Who will have more money at 45 years and why? Alicia invests Rs 5,000 per year beginning at age 25 and after 10 years, she stops. Boman invests Rs 5,000 per year starting at age of 25. This article shows how Compounding can work for you and how compounding can work against you using the example of Credit Card debt. How Compounding works in Stocks. How one can start with making small changes and being patient. And books Atomic Habits and Joys of Compounding!

Compounding is the eighth wonder of the world,

He who understands it earns it… he who doesn’t… pays it.

Table of Contents

Who would have more money and why?

Alicia started investing Rs 2,000 every month from the age of 25.

Boman, who started investing Rs 5000 per month when he reached the age of 35.

At Age of 45

After 20 years, A’s investment of ₹ 4.80 lakhs will grow to ₹ 19.98 lakhs * @ 12 % p.a

After 10 years, B’s investment of ₹ 6.00 lakhs will grow to ₹ 11.62 lakhs * @ 12 % p.a

B’s returns are more despite B investing more than A.

This is called Compounding.

Why B has less money than A in spite of saving more?

Calculation of interest can be done in two ways- simple interest and compound interest.

In simple interest, interest is earned only on the initial capital. Say, on a deposit of Rs 10,000, if 7 percent is simple interest, then at the end of 3 years, total interest paid will be Rs 2,100.

In the case of compounding interest, interest is initially calculated on the initial capital and thereafter on the accumulated interest of the previous. So if Rs 10,000 is invested at 7% p.a. compounded annually, at the end of three years, the interest earned would be Rs 2,250

Had the compounding been quarterly or half-yearly, the interest component would be Rs 2,314 and Rs 2,293, respectively.

Our article First lesson in financial education: Compound Interest explains it in detail.

Why should you start investing early?

The early bird catches the worm, as the saying goes.

Similarly, beginnings made early in life bring in success. And similar is the case with money matters.

Paying bills, buying new gadgets, weekend parties take away most of the salary, and are left with very little at the end of the month. We delay making investments as we think that we can always make up for the lost time once we start to earn more and thereby investing a higher amount. However, making up for lost years in investment is not easy, even when you invest a higher amount.

To start saving, one should follow a simple formula, i.e. save before you spend.

When does compounding work against you?

Compounding can work against you whenever you take debt i.e a credit card interest, loan, a mortgage, —you pay the bank interest – often compounded interest.

Credit cards are not free money, but a loan. You need to pay for what you have bought on the credit card. If you don’t pay full or pay the minimum balance you will have to pay more as you will be charged interest, huge interest. The cardholder is required to pay back the amount that has been borrowed in accordance with the terms and conditions of the credit card agreement.

With most types of credit cards, you can settle the amount owing in full and without interest (on purchases) within a given period of time, called the grace period.

Card issuers are also given the option of paying a minimum amount by the due date, which is usually 2.5-20% of the total amount due, along with applicable card fees, overdue minimum payment, and any installments. Any amount paid that’s less than the total amount will have interest charged on it. Any amount paid less than minimum payment due as on payment due date will also attract late payment charges.

How long will it take to pay the Credit Card debt?

For example, let’s say your balance is Rs 2,000 and your minimum payment is Rs 120. The table below shows how long it would take to pay it with minimum payments and versus adding 100 more each month. Our article Paying Credit Card Bill, Understanding statement, Paying Just Minimum explains it in detail

Minimum payments will take you 20 months to pay the balance, 1 year and 8 months

However, you can clear your balance in 10 months if you pay 100 more each month. You spend almost twice as much interest if you only pay the minimum. If you pay it within 10 months instead of 20 months, you save 176(363-187).

Credit card balance: 2,000

Annual percentage rate (APR): 20%

| Credit card | Minimum payment | Paying 100 more |

|---|---|---|

| Monthly payment | 120 | 220 |

| Total amount to principal | 2,037 | 2,013 |

| Total interest | 363 | 187 |

| Est. Pay Off Time | 20 months (1 year and 8 months) | 10 months |

Video on the effect of minimum credit card payments

This 3 minutes video uses a jug(a pitcher) and a glass of water to demonstrate the effects of minimum credit card payments. This video uses a simple analogy to describe how one is throwing away their money to the credit card companies

Compounding in Stocks

“The effects of compounding even moderate returns over many years are compelling, if not downright mind boggling” say Seth Klarman

If you remain invested over long period of time in both – mutual funds and direct equities – you benefit by the time period of your holding

If you manage to buy the right stock, the biggest benefit of BUY and Hold is the Power of Compounding.

