Buy on dips is suggested to add one’s stocks when a market decline provides a buying opportunity. But many of us are not able to track the market regularly and miss the opportunity of buying the stocks at the desired price. Many wish for the facility to set the desired price till Cancelled. Such orders are called Good Till Cancelled or GTC orders. Indian stock exchanges do not support GTC orders. All the pending orders are cancelled by the exchange at the end of the day. But now many brokers are using the technology to overcome this limitation. It allows one to set the desired buying/selling price. For example, Zerodha allows one to place GTT(Good till Triggered) orders which are active for 1 year, as shown in the image below. ICICIDirect offering is called VTC, while HDFC Securities offering is called GTD. There are no extra charges for using the GTT. In this article, we shall explore the GTT feature, How to place GTT order on Zerodha, How to place ICICIDirect VTC order and HDFC Securities GTD order.

Table of Contents

GTT by Zerodha VTC by ICICIDirect, HDFC Securities GTD

Good Till Cancelled or GTC stock orders are orders that are valid until cancelled. These are used for placing target orders or stop-loss orders and are valid till Cancelled.

Indian stock exchanges do not support such GTC orders. all the pending orders are cancelled by the exchange at the end of the day.

Brokers like ICICIDirect, HDFC Securities place all the cancelled pending orders the next trading day. ICICIDirect calls it Valid Till Cancel(VTC) and HDFC Securities calls it Good Till Date(GTD)

Zerodha has developed an innovative alternative to GTC that allows one to set Triggers at the desired price to buy or sell stocks. Only when the trigger price is met the order is sent to the exchange. Zerodha calls it GTT or Good Till Triggered

There is no need to log in repeatedly to place limit orders.

One can modify or even cancel the order(s) at any time.

There are no additional charges to place these orders.

Zerodha GTT feature is advanced than ICICIDirect VTC and HDFC Securities GTD

Zerodha GTT

Zerodha introduced the concept of GTT in July 2019 for delivery of the stocks that is CNC or Cash and Carry

In May 2020 Zerodha extended the GTT feature to include Nifty and Bank Nifty futures and options.

One does not need cash or margins in an account while creating a GTT. Cash or margins are checked only when the GTT is triggered and an order has to be placed on the exchange. You will need to have cash/margin available only then.

- No additional charges have to be paid for using the GTT

- All orders can be placed and triggered only during market hours

- Orders placed at the exchange by GTTs that trigger will only be sent to exchange

- if you have enough funds for buys and

- if you have enough stock in your Demat for selling

- When a GTT is triggered, and an order is placed on the exchange, it is executed only if the limit price order placed is filled on the exchange. It is recommended to place the limit price higher than the trigger price for buy GTT orders and sell limit price lower than the sell trigger price for sell GTT orders. The higher the difference in price from the trigger, the more likely the order will be executed

- A GTT trigger order is valid only once. So, if an order fired by a GTT is not filled at the exchange for any reason, one will need to replace the GTT order manually.

- A GTT is valid for one year. If it isn’t triggered within one year, the GTT is cancelled. Then you need to place the GTT again.

- A maximum of 50 active GTTs can be placed at a time on one account.

- If you have not submitted Power of Attorney(POA) and if you are placing a sell GTT on your equity holdings, make sure to authorise the delivery of your shares using CDSL TPIN. The validity of authorisation is only for 90 days.

- Whenever there is a corporate action, like a bonus, dividend (if greater than 5% of market value), stock split, etc., the GTTs for the corresponding stocks will be cancelled before the ex-date. You will have to re-place the GTT manually after the corporate action. These GTTs are cancelled to ensure that the order is not triggered by the movement of stock price due to corporate action.

How to place Zerodha GTT Order

Typically stock order is an instruction to buy or sell shares and is of the types: Market Order, Limit Order and Stop Order, as discussed in our article How to buy Stock: Delivery or Intraday, Market or Limit, T+2

Market orders are transactions that are sent to exchange and executed as quickly as possible at the present or market price.

A limit order puts a price limit on your market orders. It is a maximum price at which you are willing to buy or a minimum price you are ready to sell. This order is active for the day.

Stop order is an advance order to sell/buy the stock which is triggered when it reaches a particular price. It is used to limit losses or gain in a trade. This order is also active for the day.

GTT orders are like Stop orders which are active for more than 1 day.

GTT can be used only for CNC type orders in the Equity Cash segment on NSE & BSE and NRML type orders in the Equity Derivatives segment on NSE.

TRIGGER PRICE is the price at which your BUY/SELL order becomes active and is sent to exchange.

LIMIT PRICE is the price at which your shares will be sold or bought.

A GTT is a trigger that places a limit order (at the limit price selected by you) as and when the trigger price, selected by you, is met or breached. In case the trigger price is breached during a particular day and the limit price selected is not exactly met on the same day, all such orders will be cancelled at the end of such trading day session.

