To transfer money electronically between bank accounts in different banks, India currently has various methods to transfer money online such as NEFT, RTGS, IMPS, digital wallets, UPI, and more. However, the most commonly used fund transfer methods are National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), Immediate Mobile Payment Service (IMPS), Unified Payment Interface (UPI). The differences between RTGS, NEFT and IMPS are in the: who manages it?, the amount that can be transferred, when it will be transferred, instant/with delay, When is it available: 24 X 7 or during banking hours? What are the charges for using it?

Difference between NEFT IMPS and RTGS

Table of Contents

Difference between NEFT, RTGS, IMPS

Fund transfer offer convenience and flexibility to the account holders. To use these fund transfer services, remitter (person who wants to transfer money) must have the bank account details of the beneficiary (person to whom the money is to be transferred). The bank account details include the beneficiary’s name and bank’s IFSC.

If you are doing NEFT/IMPS/RTGS online you need to first register or add beneficiary details. Wait for some time and then you can use any of these methods as shown in the image above. This needs to be done only once.

If you want to transfer between bank accounts using only a mobile phone and that too without adding Bank account details and IFSC code then you should go for UPI based options: like Google Pay, PhonePe, Bhim Pe,

While NEFT and RTGS were introduced by RBI (Reserve Bank of India), IMPS was introduced by National Payments Corporation of India (NPCI) which has also introduced UPI. Explained in our article Google Pay & UPI: How to use, How to set

The differences between RTGS, NEFT and IMPS are in the

- who manages it?

- the amount that can be transferred,

- when it will be transferred, instant/with delay

- When is it available: 24 X 7 or during banking hours?

- What are the charges for using it?

| Description | NEFT | RTGS | IMPS |

| Full Form | National Electronic Fund Transfer | Real Time Gross Settlement | Immediate Mobile Payment Service |

| Managed by | RBI | RBI | NPCI |

| Settlement Type | Group i.e Half Hourly Batches | One-on-one Settlement | One-on-one Settlement |

| Minimum Transfer Limit | Rs.1 | Rs.2 lakh | Rs.1 |

| Maximum Transfer Limit | No Limit | No limit | Rs.2 lakh |

| Funds Transfer Speed | NEFT amount is debited immediately.

It is processed in next available NEFT batch (half hourly) |

Immediate | Immediate |

| Service Timings | 24/7

|

Sunday and Bank Holidays Unavailable Weekdays : 9:00 AM – 4:30 PM

Saturdays: 9:00 AM – 2:00 PM (for settlement at RBI’s end) The timings that banks follow may vary. |

24/7 |

| Transaction Charges | No charges for receiving money through NEFT.

Outward transactions at originating bank branches – charges applicable for remitter for amount: Up to Rs.10,000 is Rs.2.50 Rs.10,000 – Rs.1 lakh is Rs.5 Rs.1 lakh – Rs.2 lakh is Rs.15 Rs.2 lakh and above is Rs.25

GST is also applicable |

No charges for receiving money through RTGS.

Charges applicable for outward transactions for amount:Rs.2 lakh – Rs.5 lakh is Rs.30 Rs.5 lakh – Rs.10 lakh is Rs.55

Also, an additional amount charged from Re.1 to Rs.5 if a transaction is done after 12:30 PM. GST is also applicable |

Charges for remittance through IMPS are decided by the individual member banks and PPIs. The taxes are included. |

| Payment Options | Online and Offline | Online and Offline | Online |

Video on What is NEFT, RTGS, IMPS, UPI ? | Real Difference Between Online Fund Transfer | How it Works ?

This video explains in simple terms what is the difference between NEFT, RTGS, IMPS, UPI.

