A crypto currency is a medium of exchange, such as the US dollar, but is digital and uses encryption techniques to control the creation of monetary units and to verify the transfer of funds. The popular rise of virtual currency started in 2009 with the creation of Bitcoin, the first decentralized cryptocurrency. Since then, over 1000 cryptocurrencies have emerged, each with their own unique approaches to development, data encryption, and transactional utility. Institutional investors, banks and regulators are still wary of cryptocurrencies. This article talks about What is CryptoCurrency? What are different types of Crypto Currency like Bitcoin, LiteCoin, Etherum. What is the difference between CryptoCurrency and Block Chain?

“Virtual currencies, perhaps most notably Bitcoin, have captured the imagination of some, struck fear among others, and confused the heck out of the rest of us.” – Thomas Carper, US-Senator

The collective market cap of all cryptocurrencies on 20 Oct 2018 was $209,306,437,053(209 billion). It had plunged from its January peak of $831 billion to $186 billion its lowest level this year.

Owning and using cryptocurrency is legal in most of the world outside of India and China. Our article Is Crypto currency banned in India? talks about it in details

Table of Contents

What is Crypto Currency?

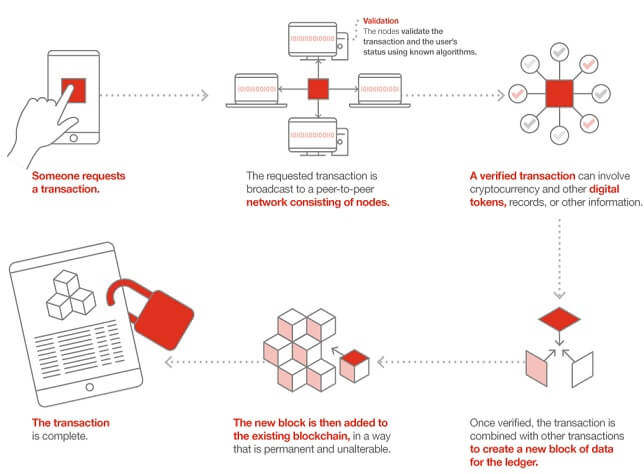

The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.

Cryptography is a method of using advanced mathematical principles in storing and transmitting data in a particular form so that only those, for whom it is intended for, can read and process it.

A Cryptocurrency transaction happens, say “Bobby gives X Bitcoin to Anita“ and is signed by Bobby‘s private key. After signed, a transaction is broadcasted in the network, sent from one peer to every other peer. This is basic peer to peer (p2p) technology.

The transaction is known almost immediately by the whole network and then it gets confirmed by miners. Miners take transactions, stamp them as legit and spread them in the network. Miners have to find a hash, that connects the new block with its predecessor. After finding a solution, a miner can build a block and add it to the blockchain. This is called the Proof-of-Work. In Bitcoin, it is based on the SHA 256 Hash algorithm. When a transaction is confirmed, it is set in stone. It is no longer forgeable, it can‘t be reversed, it is part of an immutable record of historical transactions: of the so-called blockchain. Confirmation is a critical concept in cryptocurrencies.

For this job, the miners get rewarded with a token of the cryptocurrency, for example with Bitcoins. This is the only way to create valid Bitcoins.

What is block chain?

Bitcoins can only be created if miners solve a cryptographic puzzle. Since the difficulty of this puzzle increases the amount of computer power the whole miner’s invest, there is only a specific amount of cryptocurrency token that can be created in a given amount of time.

Currency is stored in a ‘digital wallet,’ along with public and private keys that allow it to receive and spend funds.

Although more and more retailers accept cryptocurrency as valid payment, they are not backed by the gold standard.

Video on How CryptoCurrency works

Advantages Of Cryptocurrency

FAST AND GLOBAL When you use cryptocurrency transactions occur almost instantly with anyone around the world.

PSEUDONYMOUS AND SECURE With wallets that are detached from users’ real identities, funds are secured using a public key cryptography system, and only the owner of that key can send and receive funds.

FREE AND CONTROLLED The software used to participate in cryptocurrency is freely available and also used to regulate the amount of currency available on the market.

