ULIPS are back. Between 2005 -2008 Ulips were the most sold financial product. Stock market Crash of 2008 led to complaints of ULIPS. In recent times, a number of insurance companies, HDFC Life, Bajaj Allianz have launched online which are cheaper. n fact, some of the Ulips introduced in recent months are cheaper than the direct plans of mutual funds. This article talks about what is ULIP? How it works? How it compares to Mutual Funds, Traditional Insurance Plans, What are charges associated with ULIPs.

What is ULIP?

A Unit Linked Insurance Plan ( ULIP), is a financial product that combines investment as well as insurance. In an ULIP the premium amount, after deduction of charges, is invested into funds of your choice. The fund could be equity based, debt based etc. The performance of the fund will depend on the market. You can switch between the funds. The features of ULIP are similar to those of mutual funds except that ULIPs are investment products with insurance benefits. Since Ulips are insurance plans, the gains and maturity proceeds are tax-free under Section 10(10d). If the life cover is not 10 times the annual premium, you won’t get any tax deduction and the corpus will also be taxable on maturity. The deduction under Sec 80C is capped at Rs 1.5 lakh

How does ULIP work?

When you buy a ULIP you pay the premium just like for an insurance policy. Unlike the insurance policy the premium is not just for insurance but also for investment. After deducting some charges (some in beginning, some during the policy term) and for insurance ,the amount left gets invested into mutual fund of your choice. ULIPS have different funds with different risk-return profile. One may have allocation of 80-20 to equity and debt , some other can have 50-50 and some can have 20-80. You can switch between the funds (max 4 free switches in most of the cases , there after some nominal fees)

For example you buy a ULIP for annual premium of Rs 30,000 for 20 years. The plan will give him a cover of Rs 3 lakh (10 times the annual premium). After charges are deducted, say Rs 5,000, the amount left (Rs 25,000) is invested in a fund. Suppose the fund has NAV of Rs 10. So you will get 2500 units(25,000/10) of the fund. If fund NAV increases value of your fund also increases. So If after an year, the NAV is Rs 11, then your fund value will Rs 27,500(2500 units x Rs 11). This amount is lower than Rs 30,000 which was invested. If NAV has fallen, then the fund value would be lesser.

What are charges associated with ULIP?

Basic Charges associated with ULIP are:

Premium Allocation Charges: These charges are deducted upfront from the premium paid by the client. These charges account for the initial expenses incurred by the company in issuing the policy-for example Cost of underwriting, medicals & expenses related to distributor fees.

Policy Administration Charges: These charges are deducted on a monthly basis to recover the expenses incurred by the insurer on servicing and maintaining the life insurance policy like paperwork etc. They could be flat throughout the policy term or vary at a pre-determined rate.

Fund Management Charges: A portion of the ULIP premium, depending on the fund chosen, is invested either in equities or debt(bonds, money market instruments etc) or combination of these. Managing these investments incurs a fund management charge (FMC). The FMC varies from fund to fund even within the same insurance company depending on the underlying assets in the fund. Usually a fund with higher equity component will have a higher FMC. These charges are deducted for managing the funds before arriving at the Net Asset Value (NAV). The fee is charged as a percentage of funds under management. As per IRDA ULIPS cannot impose fund management fee of more than 1.35% per annum.

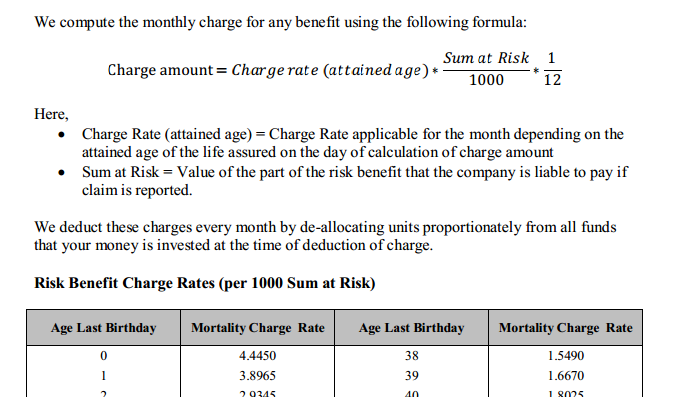

Mortality Charges: Mortality expenses are charged for providing a life cover to the individual and are deducted on a monthly basis. The expenses vary with the age and either the sum assured or the sum-at-risk (which is the difference between sum assured and fund value of the insurance policy of an individual). Typically, it is arrived at by factoring in your age, mortality tables used by the industry and also the company’s own claim experience. Though the mortality charges for a simple term plan and a Ulip should be the same, some insurers levy differential rates. For example Mortality charges as per HFDC Click2Life ULIP are