How to place GTT order in Zerodha

You need to log in to the Kite using Zerodha Login id and password.

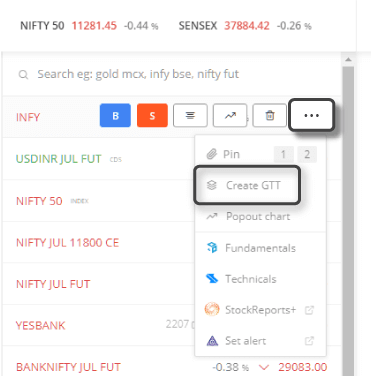

Choose a stock in the market watch, or search for the stock and it gets added to your market watch and click on the three dots icon

From the drop-down menu, select create GTT

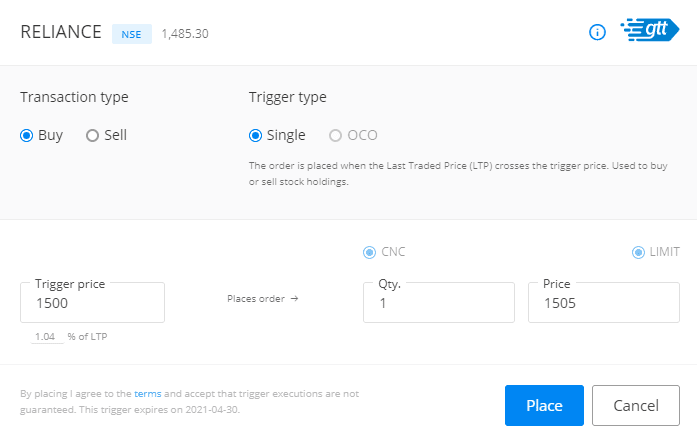

A form comes up as shown in the image below

Click on buy/Sell, fill in the trigger price, the limit price, and quantity.

- Buy GTT can be used to creating triggers to buy stocks for delivery

- Sell GTT is used to sell the current stock, as a target order single or as OCO

- Sell GTT – OCO (One Cancels Other): where both stop loss and target are set triggering of one will cancel the other

Remember

- TRIGGER PRICE is the price at which your BUY/SELL order becomes active and is sent to exchange.

- LIMIT PRICE is the price at which your shares will be sold or bought.

- You can set the Trigger price as a value or you can also set Trigger price as % of the LTP price. You can simply change the percentage value below the ‘Trigger price’ field (positive for target and negative for stoploss) and the trigger price will automatically be set to that level.

Review the filled form and click on the Place button.

Example of Buy GTT order on Zerodha

As shown in the image above The last Traded price of Reliance is 1485.30, In GTT Trigger price is set at 1500 and the Limit price is set at 1505

if the Reliance stock price becomes 1500, the trigger price a limit buy order at 1505 is placed. Since the limit price is greater than the market price, the order behaves like a market order and executes at 1500. However, since this is a limit order, it won’t be filled at a price above 1505.

Example of Zerodha Sell GTT Single

For example, one is placing Infosys GTT Sell Single order when Last traded price of Infy is 785.70, Trigger price is set to 799 and Limit price is set to 799.

if the trigger price of 799 is hit on the exchange, a limit sell order at 799 is placed. This order will be executed if you have the stock in your Demat account and a buyer is available.

Example of Zerodha Sell GTT OCO (One Cancels Other) Order

For example, one is placing Infosys GTT Sell Single order when Last traded price of Infy is 785.70, Stoploss trigger price is set to 700 and Stoploss limit price is set to 700. Target trigger price is set to 800 and the Target limit price is also set to 800

In this example, if either trigger price of 700 or 800 is hit on the exchange, a limit sell order at the corresponding limit price is placed. This order will be executed if you have the stock in your Demat account and a buyer is available. The other trigger is cancelled when one is hit.

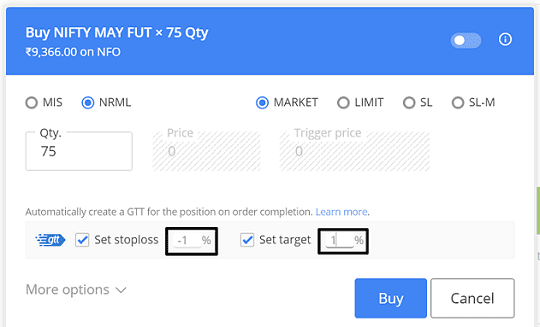

Example of Zerodha GTT for Nifty and Banknifty F&O

From May 2020 Zerodha allows placing GTT order for Nifty and Nifty Bank.

