What is Form 15G? What is Form 15H? Who can Fill Form 15G? Who can fill Form 15H? Does income tax department knows about 15G or 15H submission? If no TDS is deducted is tax liability over? if TDS is deducted then is there some tax liability? from where can one download Form 15G ? From where

What is Form 15G or 15H?

Form 15G or 15H is submitted to request income provider for not deducting tax or TDS for prescribed income.

- These forms can be used only for payments in the nature of Interest of Securities, Dividend, Interest other than Interest on Securities (Bank/Company Deposits) , NSS & Interest on Units. For other types of payments, these forms cannot be used.These days for PF withdrawal one is required to fill Form 15G if one does not want tax to be deducted.

- One can submit these forms to bank, post office, company etc

- These forms have to be filed in duplicate,at times 3 copies, to the payer which can be bank, post office, company . The payer or the institution takes them on record, the entire interest is to be paid to the depositor or lender without TDS

- While Form 15G is for Indian residents below 60 years of age, HUFs and trusts, Form 15H is for those above 60.

For example you open a Fixed Deposit in the bank. If your interest income exceeds Rs 10,000 a year, the bank will deduct 10% TDS or tax at source.If you do not furnish PAN details, the TDS rate will be higher at 20%. However, you can submit a Form 15G and 15H to avoid TDS on interest income.

But if the final tax liability is lower than the TDS? Or the investor income is below the exempted slab and investor is not liable to pay any tax. Yet the interest income that he earns may have been subjected to TDS. In such cases, the only solution is to file the income tax return specifying the extra tax paid and request a refund. The process is cumbersome and takes time. So Rule 29C of Income Tax Rules offers taxpayers the facility of furnishing Form 15G or 15H, as the case may be, requesting the payer of income not to deduct any tax.

What is TDS?

TDS is a certain percentage deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account. This withheld amount can be adjusted against tax due. The person/organization deducting the tax is called as Deductor while the person from whom the tax is deducted is called Deductee. For details on TDS you can read our article Basics of Tax Deducted at Source or TDS TDS rates at Income Tax webpage TDS Rate

Filling Form 15G or 15H for EPF withdrawal

If employee has rendered service for less than 5 years and has accumulated balance is more than or equal to Rs. 30000, he is required to submit form 15G or H along with PAN card to avoid TDS. Otherwise TDS will be deducted at 10% (if PAN is given). This is as per the amendment of section 192A of IT act effective from 1 June 2015.

TDS will be deducted

- at the Rate of 10% if Form-15G/15H is not submitted provided PAN is submitted.

- At maximum marginal rate (i.e., 34.608%) if employee fails to submit PAN.

TDS on EPF withdrawal will not be deducted in following cases:

- When there is continuous service of more than 5 years.

- When PF amount is less than Rs. 30,000.

- Termination of service is due to ill health, discontinuation of business of employer, completion of project or other reasons which are not in control of employee.

Note: if you withdraw your PF balance before the expiry of five years of continuous service, then it is taxable in the year in which withdrawal has happened. In addition to this, your employer’s contributions along with the accumulated interest amount will be taxed as profits in lieu of salary. Interest accumulated on your (employee) contributions will be taxed under the head Income from other sources. The tax deductions claimed on employee’s 80C contributions will be revoked or rolled back, and shall be liable to tax.

Who can Fill Form 15G? Who can Fill Form 15H ?

Only resident Indian,HUF and AOP can submit form 15G / form 15H. While Form 15G is for Indian residents below 60 years of age, HUFs and trusts, Form 15H is for those above 60. Our article Avoid TDS : Form 15G or Form 15H discusses the form in detail.

NRI,company and firm CANNOT submit form 15G or 15H. For NRI it may happen that your total income in India is less than the basic exemption limit in the financial year. In such cases, you may apply to the Income Tax Officer in your jurisdiction in India, requesting for a waiver of TDS. If the Tax Officer grants you the waiver, you may submit this to the payers such as your bank and claim TDS exemption. This certificate is called Tax Exemption Certificate.

What is validity of Form 15G or 15H?

Please Note Form 15G and Form 15H both have a validity of 1 financial year only. These forms are only valid for the Financial Year in which you have furnished these Forms and in case you want to apply for Nil/ Lower Deduction of TDS on Interest on Fixed Deposit in another financial year, you will have to refurnish these forms again to your Banker.

What are conditions to fill Form 15G?

Can anyone fill Form 15.G? No . You need a valid reason to request the bank or financial institution not to deduct TDS.

