invest directly in Mutual Funds from the mutual fund websites. You need to create an account in all the Mutual Fund websites,

- What is MF Utility Buy and Sell through MF Utility

- PayTM Money

- ETMoney :

NPS

National Pension System (NPS) is a defined contribution retirement savings scheme.

Link to Following articles covers the topic in detail.

Investing in Gold

- Ways to invest in Gold

- Understanding Gold:Purity,Color,Hallmark

- How Gold Ornament is Priced?

- Sovereign Gold Bonds :Should You Invest

- Reliance My Gold Plan

- Prices of Gold, Silver

- Gold : Infographics

Investing in Stocks

Our article All About Stocks, Equities,Stock Market, Investing in Stock Market covers all topics of investing in Stocks in detail.

- Stock exchange : What is it, Who owns, controls

- Stock Market Index: The Basics

- Blue Chips Stocks and Penny Stocks

- About Buyback of Shares: Types, process, why

- What is Bull Market and Bear Market?

- Difference Between NSE and BSE, Listing of company on Stock Exchange

How to buy sell stocks

- Transaction costs while buying or selling shares or stocks

- Technical Analysis and Fundamental Analysis of Stocks

- How to buy Stock: Delivery or Intraday,Market or Limit,T+2

- UPSTOX:A FAST AND SMART TRADING PLATFORM

Psychology and Stock Market

- Why people Lose Money in Stock Market

- News that affect the Stock Market

- Satyam Scam : Ramalinga Raju

Returns of Stock Market

- Ups and Downs of Sensex

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Comparison of Fixed Deposits and Sensex Returns

- Indians Invest in US Stock Market: Why,DOW, NASDAQ, How to invest

- Budget 2018:Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

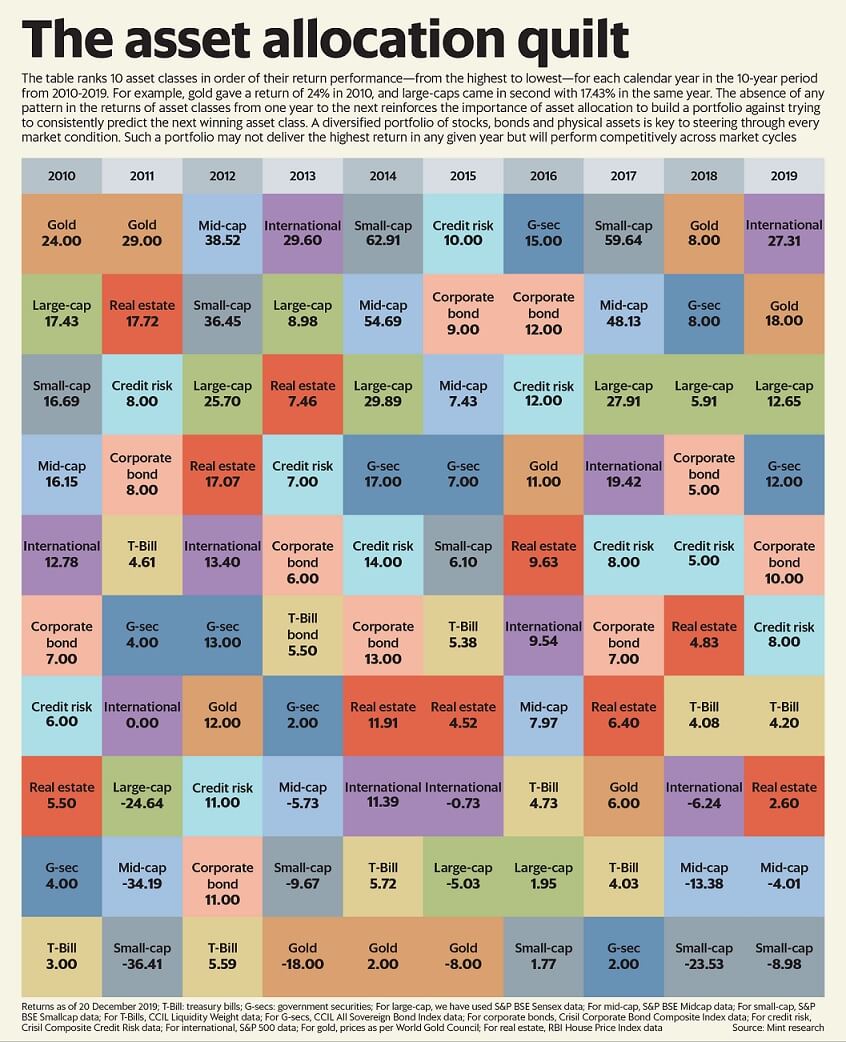

Returns of Various Asset Classes

One Asset class does not perform well in every year. The image below shows the return of various classes over the years.