Disadvantages Of Cryptocurrency

IRREVERSIBLE Once a transaction is confirmed, it cannot be reversed.

UNBACKED AND UNRECOGNIZED Bitcoin and all other cryptocurrencies are not backed by the gold standard or recognized by any government as legal tender.

NEW AND UNPREDICTABLE With blockchain technology in its infancy, it’s difficult to forecast how the technology will be supported and used in the future.

How many CryptoCurrencies?

There are thousands of CryptoCurrencies. Bitcoin is the largest cryptocurrency by market cap,CoinMarketCap.

- BITCOIN 2009

- RIPPLE 2012

- MONERO 2014

- ZCASH 2016

- LITECOIN 2011

- DASH 2014

- ETHEREUM 2015

Market Capitalization of Crypto Currencies

Differences between CryptoCurrencies such as Bitcoin, LiteCoin, Etherum etc

One can distinguish various CryptoCurrencies based on following factors

- The process used to verify transactions and avoid double spending.

- Anonymity and privacy. Can how you spend your crypto coins be monitored by others?

- Does the coin offer other services beyond transferring value such as Smart contracts and tokens?

- Governance. How is the community and development organized? How are disputes settled, direction and strategy chosen?

Bitcoin is the original cryptocurrency and was released as open-source software in 2009, with the most liquidity and significant network effects. It also has brand name recognition around the world.

Litecoin is probably bitcoin’s closest rival in terms of the use case. Litecoin was launched in 2011 as an early alternative to Bitcoin. Litecoin uses the Scrypt hashing function and creates blocks more frequently, which creates quicker transactions. Litecoin transactions take just over two minutes to go through, compared to an average of around nearly 300 minutes for bitcoin.

There is a limited supply of 84 million litecoins, compared to 21 million bitcoin. Currently, 54,293,533 litecoin and 16,740,175 bitcoin are in circulation.

Ethereum was created in 2013 using the same blockchain model as bitcoin. Ethereum was tailored for a specific purpose within the business world—smart contracts. While bitcoin was designed as a currency for consumer payments, Ethereum was designed to appeal to corporations, such as big banks, to use in executing smart contracts, computer algorithms that automatically execute deals as soon as specified terms are met in the market. For example, Barclays already uses smart contracts for derivatives trading.

Ripple is best known for its real-time gross settlement system for other currencies such as USD, Bitcoin, EUR, GBP, or any other units of value (i.e. frequent flier miles, commodities). Major global banks have already integrated Ripple into their payment systems. Ripple was designed to provide instant liquidity to international banks making payments in different global currencies. The Ripple digital currency, known as XRP, can be used by the enterprise to get instant liquidity needed in a high-value transaction. In Ripple all coins are pre-minded and distributed through various means by the creators of the cryptocurrency systems.

For more details, one can read the article How Do Crypto Currencies Differ?

Why is there a need for CryptoCurrency?

Technically, Cryptocurrencies use decentralized control unlike centralized digital currency and central banking systems. The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.

Satoshi Nakamoto, the founder of Bitcoin, tried to build a digital cash system without a central entity. It means that it runs on a worldwide peer-to-peer network and that there’s no central entity or administrator for the currency like a bank or government, such as the Reserve Bank of India for the Indian Rupee or the Federal Reserve for the US Dollar.

Announcing the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It’s completely decentralized with no server or central authority. – Satoshi Nakamoto, 09 January 2009, announcing Bitcoin on SourceForge.

This leads us to understand What is Money? Role of Central Bank and The problem of Double Spending

What is Money?

Money is what money does. That is, Money is a unit of account, a means of payment and a store of value. Many things have served as money, but experience suggests that something widely accepted, reliably provided and stable in its command over goods and services works best. To be credible Money requires institutional backup, which is provided by a central bank. Central banks provide money, ie cash (coins and notes). “money is a convention” one party accepts it as payment in the expectation that others will also do so. Money is an IOU(abbreviated from the phrase “I owe you”), but a special one because everyone in the economy trusts that it will be accepted by others in exchange for goods and service

Money is all about a verified entry in some kind of database of accounts, balances, and transactions.

