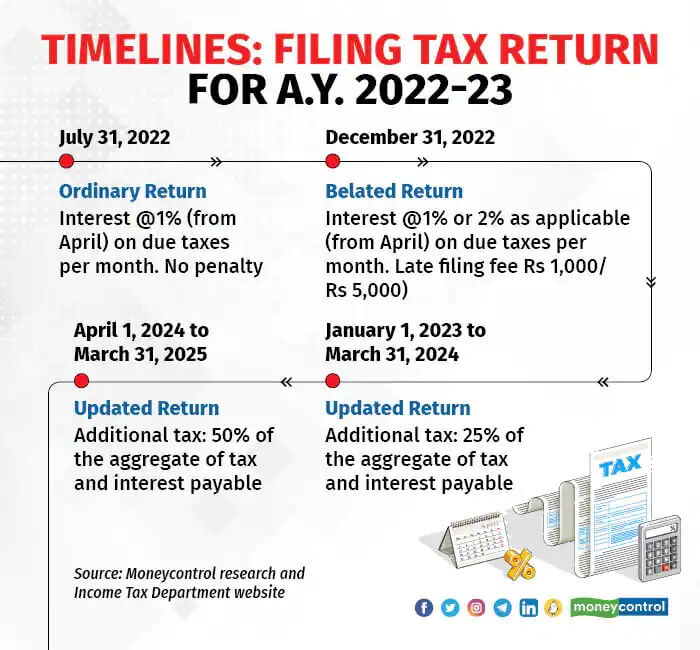

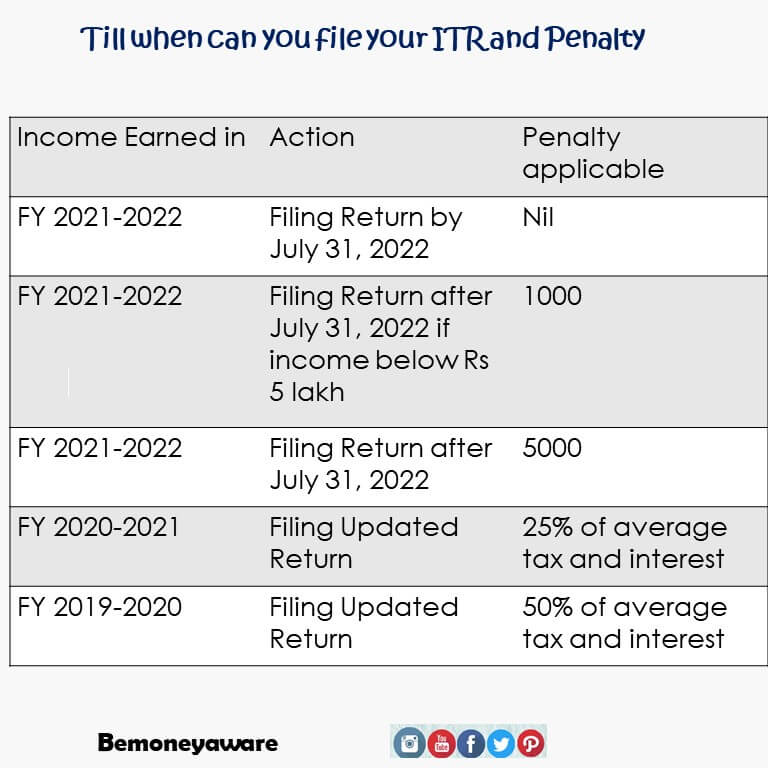

If you have missed December 31 deadline for filing your belated tax return or revising your filed ITR, then you have the option to file an updated ITR, ITR-U, under Section 139(8A) with some penalty and extra tax. An updated ITR, is an updated return that allows you to file/update any of your previous returns within 24 months of the year in which the original return was to be filed/was filed. ITR U is introduced to improve tax compliance by taxpayers without involving litigations. This was announced in the Budget 2022.

Table of Contents

What is Updated ITR return?

An updated ITR,ITR-U, is an updated return that allows you to update/file any of your previous income tax returns under section Section 139(8A) within 24 months from the end of the relevant assessment year. ITR U is introduced to improve tax compliance by taxpayers without involving litigations.

- The updated return can be furnished within 24 months from the end of the specific assessment year. For example, for the assessment year 2022-23, an updated return can be filed by 31 March 2025

- The government introduced the concept of updated returns in the Union Budget 2022.

- An updated ITR (ITR-U) can be filed irrespective of whether an individual has filed an original, belated or revised ITR or has completely missed filing the form in a particular financial year.

- A taxpayer could file only one updated return for each assessment year(AY).

- You cannot file a Nil return in ITR-U.

- ITR-U cannot be filed when there is no additional outflow of tax.

- An additional tax shall be levied u/s 140B.