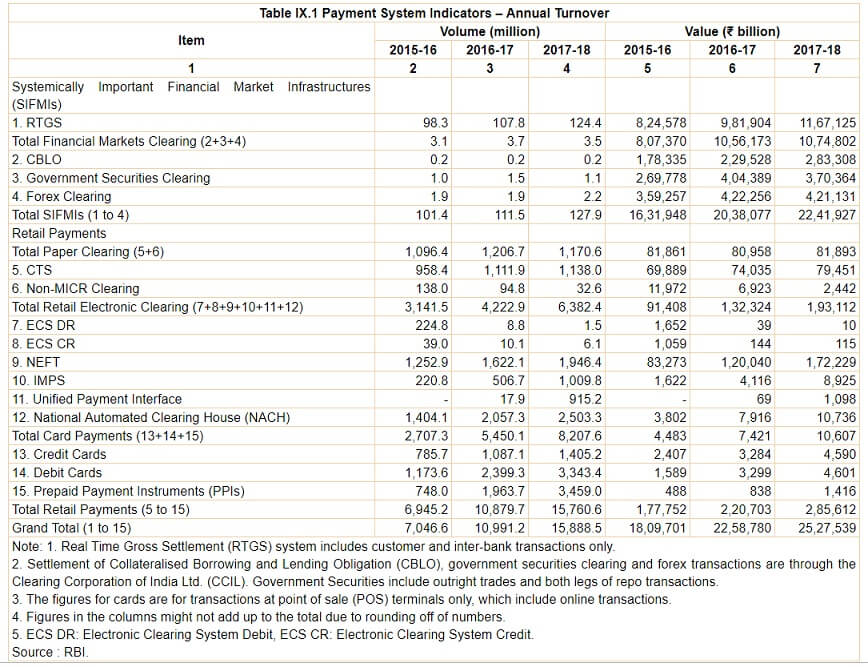

Which payment option is popular NEFT, RTGS, IMPS, UPI etc

The Reserve Bank of India on 29 Aug 2018, released its 245-page annual report for the financial year 2017-18. In the Annual Report, RBI spoke about a host of subjects like asset quality in the banking system, the government’s demonetisation exercise in 2016, the value of the Indian rupee, and India’s macros. Chapter IX, Payment and Settlement Systems and Information Technology, covers the Modes of Payment in India, which we have covered in detail in our article How India pays: Cash, Cheque,NEFT,Cards etc

- The Real Time Gross Settlement (RTGS) system handled 124 million transactions valued at ₹1,167 trillion in 2017-18, up from 108 million transactions valued at ₹982 trillion in the previous year. At the end of March 2018, the RTGS facility was available through 1,37,924 branches of 194 banks.

- The NEFT system handled 1.9 billion transactions valued at around ₹172 trillion in 2017-18, up from 1.6 billion transactions valued at ₹120 trillion in the previous year, registering a growth of 20 per cent in terms of volume and 43.5 per cent in terms of value. At the end of March 2018, the NEFT facility was available through 1,40,339 branches of 192 banks, in addition to a large number of business correspondent (BC) outlets.

- Credit cards and debit cards: During 2017-18, the number of transactions carried out through credit cards and debit cards was 1.4 billion and 3.3 billion, respectively.

- Prepaid payment instruments (PPIs) recorded a volume of about 3.5 billion transactions, valued at ₹1,416 billion.

- Mobile banking services witnessed a growth of 92 per cent and 13 per cent in volume and value terms, respectively, while the number of registered customers rose by 54 per cent to 251 million at end-March 2018 from 163 million at end-March 2017.

How India pays as per RBI annual report

What is NEFT?

NEFT is National Electronic Funds Transfer (NEFT) is a nation-wide payment system facilitating one-to-one funds transfer. The NEFT system takes advantage of the core banking system in banks. So the settlement of funds between originating and receiving banks takes places centrally at Mumbai, whereas the branches participating in NEFT can be located anywhere across the length and breadth of the country.

- You can use the NEFT service to send money offline through the bank branch through cash, cheques, DD or you can make the transfer online using net banking facility of your bank account.

- It is necessary for the beneficiary to have an account with the NEFT enabled destination bank branch in the country.

- If you use cash to do NEFT maximum limit is Rs 50,000.

- There is no minimum limit on the amount that can be transferred.

- Even such individuals who do not have a bank account (walk-in customers) can also deposit cash at the NEFT-enabled branches with instructions to transfer funds using NEFT. However, such cash remittances will be restricted to a maximum of ₹ 50,000/- per transaction. Such customers have to furnish full details including complete address, telephone number, etc.

