After Bachat, Nivesh, Badhat and One Idiot IDFC are back with series of videos or short films 2-3 minute each, titled The world according to One Idiot. While the film One Idiot was about the power of taking responsibility for our finances finances and starting early on the path to learning about saving and investing, these short films try to answer questions about how to do it, for example What is financial independence,How to be financially independent,How to pick your investments,etc without preaching, in an entertaining way. This article reviews these short films by IDFC.

Table of Contents

About the short films and characters

The short films are conversion between Abhi , an IT professional of age 25 years and Varun, a struggling actor of age 22 in Abhi’s house. These short films, each around 2-3 mins, can be viewed on one idiot website and also on Youtube. Each short film ends with a tip.

On one hand we have Varun who is cool guy busy with girl friends(Kitty), body building, parties and Abhi is software engineer (there is reference to his being from IIT in one of the films), who not only is educated but is also financially literate, a cook (he cooks pasta) and a good host (always offering food and cool drinks to Varun), shy with girls (the kind a mother would want to marry her eligible daughter!). Through the conversions between Abhi and Varun, with great illustrations on the beautifully coloured walls, we get answers to following questions : (with film links to YouTube)

- What is financial independence , film 1

- How to be financially independent, film 2

- How to pick your investments, film 3

- What is SIP, film 4

- Insurance: why and when, film 5

- Why do you need a financial advisor, film 6

Film 1: What is financial independence?

In Film 1 Abhi and Varun discuss about Financial independence after watching One Idiot. Abhi defines Financial independence as :

- When you don’t ask money from your parents.

- When you grow up,have family, kids and when you start taking care of them apni jeb se (from your own pocket)

- When you are old and retired and you don’t have to depend on your kids then you are financially independent

Film 2: How to be financially independent,

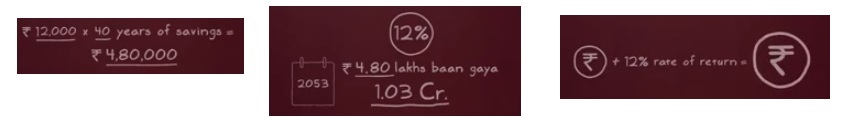

In Film 2 Abhi explains how one can be financially independent, achieve your dreams (of even owing a Big Ca….r to impress any chick) by starting early and working backwards. You need to decide how much you need, after how many years, at what returns and find out how much you need to save. Using the magic wand of Compounding you let your money grow and achieve your dreams. For example if you save 10,000 rupees a month for 40 years you would have saved 4.80 lakh. If you invest it at 12% rate of return, at end of 40 years 4.8 lakh would have grown to 1.03 crore. So to achieve your target amount you need to find out how much will you invest, for how long and at what return you expect your money to grow.

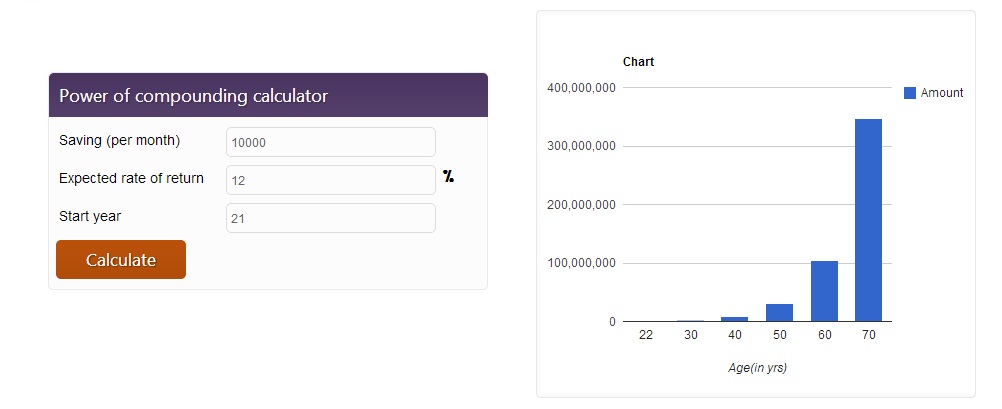

Infact IDFC has a calculator, Power of Compounding Calculator, for how much you can make your money grow.

