Reliance Industries becomes the first Indian company to cross ₹10 trillion in market cap on BSE. Market cap stands for Market capitalization is the total valuation of the company calculated by multiplying the current market price of the company’s share with the shares (total outstanding or free float) of the company. Market Cap is used to determine the size of a company and allows an investor to make calculated guesses such as risk associated, returns, liquidity(how easy is to trade)and what information one can get. How is Market Capitalization calculated? Why is it important to know about Market Capitalization? How is Market Capitalization of companies related to Mutual Funds? What are the top companies as per market capitalization?

Table of Contents

What is Market Capitalization?

Market capitalization or Market cap stands is the total valuation of the company, calculated by multiplying the current market price of the company’s share with the shares (total outstanding or free float) of the company. It varies with the share price and the number of shares.

For example, if a company has 15,000,000 shares and a share price of Rs 20 per share then the Market Capitalization will be 15,000,000 x Rs. 20 =Rs. 300,000,000.

Based on the Market Capitalization companies are classified into: Large Cap(market cap above 20,000 crores), Mid Cap(between 5000 crores-20,000 crores) and Small Cap(less than 5000 crores).

There are two ways to determine the value Market cap: full market cap and free-float market cap. The full market cap takes into account all the shares, even the ones that are held by promoters and government or are locked-in otherwise. The free-float methodology uses just the number of publicly traded shares, which is discussed here.

What can Market Capitalization Tell us?

Market Cap is used to determine the size of a company and allows an investor to make calculated guesses such as risk associated, returns, liquidity(how easy is to trade)and what information one can get. Large-cap are big, well-established companies. These companies are strong, reputable, have been around for some time and you can get a lot of information about it. For example, Reliance Industries, Hindustan Unilever. But it is difficult to get information about small-cap companies such as TCI express, Shivam Auto, Kajaria Ceramics Ltd.

Below table shows the risk, returns, liquidity and information of the company’s shares:

| Parameter | Large Cap | Mid Cap | Small Cap |

| Risk | Low | High | Very High |

| High Returns | Low | High | High |

| Liquidity | Very Good | Good | Poor |

| Information | Good | Poor | Bad |

Where can you find information about Market Capitalization?

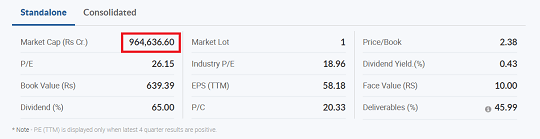

You don’t need to calculate the market capitalization yourself. You can find the Market Capitalization of the company on Financial websites like Moneycontrol(shown in image below), ET Market etc, Stock Exchange Website( NSE/BSE Website) and Company’s website. The image below shows the Market cap of Reliance Industries on moneycontrol. Note Market Cap is not constant, it varies with share price and the number of stocks.

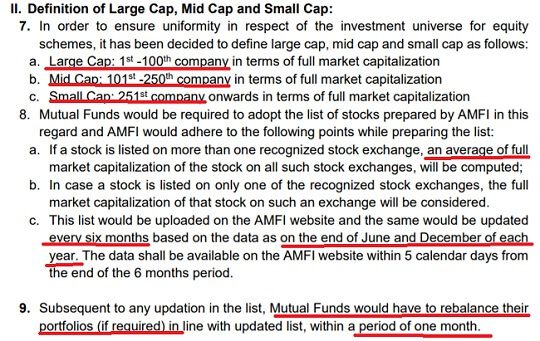

Mutual Funds and Market Capitalization

Before Oct 2017, each Mutual Fund used to have its own definition of large-cap, mid-cap etc. So SEBI(Securities and Exchange Board of India), the regulator of Mutual Funds, came up with a standard definition of large-cap, mid-cap etc. On 6th October 2017, SEBI released circular SEBI/HO/IMD/DF3/CIR/P/2017/114 ensuring uniformity for equity mutual fund schemes. Excerpt from the SEBI circular(link given above) on the definition of large-cap, mid-cap etc is given below.

