Banks and oil marketing companies (OMCs) will bear transaction charges also known as Merchant Discount Rate or MDR, for the fuel bought using cards at petrol pumps, Oil Minister Dharmendra Pradhan said on 12 Jan 2017. Charges related to card use at gas stations come out of a petrol dealer’s profits in a fee called MDR or Merchant Discount Rate. This article talks about Petrol Pumps, Debit and Credit Cards and MDR. What is MDR? What was Surcharge?

Table of Contents

Petrol Pumps, Debit and Credit Cards and MDR

There are 56,190 petrol pumps in the country, including those run by private oil companies. 60% of Swipe or Point of Sale(P0S) machines at over 52,000 outlets of the 53,842 public sector filling stations are set up by ICICI & HDFC

- MDR is a charge levied on merchants by banks for accepting payments through credit and debit cards. This charge was passed on to consumers but post-demonetisation, the government, in a bid to promote digital payments, waived it till December 30, 2016.

- Banks, after that date, decided to pass on the MDR to petrol pump operators since the government mandate was very clear that consumers should not be burdened with any additional charge for using cards for payments.

- On Sun 8 Jan 2017, Petrol pump owners threatened to stop accepting card payments, forcing the government to broker a settlement.

- Petrol pump associations had deferred their decision of not accepting debit and credit cards for fuel purchase till 13 January 2017.

- On 12 Jan 2017 Oil Minister Dharmendra Pradhan said the government stands by its decision that customers using non-cash digital modes of payments will not have to pay any transaction charge. Also, the 0.75 percent discount on fuel rate for using digital payments will continue.

- Oil Minister Dharmendra Pradhan said banks and oil companies will continue to discuss as to who should bear these charges and in what proportion. “MDR charges will be levied as per RBI guidelines of December 16,” he said. Asked if it will be shared equally between the oil marketing companies (OMCs) and banks, he said: “That is yet to be decided”

What is MDR or Merchant Discount Rate?

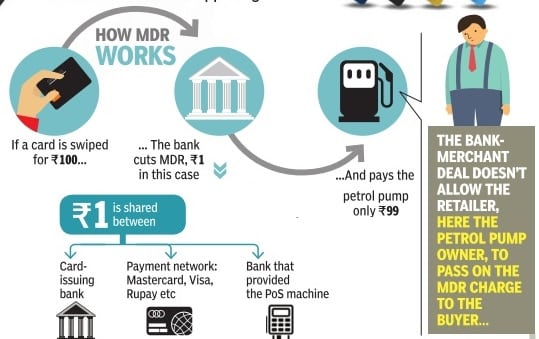

On every card transaction, petrol pump owners pay a fee of around 1%. This is the merchant discount rate. The MDR is a fee banks charge ‘merchants’ (retailers. petrol pump dealers etc) for card transactions. MDR rate: 1% for debit cards and around 2% for credit cards.

The other merchants are not protesting the MDR because on typical retail transactions, for clothes, groceries etc, margins can go in excess of 10%30%. So merchants can absorb the cost of MDR. But fuel is sold at fixed amount per litre, though in large volumes

A fee like MDR is where banks make a profit. The image below shows How MDR works?

Less MDR but more Surcharge, Customer ends up paying

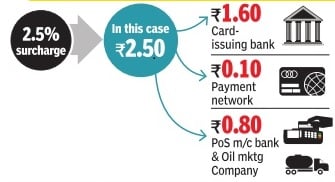

Accepting card payments used to be profitable for pumps because of the surcharge. Gas station owners’ says that at Petrol pump Margins are too thin to absorb the MDR. Profit margins fixed on kilolitre basis so there’s little headroom to absorb this charge. So Banks lowered MDR & pumps charged buyers a surcharge of up to 2.5% of the bill. Banks turned a blind eye to the surcharge and refunded select high-end customers only. So if the surcharge is Rs 2.50 then Rs 1.60 goes to Card-issuing bank, Rs .10 to Payment card networks such as Mastercard, Visa, Rupay and 80 paisa to bank who provides the Swiping machine and oil Marketing company. Following image below shows how the Surcharge is shared

What happens when the Credit or Debit Card is Swiped

But how do the credit card work? What happens when you swipe your card? Our article What happens when credit card is swiped? discusses it in detail. An overview of steps is given below.

- You swipe your credit card, giving a merchant your personal data, which gets entered into the merchant’s payment system (POS terminal or e-Commerce website).

- Your data is sent to an acquirer/payment processor who routes your data through the payments system for processing.

- The acquirer/processor sends the data to the payment brand (i.e. Visa, MasterCard, American Express, etc.) who then forwards it to the issuing bank.

- The issuing bank verifies that the card is legitimate, is not lost or stolen, and that the account has the appropriate amount of funds to cover the purchase.

- The issuer generates an authorization number and routes that number back to the card brand, agreeing to pay for the purchase on the cardholder’s behalf.

- The card brand forwards the authorization code back to the acquirer/processor.

- The acquirer/processor sends the authorization code to the merchant.

- The merchant completes the sale, gives you a receipt and lets you walk out of the store with his goods.

Related articles:

- Tax: What are Cess and Surcharge? What is difference

- Understanding Restaurant Bill : Service Tax,Service Charge,VAT

- GST Bill : Good and Services Tax

- Basics of Service Tax

- How Gold Ornament is Priced?

- Understanding Ex Showroom Price and On Road Price of Vehicle

competitive fixed factoring rates and programs

https://www.flatratefunding.com/

We provide competitive fixed factoring rates and programs with no hidden fees or monthly minimums. We offer fixed rate invoice factoring programs, as well as the best customer service.