Take the money on your bank account: It is just entries in a passbook and now bank database that changes when one debits or credits from the bank account.

What are physical coins and notes? They are limited entries in a public physical database that can only be changed if you match the condition than you physically own the coins and notes

Cryptocurrency is just limited entries in a database no one can change without fulfilling specific conditions.

How currency works today? Role of Central Bank

Most nations adhere to the fiat currency model. What this means is that all currency value for such a nation is held by a central bank, with that value being backed only by the central bank’s willingness to honour the obligation. As the value only exists with the bank – as the bank defines it – the bank is free to adjust the worth of that value to meet certain funding obligations or goals.

Most of the world’s banks still follow archaic banking systems and methodologies. One has to pay transaction fees(NEFT, IMPS) just to transfer money from between banks. This just showcases how expensive and inefficient banking systems have become the cause of all the intermediaries taking their cuts and commissions. Yet we all gladly pay up without questioning it because we trust these centralized institutions so much and because we feel there are no alternatives.

One of the worst financial crisis, Lehman Crisis of 2008, since the Great Depression of the 1930s was caused by the greed and irresponsibility of some of the world’s biggest banks.

During the Greek financial crisis, a Greek citizen couldn’t even withdraw his own hard-earned money cause the government had locked down everyone’s assets to prevent withdrawals and pay off their debt.

You place your faith in banks and governments to handle your money and they are the very ones who let you down because of their mismanagement?

Cryptocurrency is an alternative to Central Banks. Cryptocurrencies are decentralized, and the regulations are made by the community.

If it’s not regulated by a government, what decides a cryptocurrency’s value?

Supply and demand: As demand increases, so does the value of that cryptocurrency. Most cryptocurrencies have a finite amount distribution, so the value fluctuates sometimes wildly based on demand or lack of demand.

The problem of Double Spending with Digital Currency

“(Globally) the rising costs of managing fiat paper/metallic money, have led central banks around the world to explore the option of introducing fiat digital currencies”. For the financial year 2018, the total cost of printing paper notes in India was Rs 636 crore, according to the RTI response.

The risk in digital currency is that it can be spent twice also known as Double Spending or to prevent that one entity spends the same amount twice. Because digital information can be reproduced relatively easily. Physical currencies do not have this issue because they cannot be easily replicated, and the parties involved in a transaction can immediately verify the bona fides of the physical currency. With digital currency, there is a risk that the holder could make a copy of the digital token and send it to a merchant or another party while retaining the original.

CryptoCurrency solves the problem of Double Spending. Crypto currency manages the double spending problem by implementing a confirmation mechanism and maintaining a universal ledger (called “blockchain”), similar to the traditional cash monetary system. Crypto currency’s blockchain maintains a chronologically-ordered, time-stamped transaction ledger from the very start of its operation in 2009.

Suppose one makes two transacations using the same cryptocurrency. Both transactions go into the unconfirmed pool of transactions. But only the first transaction got confirmations and was verified by miners in the next block. The second transaction does not get enough confirmations because the miners judged it as invalid, so it is rejected. In the case of simultaneous transactions, one which gets more confirmations is accepted. That’s why it is recommended for merchants to wait for a minimum of 6 confirmations.

51% attack. An attack on the blockchain, whereby a group of miners controls more than half of a network’s computing power and can refuse to verify transactions and pay users. It hasn’t happened, but it’s a possibility discussed in the market.

Crypto Currency Wallets

If you want to use Bitcoin or any other cryptocurrency, you will need to have a cryptocurrency wallet. A cryptocurrency wallet is a secure digital wallet used to store, send, and receive digital currency like Bitcoin. Your wallet stores your private and public keys, allows you to send and receive coins, and also acts as a personal ledger of transactions.

There are several types of wallets you can use including online, offline, mobile, hardware, desktop, and paper. Each “type” refers to what type of medium the wallet is stored on and whether or not the data is stored online. Some wallets offer more than one method of accessing the wallet – for instance; Bitcoin Wallet is a desktop application and a mobile app.