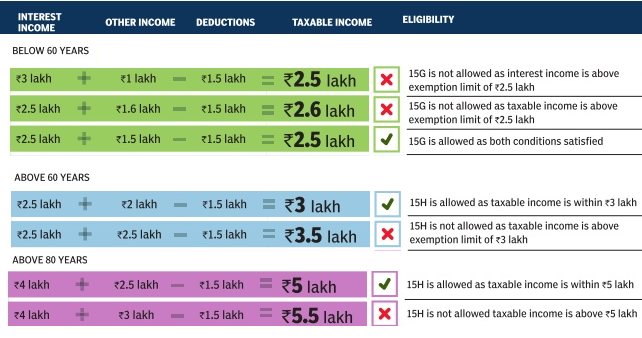

The basic conditions for filing 15G are :

- The final tax on estimated total income computed as per the Income Tax Act should be nil

- The aggregate of the interest (excluding interest earned on securities) received during the financial year should not exceed the basic exemption slab x: 2.5 lakh in AY 2015-16,AY 2016-17. Our article Income tax slab rates from AY 1986-87 to covers the basic exemption limit and tax slabs from AY 1986-87 to current Assessment Year.

If these criteria are met, you can submit Form 15G and the entire interest income would be credited without any tax cut. Please note that You need to meet both criteria. Even if the interest income is less than the basic exemption allowed during that financial year, but your total tax liability is not nil, you will not be eligible for filing Form 15G. The reverse is also true. Say your income is Rs 4 lakh, of which Rs 3 lakh is earned as interest from the bank. You might invest Rs 1.5 lakh in PPF and be out of the tax net, but you are not eligible for Form 15G as though your tax liability is zero, the interest income is higher than the basic exemption. The refund route is your only recourse.

What are conditions to fill Form 15H?

Form 15H can be only filed by individuals above 60. This form imposes only the first condition,the final tax on the investor’s estimated total income should be nil. So, if you are above 60, your taxable income for the financial year can be up to Rs 3 lakh for you to be eligible for 15H. For super senior citizens above 80 years, this limit is Rs 5 lakh.

For example, say Mr Mehta, 68 years old, has a total income of Rs 3,00,000, out of which Rs 45,000 is earned from the senior citizens saving scheme and the rest from bank deposits. He invests Rs 1,50,000 in PPF. Now, is he eligible to furnish Form 15H? As Mr Mehta is senior citizen, It doesn’t matter what amount he receives from which source; this information is irrelevant for Form 15H. We find that Mehta’s net income works out to Rs 1,50,000 (Rs 3,00,000 – Rs 1,50,000). As the basic exemption limit for Mehta is Rs 3,00,000 (on account of him being a senior citizen), his net tax liability is nil and hence he is indeed eligible to submit Form 15H.

What if I miss filling the Form 15G or 15H?

If you give wrong information in the form 15G or 15H

The repercussions of wrong filing is stiff.A false or wrong declaration in Form 15G attracts penalty under Section 277 of the Income Tax Act. Prosecution includes imprisonment ranging from three months to two years, and a fine. The term can be extended to seven years and fine, where tax sought to be evaded exceeds Rs 25 lakh.

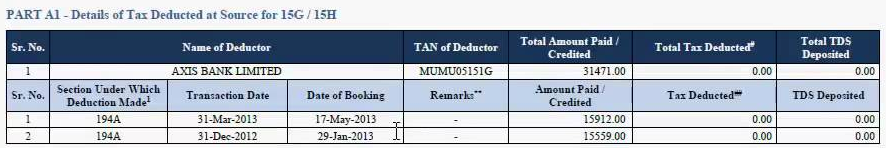

Form 26AS and 15G or 15H declaration

The Form 15G or 15H show up in Form 26AS as shown in image below (Click on image to enlarge). This is because Income Tax department knows that one has submitted form 15G or 15H. Form 15G or 15H is submitted in duplicate or triplicate( 3 copies) , one of which is forwarded to the IT department. Income Tax Authorities can make further inquiries regarding the declaration filed by the depositor. Our article What to Verify in Form 26AS covers Form 26AS in detail.

Form 15H or 15G should be submitted before Tax is deducted. Typically for FD or Senior Citizen Schemes, Form 15G or 15H should be submitted at the beginning of the year so as to avoid a situation where bank has already deducted the tax before you submit the form.