- From July 10, 2017 settlements of fund transfer requests in the NEFT system is done on a half-hourly basis. There are 23 half-hourly settlement batches run from 8 am to 7 pm on all working days of the week (Except 2nd and 4th Saturday of the month). So all NEFT transfer requests between say 10:01 am to 10:29 am are processed at 10:30 am. If you make an online transfer after 7 pm, it will be processed at 8:00 am on the next working day, but the amount will be deducted immediately from your account.

- The beneficiary can expect to get credit for the NEFT transactions within two business hours from the batch in which the transaction was settled.

- For NEFT transfers too there is no option of stopping payment once a transfer has been initiated by the bank. So one small mistake could result in a big loss.

What is RTGS

- RTGS stands for Real Time Gross Settlement, where there is a continuous and real-time settlement of fund transfers, individually on a transaction by transaction basis (without netting).

- Real Time means the processing of instructions at the time they are received;

- Gross Settlement means that the settlement of funds transfer instructions occurs individually.

- in RTGS, the transactions are processed continuously on a transaction by transaction basis throughout the RTGS business hours.

- The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is ₹2,00,000 with no upper or maximum limit.

- RTGS is not a 24×7 system. The RTGS service window for customer transactions is available to banks from 8 am to 6 pm (The timings are extended from 4:30 pm to 6:00 pm from June 01, 2019) on a working day, for settlement at the RBI end. However, the timings that the banks follow may vary from bank to bank

- Unique Transaction Reference (UTR) number is a 22 character code used to uniquely identify a transaction in the RTGS system.

- As the fund’s settlement takes place in the books of the Reserve Bank of India, the payments are final and irrevocable.

What is IMPS?

- IMPS stands for Immediate Payment Service.

- IMPS is available 24 x 7 even on Sundays and holidays. It transfers funds instantly and is a great banking platform in case of emergencies.

- IMPS is an instant interbank electronic fund transfer service through mobile phones. It is also being extended through other channels such as ATM, Internet Banking, etc.

- The IMPS fund transfer limit is Rupees 2 lakh per day. The minimum allowed transaction value in IMPS is Rupees 1.

- After initiating the payment request payment cannot be stopped or cancelled.

- As per RBI regulations, the users must check the details twice or thrice before confirming the payment through UPI or IMPS. This is because the money transferred to a wrong bank account can only be returned with the consent of the beneficiary.

- National Payments Corporation of India (NPCI) is responsible for managing the IMPS fund transfer mechanism. But is regulated by the Reserve Bank of India. Initiated in 2010 by the NPCI with the help of a pilot project with 4 major banks, IMPS has now grown to most of the banks

- The charges for remittance through IMPS are decided by the individual banks. Please check with your bank.

- HDFC Bank, ICICI Banks charges: 1) Above Rs.1 to Rs 1 Lakh – Rs.5 + GST 2) Above 1 lakh to 2 Lakh – Rs.15 + GST. GST is 18%.

- beneficiary details one requires to effect an IMPS remittance from Person to Person are :

- MMID of the beneficiary, (Mobile Money Identification Number (MMID) is a seven digit number of which the first four digits are the unique identification number of the bank offering IMPS.)

- Mobile number of the beneficiary

- Name of the beneficiary

- Beneficiary details one requires to effect an IMPS remittance from Person to Account.

- Name of the beneficiary

- Account Number of the beneficiary

- IFS Code of the beneficiary bank

To know more about IMPS, How to send money through Net Banking, Mobile App you can check out our article How to use IMPS to send money instantly

What is UPI?

- Unified Payments Interface or UPI is an instant real-time payment system transferring funds between bank accounts on a mobile platform

- It is available 24X7 even on Sundays and Bank Holidays.

- UPI allow bank account holders across banks to send and receive money from their smartphones using just their Aadhaar unique identity number or mobile phone number or virtual payments address without entering bank account details.