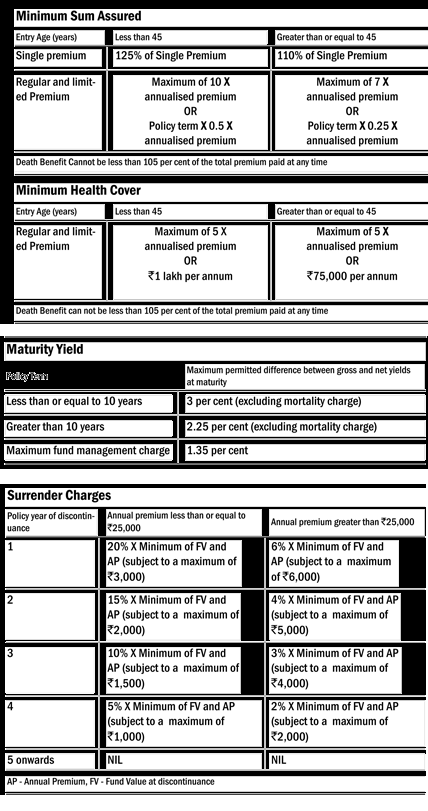

Surrender Charges: These charges are deducted for premature withdrawal (partial or full). IRDA has laid out guidelines on the maximum surrender charges that can be levied by life companies. For instance, if you surrender a ULIP in the first year, the charge will be 6% (of annualised premium or fund value), subject to a maximum of Rs 6,000. Similarly, limits have been put in the place for the next four years too. No surrender charges will be applicable after five policy years.

Fund Switching Charges: The charges when you switch between funds ex from Equity to debt. Generally a limited number of switches(typically 4) are allowed without any charge.

Cost of Guarantee: In ULIP which offer minimum guaranteed amount or NAV, there is cost of guarantee which is deducted from the total units.

Now there are online ULIPs with no charges for premium allocation, policy administration and discontinuance except 1.35% of fund management charge per annum and mortality charge from the fund value of customer in order to provide the life cover. This makes them comparable or even lower in terms of cost than equity mutual funds. While the low charges of new Ulips make them attractive, the main advantage is the seamless and tax-efficient transfer from debt to equity, and vice versa. If mutual fund investors do this, they will have to pay tax on the short-term and long-term capital gains made on the fund.

What are the types of ULIP?

Depending on the death benefit, ULIP are categorized into two broad categories:

- Type I ULIP: The death benefit is equal to higher of Sum Assured or fund value. The mortality charges go down as the fund value goes up. Let us say person buys a type I ULIP that gives her a sum assured of Rs. 5 lakh for an annual premium of Rs. 50 000. In case of death in the initial years of the policy, when the fund value is less than the sum assured, the insurer will pay the agreed sum (which here is Rs. 5 lakh) to the nominee. However, from the time the fund’s value goes higher than the sum assured, the death benefit will be the accumulated amount in the fund. In type I ULIPs, the mortality charge keeps reducing year after year as the sum at risk reduces. Sum at risk is the difference between the accumulated fund value and sum assured under the policy.

- Type II ULIP: The death benefit is equal to both Sum Assured and fund value. Suppose one has taken a type II ULIP for sum assured of 5 lakh, the insurer would give the nominee both the sum assured of Rs.5 lakh and the amount accumulated in the fund as on the date of death. Premiums on Type II plans are higher than those on Type I Ulips. Type II ULIPs also see the mortality rate increasing with every policy year (older the insured gets, higher the risk of death).

There are variety of Unit-linked insurance products to suit your goals – for your retirement planning, for your health, for your child’s education and marriage or for investment purposes.

- Wealth Plan: These plans are usually of shorter time frame around 10-15 years and focus on getting higher returns to create a good maturity amount.

- Child Plan: These plans are for securing child’s financial future. The money is invested to ensure that the child’s future financial goals like education are secured. Along with it, death benefit in most child plan is very comprehensive so that child’s future is not compromised.

- Pension Plan: These plans focus on creating a corpus amount so that life insured gets regular pension after retirement.

Comparison between ULIPs, Insurance plan(non Term) and Mutual Funds

| ULIPs | Traditional Insurance Plans(Non term plans) | Mutual Funds |

| A ULIP is an insurance cum investment plan and returns solely depends on the market performance. | Traditional plan(ex Endowment, Moneyback) is an insurance cum investment plan that promises both risk cover and returns to the investor. | A mutual fund is a pure investment product that gives market linked returns. There’s no risk cover. |

| The money is invested in debt, equity and hybrid funds which can be chosen as per risk capacity. One can switch between funds | The money is invested only in debt instruments. | The money is invested in equities, debts and other money market instruments depending on the fund. |

| You can withdraw the money but only after the lock in period (currently 5 years). | Traditional Plan locks in your funds. You can’t withdraw the money before maturity. | No lock-in period. Exiting from the funds is easy. |