How buying and holding shares in Wipro or ITC created wealth for investors?

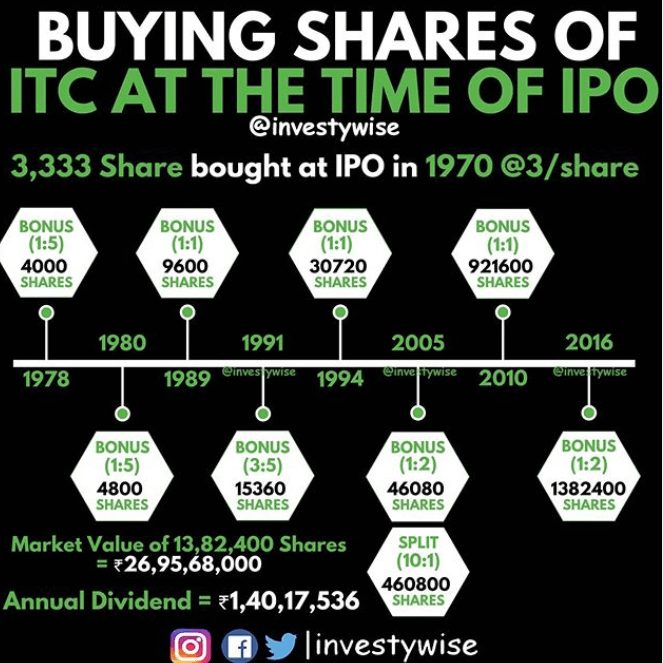

For example, if If one had bought 3,333 shares of ITC in IPO in 1970, the number of shares would have increased & so would have the dividends as shown in the image below

Similarly of one had bought 100 shares of Wipro in 1980 and held to it then due to splits and bonuses one would have 6,000 shares of Wipro in 2019 and in 2021 at a price of Rs 400 it’s value would be 10,52,16,00,000.

How does that happen? Due to Splits and Bonus of shares

Splits, reduce the share price. Typically a company replaces every old share with new ones(split of 1:3 means you would get 3 shares for every 1 share held but price would also become 1/3), each at a fraction of the former price. The same holds for bonus shares.

Over a period of time, Splits, Bonus & Dividends have a huge role to play in wealth creation as one can see from the ITC stock split, bonus and dividend. Our article Dividends of Stocks: Pros & Cons, Compounding covers it in more detail.

The reality is that stocks go through periods where values decline or stay flat. These periods could be long and declines can be huge. Greed and Fear, mental strength, and individual personality traits end up playing a huge role in the decision making and override rational investing decisions.

The billionaire investor Howard Marks interestingly said “The discipline which is most important in investing is not accounting or economics, but psychology”

Compounding Starts byMaking small changes

Your life today is essentially the sum of your habits.

How in shape or out of shape you are? A result of your habits.

How happy or unhappy you are? A result of your habits. How successful or unsuccessful you are? A result of your habits.

What you repeatedly do ultimately form the person you are, the things you believe, and the results you enjoy. It is so easy to overestimate the importance of one defining moment and underestimate the value of making better decisions on a daily basis.

The daily choices we make shape our teams, our societies, and ourselves. Change your habits and you’ll change your life.

What we repeatedly do, each and every day ultimately forms the results we enjoy and the goals we achieve. Change your habits, change your systems, and you’ll transform your life, team and organization.

one of the worst things you can do for yourself is grabbing your phone to scroll through Instagram, messages, and email first thing in the morning

Take Baby Steps

Every journey starts with a small step,

Start small, stay consistent.

Reading 20 pages per day is 30 books per year

Saving Rs 10 per day is Rs 3,650 per year

Running 1 km per day is 365 km per year.

Becoming 1% better per day is 37x better per year.

Small habits are underestimated.

Small habits can unlock the improvements you need to get the results you want.

Book Atomic Habits

If you want to predict where you’ll end up in life, all you have to do is follow the curve of tiny gains or tiny losses, and see how your daily choices will compound ten or twenty years down the line.

