We don’t talk about it. Somehow, we grew up thinking that talking about IT wasn’t polite. Maybe we saw a lot of fights and aggression in the family ,in movies, in news, in books. Maybe it’s better to see it, have it rather than talk about it. Whatever the hesitation, not talking about is like participating in a collective and damaging society-wide denial. We don’t talk about MONEY(what did you think we were talking about ;-)) An unwritten rule is it’s not nice to discuss politics, religion, or money at social gatherings, because it might make someone uncomfortable. Many of us have resistance around talking about money because we’re in a bad financial place, maybe feel we don’t have enough. Why don’t people talk about money? Is it just to avoid discomfort? Or are there more practical reasons to avoid these sorts of discussions? Many finance companies do survey on money related topics and try to figure our the pattern. DSP BlackRock Investment Managers did a study(first for them) to explores the relationship women have with financial investments. This article is about the survey.

If you’re given a choice between money and sex appeal, take the money. As you get older, the money will become your sex appeal. — Katherine Hepburn, Hollywood actress

Few women in India work — just 25.5% according to the 2011 census data. And fewer have control over what they do with their money and where it is invested. Almost voluntarily or not so voluntarily, women in India have historically outsourced that job to the men in their lives, typically husbands, fathers and sons because of traditional societal attitudes. But host of factors is now changing the status quo, especially in urban middle-class homes and we now have a growing breed of women who are working towards controlling their financial destiny. The factors that are responsible are, Changing lifestyles of Indian families at large and women in particular.

- Education : More and More women are getting educated. They are realizing investing is not rocket science

- Career: Today, more and more middle-class women are working, moving out of their parental homes to pursue careers, choosing to marry late or not at all or even walk out of marriages. Getting a handle on their finances plays(will play) a critical role on their journey. Domestic violence: Yukta Mookhey, Nigella Lawson unspared?

- Second Income : A wife’s salary is no longer a small chunk but at times a very significant part of the family income. Women have taken steps to take charge of it.

- Busy Schedule : Busy schedule of her husband and realising the family’s need to invest, women have started taking charge of the family investment decisions. Often it starts with husband telling things, go deposit cheque, pay bill and soon she is investing.

- Technology advancement: Now almost all banks across the globe are offering more value and convenience to the customer through online banking (netbanking), mobile banking, with 24×7 operations, Shorter transactions time. It has become easier to handle money(World is now just a click away)

- Information : Lot of financial information is available. You just need to spend a little time and energy on it. Rising breed of financial advisers in India are also helping simplify the complex world of financial investments for many of men and women.

According to the study,

- 92% of working women and 84% of non-working women surveyed were involved in decision-making.

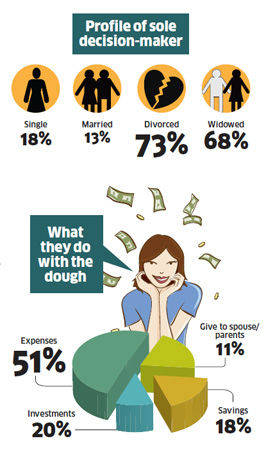

- Of those involved in decision-making, just 23% (among working women) and 10% (among non-working women) were sole decision-makers. Even this 23% of sole decision makers were largely dominated by women who are divorced and widowed, implying it isn’t so much out of choice but unavailability of any option that women are getting involved in investment decisions.

- Close to 36% of the total working women were merely informed about the investment decisions and played no role in taking them. It is worse in the case of non-working women where a much higher 53% were merely informed about the household investments decisions and had no role to play.

Excerpt from the survey is shown in picture below . You can see entire survey on our Pinterest board

Is Women not making investments a global phenomena?

That women and investments are not exactly made for each other is not just an Indian phenomenon but a global one. A recent study done by Prudential in the US called Financial experience and behaviours among women throws some interesting light on their outlook to and appetite for financial risk and reward. The study was done among 1,410 women and 605 men in the US in the 25-68-year age bracket.

- In the study, 40% of female respondents were single and working and 25% of married women earned more than their spouses/ partners.

- Yet just 23% of the breadwinning women felt adequately prepared to deal with their finances as compared to 45% of the men.

- Also, women are more likely to underestimate themselves — they are twice (15%) as likely to call themselves as financial beginners as against men (7%).

- Younger women (under 35) in the US, the study reveals, are driving the change. They are more likely to be equal partners in investment decision-making in the household and a high 42% feel they must prioritise their financial goals.

- The study also reveals that women are more likely than men to seek help from financial advisers.

- And those who do fare well — they typically had higher investments and were more confident investors with a diversified portfolio.

Is the investment style of men different from women?

According to Prudential’s study in US Financial experience and behaviours among women, reveals very different investment styles of the two genders.

- Women are far more collaborative and 35% of them say they share equally in their decision-making with their spouses. In contrast 73% of men say they are the primary decision-makers.

- Men and women also have very different risk appetites. A high 70% of the women see themselves as savers rather than investors and prefer to invest in products that offer guaranteed returns. This is exact opposite of men — 70% of them are willing to take some risk in return for some financial reward.

DSP BlackRock Investment Managers study also show the similar trend. According to experts

- Women are more long-term and less impulsive investors and hence are less reactive to market conditions.

- Women are also relatively more realistic and less aggressive about their expectations of returns

- Women typically find time to do research, understand the product and then make a decision as against men who take much for granted

- Women may need lot more handholding Often they will say I do not understand anything even though they understand everything and will not hesitate to ask questions, whether simple or complex .

- They do not invest in things they do not understand

- Women take some time to establish a rapport and build a relationship. Once they achieve a certain level of trust they take things more easy,

- Women’s investment patterns too differ from men. They save like squirrels, putting away small amounts regularly. Men prefer to do it in lump sums.

DSP Blackrock had investor education TV series for women in collaboration with CNBC 18 called Sheconomy. You can see the details here They also have launched an initiative called Winvestor A wise woman investor to inspire and empower women with financial knowledge.

Did you know many of our banks have women on the top

Reference : Economic Times How women are increasingly taking decisions on where to invest money

Related articles :

- Insights into Financial Goals of Indians!

- Amitabh Bachchan – from bankruptcy to crorepati

- Rising Education costs !

- Oh you are only a housewife!

- Women and Financial Planning

- People talking about money: Nita Ambani, Farhan Akhtar,John Abraham, Ritu Kumar etc

Disclaimer : We have no tie-ups with DSP BlackRock. It is not sponsored/paid by DSP BlackRock.

Why do we not talk about money? Is it social reason, discomfort or ? What do Nita Ambani, Farhan Akhta, John Abraham, Ritu Kumar and many more think of money,investing. People talking about money Many Indian banks are run by women which is a BIG inspiration to all the women. Women have started talking about money,investing, writing about personal finance (bemoneyaware is blogged by a woman About us). Even though small in number today, the trend of the woman calling the investment shots is likely to grow. How do you or your wife handle money, will it be different for our daughters. Do men and women also differ in investment style, financial habits, investment products?