Indian Companies based on Market Capitalization

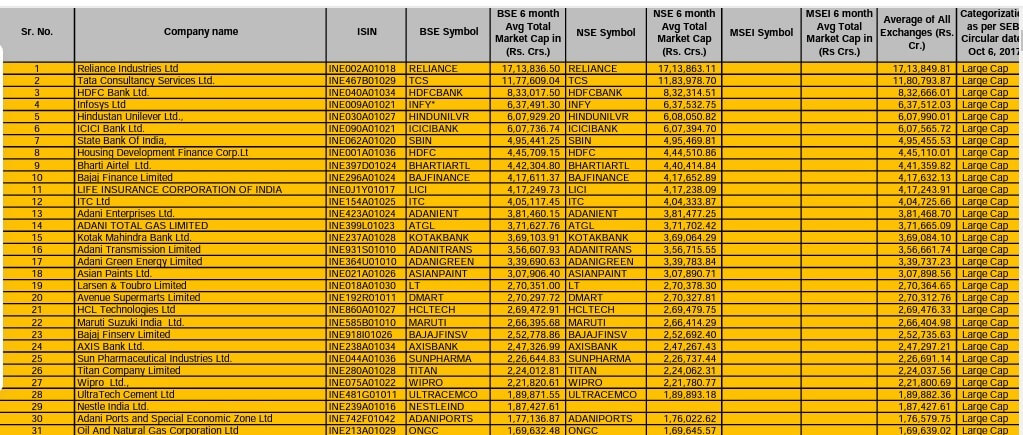

As per SEBI direction, AMFI (Association of Mutual Funds in India) comes up with a list of companies based on the market capitalization based on the data provided by Bombay Stock Exchange (BSE), National Stock Exchange (NSE) and Metropolitan Stock Exchange of India (MSEI). An excerpt of this list of market capitalization, large-cap, mid-cap and small cap is shown below. You can check it out from AMFI site, www.amfiindia.com/research-information/other-data/categorization-of-stocks

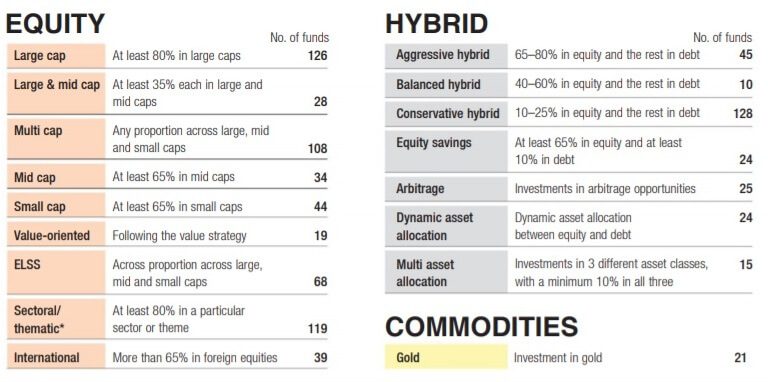

Types of Mutual Funds

There are various types of Mutual funds in India -debt, equity, hybrid. In Equity mutual funds, that the funds that invest in stock market funds are classified as Large-cap, Large and mid-cap etc. Based on SEBI(regulator of Mutual Fund) definition types of mutual funds and number of equity mutual funds of each type are shown in the image below. Our article Types of mutual funds explains in detail about types of mutual funds and also how one can compare them to the cricket players.

Why invest in different types of mutual funds?