Film 3 : How to pick your investments

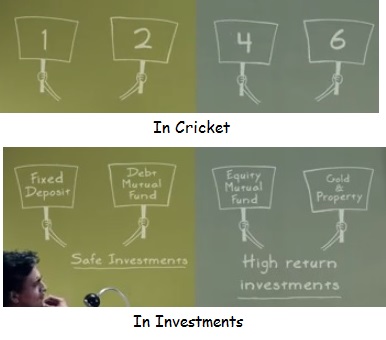

In Film 3 analogy to game of cricket is used. In cricket har ball pe chakka nahin mara ja sakta (in cricket on every ball you cannot hit a six). A great scorecard means great combination of 1,2,4,6. Comparing cricket to Investments

- Equivalent of 1,2 in cricket are safe investments like Fixed Deposit, Debt Mutual Funds.

- Equivalent of 4,6 in cricket are high return investments like Equity Mutual Funds, Gold and Property.

When one is young one should invest more in risky,high return investments but as one grows older one should move to safe investments like fixed deposits, debt mutual funds. Choosing how much to invest in what type of investment is called as asset allocation.

Film 4: What is SIP?

In Film 4 Abhi explains What is SIP to Varun? SIP is Systematic investment Plan is for those who don’t want to take chances. One invests a fixed amount every month while Stock market goes up down.

Film 5: Insurance: why and when

In Film 5 Abhi talks to Varun about importance of life insurance, health insurance. One may look like Virat, bat like Yuvraj, adjust like Sachin but one gets out in cricket. Health insurance is for when you fall sick, you don’t have to worry about money.

Film 6: Why do you need a Financial Advisor?

In Film 6 Abhi explains to Varun that Financial advisor is know it all of your investment options, a relationship manager between your money and your investment options. Abhi asks Varun about how he buys a product. Varun replies he asks his friends, checks on the net ,gets user feedback, reads magazines get expert opinion before he buys. Abhi says that Just like that one needs to do home-work or research to ask the right questions to financial advisor.

Review

There is dearth of good investing material, esp. videos on the finance in India for Gen-Y. We have lot of young people who though educated are not financially literate These films are an attempt in that direction. These films are short (2-3 mins each), cute, in conversation style ( not the boring lecture style or presentation style),Analogy with cricket was my favourite part. Illustrations on the wall were very interesting. The mood is light throughout the movie, Varun questions, answers, his girlfriend Kitty hanging every time do evoke laugh. For example in Film 1, when Abhi is trying to explain him that financial independence is not asking parents for money, Varun says that he he hasn’t asked money from his parents since Tuesday and today is Thursday. Or when Abhi asks him to calculate backwards on how to achieve his target, Varun compares it to Urdu. I would recommend you to watch these movies, with your kids if possible, it would be 15 minutes well spent.

Link to Videos on YouTube

- What is financial independence , film 1

- How to be financially independent, film 2

- How to pick your investments, film 3

- What is SIP, film 4

- Insurance: why and when, film 5

- Why do you need a financial advisor, film 6

Related Articles:

- Review of movie One Idiot by IDFC

- Videos on Money

- Money Awareness for Beginners

- Personal Finance and Scott Adams,Dilbert

- Personal Finance Books For Adults, Books on Money for Children

Disclaimer: We have no affiliation with IDFC .

How did you learn about personal finance? What and how do you want your children to learn about personal finance? What is attitude of Gen Y towards money and why? Which short film in, According to One Idiot, did you like, which one you did not like? Do you think Varun was loud, choosing an struggling actor was not an apt choice or having role reversal , IIT guy Abhi getting the Gyan would have been more effective. What kind of videos do you want to see on financial awareness?