On 4 June 1913, Emily Davison the suffragist threw herself in front of King George’s horse at the derby to make known the issue of women’s voting rights. Since then, women have come a long way in securing equality and justice in many areas. But when it comes to finances, there is still a vast disparity between men and women. In this piece, let’s find out why it is crucial for women to save more money than men to ensure a secure retirement. We shall also discuss a few money-saving ideas to make this possible.

Why should women save more than men?

- Gender pay gap

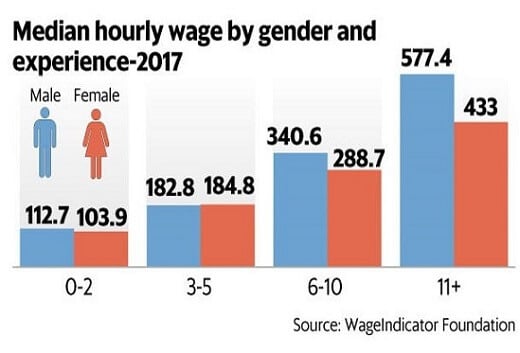

The gender pay gap is real and has been highlighted by women on the biggest stages including the Oscars. In India, women are paid around 20% lesser than men according to a report by the Livemint. Considering that women put away 10% of their salaries towards savings, the saved amount is much lesser than their male counterparts.

- A lesser number of working years

In India, women spend an average of 7 years off work to take care of children and family. They don’t get paid during this period, and when they rejoin the workforce, they may have to resume at lower salaries compared to their counterparts. Interesting article by Monika Halan in LivemintThe home likes the income, but is unwilling to let the woman give up on household work, childcare and eldercare duties

- Higher life expectancy

At 60, the life expectancy for women is 78.6 compared to 77.2 for men. Retirement is a time to relax, enjoy and take it easy. But it also comes with expenses. Without a regular salary, one’s retirement corpus must be large enough to take care of these expenses for a long time.

Money-saving ideas for Women

- Increase your savings

Women need to increase their monthly savings. A common rule of thumb is to put away around 15% of your earnings towards retirement. But to be on the safe side, aim closer towards 20% to ensure a comfortable retirement.

- Invest in better avenues

There are many investment avenues, but not all provide excellent returns. Identify your financial goals and seek out avenues that can help you reach your goals in the fastest manner. It is a good idea to invest a small portion of your money in debt but put a significant part into equity investments like ELSS funds to maximise your returns in the long term.

- Negotiate for a better salary

It is not wrong to negotiate for an increment at your workplace or when you change jobs. Perhaps, you are drawing lesser than your male colleagues. It would be a good time to chat with your manager and try to increase your remuneration. A boost in your earnings can help you save more and achieve a higher retirement corpus in the long run.

- Start investing early

One of the best ways to increase your long-term returns is to get an early head start on your investment journey. Early investments can have a significant impact on your future earnings. This is possible due to the power of compounding. Even a ten-year delay can make a massive difference to your final corpus.

Conclusion

Women need to take charge of their finances and play a more active role when it comes to money and planning for the future. Don’t leave the financial planning to your spouse or partner. Women face different constraints, and the sooner you acknowledge them and plan, the better would be your financial health in the long run.