There’s income tax and then there’s the Wealth Tax. Wealth tax is levied on individuals, HUFs (Hindu Undivided Family) and companies, if their net wealth from assets is more than Rs 30 lakh in a financial year, they may be liable to pay wealth tax. May be because they may get the benefit of certain exemptions. Wealth Tax was levied at a flat rate of 1 per cent on net wealth above the limit of Rs 30 lakh. This article will talk about when was Wealth Tax abolished, why was Wealth Tax abolished, Replacement of Wealth Tax and for interested readers Wealth Tax in detail.

Wealth tax is no longer leviable with effect from the assessment year 2016-17 i.e from 1 Apr 2016.

Table of Contents

Wealth Tax Abolished

Though the government has been able to successfully enact Wealth Tax act in India for nearly 57 years , it has now scrapped the Act in it’s entirety w.e.f 1st April, 2016. This means that the return of wealth need not be filed for the Financial Year 2015-16. Thus, with a view to tax super rich and not less affluent ones, an additional 2% surcharge is imposed. It is expected that this additional surcharge would generate a revenue of 9000 crores. Foregoing 1008 for earning 9000 sounded beneficial. Hence, wealth tax was abolished and a 2 fold benefit was achieved.

Wealth Tax was abolished due to Limitations of the Wealth Tax Act:

- The assets had to be valued by a registered valuer in order to be disclosed in the wealth tax return which was a arduous job carrying unnecessary burden of expenses on the assessee.

- Unproductive assets like, jewellery, unaccounted cash, cars are not easy to be tracked and gives an opportunity to the assessee to do away with the disclosures of such assets.

- Not many assessees in India pay wealth tax, many of them aren’t even aware of such a levy until served with a notice. The number of wealth tax asseseees in India was just 1.15 lakhs in 2011-12.

- The tax collection collection through wealth tax does not form a significant part of the total collection of Direct taxes in India. The wealth tax collection in the years 2011-12 and 2012-13 was ₹ 788.67 crore and ₹ 844.12 crore respectively. The collection from wealth tax was just 1008 crores in the year of 2013-14. Whereas, the cost of collection and the cost of compliance was more. The ratio did not seem to be favorable.

Wealth Tax Replacement

Pran jaaye par tax na jaye. An additional surcharge of 2% is now to be levied where the income exceeds ₹1 crore of :

- Individual, HUF, AOP, BOI, whether incorporated or not;

- Cooperative societies

- Firms or local authorities

Individuals and HUFs (Hindu Undivided Families) with income above a specified limit, filing returns in ITR-3 and ITR-4 are already required to furnish information of their assets and liabilities in their annual return of income.

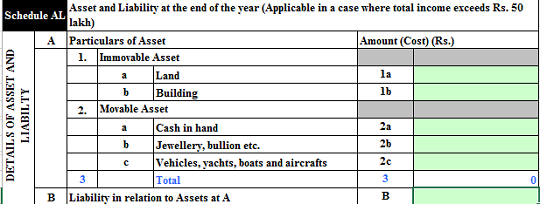

From assessment year 2016-17(FY 2015-16), individuals and HUFs filing their returns of income in ITR-1, ITR-2, ITR-2A and ITR-4S, having income exceeding Rs 50 lakh will now be required to furnish information regarding assets and liabilities in schedule-AL of the relevant ITR form.

Wealth Tax Act

Wealth tax is a direct tax, which is charged on the net wealth of the assessee. It is governed by the Wealth Tax Act. The Wealth Tax Act came into force on April 1, 1957 and it extends to whole of India including the State of Jammu and Kashmir. You can read the Wealth Tax Act at vakilno1 : Wealth Tax Act or indiankanoon.org : Wealth Tax Act.

Assets for Wealth Tax

Assets to be considered for Wealth Tax are:

- Residential properties. One residential property is exempt, taxpayer can choose whichever property he wants exempted.

- Vacant plots of land (other than agricultural land)

- Jewellery, bullion, furniture, utensils and any other article made wholly or partly of gold, silver, platinum or any other precious metal

- Cars, Aircrafts, Yachts (other than for business of hire); and

- Cash in excess of Rs 50,000 (this is cash in hand and not in the bank)

Assets not considered for Wealth Tax are:

- Financial assets such as bank balance, stocks, mutual funds, bonds and deposits are not included in assets.

- A property which is given out on rent for at least 300 days in a year is not considered to be an asset.

- If you hold any of the above assets as stock-in-trade, they will not be considered your assets for Wealth Tax purposes. So if a developer holds apartments that he proposes to sell, they will not be considered assets for the purpose of Wealth Tax. a jeweller holding jewellery worth crores of rupees but as stock-in-trade of his business is not liable to pay any wealth tax on such jewellery.

