Chatbots or Robots that Chat are computer programs, to answer questions or perform tasks in a conversational human style through an app or online service. Chatbots have been deployed by companies like travel websites, Facebook, Google etc to book flight tickets, compose a mail, set an alarm clock etc and also banks. This article answers questions like What are Chatbots? How do chatbots work in banking and financial institutions? Which Banks have adopted it? What are the advantages and limitations of Chatbots?

“I don’t know anyone who likes calling a business. And no one wants to have to install a new app for every business or service that they interact with. We think you should be able to message a business, in the same way you would message a friend.” — Mark Zuckerberg at F8 in 2016.

Table of Contents

What are Chatbots?

You can access Chatbot available on a website or through mobile app after logging in and in some cases without logging in also. Previously there were Chat windows, similar to Whatsapp, where one typed the query and a real person replied in some time. This has been replaced by Chatbots, they are like a virtual assistant, deployed to perform a wider range of task 24 X 7 X 365 round the clock at the tap of a button.

Technically, Chatbots are Artifical Intelligence(AI) based system, which uses machine learning, Natural Language Processing (NLP) to access the data, empowered to perform a transaction, provide services etc.

NLP helps Chatbots to understand natural language and emotions & respond accordingly. Machine learning helps to learn consumer behaviour and provide solutions accordingly. With these, there are set of frequently asked questions saved in the database to help bots answer fast and easy, coupled with machine learning and NLP.

Types of Chatbots

Currently, the most popular uses of chatbots are through messaging apps and services, allowing customers to talk directly to a business or vice versa.

- Chatbots provide online assistance and helpdesk facilities to customers so one need not wait to speak to a customer services representative.

- Chatbots are also being used by companies to reach out to users through instant messaging services such as Facebook Messenger. It can be in a customer service facility, or alternatively to send push notifications or vouchers to customers that might be in a particular location, or signed up to loyalty schemes.

- Chatbots as personal assistant services such as Alexa, Google Home, Siri (Apple iOS), Cortana (Microsoft Windows) and Google Assistant (Android) can be found in many mobile devices as they are able to use AI and machine learning to respond to questions. Some services are even able to link to external apps and services to provide richer experiences, such as weather updates, travel times, or even restaurant reservations.

Chatbots in Financial Sector in India

Earlier one used to call customer care of the bank and could do basic transactions while interacting with the customer executive. Since then things have changed. Chatbots have introduced to perform tasks & services like providing account summary, changing ATM card pin, suggestions to save money, pay bills, help the customer to do transactions etc. Now you don’t need to call customer care, just type a message to the chatbot and most of your query will be done.

Indian banks & NBFCs are proactively embracing the change in the technology. You can see the use of ChatBot on your bank’s website or app. They are redefining the banking and it’s many services completely.

SBI, HDFC, ICICI, YES, AXIS and many more banks have implemented it already in the year 2017. Similarly, non-banking financial companies (NBFC) are also not behind in the race and they are catching up fast with the technology. Muthoot finance, Fullerton India, Bajaj Finserv, HDFC Securities etc. have also adapted bots.

Several Indian fintech startups have developed these chatbots. Active.ai, a Bengaluru based fintech startup got projects from IndusInd Bank and HDFC securities. Banks are developing these chatbots on their own and taking help from small and big tech companies to get an edge.

| Banks | Name of ChatBot | |

| ICICI bank | iPal | |

| YES Bank | YES Robot | |

| SBI | SIA (SBI Intelligent Assistant) | |

| HDFC Bank | EVA | |

| AXIS Bank | Axis Aha | |

| Kotak Mahindra Bank | Keya | |

| IndusInd Bank | IndusAssist | |

| NBFC | ||

| Muthoot Finance | Mattu & Mittu | |

| Bajaj Finserv | Blu |

Example of Banking Chatbot

ICICI bank launched iPal chatbot in the Oct 2017,

one of the early adopter of this technology in India. Through iPal one can perform many transactions like bill pay, fund transfer, recharge and make queries about Insurance, credit card, personal loan etc.