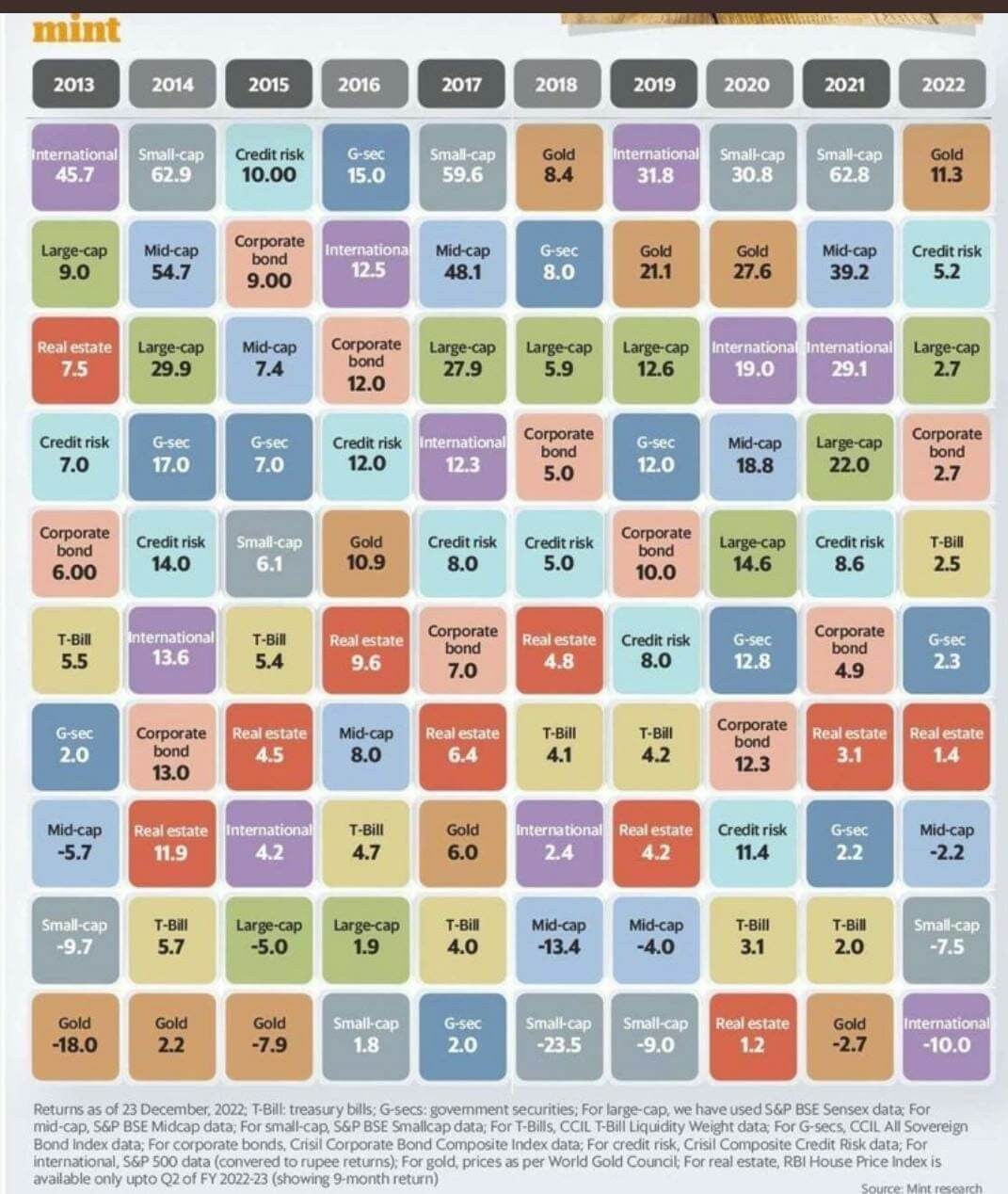

One Asset class does not perform well in every year. Among Mutual funds, different mutual types of mutual funds perform well in different years. The image below from Understanding Investing shows the return of various classes over the years. As you can see 2017 Small-Cap and Midcap did well while in 2018 and 2019 Large-cap did well.

Comparing Indian Top Companies in Market cap with USA

The following image shows the Market Capitalization of top companies in USA with that in USA

How does Number of shares of Company change?

A company’s number of shares outstanding is not static and changes over time.

- The number will increase if the company issues additional shares. Companies typically issue shares when they raise capital through an equity financing, or upon exercising employee stock options (ESOP) or other financial instruments.

- Outstanding shares will decrease if the company buys back its shares under a share repurchase program.

Shares Outstanding vs. Floating Stock and Market Capitalization

The number of shares that can be used for calculating Market Capitalization can be

- The total number of shares of the company called as outstanding shares. Shares outstanding refer to a company’s stock currently held by all its shareholders, including shares held by institutional investors and restricted shares owned by the company’s promoters.

- The number of shares available for trading called Free float shares. Free float refers to the number of shares that are available for trading in the open market. It excludes shares held by promoters, government holding, strategic holding and other locked-in shares, which will not come to the market for trading in the normal course.

For example, if a company has issued 10 lakh shares of face value Rs 10, but of these, four lakh shares are owned by the promoter, then the total market capitalization 100 lakhs or 1 crore while the free-float market capitalisation is Rs 60 lakh.

The free float market cap method is preferred over the full market cap way as it reflects the trading activity and liquidity in the market better by taking into consideration only those shares that are available for trading in the market, and, thus, provides a more accurate reflection of market movements. For example, If the total number of shares of Company A is 1,00,000. If the free float is just 10,000, then the liquidity in the stock is very poor. Therefore, it’s important that the free float remains high.

Both NSE and the BSE use the free float market capitalisation method to calculate their benchmark indices BSE’s flagship index, the Sensex, started using the free float method in September 2003. Until then, the Sensex and the other indices were using the full market cap method. Internationally, too, most exchanges, Nasdaq, FTSE, Dow Jones, S&P, STOXX and others, follow the free float method.

Nifty and Sensex respectively and assigning weight to stocks in the index. So a company with a higher free float has a higher weightage on the indices. A free float index reflects market trends better as it takes into consideration only those shares which are available for trading. It also makes the index more broad-based as it helps to reduce the concentration of top few companies.

How to find the shareholding pattern of a company?

- Financial websites like Moneycontrol, ET Market etc

- Stock Exchange Website- NSE/BSE Website

- Company’s website

How to find shareholding pattern of a company on BSE?

- Go to BSE India website (https://www.bseindia.com).

- Enter the name of the company whose shareholding pattern you want to find in the search bar.

- Scroll down and click on the ‘shareholding pattern’ tab.

- Select the ‘quarter/year’ whose shareholding pattern you are interested to find.

Related Articles:

All About Investing in India: PPF,Fixed Deposits, Mutual Funds, NPS, Stocks

- Stock exchange : What is it, Who owns, controls

- Stock Market Index: The Basics

- Blue Chips Stocks and Penny Stocks

- Investing in Equities: Stocks vs Mutual Funds

- How to buy Stock: Delivery or Intraday,Market or Limit,T+2

- Difference Between NSE and BSE, Listing of company on Stock Exchange

Hope this article helped you in understanding the market capitalization concept? How Mutual funds invest in companies based on Market Cap? How Indian companies have to catch up with US companies in terms of market cap.

Epf fields