UPI 2.0 was launched on 16 Aug 2018 with additional features such as View Invoice and then Pay, QR support, One Time Mandate, Link your Overdraft account. These are explained in detail in the article.

Table of Contents

UPI

UPI was launched on 11 April 2016 and in the last two years, the platform has emerged as a popular choice among users for sending and receiving money. BHIM UPI recorded transactions worth Rs 45,845 crore and 235 million in terms of value and volume in the month of July 2018.

UPI 2.0 was launched on 16 Aug 2018 with additional features such as View Invoice and then Pay, QR support, One Time Mandate, Link your Overdraft account. These are explained in detail in the article.

UPI is a single payment interface across all payment systems thus enabling all account holders to send and receive money from their smart phones using a single identity mode- Aadhar Card Number, Mobile Number or virtual payment address. This doesn’t require the bank details of the beneficiary or the sender. The ultimate aim of UPI is to enable cash-less hassle-free transactions all the time, i.e, 24 x 7, for millions of people in India

UPI makes sending or receiving money easy like sending an email. To send or collect money you need to just give the UPI id and you are done. So no remembering bank account number, IFSC code etc.

Just like you need to create an Email account similar way you need to create a UPI id which linked with your bank account.

Our article What is Unified Payment Interface or UPI? How to use it? explains UPI in detail

UPI 2.0

The key features of UPI 2.0 are given below. UPI 2.0 member banks as on Aug 2018 are State Bank of India (SBI), HDFC Bank, Axis Bank, ICICI Bank, IDBI Bank, RBL Bank, YES Bank, Kotak Mahindra Bank, IndusInd Bank, Federal Bank and HSBC.

One-time mandate

Have the funds but don’t want to pay now? For example, you want to pay for the cab ride after reaching your destination. UPI 2.0 allows you to block funds for future use!

UPI mandate could be used in a scenario where money is to be transferred later by providing commitment at present. UPI 2.0 mandates are created with one-time block functionality for transactions. Customers can pre-authorise a transaction and pay at a later date. It works seamlessly for merchants as well as for individual users. Mandates can be created and executed instantly. On the date of actual purchase, the amount will be deducted and received by the merchant/individual user.

Have the funds but don’t want to pay now? UPI 2.0 allows you to block funds for future use! @Olacabs @Uber #UPI2.0 #HighOnUPI pic.twitter.com/aBjO636Rb4

— NPCI (@NPCI_NPCI) August 16, 2018

Verify Invoice before payment

UPI 2.0 gives you the additional freedom of verifying the invoice details before payments!

According to NPCI, this feature is designed for customers to check the invoice sent by merchant prior to making payment. It will help customers to view and verify the credentials and check whether it has come from the right merchant or not. Customers can pay after verifying the amount and other important details mentioned in the invoice.

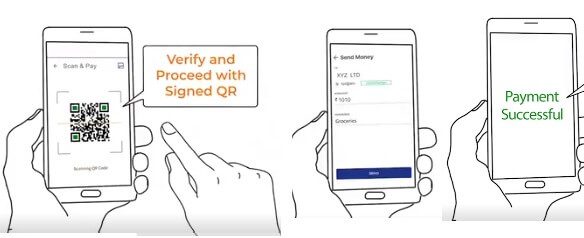

Signed intent and QR

Pay via verified QR codes & signed intents of merchants before you make a payment. Secure, hassle-free & convenient way to make sure your money isn’t misused!

This feature is designed for customers to check the authenticity of merchants while scanning QR or quick response code. It notifies the user with information to ascertain whether the merchant is a verified UPI merchant or not. This provides an additional security. Customers will be informed in case the receiver is not secured by way of notifications.

Linking of overdraft account to UPI

In addition to current and savings accounts, customers can link their overdraft account to UPI. Customers will be able to transact instantly and all benefits associated with overdraft account shall be made available to the users. UPI 2.0 will serve as an additional digital channel to access the overdraft account.

What is Overdraft account?

An overdraft facility is a credit agreement made with a bank that allows an account holder to use or withdraw more money than what they have in their account up to the approved limit i.e The overdraft facility works like an approved loan.

Typically overdraft facility granted to people with current account up to an agreed limit. Establishing an overdraft facility with a bank can help individuals or small businesses with short term cash flow issues.

Many Banks offer temporary overdraft facility against your monthly salary. For example, if you have HDFC Bank Corporate Salary Account, then you can avail of Smartdraft, overdraft against your salary if your minimum net monthly income is above Rs. 15,000 and your salary account with HDFC has regular salary credits and your company is on HDFC approved list for overdraft facility. This amount is made available in your Salary Account. You can withdraw it through the regular modes i.e. ATM, Cheques, online transfers. You can get a loan worth up to three times your salary, and you won’t have to worry about repaying the loan in EMIs.

The line of credit is typically given based on account holder balances, and as pre-sanctioned loans against assets such as bank FDs, shares and bonds offered as collateral.

The sanctioned overdraft limit and the interest charged will vary based on the nature of the asset offered as collateral.

Money can be withdrawn as and when required and the interest has to be paid only on the amount borrowed and only for time it was borrowed.

The process to apply for an overdraft facility is similar to taking any other loan from banks. You will offer an asset as collateral to banks and obtain overdraft facility. The duration is longer for sanction of overdraft in case collateral is your home since it requires property valuation and survey from bank / government officer. Whereas, getting an overdraft amount sanctioned against fixed deposits or life insurance policy is quick.

Banks charge a processing fee of 0.5% to 1% with a cap of Rs 25,000 along with collateral. This overdraft facility is approved for one year and the bank reviews value of assets as collateral every year.

Related Articles:

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards

- What is Unified Payment Interface or UPI? How to use it?

- Payment Banks,Types of Banks in India, History of Banking in India

- Interest on Saving Bank Account : Tax, 80TTA

Have you started using UPI? Which Digital payment method do you use?

Hi

I have applied for pf withdrawal.

The approved amount is showing 62109/-

In passbook also the same amount is reflecting.

But I have received onle 56000/- through neft transfer.

Can you please help me, why this deduction happened?

10% of TDS has been deducted.

Did you work for less than 5 years?

10% of 62109 = 6210.9

Total payable amount=62109-6210.9=55898.1 approx 5600

Please check your Form 26AS. There should be an entry for TDS deduction in EPF.

Can you send the snapshot of your Form 26 for EPF deduction to our email id bemoneyaware@gmail.com

Our article Viewing Form 26AS on TRACES explains how to View Form 26AS in detail