Global Assets

A recent amendment in section 17 (w.e.f July 1, 2012) of the Wealth Tax Act mentions that if any person is found to have any asset or financial interest in any entity located outside India, it will be deemed to be a case where net wealth chargeable to tax has escaped assessment and the wealth tax assessment can be re-opened within 16 years. If one does not mention the asset outside India and the wealth tax authorities, decide to pick up his/her case for scrutiny and probe further, they could be in a strong position to re-open wealth tax assessment, global asset would be deemed to be wealth escaping assessment and penalties would be levied.

Ownership of Assets

Wife and Minor Child: Assets also include those assets that are transferred to the spouse, minor child or wife of son without adequate consideration. So if you have gifted property to your spouse or transferred property in the name of your minor child or in the name of your son’s wife, without any consideration, the asset will be considered to be held by you for Wealth Tax Purpose. The value of chargeable assets owned by the wife is included only if they have been gifted by you to her. Thus, if your wife owns jewellery worth Rs 40 lakh which was gifted to her by her parents, then such jewellery is not to be included in your chargeable wealth.

The position of the chargeable wealth of your minor children is different. Irrespective of who gave the chargeable asset to your minor child, the value of such assets has to be included in your chargeable wealth. But if the value of your spouse’s chargeable wealth is higher than your chargeable wealth, then the minor child’s chargeable wealth has to be included in your spouse’s wealth and she has to pay the wealth tax on such assets also.

Net Wealth

While working out your aggregate assets on which wealth tax is payable, you are permitted to deduct any liability or a loan taken by you. Wealth Tax is on Net Wealth. Net wealth is the aggregate value of all the above mentioned assets minus any loans taken in order to purchase these assets. So if you have acquired a second house that cost, say, Rs 50 lakh by taking a loan of Rs 40 lakh, the net value of that house on which wealth tax will have to be paid will be only Rs 10 lakh.

Valuation of Assets

For the purpose of Wealth-tax the value of any asset (other than cash) shall be its value as on the valuation date determined in the manner laid down in Section 7(2) and in Schedule III to the Wealth Tax Act. There are different valuation mechanisms for each asset explained as follows:

- For Property : a multiplier factor is applied to the net rent.

- For Jewellery : value of jewellery shall be estimated to be the price which it would fetch if sold in the open market on the valuation date. If the value exceeds Rs 5 lakh a report of a registered valuer must be attached. In support of the valuation of jewellery, the prescribed form to be attached with the return is:

- Where the value of the jewellery on the valuation date is upto Rs.5 lakhs, a statement in Form No. 0-8A, a prescribed by rule 13(c), signed by the assessee, or

- Where the value of the jewellery on the valuation date exceeds Rs.5 lakhs, a report of Registered Valuer in Form No.0-8, as prescribed by rule 8D.

- Other assets : the Assessing Officer may conduct the valuation himself or refer the valuation to a Valuation Officer.

Note that Jewelry Includes:

- Ornaments made of gold, silver, platinum or any other precious metal or any alloy containing one or more of such precious metals, whether or not containing any precious or semi-precious stones, and whether or not worked or sewn into any wearing apparel.

- Precious or semi-precious stones, whether or not set in any furniture, utensils or other article or worked or sewn into any wearing apparel.

Rates of Gold and Silver for Wealth Tax valuation Purpose can be found at TaxGuru. The report can be the basis for arriving at the valuation for 4 subsequent years. All that is needed is to substitute the value of gold, silver or any alloy of the base year with that of the relevant year. Again, adjustment for purchases and sales made during the relevant year will have to be carried out. Valuation can be a complicated and tedious process and it would be best to consult a professional for this.

Wealth Tax

Wealth tax is levied on individuals, HUFs (Hindu Undivided Family) and companies. Pensioners, retired persons or senior citizens have not been accorded any special benefits under this Act. Wealth tax is payable over and above the income tax on the income earned by you during the year, irrespective of whether that asset generates any income for you or not. Jewellery does not generate any income, but wealth tax is payable on it.

The due date for filing wealth tax returns is the same as the due date for filing income tax returns, that is, 31st Jul. If the assessee is liable for an audit, the last date of filing is 30 September. If you miss the last date, you can still file the return before the expiry of one year from the end of the assessment year.

Wealth tax is levied at the rate of 1% over and above the limit of Rs 30 lakh. (Before 31st Mar 2009 limit was 15 lakh). No surcharge is levied on wealth tax.

Ex:If the value of the assets adds up to Rs 75 lakh, you have to pay Rs 45,000 (1% of Rs 75 lakh – 30 lakh i.e 45 lakh) as wealth tax.

While income tax is a tax on the income earned in a particular year, wealth tax is a tax on the value of assets held on 31st Mar of the year. So if you sell a property before the 31st of March of a financial year, you would not have to include that asset while calculating wealth tax. But the gains from the sale would be included in income tax.