| ULIps offer tax benefits under section 80C | Insurance plan offer tax benefits under section 80C | Only investments in ELSS funds are eligible for section 80C benefits |

| Unit Linked Plans (ULIP) allows you to switch your investment between the funds linked to the plan. | No switching option | No switching option is available. If you are not satisfied with the performance of the fund you can exit completely from the same by paying exit charges, if applicable |

| Charges in ULIP include mortality charges, premium allocation charge, fund management charge and administration charges | Charges include commission paid to the insurance agent, administration charges towards your policy, mortality charges, etc. | Mutual fund charges include an entry load, the annual fund management charge and an exit load, if applicable. |

ULIP Controversy

Between 2005 -2008 Ulips were the most sold financial product. Due to higher commissions many agents sold it aggressively during 2005-2008, when the stock market was rising consistently. Distributors lured gullible investors by not revealing the high charges( In some cases, the charges were as high as 80% of the first year’s premium) and showcasing only the returns offered by ULIPs.

Stock market Crash of 2008 led many to surrender their ULIPS and then they found out that high premium allocation and surrender charges had eaten away whatever was left of their investments. This led to complaints of ULIPS. In 2010, the Insurance Regulatory and Development Authority of India(IRDA)(after tussle with the Securities Exchange Board of India(SEBI) capped charges at 3% of gross yield for policies with term of up to 10 years and 2.25% for those with term of more than 10 years. This forced insurers to cut commissions.The charges were fixed at this rate because it was the average cost charged by competing products such as mutual funds. With no incentive left for distributors, Ulip sales plunged.

ULIP Reforms

Reforms introduced were introduction of a cap on charges and commissions which were not allowed to be front loaded but evenly distributed throughout the tenure of the policy.

- The compulsory 3 year lock in of the Ulip has been increased to 5 years.

- Reduction in premium allocation fees :Before September 2010 commissions were 30-35% of the premiums you paid in the initial years of the policy.Now 8-10% goes to the life insurance agent as a commission through premium allocation charges.

- If policy holder is below 45 years of age he gets death benefits 10 times the annual premium paid . If above 45 years of age the death benefits is 7 times the premium paid each year.The death benefit at any time cannot be less than 105% of the total premiums you pay .

- If you invest in a Ulip with maturity less than 10 years the maximum charges (total of all charges) cannot be more than 3% of the premium you pay. If you invest in a Ulip with maturity more than 10 years the maximum charges (total of all charges) cannot be more than 2.25% of the premium you pay.

- If you had surrendered the Ulip within the first year (before reforms) you would have got nothing back. Surrender value (Amount payable on surrender of the Ulip) would be nil. Now The maximum surrender charges cannot be more than INR 6000 if you surrender the Ulip in the first year. The surrender charges reduce to a maximum of INR 2000 if you surrender the Ulip in the fourth year and are zero by the fifth year.

Details of charges are captured in image below. Click on image to enlarge

ULIPs are back

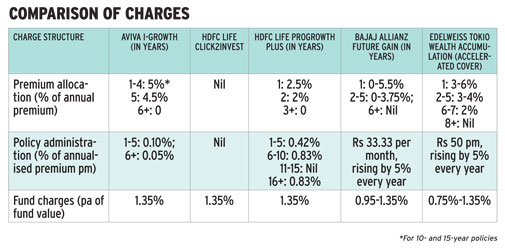

With stock markets rising, Ulips have started making a comeback, mostly through the online route.Online distribution has sharply reduced acquisition and maintenance costs so insurers are able to pass on the savings on agents’ commission as lower premium allocation charge. There are some Ulips whose costs are less than that of mutual funds(the average expense ratio of top mutual funds is roughly 2.6%). Some lost-cost Ulips are Aviva i-Growth, Bajaj Allianz Future Gain, HDFC Life Click2Invest, HDFC Life ProGrowth Plus and Edelweiss Tokio Wealth Accumulation. Comparison of their charges from Business Today Cost factor is given below

Due to low charges one can accumulate a sizeable amount. For instance, if a 30-year-old male invests Rs 50,000 every year in Aviva’s i-Growth plan, an online Ulip, he will have around Rs 13 lakh in 15 years assuming 8% return. Even after taking into account the rise in mortality charges as one grows old, the cost per annum is 1.29%. If he invests the same money in a five-star rated large- and mid-cap fund he will receive around Rs 11 lakh in 15 years (at 8%). Even if we invest directly and assume an expense ratio of 2.3% (by removing the trail commission paid to agents), the fund will grow to Rs 12 lakh, still lower than what the Aviva Ulip will yield.