We suggest using an official (or officially endorsed) wallet for any given coin. So, for Bitcoin we would suggest using the Bitcoin Core Wallet, for Litecoin we would suggest Litecoin Core, and for Ethereum we would suggest either Ethereum Wallet or MyEtherWallet.

There are also universal wallets / multi-coin wallets like HolyTransaction and Coinomi (these can be used to store many, but not all, cryptocurrencies).

There are also custodial wallets where you don’t control your private keys directly like Coinbase.

There is an ever-growing list of options. Before picking a wallet, you should, however, consider how you intend to use it.

- Do you need a wallet for everyday purchases or just buying and holding digital currency for an investment?

- Do you plan to use several currencies or one single currency?

- Do you require access to your digital wallet from anywhere or only from home?

Video on How to buy bitcoin and Store in Wallets

How to buy Bitcoin from exchanges, ATMs, and in person. Also, how to store it in wallets

How Can You Use Cryptocurrency?

BUY Bitcoin is accepted at over 15,000 online retailers like Expedia, Microsoft, and Overstock.

TRANSFER Swap currencies for others at a cryptocurrency exchange.

INVEST Hedge your bets and support the development of blockchain technology.

Is Blockchain the same as Cryptocurrency?

The blockchain is a digital, decentralized ledger that keeps a record of all transactions that take place across a peer-to-peer network. The major innovation is that the technology allows market participants to transfer assets across the Internet without the need for a centralized third party. There are information and data in each block that is verified and bundled together.

The blockchain is like a platform and is used for things other than Crypto Currencies.

- Supply Chain Management: It can be used for recording transparent transactions and making them visible for all. This way a lot of human mistakes, time delay, and cost can be reduced. Blockchain can be used to track the origin of products and verify their authenticity. There are some startups that have already started using blockchain technology for this purpose.

- Transport: This use of blockchain can pose a serious challenge to some of the renowned ride-sharing companies in the world. It is because peer to peer ride sharing apps can be created by using blockchain technology. This way the car owner and rider can easily set their own terms without the interference of any third party.

- Refugee Aid: Due to the turmoil in Syria, Ethereum blockchain was successfully used for a charitable cause. The United Nation’s World Food Programme (WFP) ran a project of cryptocurrency-based vouchers to Syrian refugees that could be used to purchase food in participating markets.

- Elections: To avoid the rigging during elections, blockchain technology can be used for some major roleplaying areas such as voter registration and counting of votes. This means that there will be no fake voters. It can be a great application of blockchain to eliminate rigging during elections.

- Music: Blockchain technology is being used to give singers a chance to earn more without paying the contract companies. This way a singer can no longer feel dependent on contract companies and can get directly paid from the listeners.

Blockchain, promises the ability to improve the business processes that occur between companies, radically lowering the “cost of trust”. From a business perspective, it’s helpful to think of blockchain technology as a type of next-generation business process improvement software.

Our article Blockchain What is it? How it differs from Cryptocurrency? What is the future? explains it in detail

Related Articles:

- Blockchain What is it? How it differs from Cryptocurrency? What is the future?

- Is Crypto currency banned in India?

- What are Central Banks,What is RBI? What do they do?

- What is HyperInflation? Why is Venezuela having Hyper Inflation?

- UN,IMF,World Bank: Rich and Poor countries of World, MUN

Summary

A cryptocurrency is a medium of exchange, such as the US dollar, but is digital and uses encryption techniques to control the creation and to verify the transfer of funds.

Blockchain is the technology that enables the existence of cryptocurrency (among other things).

Bitcoin is the name of the best-known cryptocurrency, the one for which blockchain technology was invented.

“What’s up friends, pleasant piece of writing and good arguments commented

at this place, I am really enjoying by these.”

“Thanks for the good writeup. It if truth be told used

to be a amusement account it. Glance advanced to more brought agreeable

from you! However, how can we keep in touch?”

“Thanks designed for sharing such a pleasant thought,

paragraph is fastidious, thats why i have read it entirely”

Backlinks SEO Package for Cryptocurrency and Blockchain Websites

Blockchain and Cryptocurrency Email List for B2B Marketing