It can do simple operations smoothly, in case things go little complex then it automatically calls the executive for their intervention, this makes banks to achieve high operational efficiency. The interesting part is while the executive replies to the complex queries through the chatbots window, it captures the information and starts learning on its own (Machine learning at work).

iPal also works on voice commands and can be integrated with virtual assistants like Alexa, Siri, Cortana. ICICI bank intends to work shift 50% of mundane work to this chatbots.

Here is a snapshot from ICICI bank’s website. Left side there is a window of iPal. Similarly, other banks have also implemented this type of chatbot.

Advantages of Chatbot

Chatbots are simple, No new app to download

Chatbots can have conversations with the best timing, based on users’ interactions.

The main benefits of the chatbot are it gives real-time service or data, 24X7 self-service, highly efficient, it can access records in no time for you. As of now, these chatbots are primarily used for customer support, marketing & lead generation. Businesses can now spend less time on meaningless tasks, focus on creating value for your customers.

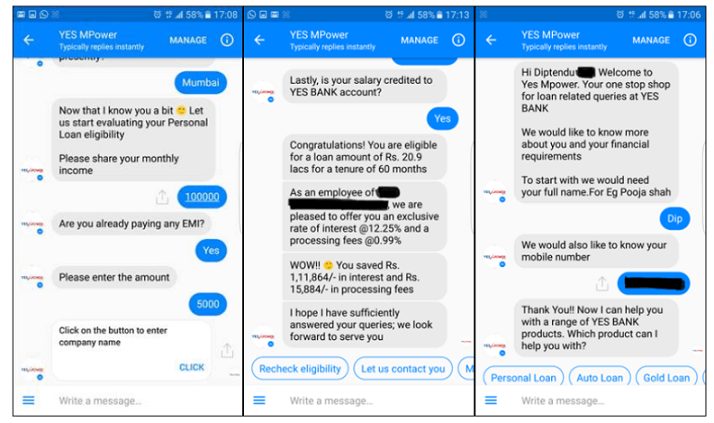

We have personally used these chatbots many times on different platform. Turn around time of bots are negligible which makes the customer experience very delightful. We sent few queries to the chatbot of YES bank and this is the result we got.

Limitations of ChatBots

As with any new technology, chatbots have had to overcome a number of issues as part of their evolution process. Facebook was also forced to shut down one of its AI chatbot processes after the system started conversing in a language of its own formation, raising fears it had superseded human control.

With all their benefits, chatbots come with some limitations too. Let’s see a few of them.

- Bots can not handle complex queries which involves multiple questions or random information.

- To decrease the time of user interaction and generate quick responses bots and implemented but at times Bots can take too long to process any query. They get the information from the internet and collect data set out of that information which can be a time taking process.

- A machine can’t always generate an accurate result, so does the bot, especially when it is in its learning stage. Hence there are 20-30% chances that the bot generates the wrong result for any given question.

- Companies need to be extremely careful and attentive on what informations are being programmed in their bots. Bots answer questions with the information programmed in it if they have wrong information it can mislead a user.

- Learning is a slow process, most of the bots in today’s banking and finance industries are still in the initial stage of learning, they can’t be programmed to handle the infinite number of scenarios that a human can handle.

- We, humans, have the tendency to answer any question by taking account of context, situation and our answer varies user to user, whereas bots don’t pursue this level of intelligence yet.

Ultimately the challenge will be whether a chatbot is able to pass the famous Turing Test and fool a human into thinking they are conversing with a real person.

Wrap Up

White collar automation, as they call it, will continue and there is no stopping. The banking sector is the one which has embraced it with open arms and it has helped them with increased operational efficiency and reduction in spendings. Days are not far when we will see a robot in a bank which will perform complex jobs at ease.

As of now, chatbots have been used by many banks and NBFC companies however there are many small banks who are yet to hop on the bus, waiting for technology to turn cheap. For consumers, they should get their hands on the chatbots, voice bots and visuals bots as companies are ambitious to reduce human interaction and make the robot do process-oriented jobs at scale.

We are eager to see where this ‘Bo(a)t’ will take us! How has been your experience with the chatbots?

nice, is there need to pay for Chatboats to keep on personal sites.?