Tracking ULIP Performance

In case of Ulips I could only find information on MorningStar Insurance Funds, at Moneycontrol , at insurance site (policybazaar,myinsuranceclub if your provide your details)

So Should one buy a ULIP now?

No We are not suggesting that. We are only trying to explain the ULIP concept so that you make the informed choice. Though things are much better than the earlier phase, you should understand that ULIP is a bundled product combining insurance and investment. Our article Mixing Insurance with Investment talks of Difference between investment and insurance. We have personally not invested in ULIP.

- Like mutual funds, Ulips also invest in the markets. So understand that Ulips are market-linked products

- Ulips were mis-sold as investments you can exit within three years. The lock-in period has been extended to 5 years but to get the best out of the Ulip, you need to hold it for at least 12-15 years. You know that exiting in 5-6 years will not yield desired results. In case of mutual funds, one can exit the scheme if it is a non-performer over a few quarters.

- The switching facility of a Ulip is a key feature that differentiates it from a mutual fund. You can shift money from debt to equity, and vice versa, depending on your reading of the market.

Related Articles :

- Direct Investing in Mutual Funds

- Not All Mutual Funds Do Well -the Laggards

- Investing in Mutual Funds for Beginner

- Checklist for buying Life Insurance Policy

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

Do you think ULIPs in their new avtaar are better? Should one look at them as investment option? What should one look at before buying an investment product?

Hi, The charges you mentioned here are deducted annually or monthly? I was going through some articles which said that Fund Management Charges and Risk charges are deducted monthly. For example if my annual premium is 50,000 and the FMC is 1.35%, would that be 1.35% of 50K or 1.35% each month of Nest Asset Value?

Much of the information regarding unit linked insurance plan is available over Turtlemint. Here also the same aspect is explained in a very concise and beautiful manner for the best financial products.

Hi,Thank you for the information that not to invest in ULIP, I am a follower of your blog as well as a blogger and written a long post about Mutual Funds versus ULIP which provides details with an actual example on why you should avoid ULIP and invest in mutual funds , Hope your followers can also benefit from the same

Hi Kirti , I’ve one question for you. Hi Sumit, I’ve one question for you. I wanted to know which investment option will be better for investment respectively in Public Provident Fund, Equity-Linked Savings Scheme or Unit Linked Insurance Plan under income tax section 80C to save some amount on my income tax reurn.

Hi Kirti , I’ve one question for you. Hi Sumit, I’ve one question for you. I wanted to know which investment option will be better for investment respectively in Public Provident Fund, Equity-Linked Savings Scheme or Unit Linked Insurance Plan under income tax section 80C to save some amount on my income tax reurn.

I was searching for the same ULIP policies on policy bazaar website for too much time but still confusing which one is better. Either ULIP for retirement or ULIP for wealth creation. So I just wanted some expert suggestion. Can you please tell me which policy is better ???

There is no one policy or product that suits all. ULIP has it’s advantages and disadvantages. What is fit for you depends on what else is in your basket and your risk profile.

As we said in the article

We are only trying to explain the ULIP concept so that you make the informed choice. Though things are much better than the earlier phase, you should understand that ULIP is a bundled product combining insurance and investment. We have personally not invested in ULIP.

Like mutual funds, Ulips also invest in the markets. So understand that Ulips are market-linked products

Ulips were mis-sold as investments you can exit within three years. The lock-in period has been extended to 5 years but to get the best out of the Ulip, you need to hold it for at least 12-15 years. You know that exiting in 5-6 years will not yield desired results. In case of mutual funds, one can exit the scheme if it is a non-performer over a few quarters.

The switching facility of a Ulip is a key feature that differentiates it from a mutual fund. You can shift money from debt to equity, and vice versa, depending on your reading of the market.

I was searching for the same ULIP policies on policy bazaar website for too much time but still confusing which one is better. Either ULIP for retirement or ULIP for wealth creation. So I just wanted some expert suggestion. Can you please tell me which policy is better ???

There is no one policy or product that suits all. ULIP has it’s advantages and disadvantages. What is fit for you depends on what else is in your basket and your risk profile.

As we said in the article

We are only trying to explain the ULIP concept so that you make the informed choice. Though things are much better than the earlier phase, you should understand that ULIP is a bundled product combining insurance and investment. We have personally not invested in ULIP.

Like mutual funds, Ulips also invest in the markets. So understand that Ulips are market-linked products

Ulips were mis-sold as investments you can exit within three years. The lock-in period has been extended to 5 years but to get the best out of the Ulip, you need to hold it for at least 12-15 years. You know that exiting in 5-6 years will not yield desired results. In case of mutual funds, one can exit the scheme if it is a non-performer over a few quarters.

The switching facility of a Ulip is a key feature that differentiates it from a mutual fund. You can shift money from debt to equity, and vice versa, depending on your reading of the market.