However in case the bank/company deducts the tax in spite of you having submitted the form or before you actually submit the same, the bank/company will not refund the tax already deducted, as the bank would have already deposited the tax with the government. In such a situation the only option available with you is to file your income tax return and claim the amount of TDS a refund.

Summary of article

| Sl. No. | Question | Fact |

| 1 | Anybody who wishes to avoid tax deduction can make use of Form 15G/15H | Only persons with income below taxable limits and Nil Tax liability can only make use of this form. |

| 2 | Once declaration is given in Form 15G/Form 15H, there is no need to declare this income in return of Income. | Irrespective of the fact whether the Form is used or not, the respective income should be compulsorily declared in return of income. |

| 3 | Once declaration is given in Form 15G/Form 15H, there is no need to pay tax on the same. | As per the provisions, only persons with NIL tax liability only can give these forms. But if there is a tax liability, they have to necessarily pay the requisite tax. On the other hand, by payment of tax they run the risk of giving a wrong declaration. Hence before giving Form 15G/15H, please be doubly careful. |

| 4 | Form 15G & 15H are submitted only to the banks/Financial Institutions/Payer. | This is partly correct. The person who receives the Form 15G/15H is required to submit one copy of the Form to the Commissioner of Income-tax . Hence the information is passed on the Income-tax department and the Income-tax Department can make further enquiries on the same. |

| 5 | Submission of Form 15G/15H once is sufficient. | No. These forms shall be submitted every Financial year at the beginning of the Financial year. |

| 6 | It is enough that irrespective of the fact that deposits are held in different branches, a single Form is sufficient. | No. These forms should be submitted to each and every branch where you hold the deposits. For example, if you hold deposits in 3 different branches of State Bank ofIndia, this declaration shall be given for each branch separately. |

| 7 | Since my Income is below taxable limits and tax is NIL , I do not have to submit the PAN details with the declaration | No. Every person giving declaration using Form 15G/15H shall compulsorily provide the PAN details along with the declaration irrespective of their Income/Tax status. Otherwise tax will be deducted @ 20% on the Interest (w.e.f 01/04/2010) |

| 8 | Form 15G/15H can be used for not deducting TDS for all types of payments (viz.,) Contract payments, Professional fees, rent,etc., | These forms can be used only for payments in the nature of Interest of Securities, Dividend, Interest other than Interest on Securities (Bank/Company Deposits) , NSS & Interest on Units. For other types of payments, these forms cannot be used. |

From where can we download Form 15G and 15H?

You can download Forms 15G and Form 15H from here 15G and 15H or from Income tax India website http://www.incometaxindia.gov.in/Pages/downloads/most-used-forms.aspx

How to Fill Form 15G? How to Fill Form 15H? explains in detail How to fill the forms.

Related Articles:

- Taxing Times: In a lighter vein

- Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR

- How To Fill Salary Details in ITR2, ITR1

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- Tax on EPF Withdrawal

Hope it helped to clarify FAQ such as What is Form 15G? What is Form 15H? Who can Fill Form 15G? Who can fill Form 15H? Does income tax department knows about 15G or 15H submission? If no TDS is deducted is tax liability over?If TDS is deducted then is there some tax liability? From where can one download Form 15G or Form 15H?

https://bemoneyaware.com/wp-admin/post.php?post=14432&action=edit

Dear member, for viewing Member Passbook, filing of e-nomination is compulsory.101199676964 and 101345452945

I left perivies consern 2years back is it requires 15g or not. Now I am working abroad

15G form is so that tax is not deducted on your EPF Withdrawal.

If you have worked for more than 5 years tax should not be deducted but still some companies are insisting for 15G to be on safe side.

If TDS gets deducted the only way to claim is by filing ITR.

As you are working abroad are you filing Income Tax Return (ITR)?

My date of birth is 22-March 1957. i.e. I will be completing 60 yrs on 31-March-2017. So, Whether I should submit form15G or 15H to the banks?

Bank employees are not clear about this.

hi, what to fill in the item no 23 which says “Estimated total income of the previous year in which income mentioned in Column 22 is to be included” it is not clear to me, Please elaborate , i need this for PF withdrawal , and item 22 i dont have any income from any schedules. Thanks in Advance!

What if interst limit exeeds Rs.10000 for those who has submited the form-15G/Form 15H what will be the statas of TDS dedcution by Bank?????

Only when the interest income exceeds 10,000 bank can deduct TDS. If Form 15G/H is submitted then no TDS is deducted.

If Interest income is less than 10,000 Rs no TDS is deducted.

Very informative and thanks for writing in such a details. It helped me.