- The additional tax is 25% or 50% of the tax and interest due, depending on whether the ITR-U is filed within 12 or 24 months from the end of the relevant assessment year.

Your total income tax liability would be as under:

Total Income Tax Liability = Tax Payable + Interest +Late-filing fees + Additional Tax

Net Tax Liability = Total Income Tax Liability (as above) – TDS/TCS/Advance Tax/Tax Relief

Note: that ITR-U cannot be used to show a loss return, claim income tax refund and so on.

When can an Updated ITR be filed?

An Updated Return can be filed in the following cases:

- Did not file the return. Missed return filing deadline and the belated return deadline

- Income is not declared correctly

- Chose wrong head of income

- Paid tax at the wrong rate

- To reduce the carried forward loss

- To reduce the unabsorbed depreciation

- To reduce the tax credit u/s 115JB/115JC

When can an updated ITR not be filed?

ITR-U cannot be filed in the following cases:

- Updated return is already filed

- For filing nil return/ loss return

- For claiming/enhancing the refund amount.

- When updated return results in lower tax liability

- Search proceeding u/s 132 has been initiated against you

- A survey is conducted u/s 133A

- Books, documents or assets are seized or called for by the Income Tax authorities u/s 132A.

- If assessment/reassessment/revision/re-computation is pending or completed.

- If there is no additional tax outgo (when the tax liability is adjusted with TDS credit/ losses and you do not have any additional tax liability, you cannot file an Updated ITR)

What is the time limit to file ITR-U?

ITR-U is applicable from 1st April 2022. So during the current financial year 2022-23, you can file ITR-U for AY 2020-21 and AY 2021-22.

E.g., The Return of FY19-20 can be updated till 31st March 2023.

Steps to File ITR-U (Income Tax Updated Return) Form

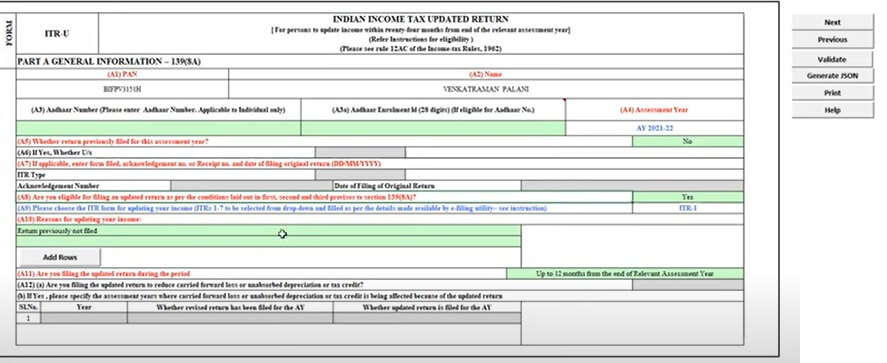

The Updated ITR form has been kept very short and simple so that the assessee can fill in the relevant information easily. Income Tax Department has enabled E-filing of Updated ITR u/s 139(8A) for AY 2020-21 and AY 2021-22

- Download the ITR U Excel utility fill it from Income Tax e-filing portal for the Asssement Year you are interested in. Go to the Download section of the Income Tax Site (https://www.incometax.gov.in/iec/foportal) and select the AY for which you want to file Updated ITR. Check our article Difference between Assessment Year and Financial Year for details

- You can import the pre-filled data in the Excel utility by clicking on import pre-fill. It will take you to e-file income tax return and then click on download pre-filled data

- Under Filed u/s option choose Section 139(8A)

- Fill the reason for filing an updated return

- Fill when are you filing the updated return (Options are with 12/24 months from the end of relevant assement year)

- Fill the different Types of Income you earned in that Assessment Year like Income From Salary, Income from House Property etc

- Claim any Tax Deductions/Exemptions

- Fill/Verify the TDS

- Click on Calculate Tax

- Pay the Tax due using Challan 280, update the details. Check our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR for details

- Load the Json file on the Income Tax e-filing portal

- If you are an individual earning salaried income and have not done trading then you have select not audited under section 44AB. Tax audits are generally required for companies and individuals whose total sales, turnover, or gross receipts exceed a certain threshold in a financial year. For more details you can check out our article What is Tax audit

- Complete the verification

- Submit the return

Video about Updated ITR

This YouTube video from Income Tax explains what is updated ITR and how to file Updated Income Tax Return (ITR U)

Related Articles:

- How to Revise Income Tax Return (ITR)

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- E-filing : Excel File of Income Tax Return

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Updated ITR, ITR U: What is it? How to file it?

- Missed Filing ITR: Check Tax Liability,File Condonation of Delay

It is best to file ITR before the deadline. After missing the deadline one has to pay extra penalty and extra tax. You can file Updated ITR, ITR-U even if you missed the original ITR filing deadline.