- UPI is developed by National Payments Corporation of India(NPCI) facilitating inter-bank transactions. The interface is regulated by the Reserve Bank of India. The NCPI operates the Rupay payments infrastructure that – like Visa and MasterCard.

- Example the Apps which use UPI are

- BHIM (Bharat Interface for Money) is an easy and secure UPI app launched by NPCI

- PhonePe: Powered by Yes Bank, PhonePe is a UPI based app launched by Flipkart,

- Google Pay(or Tez): Payment app launched by Google for India

- It was launched in Jan 2016. On August 16, 2018, UPI 2.0 was launched which enabled users to link their Overdraft accounts to a UPI handle. Users were also able to pre-authorize transactions by issuing a mandate for a specific merchant. 2.0 version included a feature to view and store the invoice for the transactions

- As of March 2019 there are 142 banks live on UPI with a monthly volume of 799.54 million transactions and a value of ₹1.334 trillion

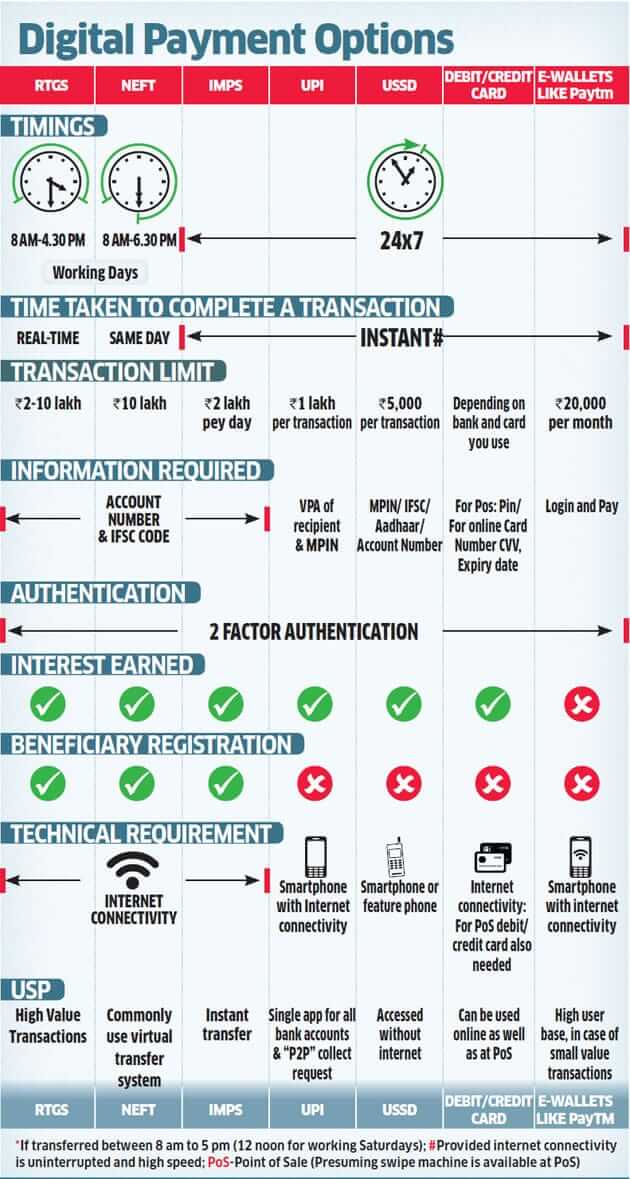

Infographic on Difference between NEFT, RTGS, IMPS, UPI

The image below shows the difference between NEFT, RTGS, IMPS, UPI etc

Difference between NEFT, RTGS, IMPS, UPI etc

Related Articles:

- What are Central Banks,What is RBI? What do they do?

- How Credit Card Number is Verified Online Using CVV2

- How India pays: Cash, Cheque,NEFT,Cards etc

- How to use IMPS to send money instantly

- What is Bank?

- Kinds of Cheques

- Cheque: Clearing Process, CTS 2010

Nice article.

you will read more detels in Bangla

https://rtelern.blogspot.com/2020/09/What-is-NEFT-IMPS-UPI.html