Margin Intraday Square Off (MIS) is used for trading Intraday Equity, Intraday F&O, and Intraday Commodity Trading. Using the MIS product code you will get an intraday leverage between 3 to 10 times based on what stock you are trading.

Normal (NRML) is used for overnight trading of futures and options

In the image below, while placing a buy Nifty May Futures market order, an SL and target of 1% are set. This means that whatever the price at which the market order gets executed, a sell GTT is placed at 1% above and below that price. If either one of these gets executed, the other gets cancelled.

Modify the GTT order on Zerodha

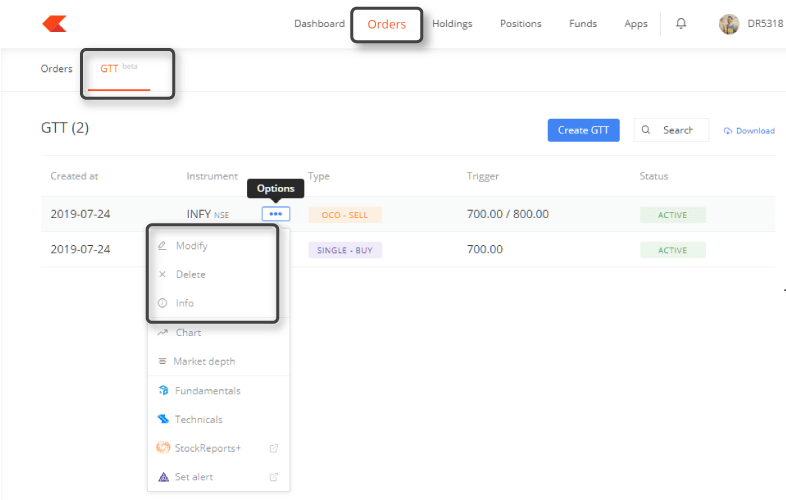

All GTTs placed in one places can be managed under the GTT tab on the Orders page of Kite.

To view/update your order, go on the Orders page and click on the GTT tab.

Video on How to Place GTT order in Zerodha

This video explains the complete concept of the GTT order, how it helps and how you can place it.

ICICIDirect VTC order

Types of order that ICICIDirect allows

Day Order: A Day order is valid till the end of the trading day. It gets cancelled automatically if unexecuted before the closing of market hours.

IOC (Immediate or Cancel): The order matches with open orders at Exchange for execution. If no match is not found It will be cancelled immediately. A partial match is allowed for the order and the unmatched portion of the order is cancelled immediately.

VTC (Valid Till Cancelled): It is an order type where the order is open up to 45 days. i.e the Order remains open till the entire quantity is executed or till the validity expires, whichever is earlier. ICICIDirect allows one to specify the number of days during which you wish to place the orders. The unexecuted order can be cancelled by the customer at the point of time.

The maximum days defined by ICICIDirect are up to 45 calendar days.

For example, day one places an order on 4 Mar 2023 then the default date for VTC is 45 days i.e 18 April 2021 one can change the validity of the VTC order to be less than or equal to 18 Apr 2021.

Anytime within the validity period if the shares are available at the specified price, then the order gets executed.

If the specified price is not reached within the validity period, it will get cancelled after the validity period.

- VTC is available to all customers at no additional charges

- VTC is available for both Buy and Sell orders.

- VTC is available on Equity Cash and Margin client mode products only.

- VTC is not available when placing Stop-loss orders

- Only limit price orders are available in VTC. Market orders can’t be placed.

- VTC order can be modified or cancelled at any time

Video on How to play ICICIDirect VTC order

HDFC Securities Good Till Date GTDt

One can Place orders at a specified price and quantity for stocks. So no need to log in repeatedly or call dealing desks to place limit orders

Available only for equity – cash products

GTDT available scrips – All securities in BSE & NSE, except dept securities, NCD, Bonds and illiquid scrips

The validity of the GTDt order is a maximum of 30 calendar days

The price range of the GTDt order should be within the limit prescribed by the exchange on the given day

Video on How to Place GTD order in HDFC Securities

Related Articles:

All About Stocks, Equities, Stock Market, Investing in Stock Market

- How to buy Stock: Delivery or Intraday, Market or Limit, T+2

- Difference Between NSE and BSE, Listing of company on Stock Exchange

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

- Investing in Stock Market: Open Demat account and Trading account

- Top Websites for Indian Stocks Market Investors, Stock selection

- Technical Analysis and Fundamental Analysis of Stocks

What do you feel about this feature of buying or selling stocks at the desired price? Have you used the GTT of Zerodha, ICICIDirect VTC, or HDFC Securities GTD? Zerodha GTT feature is an advanced than ICICIDirect VTC and HDFC Securities GTD

Great Article, thoroughly explained

Thanks a lot for kind and encouraging words