Returns in various years in Stocks, Debt, Equity from 2010

Taxes

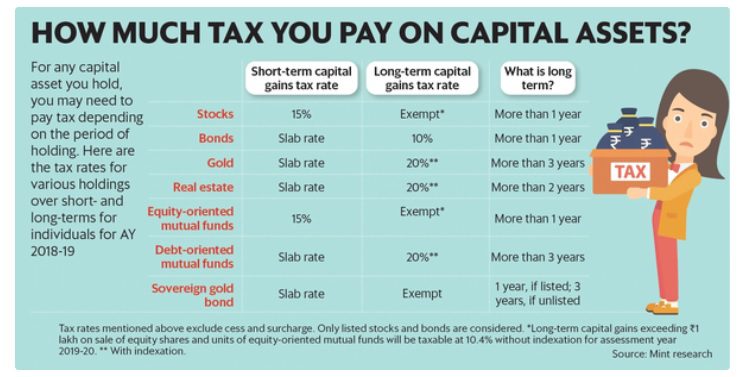

When you sell an investment, stocks, Mutual Funds(Debt and Equity), real estate, gold you can get Capital Gains or Capital Loss. These are taxable and have to be reported in ITR(Income Tax Return) in the financial year when you made the sale. To assess your tax liability and file your tax returns correctly, you need to know what capital gains you earned during the financial year. The image below shows the various taxes one pays

Tax on FD

- Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund covers Tax and TDS on FD

Tax On Selling of House

- How to Calculate Capital gain on Sale of House?

- Capital Loss on Sale of House

- Can Capital Gains on Sale of House be used to pay Home Loan

Tax On Selling Stocks and Mutual Funds

- Long term Capital Gains of Debt Mutual Funds: Tax and ITR

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc

Capital Gain Tax : Long and Short Term

Paper Work

Most of us assume that our family will get access to our investments, bank accounts when we are no more but the law doesn’t recognize things this way. It needs valid papers in the form of Survivorship mandate, Nominations, Will. What are the type of records to keep, what to keep, why and for how long.

If there are no nominees then banks, Mutual funds, PPF account, Demat accounts, Insurance Policies require lots of additional documents such as a will, legal heir certificate, no-objection certificate from other legal heirs etc.

Note though a nominee is an important person, he or she has no rights over the money or assets unless that is specified under the will. (except for shares)

What is Will, How does it differ from Nomination etc? How to make a Will?

- Bank Statements,Income Tax Statements,Property Records

- NSDL CAS, CDSL CAS: Statement of holdings in all Demat Accounts, Mutual Funds

- What is Folio Number in Mutual Funds?

- How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc

For your family

- Nomination, Will, Operation of Joint Account

- Will: Right PaperWork For Those You Love-Part II: What is Will, How does it differ from Nomination etc? How to make a Will?

- How to Nominate:Bank Account, Mutual Funds,

Maintain a Money Book

- It should be one-stop for all your financial information. Your insurance,(life, health, motor), your bank details(Accounts, Lockers, Demat Account, Credit Card), Your Loans(Home loan, Auto loan), your investments(FD, Mutual Funds, PPF, EPF, Others..) It would help you to stay organised as it will have all your information in one place

- It would be your legacy book: So your family don’t have to go through the inconvenience of searching for documents and whom to contact,

After Death

DEATH of a dear one is an unbearable blow. Apart from the loss his family has to confront issues relating to the transfer and distribution of the dead one estate, which includes all his property, assets etc. Then there are tax issues to be dealt with. These include filing of returns for income earned by the deceased till the time of death, and helping the tax department with assessment proceedings. Some of the articles which can help you are given below.

- Income Tax Return of Deceased:

- Bank Account,Term Deposit,Locker:Paperwork Required For Claim

- Succession Certificate,Letter of Administration,Probate of Will

- Claiming Deceased’s Mutual Fund Units

- On Inheriting,Tax of Property,Mutual Funds,Shares,FD etc