If you are looking to form a new habit you have to read this book, Atomic Habits by James Clear

Atomic habit is a little habit that is part of a larger system. Just as atoms are the building blocks of molecules, atomic habits are the building blocks of remarkable results.

Getting 1 percent better every day counts for a lot in the long-run.

- The most effective way to change your habits is to focus not on what you want to achieve, but on who you wish to become

- Habits are the compound interest of self-improvement.

- If you want better results, then forget about setting goals. Focus on the process, that is more important than goals

- The Four Laws of Behavior Change are a simple set of rules we can use to build better habits. They are (1) make it obvious, (2) make it attractive, (3) make it easy, and (4) make it satisfying.

- The environment is the invisible hand that shapes human behavior.

This book provides supplementary material like cheat sheets and templates which are very useful for planning your own habit profile and continuous improvement.

This book is action-oriented. The concepts present an action plan for trying them in your own situation and to practice the ideas directly in day-to-day life. This makes the book an instruction manual for nurturing good habits and killing bad habits

Be Patient

No matter how great the talent or efforts, some things just take time.

You can’t produce a baby in one month by getting nine women pregnant ― Warren Buffett

Being patient with your investment means that once you have selected the asset to invest in, you should not be bothered by short-term volatility in the value of the investment and stay invested for long-term. The idea here is to select worthy assets at a reasonably good price.

The patience required for investing is a vital part of financial discipline and shows how well you can check your emotional state, greed, and manage money to achieve your goals. Infact patience is more important than intelligence when investing

Trying to time the market is a futile exercise.

When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever. Warren Buffett

While picking individual stocks can be fun, exciting, and give investors the possibility of outsized returns, most investors will do just fine over the long term with either an index fund or diversified exchange-traded fund (ETF) with broad market exposure.

Sometimes the hardest thing to do is to do nothing!

The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.- Benjamin Graham

The stock market is a device to transfer money from the impatient to the patient.- Warren Buffett

Book Joys of Compounding: The Passionate Pursuit of Lifelong Learning

By Gautam Baid, 456 pages, Nov 2020

This book will help you understand and appreciate the concept of lifelong learning and compounding.

Compounding is like a Chinese bamboo tree. We should have a passion for the journey as well as patience and deep conviction after planting the seeds. The Chinese bamboo tree takes more than 5 years to grow. But once it starts, it grows rapidly to eighty feet in less than six months.

The beauty of the book is that it is not the ’10 ways to make a quick buck in the stock market’ kind of book.

The book talks about varied subjects such as how to compound in every aspect of one’s life be it on investments, acquiring knowledge, health & so on – essentially to make one’s life-enriching and rewarding. It is a holistic book which talks about, the importance of reading and investing in oneself first, investing, wealth creation, personal finance, delayed gratification, the importance of patience, giving back to society.

Checklists for decision making, Value Investing, Investing in cyclical, Special situation, spin-off investing, Gautam’s own investments.

It also has Learnings and quotes from great investors, like Warren Buffett, Charlie Munger. All of them well-articulated in lessons.

A fantastic read which distills so much wisdom from the investment classics into a single book.

It is not an easy read unlike Rich Dad Poor Dad, or Psychology of money or Victory Project It makes you pause, think, reflect!

The only complaint I have is Content is good, but the font size is small.

Buy the book (and a new highlighter pen as you will need it!).

Key rules of Power of Compounding

Here are the 3 key rules of investment that helps you to get the true benefit of compounding:

1. Starting Early: If you start investing from the time you start earning, it will make a solid base for you that will enable your wealth to grow further over a period of time.

2. Discipline: Regardless of how little you earn, knowing what your priority is and understanding how being disciplined now would pay off later, will help you develop the habit to keep money aside for investing.

3. Be patient: You will have to allow your investment to grow at its own pace without interfering with it. Years of dedicated investment on your part will render a strong and healthy lump sum capital for you in the end.

Remember the Rabbit and Tortoise story we read in childhood. Compounding is like the Tortoise slowly but steadily helps in building wealth.

Related Articles:

- Best Books about Stock Market, Psychology, Personal Finance, Mutual Funds

- Dividends of Stocks: Pros & Cons, Compounding