Examples of Wealth Tax Calculation

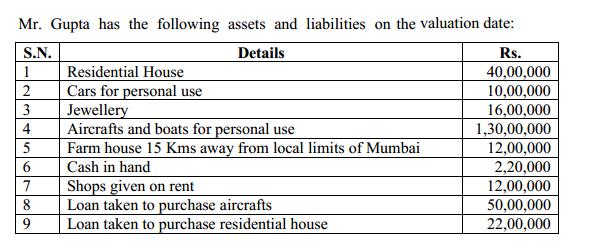

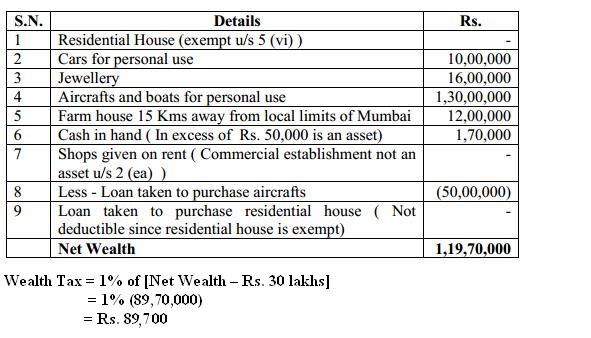

Let’s see how to compute Wealth Tax for Mr. Gupta. His assets and liabilities are given below:

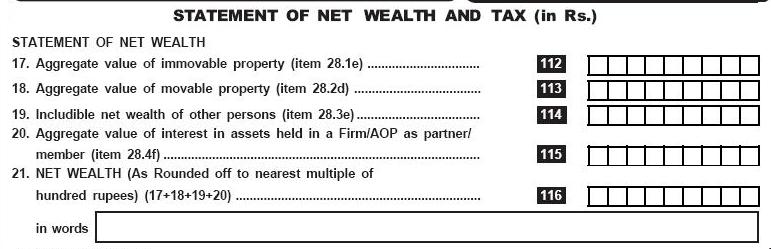

Calculation of Net Wealth and Wealth Tax is as shown in picture below:

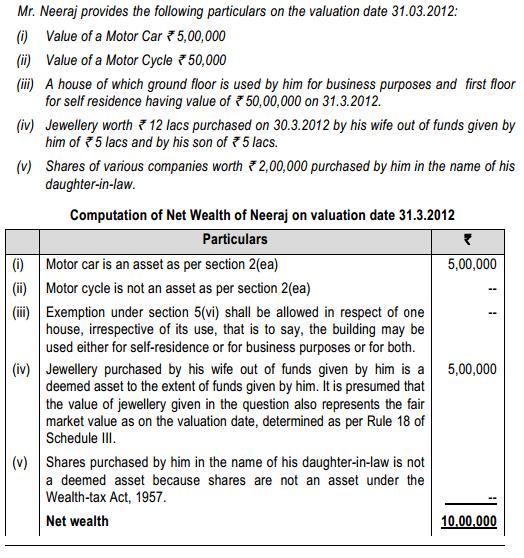

Another example of Net Wealth Calculation For Mr. Neeraj is shown below.As his net wealth is less than 30 lakhs he does not have to pay any wealth tax:

Penalty for not filing Wealth Tax

The penalty for not filing wealth tax returns is as follows:

- 1% interest for every month of delay from the due date.

- Tax evasion invites penalty ranging from 100% to 500% of the evaded amount.

- In extreme cases, imprisonment ranging from six months to seven years, with fine, if the wealth tax exceeds Rs 1 lakh.

Laxity on the part of the government has encouraged taxpayers to ignore their wealth tax liability. Wealth tax raked in only Rs 787 crore for the exchequer in 2011-12, which was a piffling 0.16% of the total direct tax kitty of Rs 4,93,912 crore. The securities transaction tax brings in seven times as much revenue as the wealth tax. An increased focus on wealth tax compliance can bring in significant revenue for the exchequer. The best part is that there cannot be any political opposition to such a move because the law already exists. All that the government needs to do is invoke it more seriously, say tax experts.

Forms

Form prescribed for filing return of wealth tax is Form BA. Form BA has to be filed with the wealth tax officer. The income-tax authorities specified under the Income-Tax Act shall be the wealth-tax authorities too. The form BA can be downloaded from here(pdf format) or clicking on image which shows part of the form.

References: HinduBusinessLine : When to file your wealth tax return, FinoTax: Wealth Tax Return

This article tried to bring awareness about Wealth Tax. Waiting for your comments/feedback. Please use it for information purpose only. Check out our Disclaimer.

Trackbacks/Pingbacks